Oil prices are marginally lower this morning after four straight sessions of gains driven by tariff optimism, following a bigger than expected build in crude stocks reported by API overnight.

The rise in stocks comes as OPEC+ readies to add another 411,000 barrel per day tranche of supply to the market as it unwinds 2.2-million barrels per day of voluntary production cuts. The new supply is likely to check prices as Saudi Arabia looks to regain market share and respond to a U.S. call for lower prices, even as U.S. President Donald Trump began the first presidential trip of his current term with a visit to Riyadh on Tuesday.

"While OPEC officials maintain that the US played no role in the decision to accelerate the phase -in of the voluntary barrels, the oil price environment has provided a beneficial backdrop to the Presidential visit from the Washington standpoint, Helima Croft, Head of Global Commodity Strategy and MENA Research at RBC Capital Markets, said in a note.

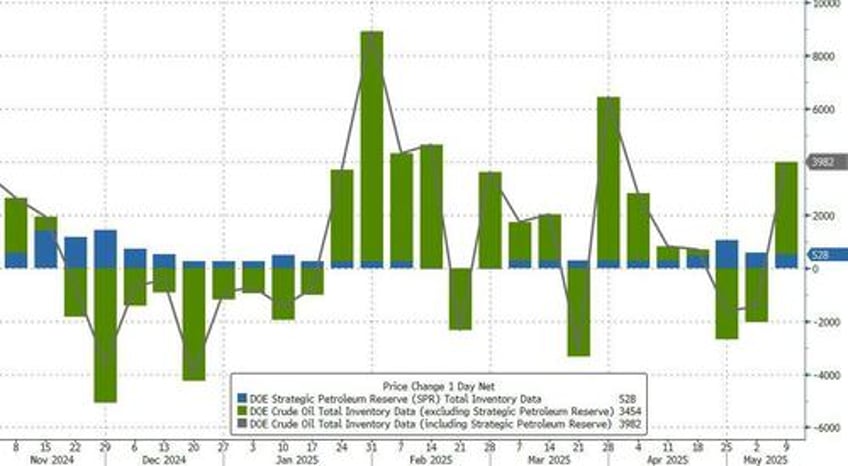

All eyes now on the official data for confirmation of builds...

API

Crude +4.29mm

Cushing -850k

Gasoline -1.37mm

Distillates -3.68mm

DOE

Crude +3.45mm

Cushing -1.07mm

Gasoline -1.02mm

Distillates -3.16mm

The official data echoe API's report with a sizable crude build but draws at the Cushing Hub and in products...

Source: Bloomberg

In a week when the Trump administration proposes a major bill to refill the SPR, total crude stocks rose around 4mm barrels (including 528k barrels to the SPR)...

Source: Bloomberg

US crude production rose very modestly last week but along with the rig count is basically unchanged since President Trump's election...

Source: Bloomberg

OPEC released its May Monthly Oil Market Report on Wednesday, sticking with its forecast for 2025 demand growth of 1.3-million barrels per day, higher last week's estimate from the Energy Information Administration for demand growth of one-million bpd this year.

The International Energy Agency will release its monthly outlook on Thursday.

The cartel also lowered its estimate from production growth for countries outside of OPEC+ by 100,000 bpd to 0.8-million bpd.

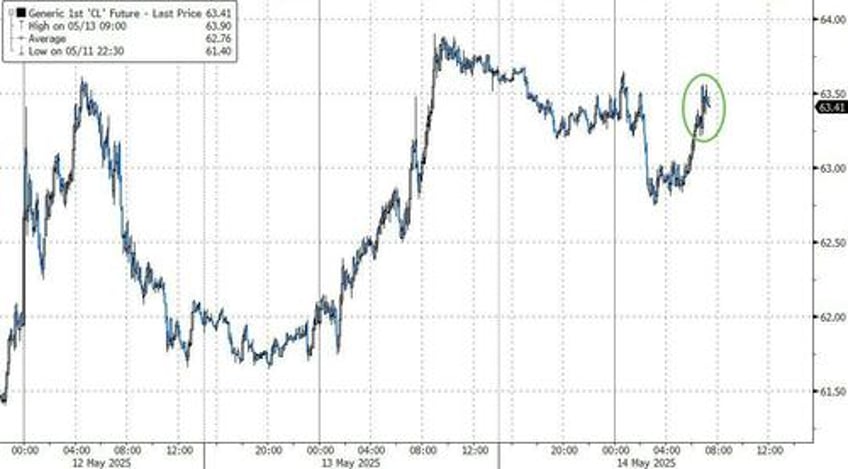

WTI is rallying back from overnight weakness...

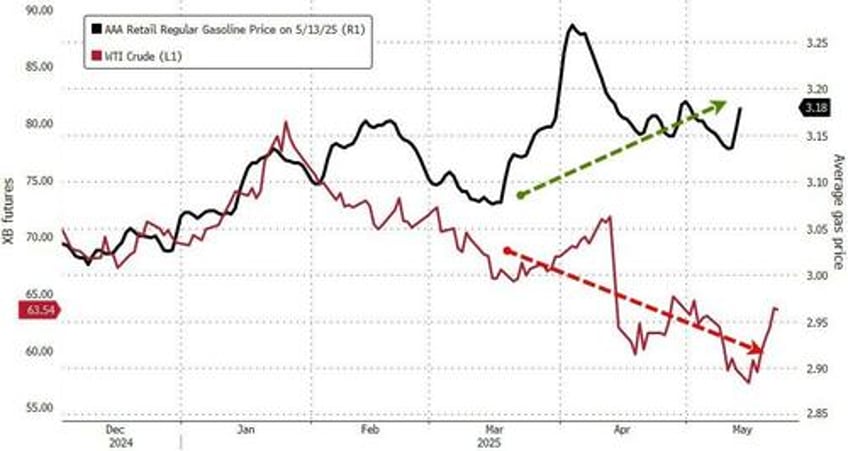

Finally, the question many are asking is when will see prices at the pump lower as Refineries are expected to keep ramping up ahead of the summer, allowing nationwide crude processing rates to remain at the highest seasonal level since 2019.

...and along with those lower prices, lower inflation.