As home prices continue to climb and mortgage rates remain elevated, buying a home in the U.S. has become increasingly out of reach for the average household.

In 2025, buyers now need six-figure salaries to afford a median-priced home in all but 15 states.

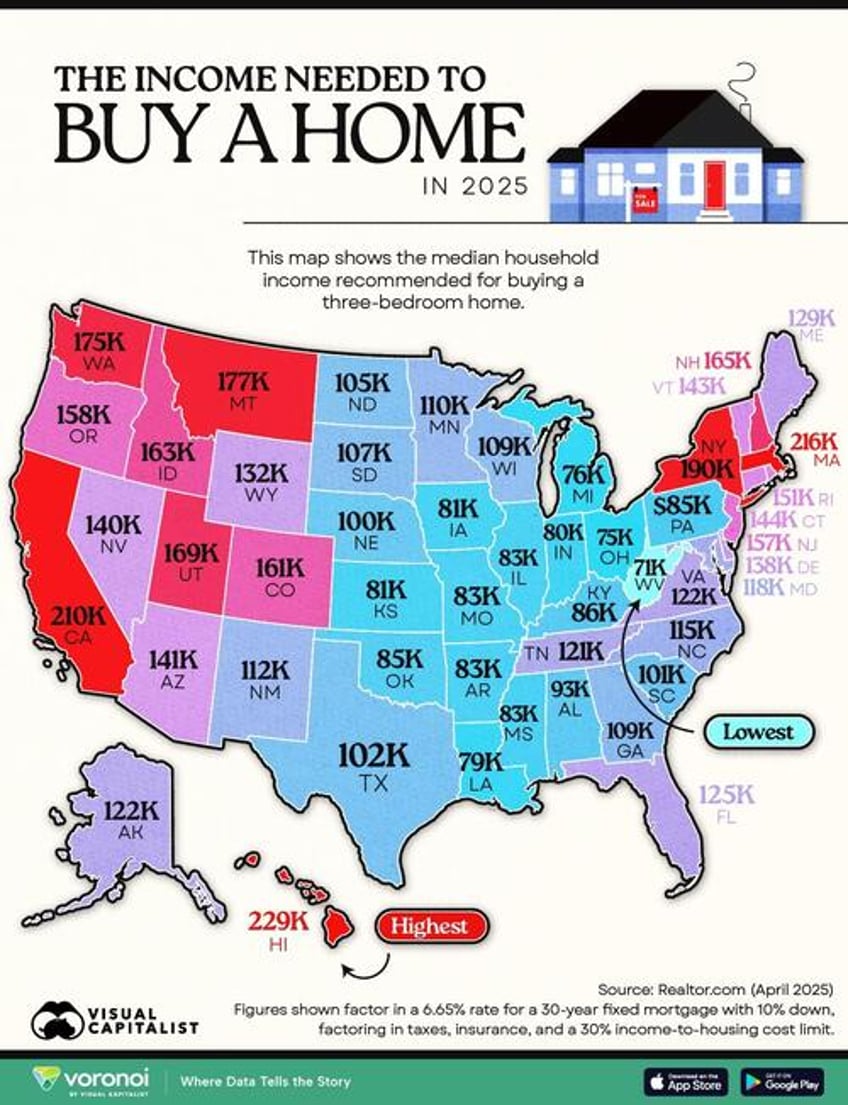

This visualization, via Visual Capitalist's Bruno Venditti, using data from Realtor.com, maps the annual income required to purchase a typical three-bedroom home in every state, based on a 10% down payment, a 6.65% interest rate on a 30-year fixed mortgage, and a 30% income-to-housing cost threshold (which includes taxes and insurance).

The Growing Gap Between Income and Home Prices

A recent study found that nearly 50% of U.S. households cannot afford a home priced at $250,000. This is particularly concerning when the median price of a new single-family home nationwide has reached $495,750, according to the National Association of Home Builders.

In many states, the income needed to comfortably afford a median-priced home far exceeds what a typical family earns.

Where Buying a Home Requires the Highest Salaries

Here are the top five most expensive states for homebuyers in 2025:

Hawaii tops the list, where buying a median three-bedroom home requires an annual income of $229,000—the highest in the country. Despite its small population, Montana has climbed into the top five least affordable states, driven by a widening gap between soaring home prices and relatively modest local incomes.

In contrast, in West Virginia a buyer would need a salary of just $71,000 to afford a median-priced home—well below the state’s median household income of $90,000. Other states with lower thresholds include Mississippi, Ohio, and Indiana.

What’s the cost of a median price in every U.S. state? Find out in this map on Voronoi.