Oil prices are extending their decline (third day in a row) this morning as, after a tumultuous period of geopolitics, traders are returning their focus to market fundamentals. A lack (so far) of response from Israel to Iran's retaliatory attack combined with The American Petroleum Institute reporting a gain in US stockpiles before government data later Wednesday has key timespreads weakening in recent days, pointing to softening sentiment.

API

Crude +4.09mm (+600k exp)

Cushing -169k

Gasoline -2.51mm (-1.0mm exp)

Distillates -427k (-400k exp)

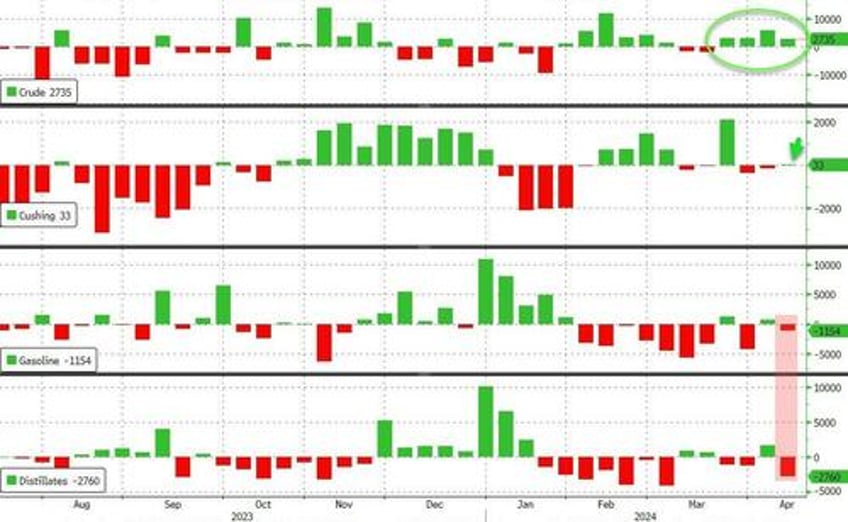

DOE

Crude +2.375mm (+600k exp)

Cushing +33k

Gasoline -1.154mm (-1.0mm exp)

Distillates -2.76mm (-400k exp)

Crude stocks rose for the fourth straight week (well above expectations - but smaller than API), but that was offset by sizable product draws. Cushing stocks were flat...

Source: Bloomberg

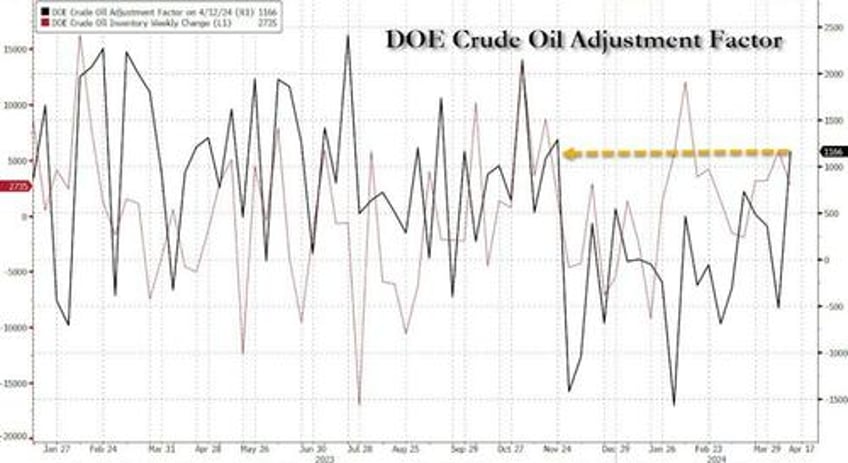

And in case you wondered, the 'ol 'adjustment factor' is back... to its highest in 2024...

Source: Bloomberg

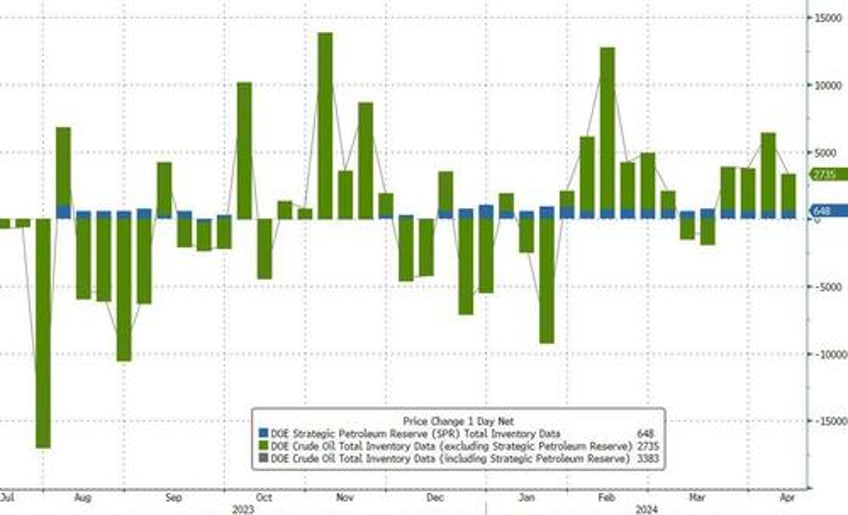

The Biden administration continued (for now) to add to the SPR (see below for why that may end soon)...

Source: Bloomberg

US crude production was flat - near record highs

Source: Bloomberg

WTI was trading around $84.40 ahead of the official data (though had been chopping around prior)

However, Joe and Jerome still have a problem as pump-prices just keep going higher...

Source: Bloomberg

President Biden “wants to keep the price of gasoline affordable, and we’ll do what we can to make sure that that happens,” White House senior adviser John Podesta says at the BloombergNEF Summit in New York, responding to a question about a potential release of oil from the nation’s Strategic Petroleum Reserve amid forecasts that already rising prices at the pump will spike this summer.

JOE BIDEN'S APPROVAL RATING FALLS TO 38% FROM 40% IN MARCH - REUTERS/IPSOS POLL

Source: Bloomberg

Who could have seen that coming?

And there it is

— zerohedge (@zerohedge) April 16, 2024

SENIOR WHITE HOUSE ADVISOR: US COULD RELEASE MORE SPR OIL TO KEEP GAS PRICES LOW https://t.co/AzEQ5K9XFY

'Strategic' - "you keep using that word... I do not think it means what you think it does."