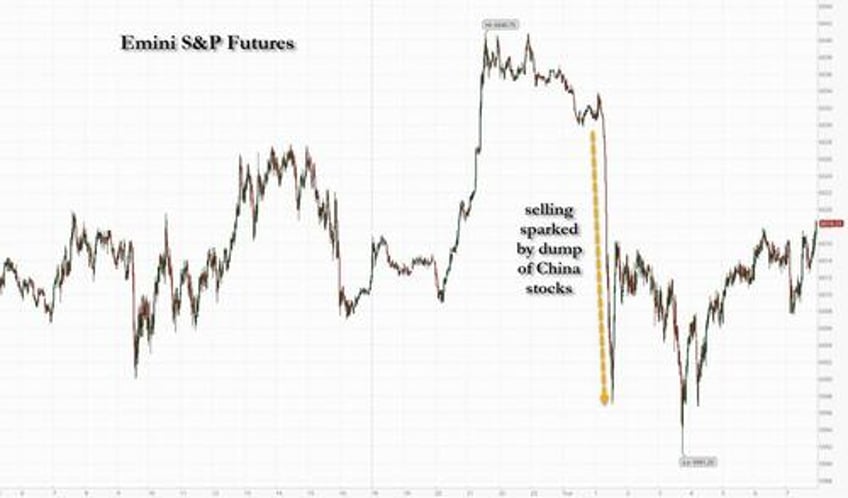

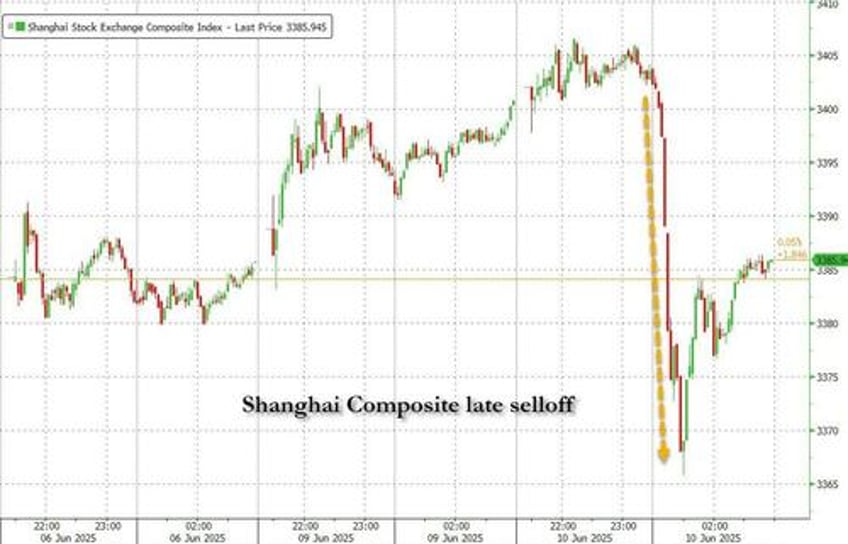

US equity futures are little changed, paring earlier gains along with European stocks, as Commerce Secretary Lutnick says US-China trade talks are "going well" and that they’re expected to go on all day. The bar for an improvement risk appetite appears high after Chinese stocks suddenly fell toward the end of trading day earlier, sparking a broader souring of sentiment. As of 8:00am S&P futures were up 0.1% into today’s trade talks and tomorrow's CPI print; Nasdaq 100 futures rose 0.1%, with Mag7 names seeing muted returns ex-TSLA which is +3%. Semis/Cyclicals are seeing a bid. The UK’s FTSE 100, however, was poised to close at an all-time high for the first time since March. US/China talks continue for a second day with Bessent empowered to alter US export controls; US/Iran talks are set for Thursday.

US Treasuries extended gains ahead of a $58 billion auction of three-year bonds; the USD is higher into tomorrow's CPI; commodities are higher led by Ags/Energy. Today’s macro data print is the Small Business Optimism survey, which rose from 95.8 to 98.8, beating expectations of a 96.0 print.

Inpremarket trading, Mag 7 tech giants were miexed: Tesla +2%, Nvidia +0.2%, Alphabet -0.2%, Amazon -0.1%, Meta Platforms +0.6%, Apple -0.3%, Microsoft -0.3%. McDonald’s fell 1.6% after Redburn downgrades the restaurant chain to sell from buy, saying weight-loss drugs are suppressing consumer appetites and presenting an under-appreciated longer-term threat. Here are some other notable premarket movers:

- Brown & Brown (BRO) falls 3% after agreeing to buy privately-held insurance brokerage Accession Risk Management Group for $9.825 billion.

- Insmed (INSM) rises 17% after the company announced positive topline results from Phase 2b study of treprostinil palmitil inhalation powder as a once-daily therapy in patients with pulmonary arterial hypertension.

- JM Smucker (SJM) falls 7% after the packaged-food company projected profit for the coming fiscal year that trailed Wall Street’s expectations, continuing a challenging run for the biggest US packaged food producers.

- TechTarget (TTGT) drops 4.8% after the marketing software firm was downgraded to underweight at JPMorgan on a lack of catalysts.

- Tencent Music Entertainment Group (TME) ADRs rise 5% after agreeing to buy Chinese podcasting startup Ximalaya Inc. for $1.3 billion in cash plus an issuance of stock, a deal that propels its ambition to become China’s answer to Spotify

While Monday’s negotiations in London between the US and China delivered no breakthrough, American officials had sounded optimistic that the two sides could ease tensions over shipments of technology and rare earth elements. With a key inflation read on tap Wednesday, investors are waiting for fresh drivers after stocks rebounded to near record levels from their April lows.

“We believe the path of least resistance for equities remains upward and potentially see room for some US performance catch-up,” wrote Alastair Pinder, global equity strategist at HSBC Holdings Plc.

As delegations from the US and China arrived at London’s Lancaster House for the start of talks on Tuesday, US Commerce Secretary Howard Lutnick said discussions were “going well” and expected negotiations to continue “all day today.”

Meanwhile, analysts at firms including Barclays and JPMorgan Chase & Co. see further upside for US stocks, in part because they expect institutional investors to abandon their cautious stance and ramp up exposure to equities. Citigroup strategists said that technology heavyweights have attracted a flurry of bullish bets as optimism around the trade outlook overshadows trade concerns.

“Flow activity has been largely one-sided, driven by new risk flows for large caps,” the team led by Chris Montagu wrote. “While tariff policy issues remain a concern, investors have also been assessing the evolving macro backdrop.”

European stocks were little changed, with investors reluctant to make big bets ahead of a second day of trade negotiations between the US and China. Stoxx 600 fell 0.2% with energy and auto sectors leading gains, while financial services stocks among the biggest laggards. Among individual stocks, UBS fell after Vontobel analysts wrote that Swiss capital demands could impact its competitiveness. The FTSE 100 surpassed its previous closing peak as investors took comfort from an improving economic outlook and easing trade tensions, with the UK becoming the first nation to strike a deal with President Donald Trump after his April 2 tariff announcements. That said, sentiment remains fragile as London faces an exodus of companies moving listings to the US and shelving initial public offerings.

Here are the most notable European movers:

- SoftwareOne shares rise as much as 12% to hit a seven-month high after the company said its deal to buy Crayon will close on July 2.

- Umicore shares jump as much as 10% to hit a seven-month high, after Goldman Sachs analysts upgraded the chemicals firm to buy and doubled the price target.

- Tecan shares gain as much as 5.4% after Berenberg started coverage of the Swiss laboratory-equipment maker with a buy rating, saying it is a high-quality operator that currently trades at a discount.

- Bellway shares rise as much as 4.1% after the UK housebuilder reported robust trading and said it expects to build more houses and sell them at higher prices than previously thought.

- Aberdeen rises as much as 5.9%, climbing to highest since August 2023, as JPMorgan upgrades to overweight and places the UK investment firm on a positive catalyst watch.

- Puuilo gains as much as 8.5%, setting a new record high, as DNB Carnegie says the Finnish home-improvement retailer’s results surpassed what had been already bullish expectations.

- European energy stocks are outperforming as oil prices rise for a fourth straight day due to investor optimism around extended US-China trade talks and signs of near-term tightness in the physical market.

- FirstGroup rises as much as 7.2%, hitting the highest since Sept. 2012, as analysts welcome a full-year beat from the UK bus and rail company.

- UBS shares drop as much as 7.4%, erasing all of Friday’s gains that followed the Swiss government proposing new rules that could see the bank hold up to $26 billion in fresh capital.

- Renk shares fall as much as 10% after Bank of America double-downgraded the stock to underperform, saying it has run too far in the short term and noting the German firm’s lack of exposure to defense electronics.

- Hochschild Mining shares plummet as much as 21%, the most in over two years, after the company warned the Mara Rosa mine in Brazil will produce far less gold than hoped this year.

- GB Group shares drop as much as 13% after the identity verification and fraud prevention specialist delivered another year of “underwhelming” growth, according to Jefferies.

Earlier in the session, Asian equities rose before the second day of trade talks between the US and China began, as traders stayed cautiously optimistic over any potential progress. The gains in the MSCI Asia Pacific Index narrowed to 0.3% from 0.7% earlier. TSMC, MediaTek and Commonwealth Bank of Australia were among the biggest boosts. Taiwan led the charge among local markets, with notable advances also in Indonesia and South Korea.

Chinese stocks slid suddenly in the afternoon session amid speculation that the US-China trade negotiations might have hit bumps. The move came on an elevated trading volume with major index ETFs also see surging volume. Rare earth names on the opposite saw a sharp move higher. Defensive names including high-div and agribusiness sector managed to claimed the loss first, and lead the index to rebound around 13:28. China managed to recovered part of the loss and ended up small loss by end of day. The Hang Seng China Enterprises Index dipped almost 1% during the session and then recovered most of the losses.

Focus continues to be on the US-China trade talk in London of which more active headlines are expected to rise. From a full day perspective, Pharma continued the positive momentum, banks picking up buyers as risking off. Growth names all pulled back in PM.

“Beyond the very short term dynamic, I think our expectation should be very low because I think that what we have seen from Geneva talks, London talks now is that this is going to be a protracted, long period of discussions between the two,” Bilal Hafeez, CEO at Macro Hive, said in a Bloomberg TV interview.

In FX, the Bloomberg Dollar Spot Index also trims gains, up 0.1%, while the Swiss franc tops the G-10 FX leader board, rising marginally along with haven assets. USD/JPY rises as much as 0.5% to the day’s high of 145.29, before paring gains; the yen came under selling pressure after Bank of Japan Governor Kazuo Ueda said Japan’s price trend still has some ways to go to reach 2. The dollar index would likely stay in a range “given the tariff uncertainty and the need for investors to keep assessing conditions,” Malayan Banking Bhd strategists wrote in a note.

In rates, treasuries hold modest gains in early US session, supported by bigger advance for gilts after soft UK labor-market data boosted expectations for Bank of England interest-rate cuts this year. US yields are 2bp-3bp richer across maturities with the curve flatter; 10-year is around 4.45%, about 2.5bp lower on the day with UK counterpart outperforming by around 4bp. Gilts outperformed their US and European peers after UK employment fell by the most in five years and wage growth slowed more than forecast. UK 10-year yields fall 7 bps to 4.56% as traders also boosted their Bank of England interest-rate cut bets; swaps tied to Bank of England’s policy rate price in around 47bp of easing by year-end vs 41bp at Monday’s close.

The US session features first of this week’s three Treasury coupon auctions, a 3-year new issue for $58 billion at 1pm New York time; $39 billion 10-year and $22 billion 30-year reopenings follow Wednesday and Thursday. WI 3-year yield near 3.955% is ~13bp cheaper than last month’s, which stopped through by 0.2bp. Traders will be closely watching Tuesday’s three-year Treasury auction as a read on whether or not foreigners are reducing their holding of US assets, wrote Chris Turner, head of foreign exchange strategy at ING Bank in London. “The focus therefore will be on the indirect bid at the auction and also the general gauge of auction success,” Turner wrote. “A poor auction could rekindle the weaker dollar story.”

In commodities, spot gold reversed an earlier fall and is now a few dollars higher on the day. Oil prices rise for a fourth day, with WTI up 0.1% at ~$65 a barrel. Bitcoin rises 0.4% and above $109,000.

Looking to the day ahead now, and data releases include UK unemployment and Italian industrial production for April, and in the US there’s the NFIB’s small business optimism index for May (printed at 98.8, above the est. of 96.0 and up from 95.8 prior).. Meanwhile from central banks, we’ll hear from the ECB’s Villeroy, Holzmann and Rehn.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.2%

- Stoxx Europe 600 -0.1%

- DAX -0.6%

- CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.45%

- VIX +0.2 points at 17.38

- Bloomberg Dollar Index +0.1% at 1211.05

- euro -0.1% at $1.141

- WTI crude +0.4% at $65.58/barrel

Top Overnight News

- US military confirmed it has activated 700 marines to help protect federal personnel and federal property in the greater Los Angeles area: RTRS

- US Health Secretary Robert F. Kennedy Jr. dismissed all 17 members of one of the main committees that advises the government on vaccine safety and policy. BBG

- META is creating a new AI research lab dedicated to achieving “superintelligence,” and Alexandr Wang, the founder and CEO of Scale AI, is set to join the initiative (Meta is in talks to invest billions into Scale AI). NYT

- House Speaker Johnson said they are on track to get a budget bill passed by Independence Day and urged the Senate to modify SALT as little as possible.

- US GOP Rep. Green notified the Speaker he would resign from Congress after the reconciliation package vote.

- China is tapping its $1.5 trillion housing provident fund to salvage its property sector, with the government program outpacing banks in providing mortgages. BBG

- TSMC reported a 40% jump in May revenue, fueled by companies stockpiling chips in response to mounting trade uncertainty. BBG

- Huawei’s founder said US export controls won’t have an impact on the company as Washington exaggerates the firm’s capabilities. Ren Zhegfei said Huawei’s Ascend chip, the main rival to NVDA’s products in China,

- “still lags behind the US by one generation.” FT

- Bank of Japan Governor Kazuo Ueda said the central bank is still some distance from its inflation goal in comments that helped accelerate a weakening of the yen. While Ueda also talked down the possibility of any rate cut to boost the economy, the mention of a possible need to offer support for the economy likely gave the impression that the bank’s next move to raise rates will be more distant. BBG

- The U.K.’s labor market cooled in the three months to April, offering reassurance to Bank of England policymakers despite the level still being well above that required to return inflation to target any time soon. Average weekly earnings excluding bonuses rose 5.2% from a year earlier, down from 5.5% in the three months to March. The unemployment rate climbed to 4.6% in the period from 4.4% in the prior quarter, the highest since May-July 2021. WSJ

- Britain approved a £14.2 billion investment to help build its nuclear plant Sizewell C. The country’s wide-ranging spending review — set to be announced tomorrow — includes plans to offer cheaper financing for housebuilders. BBG

- META is creating a new AI research lab dedicated to achieving “superintelligence,” and Alexandr Wang, the founder and CEO of Scale AI, is set to join the initiative (Meta is in talks to invest billions into Scale AI). NYT

- Autos are a key component of trade negotiations and Trump might need to make a choice: he can’t keep his auto tariffs and strike trade deals. Politico

Tariffs/Trade

- US-China talks in London were scheduled to continue on Tuesday at 10:30BST/05:30EDT (delayed from 10:00BST/05:00ET, no reason provided) following talks on Monday which concluded after 6 hours and 40 minutes; the US Treasury announced Tuesday's talks began around 10:44BST/05:44ET. Heading into the talks, US Commerce Secretary Lutnick said discussions with China are "going well", and talks are to continue all day Tuesday.

- US DoJ requested that judges extend a hold on the ruling against Trump tariffs.

- Japanese PM Ishiba and US President Trump will hold bilateral talks on the sidelines of the G7 summit in Canada.

- Japanese Economy Minister Akazawa said the key is if Japan and the US can agree on a trade package, while it was separately reported that he is to visit the US and Canada from June 13th-18th for tariff talks, according to Nikkei.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher with risk sentiment underpinned amid some optimism surrounding US-China talks which are set to resume on Tuesday and have been described so far by US officials as a 'good meeting' and "fruitful". ASX 200 gained on return from the long weekend with the advances led by outperformance in Consumer Discretionary, Financials, Energy and Tech, while further upside was capped amid mixed consumer and business sentiment surveys. Nikkei 225 initially outperformed as it coat-tailed on the recent upside in USD/JPY which was partially facilitated alongside comments from BoJ Governor Ueda who stated that the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%. Hang Seng and Shanghai Comp kept afloat as the attention centred on US-China talks in London which are scheduled to extend for a second day.

Top Asian News

- Chinese President Xi and South Korean President Lee held a phone talk, while Xi said that China and South Korea should promote strategic cooperative partnership to a higher level and he urged the countries to inject more certainty into regional and international situation. Furthermore, Xi urged they jointly safeguard multilateralism and free trade and ensure stable, smooth global and regional industrial and supply chains.

- Chinese Vice President Han Zheng met with French President Macron in France and said that China is ready to work with the EU to further expand areas of cooperation and promote new development in China-EU relations, while Han said at the UN Ocean Conference that China will carry out bilateral and multilateral cooperation projects to support small island states and other developing countries in implementing sustainable development goals.

- Chinese Finance Ministry announced that China is working on setting up a childcare subsidy system.

- BoJ Governor Ueda said if the economy and prices come under strong downward pressure, the BoJ has limited room to underpin growth with rate cuts with the short-term rate still at 0.5% and noted that underlying inflation is still below 2%. Ueda stated the BoJ is keeping the real interest rate negative, so underlying inflation achieves 2% and keeps inflation sustainably and stably at 2%, but reiterated that the BoJ will raise interest rates if it has enough confidence that underlying inflation nears or moves around 2%.

European bourses (STOXX 600 -0.1%) opened mixed and on either side of the unchanged mark; sentiment did gradually improve just after the cash open but then a bout of hefty pressure took most European indices back into negative territory. No clear driver for the downside, but perhaps in anticipation of the US-China talks.

European sectors are mixed and with no clear theme or bias. Energy takes the top spot, following closely by Autos & Parts; the latter likely benefitting from the optimism surrounding the US-China talks. Financial Services sits at the foot of the pile, with the downside driven by losses in UBS (-6.6%), reversing some of the upside seen on Friday and as traders digest the latest government proposals which aim to force the bank to hold an extra USD 26bln in extra capital.

Top European News

- UK Chancellor Reeves is planning a ‘housing bank’ to provide cheaper financing for builders and is considering a funding settlement of up to GBP 25bln for social housing in Wednesday’s spending review, according to FT.

- ECB's Holzmann said the pause in cutting rates could last a while and if economic data worsens there could be more cuts, while he is moderately optimistic about what will happen with Trump and tariffs, according to Orf TV.

- ECB's Villeroy says ECB has successfully normalised policy; policy and inflation are now in a favourable zone Being in a favourable zone does not mean the Bank is static. ECB will be as agile as needed.

- ECB's Rehn says will take decisions on a meeting by meeting basis, must avoid complacency over the inflation outlook.

- French President Macron says he does not rule out the possibility of dissolving the National Assembly and calling snap elections, according to Bloomberg.

FX

- USD has kicked the session off on the front foot with support stemming from the positive readout of the US-China trade talks which saw US Treasury Secretary Bessent state that it was a 'good meeting' with China, whilst Commerce Secretary Lutnick said talks were "fruitful". Focus today will be on the US 3yr auction, to give further indication of if the "Sell America" theme is still at play. DXY currently around 99.15.

- EUR is a touch softer vs. the broadly firmer USD with fresh macro drivers lacking for the Eurozone. Markets continue to be drip-fed ECB speak with known hawk Holzmann noting the pause in cutting rates could last a while. Elsewhere, France's Villeroy remarked that the Bank has successfully normalised policy, adding that policy and inflation are now in a favourable zone. However, being in a favourable zone does not mean the Bank is static. EUR/USD continues to pivot around the 1.14 mark and is currently contained within Monday's 1.1386-1.1439 range.

- JPY is fractionally lower vs. the USD, albeit off worst levels which saw the pair hit a new high for the month during APAC trade at 145.29. The price action took place alongside the broad pick-up in the USD and mostly positive risk appetite, which eventually faded. In terms of Japanese-specific newsflow, BoJ Governor Ueda reaffirmed the familiar rate hike signal but also stated the BoJ has limited room to underpin growth with rate cuts if the economy and prices come under strong downward pressure. On the trade front, Japanese Economy Minister Akazawa is reportedly to visit the US and Canada from June 13th-18th for tariff talks. USD/JPY has returned to a 144 handle but is holding above its 50DMA at 144.34.

- GBP is sat at the foot of the G10 leaderboard in the wake of the latest UK jobs which report which showed an expected uptick in the unemployment rate to 4.6% from 4.5%, a 109k slump in the HMRC payrolls change metric for May (largest decline since May 2020) and a further cooling of average earnings. In reaction, BoE market pricing moved dovishly, now fully pricing in a 25bps cut in September vs November pre-data. Cable has slipped onto a 1.34 handle for the first time since June 2nd with a current session low at 1.3457 (June 2nd low was at 1.3451).

- Antipodeans are both are slightly softer vs. the USD with price action choppy during APAC hours on account of mixed Business Sentiment data from Australia and the overall constructive risk tone. However, of greater interest for both will likely be the outcome of the US-China trade talks in London today given that China is both nation's largest trading partner.

- PBoC set USD/CNY mid-point at 7.1840 vs exp. 7.1853 (Prev. 7.1855).

Fixed Income

- Gilts are outperforming, gapped higher by 55 ticks after a dovish UK labour market series. This caused Gilts to open at 92.36 before extending to a 92.66 peak with gains in excess of 80 ticks on the session at best. In brief, HMRC Payrolls fell more-than-expected with the accompanying wage figures also cooler than expected. In the near term, there is around a 10% implied probability of a June cut while August has increased to -18bps vs 15bps pre-release - a cut is now fully priced in September vs November pre-data.

- Bunds are in the green but with upside of only around half of that seen in Gilts at best. Specifics for the bloc include the latest ECB SMA and remarks from Villeroy, who said that while policy has now been normalised and the ECB is in a “favourable zone” this does not mean they are “static”. Bunds were only a little firmer in APAC trade, then caught a slight bid as the risk tone dipped in early morning trade before taking another leg higher alongside the Gilt open. Currently at 130.63, if the move continues, Friday’s high is just above at 130.77 before 130.99 from Monday and then last week’s 131.47 peak.

- USTs are broadly in-line with Bunds though the magnitude of gains is a little less, given that US equity futures have proven to be more resilient than European peers this morning; though, US equity sentiment is still very much on the back foot. Thus far, this has taken USTs to a 110-12 peak. If surpassed, Friday’s pre-NFP high resides at 110-29. The US data docket is light, focus turns to US-China talks in London and a 3yr auction thereafter.

- Netherlands sells EUR 2.45bln vs exp. EUR 2-2.5bln 2.50% 2035 DSL: average yield 2.749% (prev. 3.011%).

- Germany sells EUR 3.078bln vs exp. EUR 4bln 2.40% 2030 Bobl: b/c 1.8x (prev. 1.20x), average yield 2.14% (prev. 2.07%) & retention 23.05% (prev. 22.67%)

- Books have opened on the UK's 1.75% September 2038 I/L Gilt via syndication; price guidance 11.75-12.25bps above November 2037 I/L. Orders for the UK's 2038 I/L are in excess of GBP 46bln; price guidance unchanged. Orders for new UK 2038 I/L Gilt exceed GBP 58bln, according to a bookrunner; guidance set at 2037 I/L +11.75bps.

Commodities

- Crude prices are indecisive on a day when two major events (US-China talks and the Iranian nuclear counteroffer) are taking place. Ahead of the Iranian proposal, both sides confirmed the sixth round of nuclear talks will take place this weekend - the timing is unclear. Brent Aug'25 currently trades in a USD 66.95-67.40/bbl range.

- Spot gold is looking to build on Monday’s gains, as ongoing US-China tariff negotiations continue to support safe-haven demand - but with gains capped by modest Dollar strength. XAU/USD trades around 3,330/oz.

- Base metals are broadly lower, tracking the mood seen in Gold ahead of further trade/mineral-specific updates. EV sensitive metal Lithium is the outperformer, however, Palladium, used only in combustion cars, is suffering, given optimism on a rare earth deal. Copper has been rangebound, though is ultimately lower after the prior session of gains. The industrial metal looks to test the USD 9,760 mark, and sits within a USD 9,724-9,782.55 range.

- Kazakhstan says its oil exports to Germany via Druzhba pipeline +48% Y/Y in Jan-May; via Baku-Tbilisi-Ceyhan pipeline at +10% Y/Y in Jan-May.

Geopolitics: Middle East

- The sixth round of nuclear talks between the US and Iran will take place either on Friday in Oslo or on Sunday in Muscat, according to an Axios reporter citing a US official, while Iran's Foreign Ministry spokesman confirmed that the sixth round of Iran-US talks is being scheduled for Sunday, June 15th in Muscat.

- Security sources estimated if nuclear talks fail, Israel would have to decide whether to attack Iran, according to the Israeli Broadcasting Authority.

- Israel launched strikes on Yemen's port city of Hodeidah, according to Houthi-affiliated Al Masirah TV.

- Israel's navy attacked Houthi targets in the Hodeidah port of Yemen, via an army statement.

Geopolitics: Ukraine

- Russia launched an air attack on Kyiv which Ukraine's defence systems attempted to repel, while emergency units were dispatched to several districts in Kyiv after Russian drone attacks, according to the mayor.

- Flights were halted at all airports serving Moscow following a Ukrainian drone attack, according to Russia's civil aviation authority.

US Event Calendar

- 6:00 am: May NFIB Small Business Optimism 98.8, est. 96, prior 95.8

DB's Jim Reid concludes the overnight wrap

Who knew quiet Mondays were still a thing? Its only taken until June but maybe we can start easing back into weeks again. Famous last words I’d imagine. To be fair we were all waiting for the outcome of the US-China trade talks, which will now carry on into today. Indeed, after the volatility of the last two months, it was striking just how little any of the major assets shifted yesterday, with the S&P 500 (+0.09%) barely budging while 10yr Treasuries (-3.2bps) saw their narrowest daily trading range in over 6 weeks. The calm is unlikely to last though with more trade talk headlines likely to come through today, US CPI to look forward to tomorrow and that 30yr Treasury auction on Thursday.

In terms of those trade talks, the US and Chinese negotiators started to talk in London yesterday, with talks reported to resume again today at 10am London. There were some positive noises heading into the meeting, with US NEC Director Kevin Hassett saying to CNBC that they expected that “after the handshake”, that “any export controls from the US will be eased and the rare earths will be released in volume”. So that suggested a potential compromise whereby the US would ease their export controls in return for China easing their own restrictions on rare earths. There were few substantive comments after yesterday’s round of talks, with Treasury Secretary Bessent saying they had a “good meeting” and Commerce Secretary Lutnick calling the discussions “fruitful”. While we await any concrete news, it’s worth remembering that markets have been used to a lot of back-and-forth in recent weeks. After all, US tariffs on China went all the way up to 145%, before they were then slashed back to 30%. Then Trump said that China “HAS TOTALLY VIOLATED ITS AGREEMENT WITH US.” But the following week he had a phone call that he said “resulted in a very positive conclusion for both Countries.” So there’ve been several twists and turns already, and markets are getting fairly used to this uncertainty by now. Note that US / India trade talks are also quietly expected to end today so maybe we'll see some headlines there soon too.

In a generally light session, one supportive factor was some positive news on the inflation side, as the New York Fed’s Survey of Consumer Expectations showed a clear decline in inflation expectations. 1yr expectations came down four-tenths to 3.2%, whilst 5yr expectations were down to a 14-month low of 2.6%. So that was a far more benign assessment of inflation relative to other measures, as the University of Michigan’s reading had shown 1yr expectations surging up to 6.6% in May. So that was seen as encouraging ahead of the CPI print tomorrow, and that in turn supported a rally in front-end Treasuries, with the 2yr yield down -3.3bps on the day to 4.00% and the 10yr down -3.2bps to 4.47%, while 30yr yields were -2.8bps lower ahead of that monthly supply on Thursday.

Against that backdrop, the risk-on move broadly continued, which helped the S&P 500 (+0.09%) to a very modest advance. That was driven by the Magnificent 7 (+0.92%), which hit a 3-month high led by a +4.55% rise for Tesla which continued to recover as last week’s Trump-Musk feud appeared to wane. Small-cap stocks also outperformed, with the Russell 2000 (+0.57%) hitting a 3-month high of its own. On the other hand, defensive sectors within the S&P 500 lost ground, including utilities (-0.66%) and consumer staples (-0.24%). It was also a more negative story in Europe, with the STOXX 600 (-0.07%) losing ground after 4 consecutive gains, whilst the German DAX (-0.54%) saw a particular underperformance in thin trading due to a holiday.

In the quiet session, Italian BTPs continued to edge tighter, with the spread of 10yr Italian yields over bunds falling to just 92.1bps (-0.6bps), which is the tightest they’ve been since February 2021. In fact, the spread is getting increasingly close to the post-Euro crisis low of 88bps, back in 2015. Meanwhile in the UK, gilts did briefly underperform after the government announced a U-turn on paying winter fuel payments to most pensioners. But that had unwound by the end of the session, with 10yr gilt yields (-1.2bps) performing broadly in line with elsewhere.

Commodities gained amid the sanguine market mood, with WTI crude (+1.10%) posting its fifth advance in six sessions to reach a two-month high of $65.29/bbl.

Asian equity markets have picked up a bit of momentum overnight led by the Nikkei (+0.91%) and the ASX (+0.71%). Other markets are up but off their highs with the Hang Seng (+0.33%) and Shanghai Composite (+0.11%) slightly higher. S&P 500 (+0.35%) and NASDAQ (+0.45%) futures are optimistic we'll get positive trade headlines today.

In FX, the Japanese yen (-0.19%) is dipping, trading at 144.85 against the dollar, following comments from BOJ Governor Kazuo Ueda, who noted that Japan’s price trend still has a considerable distance to cover to reach the 2% target. Some market participants have interpreted these remarks as diminishing the likelihood of an imminent interest rate hike.

To the day ahead now, and data releases include UK unemployment and Italian industrial production for April, and in the US there’s the NFIB’s small business optimism index for May. Meanwhile from central banks, we’ll hear from the ECB’s Villeroy, Holzmann and Rehn.