By Ye Xie, Bloomberg Markets Live reporter and strategist

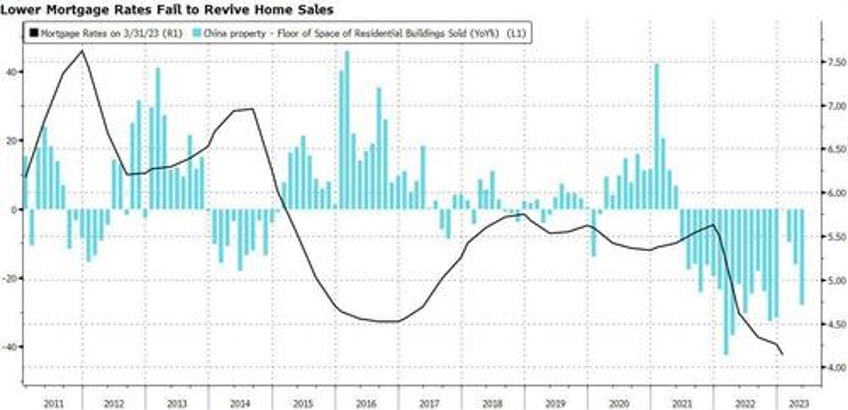

China’s top housing official has stepped up rhetoric meant to revive the housing market. It comes after the Politburo removed “the housing is not for speculation” slogan from the readout of its meeting, which increased expectations for more support for the market. Unfortunately, there’s no panacea to end the crisis quickly.

Hang Seng futures pointed to a weaker opening Friday. Strong US data spurred a dollar rally and higher US Treasury yields, which may weigh on foreign inflows to China. A Nikkei report that the Bank of Japan may discuss changing the yield-curve control policy added to uncertainties.

On the China front, the news flow continues a pattern of traders going “long on the words, short on actions.” Top housing official on Thursday urged more support, including calling for homebuyers who had paid off previous mortgages to be considered as first-time purchasers, so that they could enjoy lower mortgage rates. (The so-called “recognizing houses but not loans” policy.)

None of the talking points are entirely new. In 2022, 57 cities have adopted the “recognizing houses” policy, according to Nomura, citing data from China Real Estate Information Corp. Altogether, nearly 300 cities issued almost 600 various easing measures last year, including lowering down payments and loosening purchasing restrictions.

If that hasn’t helped prop up the market already, one can be excused for having doubt that any incremental, piecemeal measures will do the trick.

In a report published in June, Nomura’s economists, including Lu Ting, listed a few reasons why investors should lower their expectations on the housing stimulus, even though more support is likely to come.

For starters, Beijing simply has no appetite for a policy bazooka when the priority is focused on security and sustainability. So forget about another round “shantytown renovation” programs. That scheme, which offered cash compensation for homes demolished in less-developed areas, helped turn around a housing downturn in 2015-2016, but it also helped fueled a real estate bubble in lower-tier cities.

Second, some easing measures will likely increase sales of existing homes, strengthening expectations of home price declines and delaying purchases.

It’s questionable that China will meaningfully ease restrictions in big cities such as Beijing and Shanghai. Even if it does, easing in big cities may crowd out the demand for homes in low-tier cities, which have been the driver of commodity demand and construction activity over the past decade.

Smaller cities are still suffering from the overhang of the shantytown renovations, which have pulled forward home demand. These cities are facing high leverage, falling home prices and population outflows. Coupled with a large amount of unfinished projects and the withdrawal of private developers, a sustainable property rebound there is questionable.

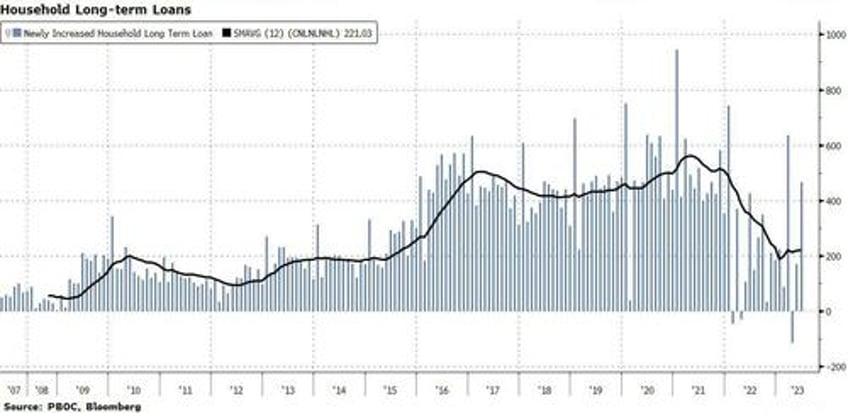

Finally, the capability and willingness of Chinese households to borrow and buy homes may have been significantly reduced, even in large cities, once expectations that housing prices can only go up have been shattered.

All told, an “L-shaped” recovery in housing is all one can hope for.