"Higher, then lower..." is the key message from Nomura MD Charlie McElligott.

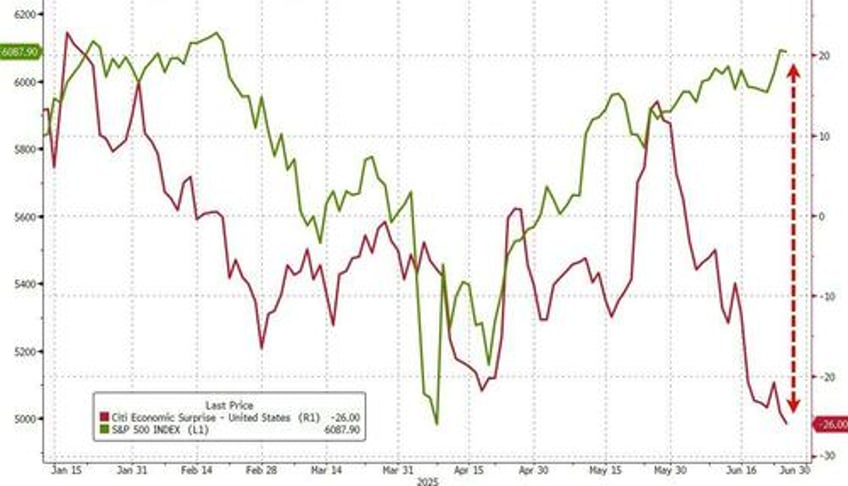

There’s simply not enough 'Net'-leverage / Beta-'on' and returns have under-captured the rally for most (my common refrain that "Nobody owned the Right-Tail" certainly playing-out into the V-shaped recovery back towards all-time highs), while gradual disinflation (which means a Fed tilting incrementally more dovish with this curious July-talk) against still solid 5-6% nominal GDP (aggregate consumption holds the line for Corporate Earnings) keep the bullish tailwinds intact, all while continuing to avoid "hard-landing" red flags (although with mounting “yellow flags”) in U.S. Economic Growth data...