One day after a solid 2Y auction, moments ago the Treasury conducted the second coupon sale of the week when it sold $70BN in 5Y paper in what was a mediocre affair.

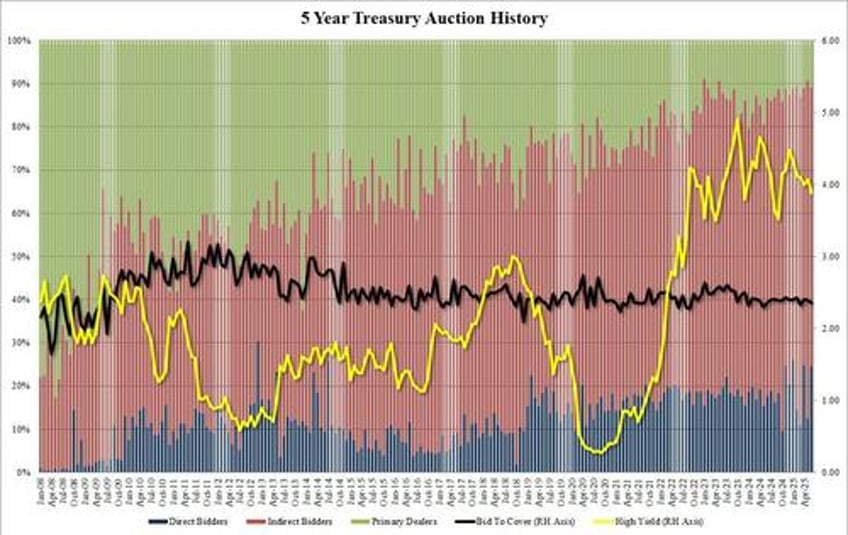

Starting at the top, the auction stopped at a high yield of 3.879%, down from 4.071% in May and the lowest since last September. However, despite the intraday concession which saw yields rise across the curve into the 1pm auction, the auction tailed the When Issued 3.874% by 0.5bps, the first tail since March.

The bid to cover was also a deterioration from May, printing at 2.36, down from 2.39 and the lowest since March's 2.33; not surprisingly it was below the six-auction average of 2.39.

The internals were also soft: foreign demand slumped to 64.7%, almost 14% lower than the 78.4% last month, and below the recent average of 70.5%. And with Directs awarded 24.4%, or double last month's 12.4%, Dealers were left with just 10.9%, up from 9.2% but one of the lowest on record.

Overall, this was a medicore and disappointing, if quickly forgettable, 5Y auction, yet one which barely caused a blip in the second market upon the break. Attention now turns to tomorrow's 7Y sale while the big question is just how will the US fund the trillions in looming deficits that make up the Big Beautiful Bill, and when will that finally hit demand for long-term debt.