Goldman Sachs Managing Director Kate McShane issued a wave of notable rating changes across the consumer sector on Tuesday. The most eye-catching:

Dollar General was cut from Buy to Neutral

RH (formerly Restoration Hardware) was downgraded from Neutral to Sell

Advance Auto Parts also moved from Neutral to Sell

In contrast, Five Below was upgraded to Buy

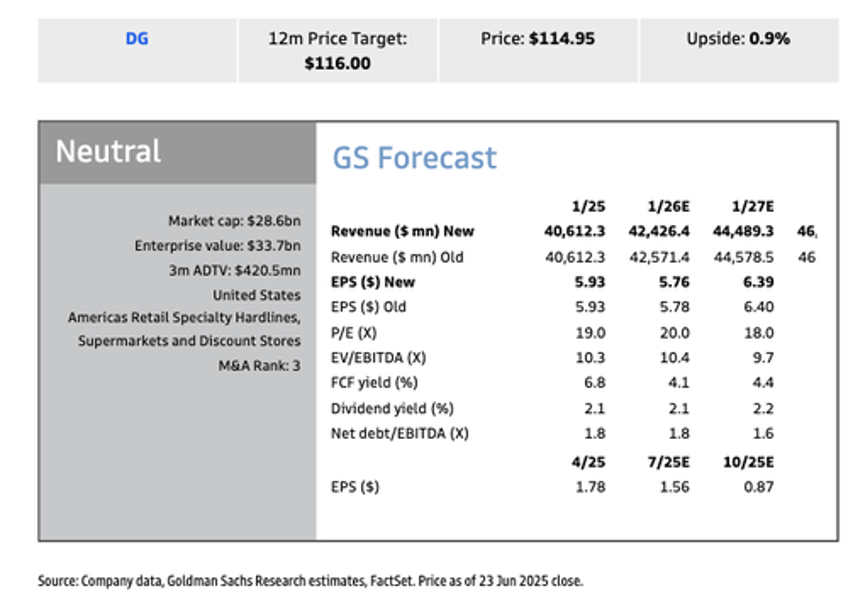

Let's start with Dollar General (DG). McShane downgraded the stock from Buy to Neutral following a 66% rally off the mid-January lows around $70. Her view: recent gains in margins and comps—driven by supply chain improvements, labor efficiencies, and better store restocking—are now largely priced into the stock.

She noted there's still room for long-term margin expansion, but near-term upside in the stock appears limited given:

a highly competitive retail landscape that could pressure same-store sales, and

the continued need for investment in stores and supply chain infrastructure.

Her 12-month price for DG stands at $116, with her view of minimal upside.

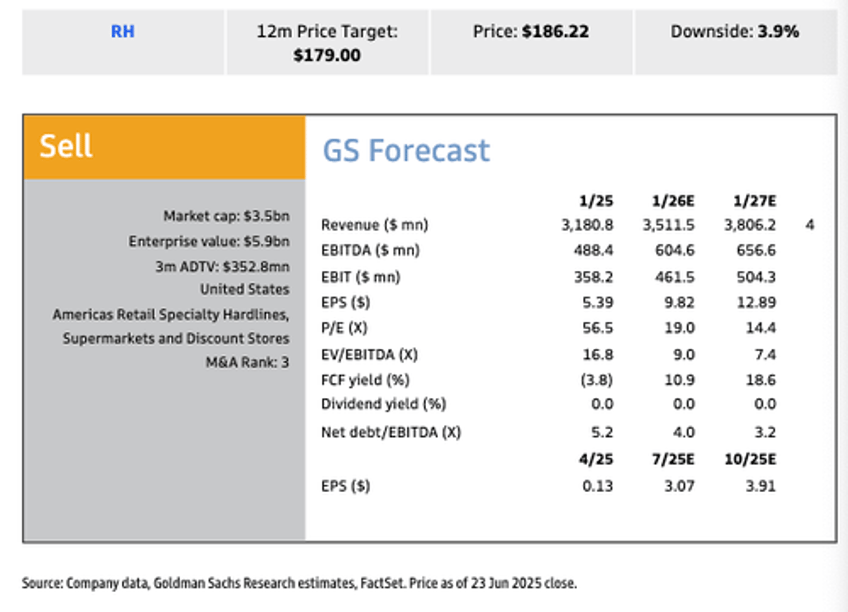

Next, RH (formerly Restoration Hardware) was downgraded from Neutral to Sell. McShane cited these headwinds for the high-end, luxury home furnishings company:

A still-pressured housing market and tough year-over-year comps in the second half of 2025.

A delay in a key brand extension from 2H25 to spring 2026, limiting near-term growth.

Weakening consumer sentiment, with RH's NPS and NPI scores now trailing peers and NPS decelerating since February.

A shift toward increased promotions—contrary to RH's past strategy—which could pressure margins and dilute brand value.

Year-to-date, RH shares have been cut in half, with the stock trading near $179 on Tuesday afternoon—just shy of the analyst's 12-month price target.

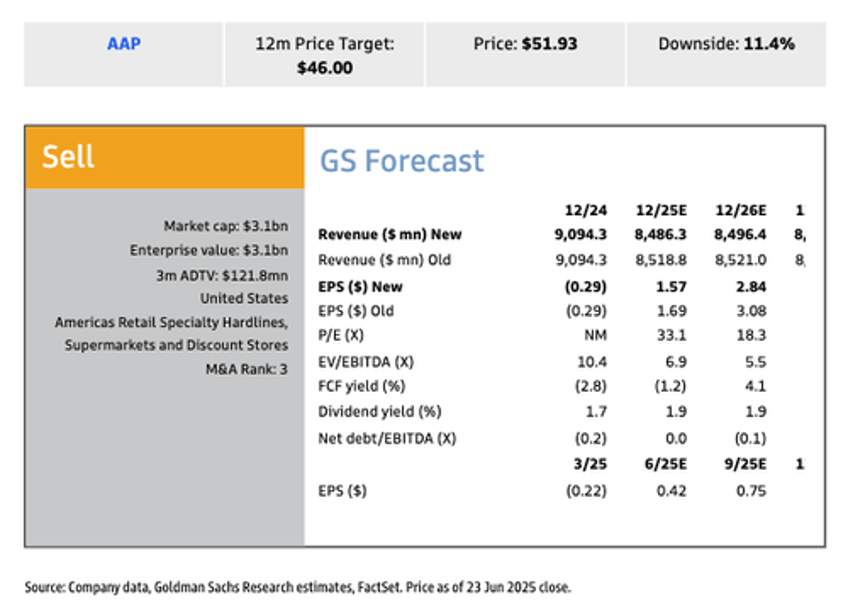

Moving on to Advance Auto Parts (AAP)—McShane downgraded the stock to Sell from Neutral, setting a new 12-month price target of $46, which implies an 11% downside. She sees AAP underperforming peers like O'Reilly Auto Parts and AutoZone in the near term, pointing to:

Traffic and survey data suggesting potential market share losses

A more cautious stance on margin recovery

A rich valuation at 19.5x NTM P/E, seen as unjustified without clearer signs of a turnaround

The analyst noted, "However, despite our downgrade, we continue to believe the company's current turnaround strategy is the right approach, and we hold a favorable view of the company's prospects longer term."

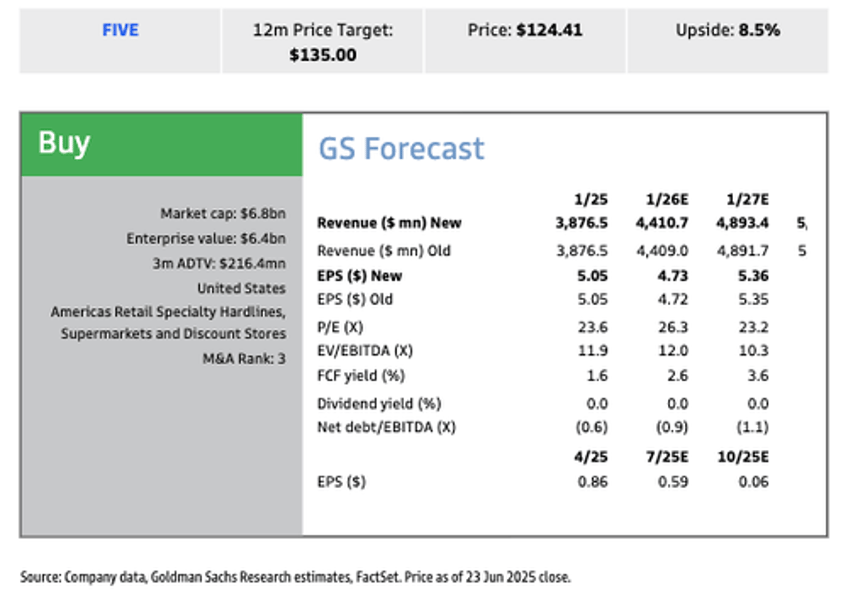

Separate from the downgrade parade in the consumer space, McShane upgraded retailer Five Below (FIVE) to Buy and raised the price target to $135, citing improving fundamentals and brand momentum.

Here are her key points from the note:

Tariff risk from China remains, but is likely priced in, based on management's guidance.

Valuation remains attractive, with a current P/E of 25.7x vs. historical averages.

Brand perception is improving, according to HundredX data, supporting the bullish thesis.

Earnings estimates raised, with Q2 EPS now at $0.59 (from $0.54) and FY25 EPS at $4.73 (up $0.01).

Margin expansion and merchandising improvements expected to drive continued outperformance.

McShane’s three downgrades and one upgrade have certainly turned heads across the consumer sector earlier today.