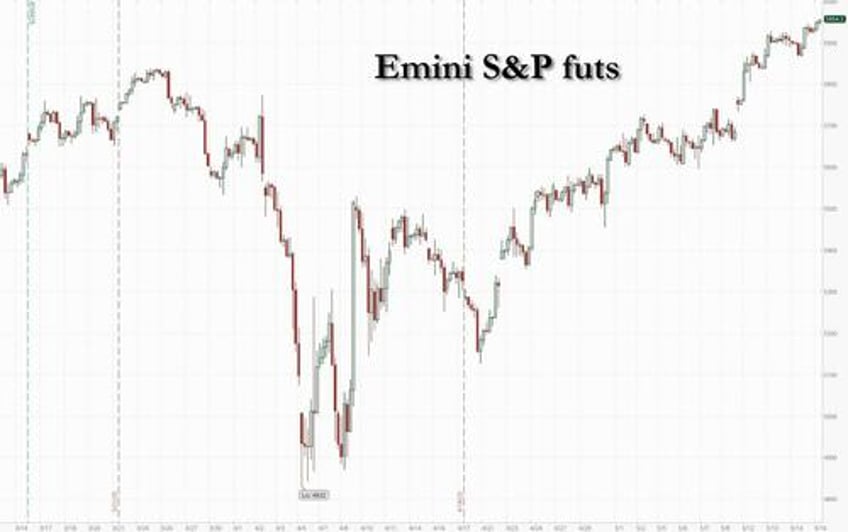

US stock futures are set for a fifth straight session in the green, as US equity funds benefited from their first inflows since the Liberation Day shock, and with 6000 in the S&P now less than a 100 points away. As of 8:00am, S&P 500 futures were up 0.3% after the index closed up 4.5% for the week on Thursday as the latest economic data spurred speculation the Fed will cut interest rates twice this year. Nasdaq futures gained 0.4% with Mag 7 leading (TSLA (+1.1%), GOOGL (+0.9%), and NVDA (+0.7%) are outperforming). The powerful rally this week has pushed the tech-heavy equity benchmark into overbought territory, while the S&P closed Thursday at the highest level since February. Europe’s benchmark Stoxx 600 gauge also gained, heading for a fifth weekly advance. The dollar weakened for a second session against major peers, while the yen and Swiss franc gained, and the 10-year Treasury yield was lower after declining 10 basis points Thursday as traders priced in more Fed cuts: bond yields are lower, with 2-, 5-, 10-, and 30-year yields down by 3.09bp, 3.7bp, 3.5bp, and 2.6bp respectively. Commodities are mostly lower, led by gold while oil reversed earlier losses. Overnight headlines were largely quiet. Today, we will receive University of Michigan Sentiment survey data, where consensus expects a modest bounce (to 53.5 vs. 52.2 prior).

In premarket trading, Mag 7 stocks are mostly higher with the exception of Meta after an equal-weighted gauge of the group fell over 1% on Thursday (Alphabet +1.5%, Tesla +1.1%, Nvidia +0.9%, Amazon +0.4%, Microsoft little changed, Apple +0.1%, Meta Platforms -0.1%). Charter Communications (CHTR) gains 9.4% after agreeing to merge with Cox Communications in a deal that values Cox at an enterprise value of about $34.5 billion. Vistra (VST) is up 5.1% after it said it executed a definitive agreement to acquire seven modern natural gas generation facilities from Lotus Infrastructure Partners for $1.9 billion. Here are some other notable premarket movers:

- Archer Aviation (ACHR) shares rise 5.7%, adding to gains from Thursday following its announcement that the electric vertical take-off and landing aircraft company had been selected as the ‘Official Air Taxi Provider’ for the LA28 Olympic and Paralympic Games.

- Doximity (DOCS) drops 18% after the healthcare-software company’s full-year forecast disappointed, with analysts pointing to a cautious tone from the management team on the call regarding the outlook for market growth.

- Globant (GLOB) shares sink 28% after the technology services provider cut full-year revenue guidance for 2025 to a level that undershot analysts’ expectations.

- Pentair (PNR) shares rise 2.2% after JPMorgan upgrades the water-treatment company to overweight from neutral on expectations of potential guidance upside.

- Quantum Computing (QUBT) shares are up 9.7% after the quantum optics technology company reported its first-quarter results.

- Rocket Cos. (RKT) gains 4.4% after ValueAct Capital Management LLC reported a 9.9% holding in the mortgage finance company, according to a new 13D filing with the US Securities & Exchange Commission.

- Take-Two (TTWO) falls 2% as the video-game publisher’s full-year forecast for revenue came up short.

- Travere Therapeutics (TVTX) shares drop 17% after the biotech’s application for its kidney disease treatment Filspari (sparsentan) failed to get priority review status from the US FDA and is set to face an advisory panel.

One month after the nevertrump media hyperventilated about the "US exceptionalism" trade dying, US equities are back in favor following the de-escalation of trade tensions between the US and China. Stocks are now trading like last month’s rout never happened, even though uncertainty remains about the effect of tariffs on the US economy and the direction that the global trade war will take in the coming months. Bank of America's Michael Hartnett said weekly US equity inflows resumed at $19.8 billion for the first time since Liberation Day. Meanwhile, stocks haven’t been getting rewarded for earnings beats: firms that topped expectations in the first quarter reports saw their share prices rise by less than usual, according to JPMorgan strategists. Meanwhile, Federal Reserve Bank of Atlanta President Raphael Bostic said he expects the US economy to slow this year but not fall into recession.

“For now, we believe that the path of least resistance is still higher for risky assets,” said Mohit Kumar, chief economist and strategist at Jefferies International. “We would start turning a bit more cautious around June/July when we expect the hard data start weakening.”

Thursday afternoon brought a deluge of 13F filings, which showed hedge funds adding healthcare exposure and cutting tech over the first three months of the year. Michael Burry’s Scion Asset Management liquidated almost its entire listed equity portfolio in the first quarter. Meanwhile, Warren Buffett’s Berkshire Hathaway trimmed its holdings of financials stocks.

Traders are also watching negotiations around the US budget with its promise of large tax cuts and the potential impact that will have on the fiscal deficit.

Elsewhere, Japan’s economy shrank for the first time in a year as the surging yen crushed exports, illustrating its vulnerability even before sustaining the impact of Trump’s tariff measures. Paradoxically, the yen gained 0.2% on Friday to trade around 145 per dollar even as Bank of Japan official Toyoaki Nakamura, the most dovish board member, warned against hurrying to raise the benchmark interest rate.

Europe’s benchmark Stoxx 600 gauge also gained, heading for a fifth weekly advance as cooling global trade tensions improve investor sentiment and corporate earnings season comes in better than expected. Health care and food and beverage sectors outperform. Among single stocks Richemont rises after reporting a rise in full year sales. Here are the most notable European movers:

- Richemont shares rise as much as 5.5% after the Swiss firm’s jewelry division saw strong growth thanks to demand for its high-end Cartier and Van Cleef & Arpels brands.

- Orsted shares rise as much as 2.1%, snapping three days of declines, after UBS analysts say the stock is pricing in a “close to worst case” scenario when it comes to a potential halt order on the Danish company’s two US offshore projects.

- 1&1 shares soar after its parent United Internet submitted a partial offer to acquire as much as 9.19% of 1&1 shares, for a cash consideration of €18.5 apiece.

- Tate & Lyle shares gain as much as 3.1%, among the best performers in the Stoxx 600’s food, beverage and tobacco subgroup, after Citi upgrades the stock to buy from neutral, saying the risk/reward “looks attractive.”

- CVC Capital shares climb as much as 5.4%, to the highest in six weeks, after Morgan Stanley upgrades its recommendation on the alternative investment manager to overweight, seeing scope for recovery after recent underperformance.

- Nibe falls as much as 4.1% after Handelsbanken cut its recommendation on the Swedish heat-pump manufacturer to sell from hold, quoting recent strong share performance.

- Eutelsat shares drop as much as 11% after the satellite operator said on earnings call that it’s “far too early” to discuss the European Union’s revenue commitment to its next-generation low-earth orbit satellites, dampening hope of enhanced government support in the near term.

- Rubis shares fall as much as 3.7% after the French energy solutions firm said Nils Christian Bergene will step down as chairman and a member of the supervisory board, a departure that CIC analysts called a surprise.

- Workspace Group shares fall as much as 11% after the landlord to mostly small- and medium-sized London businesses warned rising vacancies in its portfolio will dent profits.

- Future shares decline as much as 9.2% after the UK specialist publisher said its FY25 organic revenue will face a low-single-digit decline, below estimates.

- Tokmanni falls as much as 14%, the most since last July, after the Finnish retail group missed expectations in its first-quarter report.

- Dino Polska drops as much as 7.5%, most since August, as Poland’s food retailer reported slowing like-for-like sales in 1Q, raising concerns about its business model and triggering profit taking after 42% rally YTD.

Earlier in the session, Asian stocks traded in a narrow range as the rally sparked by US-China trade talks continued to cool and earnings from Chinese e-commerce giant Alibaba underwhelmed. The MSCI Asia Pacific Index swung between a gain of as much as 0.3% and loss of 0.2%. NetEase was the biggest contributor to the gains, after the China-based video-game company reported first-quarter results that beat expectations. Meanwhile, Alibaba was among the major drags, after its quarterly revenue missed estimates and cloud business disappointed. Key indexes dropped in mainland China, Hong Kong and India, while benchmarks rose in Australia and Taiwan. Goldman Sachs strategists raised their 3-month and 12-month targets for the MSCI Asia Pacific ex-Japan Index to 610 and 660, respectively, from 570 and 620, expecting “moderately higher” returns for the region thanks to improved earnings growth amid a better-than-expected outcome to US-China trade talks.

In FX, the Bloomberg Dollar Spot Index fell as much as 0.2%, declining for the second straight day; it is on track to end the week 0.1% higher; the yen and Swiss franc among the beneficiaries.

In rates, the 10-year Treasury yield was lower after declining 10 basis points Thursday as traders added bets on Fed rate cuts; treasuries are richer across the curve with futures adding to Thursday’s gains and 10-year yields dropping back to 4.405% and near 100-DMA. US yields richer by 2bp to 3bp across the curve with spreads broadly within a basis point of Thursday close; in the 10-year sector bunds and gilts outperform Treasuries by 2.5bp and 1.5bp so far on the day.

In commodities, gold fell to extend its weekly loss as demand for haven assets waned. Oil prices declined after Iran’s foreign minister cast doubts on the status of US-Iran nuclear talks.

Looking at today's US data calendar, key events includes April housing starts/building permits, import/export price index, May New York services business activity (8:30am), University of Michigan sentiment (10am) and March TIC flows (4pm). Fed speaker slate includes Daly at 9:40pm

Market Snapshot

- S&P 500 mini +0.3%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.4%

- Stoxx Europe 600 +0.6%

- DAX +0.7%, CAC 40 +0.6%

- 10-year Treasury yield -3 basis points at 4.4%

- VIX -0.2 points at 17.66

- Bloomberg Dollar Index -0.1% at 1228.52

- euro +0.2% at $1.1208

- WTI crude -0.3% at $61.45/barrel

Top Overnight News

- Donald Trump said he’d set tariff rates for US trading partners “over the next two to three weeks.” BBG

- US Deputy Treasury Secretary Faulkender said he is not concerned about persistent increases in prices, while he added that inflation will return to target levels and they are setting the foundation for the US economy to take off in H2.

- The Trump administration plans to put a number of Chinese chipmaking companies (including memory chipmaker ChangXin Memory) on an export blacklist, but some officials want to delay the move to avoid hurting efforts to strike a long-term trade agreement with China. FT

- Hopes faded for Russia-Ukraine talks set to take place today in Istanbul. The focus now shifts to when Trump may meet Vladimir Putin.

- US President Trump says deals from his trip are worth USD 12-13tln, includes deals already announced and some that will be outlined "very shortly". Will be sending out letters to nations for trade deals soon.

- China approves 10 nuclear reactors, putting the country on pace to surpass the US in nuclear power capacity by 2030. Nikkei

- NVDA is seeing to build a research and development center in Shanghai that would help the world’s leading maker of AI processors stay competitive in China, where its sales have slumped due to tightening US export controls. FT

- Japan’s Q1 GDP falls short of expectations, dropping 0.7% on an annualized basis vs. the consensus forecast of -0.3%, with the shortfall driven by weak consumption and higher imports. Nikkei

- Japan has signaled it is prepared to hold out for a better deal with the US over trade tariffs, pushing for full removal of his 25% duty on imports of Japanese cars rather than risk a domestic political backlash. FT

- The Fed’s Raphael Bostic said in a May 14 interview that he expects the US economy to slow this year but not fall into recession, and reiterated that he sees one rate cut in 2025. BBG

- The cost to ship a container of Chinese-made goods to the U.S. is jumping as importers race to pull cargo across the Pacific during a 3 month trade war truce. Freight rates from China to the US west coast have risen about 8% this week as bookings have boomed. Importers rushing to ship Chinese goods to the US during a short reprieve from higher tariffs may boost freighters. The surprise truce is seen causing a surge in transpacific shipping, Bloomberg Intelligence said. BBG, WSJ

- BofA card spending, week to May 10th: -1.3% (1.0% April average), spending has seen a recovery from the Easter slowdown.

Tariffs/Trade

- US President Trump's administration is reportedly split on adding Chinese chip makers to export blacklists as some US officials fear the move could jeopardise trade talks with Beijing, while the Commerce Department has compiled a list of Chinese companies including memory chipmaker ChangXin Memory to add to the 'entity list' although the timing of the move has been complicated by the recent agreement by China and the US to cut tariffs, according to sources cited by the FT.

- US told Vietnam its trade deficit is unsustainable and a major concern amid tariff talks, according to Vietnam state media.

- Mexican President Sheinbaum spoke with Canadian PM Carney regarding the importance of USMCA in strengthening the competitiveness of the three North American countries, while they also discussed the continuity and strengthening of the seasonal agricultural worker program.

- Greenland's Foreign Minister has suggested that she wants to deepen bilateral ties with the EU, highlighting Greenland's mineral resources as an area for collaboration, via Politico.

- Japan has reportedly indicated that it is prepared to hold out for a better deal with the US, pushing for the full removal of the 25% duty on car imports, via FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after the recent soft US data releases spurred Fed rate cut bets, while participants also digested weak data from Japan and earnings reports. ASX 200 was led by strength in miners and outperformance of gold producers after the recent rally in the precious metal. Nikkei 225 initially retreated amid recent currency strength and after GDP data for Q1 showed a steeper-than-expected contraction in Japan's economy, although the index gradually recovered and returned to flat territory as USD/JPY regained some composure and with the weak data effectively narrowing the scope for the BoJ to resume normalisation. Hang Seng and Shanghai Comp declined with sentiment dampened by earnings releases after Alibaba's results underwhelmed which pressured its Chinese blue-chip tech and ecommerce peers such as Tencent, Meituan and JD.com.

Top Asian News

- BoJ Board Member Nakamura said Japan's economy has recovered moderately, but some weakness has been seen, while he added the economy is facing mounting downward pressure due to the implementation of US tariff policies. Nakamura said the momentum for wage hikes has accelerated but could weaken depending on impact of US tariff policies and noted that it is appropriate to keep monetary policy steady for the time being. Furthermore, he said uncertainty over the economic outlook is heightening, so a cautious monetary policy approach is necessary and hiking rates prematurely when growth is slowing could curb consumption and capex.

- Japan's Economy Minister Akazawa said improvements in job and income conditions are likely to underpin moderate economic recovery, while he added must be mindful downside risk to the economy from US trade policy and the hit to consumption and household sentiment from sustained price rises also becoming a downside risk to Japan's economy.

European bourses (STOXX 600 +0.6%) opened modestly firmer across the board, and have traded with an upward bias this morning. European sectors hold a strong positive bias, with only a handful of industries in negative territory. Healthcare takes the top spot, with gains in the sector seemingly broad based. In terms of stock specific stories, Sanofi (+2.2%) gains after it received FDA orphan designation for treating sickle cell disease. Bayer (+3.5%) benefits from an FT report which suggested it is seeking a Roundup settlement.

Top European News

- ECB's Villeroy says "we are not currently in a currency wars situation but rather a trade war situation".

- ECB's Kazaks says a meeting by meeting approach at the ECB is right and notes a lot of uncertainty around trade measures, according to CNBC.

FX

- Dollar is on the backfoot, continuing the pressure seen following Thursday’s disappointing Retail Sales and softer-than-expected PPI data. As a reminder, this led money markets to fully price in two Fed cuts by year-end; currently pricing in roughly 57bps. DXY currently sits in a 100.52-78 range. Further downside for the index will see a potential test of the week’s trough at 100.27 – should that be taken out, 100.00 will be next in focus. Ahead, US Import Prices, UoM Survey and commentary from Fed's Barkin.

- EUR is modestly firmer vs the Dollar, with specific for the Bloc very light today – Final Italian inflation metrics were revised marginally lower but ultimately had little impact on the Single-Currency. Commentary via ECB’s Kazaks and Villeroy this morning has not added too much to the agenda; the former reiterated the need for a meeting-by-meeting approach and highlighted the uncertainty around trade. This morning EUR has climbed back above the 1.12 mark and has traded in a busy 1.1182-1.1219 range.

- JPY is slightly firmer vs the Dollar after choppy price action overnight, which saw USD/JPY initially trickle lower amid initial haven flows into the yen and recent declines in US yields, but later bounced off support at the 145.00 level. USD/JPY was little moved following weaker-than-expected GDP data. USD/JPY currently trading around 145.30 in a 144.93-145.68 range

- GBP is flat/incrementally firmer vs the Dollar and holds just above the 1.33 mark, in a very thin 1.3300-1.3320 range. UK-specific updates have been lacking today. Some focus has been on an FT article which suggested that EU leaders are urging UK PM Starmer to improve the region’s mobility deal – particularly for EU students.

- Antipodeans are the best performers vs the Dollar, nursing some of the losses seen in the prior session. The Kiwi is the best G10 performer today; overnight, New Zealand 1yr and 2yr inflation expectations are both seen higher, which may explain some of the outperformance in today’s session. Do note that the NZD is outmuscling the AUD in the AUD/NZD cross; some traders may be focused on next week’s RBA meeting, where markets widely expect the Bank to deliver a 25bps cut.

- PBoC set USD/CNY mid-point at 7.1938 vs exp. 7.2085 (Prev. 7.1963).

Fixed Income

- Firmer start to the day as USTs continue the data-induced upside from Thursday with newsflow since a little light and markets largely awaiting updates on numerous geopolitical situations. At the top-end of a 110-10 to 110-20 band. As it stands, on track to end the week almost flat, opened the week at 110-18, despite the marked pressure seen in the first half on US-China progress. Trade developments that sparked notable hawkish action Monday through Wednesday, before being offset by Thursday’s data deluge. Ahead, the docket is comparably light but does feature Building Permits/Housing Starts, Import Prices (factor into PCE) and the prelim. Uni. of Michigan series for May.

- Bunds are in-fitting with USTs, but with action slightly more pronounced as EGBs experienced a marginal rally early doors as European players entered the fray and reacted to the bullish bias of APAC trade. Specifics light. A few ECB officials on the wire but nothing that has fundamentally shifted the narrative. Bunds just off highs in a 130.11-50 confine and, as with USTs, near-enough on track to end the week flat despite a WTD range in excess of 135 ticks.

- Gilts are outperforming slightly, likely on account of the marginal underperformance vs Bunds seen at points this week and as such, the UK is catching up on the final session of the week. As above, Gilts are also set to end the week essentially unchanged, currently just off highs in a 91.84-92.00 band. Resistance at 92.59 from mid-April and thereafter 93.00 before highs from the last few weeks, beginning at 93.59.

Commodities

- A hesitant start for WTI and Brent as geopolitics dominates ahead of the weekend. WTI and Brent traded largely flat through the morning but are currently down by around USD 0.10/bbl, nearing overnight lows.

- In terms of Iran-related headlines, crude prices whipsawed on conflicting media reports yesterday and mixed signals from US and Iranian officials. This morning, Iran's Foreign Minister stated that negotiations will continue as long as the other party remains engaged, maintaining that no formal proposal from the US has been received.

- On Russia-Ukraine, talks are underway in Istanbul, with the Trilateral meeting between Turkey-US-Ukraine supposedly concluded. We are yet to hear the readout from it. Ahead, there will be another trilateral meeting, this time with Russia taking the place of the US.

- Spot gold is continuing losses, pulling back from yesterday’s gains after soft data, lower yields and Fed rate cut bets aided the yellow metal. At the time of writing, the yellow metal trades towards the upper end of a USD 3,205.49-3,252.17/oz range.

- Base metals are softer after the subdued mood in its largest buyer, China, overshadows the positive sentiment in Europe this morning. 3M LME Copper currently rests within, but at the lower-end of, a USD 9,474.9-9,591.42/t range.

- Shanghai Copper warehouse stocks +27.44k/T (prev. -8.60k/T), Aluminium stocks -13.59k/T (prev. -6.19k/T)

- ADNOC Chief says the UAE and the US plan investment of USD 440bln in the energy sector through 2035.

Geopolitics

- US President Trump says he is willing to meet with Ukrainian President Zelensky and Russian President Putin as soon as arrangements can be made; going to take care of Gaza; will make good progress on geopolitical situations in the next two or three weeks In one way or another, will take care of Iran.

- Iranian Foreign Minister says the nation's position is clear and we are ready to build confidence and adopt transparency in our Nuclear Programme in exchange for the lift of sanctions. Not received any agreement proposal from the US; is possible will be informed via a meditator

- Hamas is reportedly holding direct negotiations with the US Administration, according to a senior Hamas official cited by Al Arabiya.

US Event Calendar

- 8:30 am: Apr Housing Starts, est. 1363.5k, prior 1324k

- 8:30 am: Apr P Building Permits, est. 1450k, prior 1467k

- 8:30 am: Apr Import Price Index MoM, est. -0.3%, prior -0.1%

- 10:00 am: May P U. of Mich. Sentiment, est. 53.5, prior 52.2

- 4:00 pm: Mar Net Long-term TIC Flows, prior 112b

- 4:00 pm: Mar Total Net TIC Flows, prior 284.7b

Central Banks

- May 16: Fed’s Barkin Gives Commencement Speech

- May 17: Fed’s Daly Gives Commencement Address

DB's Jim Reid concludes the overnight wrap

Markets continued to advance over the last 24 hours, as weak US inflation data and lower oil prices raised expectations that the Fed would still cut rates this year. By the close, that meant the S&P 500 (+0.41%) had posted a 4th consecutive gain, which now brings its advance since the April low to +18.75%. In fact, the index isn’t far away from a +20% gain that would mark the technical definition of a bull market, and futures this morning are pointing to another modest gain. So it’s been an astonishing turnaround from where we were just over a month ago at the height of the tariff uncertainty.

There were several factors driving the rally, but a critically important one was the US PPI data for April. It showed inflation pressures were much softer than expected, with headline PPI down -0.5% on the month (vs. +0.2% expected). So that marked the biggest monthly decline in producer prices since April 2020 and the Covid lockdowns, and it pushed the year-on-year reading down to +2.4% (vs. +2.5% expected). Core PPI was also softer than expected, with the measure excluding food energy and trade down -0.1% on the month (vs. +0.3% expected), which was the first negative print since April 2020. It also helped broader inflation expectations to move lower, and the US 10yr inflation swap fell -4.7bps on the day to 2.50%, marking its biggest decline in over a month.

With investors feeling less concerned about inflation, they then dialled up their expectations for Fed rate cuts in response. For instance, the amount priced in by December up +7.1bps on the day to 56bps. And in turn, that contributed to a large rally in Treasury yields across the curve, with the 2yr yield (-9.0bps) falling back to 3.96%, whilst the 10yr yield (-10.5bps) fell to 4.43%.

Those moves got further momentum from the latest decline in oil prices, which added to the sense that inflationary pressures were easing. The move followed comments from President Trump, who said “I think we’re getting close to maybe doing a deal” with Iran. Moreover, Trump posted an NBC news story citing a top Iranian official that Iran would sign a nuclear deal in exchange for lifting economic sanctions. So the newsflow led to growing expectations that oil supply could rise, and Brent crude fell another -2.36% on the day to $64.53/bbl.

The fall in yields came despite comments from Fed Chair Powell yesterday, who indicated that the Fed were reconsidering the language on average inflation targeting in their latest review. For reference, in 2020 they changed their approach to permit a period of inflation above the 2% target, if it followed a period of inflation running beneath target, so that was a significant shift. However, the potential to move back off that again was seen in a hawkish light, as it implied less tolerance for higher inflation in the future, and Treasury yields briefly spiked as the headlines came through.

Nevertheless, the Powell comments weren’t enough to counteract the broader rally, and there was also relief yesterday that the US data continued to point away from a recession. For instance, the weekly initial jobless claims remained at 229k over the week ending May 10 (vs. 228k expected), so still in their recent range and not signalling a sharper deterioration. In the meantime, the retail sales data showed modest growth of +0.1% in April (vs. unch expected), which was a slowdown from March, but still not the contractionary territory that might be expected in an outright recession. And with the latest data in hand, the Atlanta Fed’s GDPNow estimate for Q2 moved up to an annualised +2.5% pace.

That environment proved to be a strong one for equities on both sides of the Atlantic, with the S&P 500 up +0.41% on the day. The advance was reasonably broad-based, with 75% of the index moving higher. Defensive sectors outperformed, with utilities (+2.12%) and consumer staples (+2.00%) leading the gains for the S&P 500. By contrast, the Magnificent 7 (-1.09%) ended a run of 5 consecutive gains. Within the Mag-7, Meta fell -2.35% following a WSJ report that it was delaying the rollout of a flagship AI model. In terms of other individual moves, Walmart (-0.50%) lost ground after their earnings, and they warned that prices would go up as a result of the tariffs. And Cisco Systems gained +4.85% following their own earnings after the previous day’s close.

Earlier in Europe, bond markets had also rallied on hopes for weaker inflation, and yields on 10yr bunds (-7.7bps), OATs (-8.5bps) and gilts (-5.2bps) all moved lower. There were similar gains for equities, with the STOXX 600 (+0.56%) closing at a 7-week high, alongside a fresh record for the DAX (+0.72%). That positivity was reinforced by strong UK GDP numbers, with Q1 growth running at a quarterly +0.7% pace (vs. +0.6% expected), and the FTSE 100 (+0.57%) closed above its Liberation Day level for the first time.

Overnight in Asia however, the tone has generally been more negative, with several of the major indices losing ground. Sentiment hasn’t been helped by Japan’s Q1 GDP reading, which showed a larger-than-expected contraction, with the economy shrinking at an annualised -0.7% pace in Q1 (vs. -0.3% expected). So that raised fears about how resilient the economy was, particularly given those numbers were before the Liberation Day announcement in April. Against that backdrop, Japan’s Nikkei fell -0.28%, and elsewhere there’ve been losses for the Hang Seng (-0.76%), the CSI 300 (-0.57%) and the Shanghai Comp (-0.52%). That said, there have been some gains, including South Korea’s KOSPI (+0.19%), and Australia’s S&P/ASX 200 (+0.57%).

Looking forward, the planned US budget reconciliation bill will remain in focus today. Politico reported yesterday evening that today’s planned procedural vote in the House Budget Committee may be in peril due to opposition from fiscally hawkish Republicans to the CBO’s scoring of the bill, and proposed delays to Medicaid cuts. Yesterday our US economists published a report (see here) analysing the details of the tax bill released this week, which they see putting the US on course for a 6.5% of GDP fiscal deficit in the coming years.

In geopolitics, it’s also worth keeping an eye on today’s talks between Russian and Ukrainian officials in Istanbul. These mark the first direct talks since spring 2022, but with Moscow sending a relatively low-level delegation, no immediate progress is expected. Trump claimed yesterday that “nothing’s going to happen” in terms of resolving the war in Ukraine until he and Putin meet.

To the rest of the day ahead, data releases include the University of Michigan’s preliminary consumer sentiment index for May, along with April’s building permits, housing starts, and the import and export price indices. In the Euro Area, we’ll get the March trade balance. And from central banks, speakers include the Fed’s Barkin, the ECB’s Lane, and the BOE’s Lombardelli.