By Michael Every of Rabobank

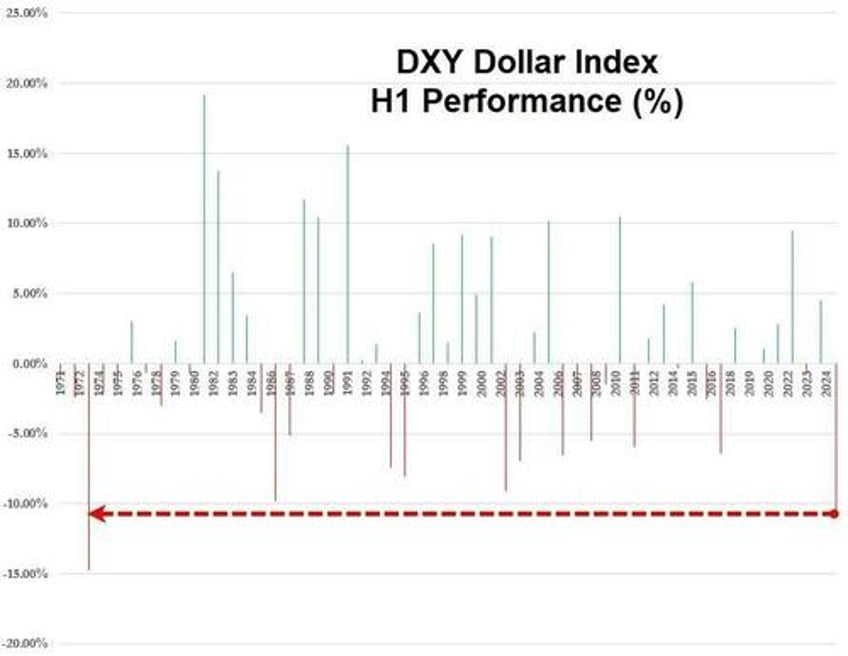

Equity markets at new record highs continue to think 2025 is more of the same-old, same-old. Bond markets whispering about a series of Fed rate cuts do too. Yet the US dollar just had its worst H1 -- down around 10% -- in over five decades.

Those in markets who know economic history recall this was when the gold-backed-dollar Bretton Woods system was about to collapse under the Triffin Paradox demand for offshore dollars earned via a swelling trade deficit, with a fiscal deficit led by hot war in Vietnam, Cold War in general, and demands for more social spending. The Yom Kippur War in 1973 and the Iranian Revolution in 1979 then helped western inflation became entrenched and its politics often went haywire.

In June 1970, TIME magazine wrote ‘Money: Anger at Dollar Imperialists’, noting:

“The men who manage Europe’s money are increasingly annoyed with the US. They are upset by America’s old habit of spending, lending and investing more abroad than it takes in from foreign sources… The BIS annual report added that it is “hard to discern how the US authorities expect, by their own actions, to correct the balance of payments.” … Robert Triffin… [says] the US is unconcerned about its deficits because it has discovered that it can get away with a kind of “monetary imperialism.” The position of the dollar as the standard of value against which all other currencies are measured enables the US to escape the consequences that other countries suffer if they consistently overspend abroad. In any other country, a parade of deficits comparable to those the US has run would force devaluation of the currency. Devaluation of the dollar, the currency that more than any other has been considered as good as gold, would bring such chaos that it has been considered unthinkable.”

No, history doesn’t repeat itself. Yes, it can rhyme.

On the fiscal front, are there are any serious global fiscal rules anymore even before we hit the next crisis? Italy will include a €13.5bn bridge to Sicily as NATO spending, suggesting the resolution to get broad defense from under 2% to 5% of GDP by 2035 will at least blow up deficits. UK PM Starmer is failing to win over party rebels opposed to welfare cuts. Trump just told Republicans to stop cutting spending and ‘go for growth’ to raise revenue “10 times”. Even Xinhua has reported the creation of a new “decision-making and deliberative coordination body” at the CCP’s Central Committee – does that lean towards more China stimulus?

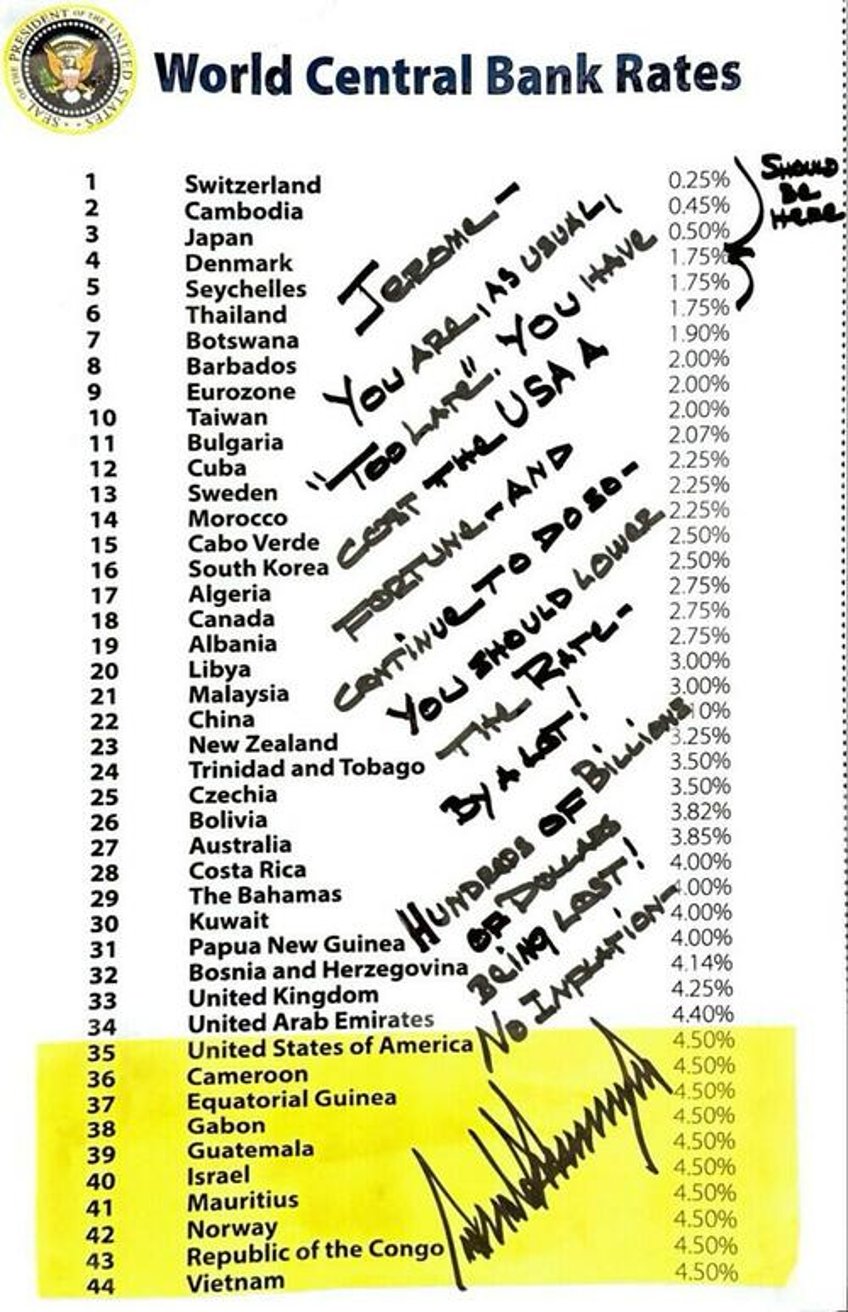

On the monetary front, Trump took his attacks on Fed Chair Powell to a new level in visually showing he’d like Fed Funds between 0.25% - 1.75% as Treasury Secretary Bessent said he can’t fund down the curve because of where yields sit, against whispers of zero-coupon bonds.

The ECB used its policy strategy review to underline that geopolitics, digitalisation, AI, demography, the environment, and changes in the international financial system all suggest inflation will be more volatile, with larger target deviations from its 2% CPI target in both directions. Yet while it’s prepared to take “appropriately forceful or persistent monetary policy action in response to large, sustained deviations of inflation from the target in either direction,” it flagged longer-term refi operations, QE, negative rates and forward guidance, all on the easing side – what’s the tightening equivalent? Lastly, there was market chatter that the RBA should drop its 2.5% CPI mid-point target: but only to cut, allowing housing to get even more expensive.

In FX, all is in flux. Many countries that are not set up to see higher exchange rates are getting them anyway. There is deepening discussion of the strategic role that Bitcoin and dollar stablecoins will play within the new US and international financial architecture – and if a weaker dollar is now a US gameplan after markets rudely rejected what higher tariffs were supposed to achieve, which was a stronger greenback. There is equivalent talk of gold’s future in many circles, and in some of both Europe and China’s fresh attempt to internationalise their currencies… with almost zero realpolitik power in the former case, and a closed capital account and vast trade surplus in the latter. Anybody thinking this is markets business as usual frankly looks like they are wearing 1970’s flares.

In politics, not only are centrists failing and populists rising, but the latter are being outflanked. A farther right alternative to the UK Reform Party now leading opinion polls, the Advance UK Party, has just been launched by key ex-members. Openly socialist Democrat Zohran Mamdani could easily be the next Mayor of New York City. Elon Musk just posted: “If this insane spending bill passes, the America Party will be formed the next day. Our country needs an alternative to the Democrat-Republican uniparty so that the people actually have a VOICE.” A libertarian one that votes for austerity - really?

In geopolitics, we luckily just avoided another Middle East oil shock involving Israel and Iran. On that, one hopes for the best, and Israel is reported to be in advanced talks with Syria over officially ending hostilities running since 1948 and hopes remain for a ceasefire in Gaza, which President Trump reportedly wants to be permanent. He and PM Netanyahu will meet in the White House on Monday. However, we still have a hot war in Ukraine, with huge forces arrayed around Sumy, with clear risks of other global flash points.

One key difference from the 1970s is that protectionism is already back with a bang. The EU has reportedly accepted it’s going to get stuck with a 10% US universal tariff and now wants to find UK-style quota workarounds for 25% and 50% sectoral tariffs: following Canada’s humiliating climbdown on its digital services tax the day before, that’s another victory for the US brute force, which hasn’t changed since the 1970s. Japan was also called “spoiled” by Trump and criticised for not buying its rice - but it may buy US oil; and a trade deal with India is reported as close (again) - expect a flurry of activity over the next week, it seems. The US is already reshaping the global economy, despite markets saying TACO, and it will continue to do so.

For its part, the EU has promised greater market access for Ukrainian farm goods in return for aligning farm standards; as France and Germany combined to destroy an EU ethical supply chain law, says Politico.

Moreover, China warned it: “is pleased to see parties resolving their economic and trade differences with the US through equal consultation. At the same time, we urge all parties to stand on the side of fairness and justice, to be on the right side of history, and to firmly uphold international economic and trade rules and the multilateral trading system. China firmly opposes any party making a deal that sacrifices China’s interests in exchange for so-called tariff reductions. Should that occur, China will not accept it and will respond resolutely to safeguard its legitimate rights and interests.” In short, expect supply-chain friction ahead – and for years.

We also see more economic statecraft: Australia just moved to set up a domestic fuel reserve rather than exporting it all and then suffering local shortages.

So, yes, the dollar just had its worst H1 since 1973. But what happened to it after that? Not in H2, but structurally. It transmogrified into an even more powerful fiat currency than it was on gold. Given the Achilles heels everyone is now displaying, can a reverse change in the dollar occur – especially when it alone has mighty military muscles (for now)?

Look beyond all of the above to note that the dollar question is perhaps not “To be or not to be?”, but “B-2 or not B-2?”