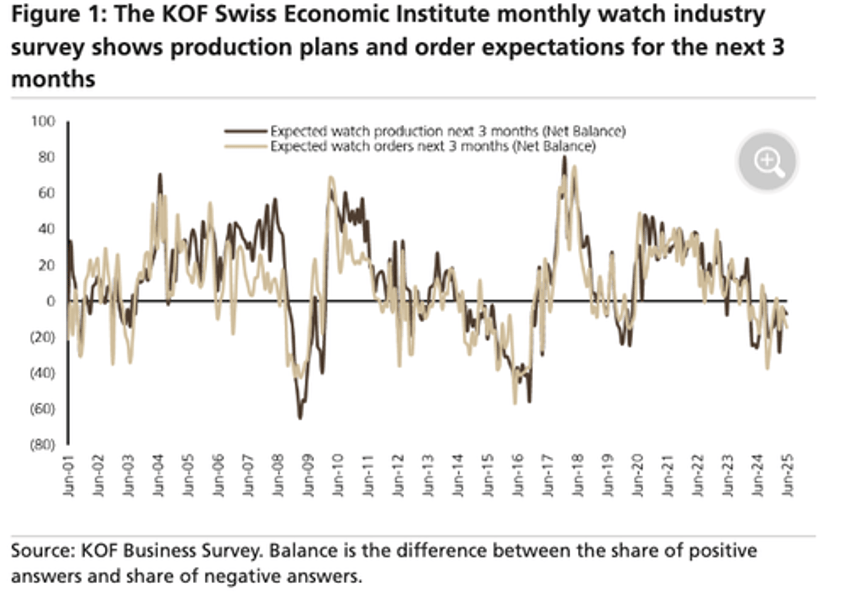

A team of UBS analysts led by Zuzanna Pusz pointed to new June data from the KOF Swiss Economic Institute showing deteriorating sentiment across Swiss watchmakers, further validating their cautious stance on the global luxury market.

June readings from the KOF Swiss Economic Institute (monthly survey of Swiss watch producers) show that expectations of production plans over the next three months decelerated m/m to -7.3 (restated May -5.5). Additionally, sentiment on expected orders over the next three months also decreased to -14.8 (May -10.7), the second lowest point in 2025ytd. -Pusz

The survey revealed declines in both production expectations and order outlooks, suggesting that a meaningful recovery in the global global luxury market might not occur until 2027.

The Jun readings show a sequentially more negative picture regarding sentiment in the industry vs. May, supporting our cautious view about the potential recovery in the global luxury market in 2025, as we believe it may take until 2027 for the sector's momentum to meaningfully re-accelerate.-Pusz

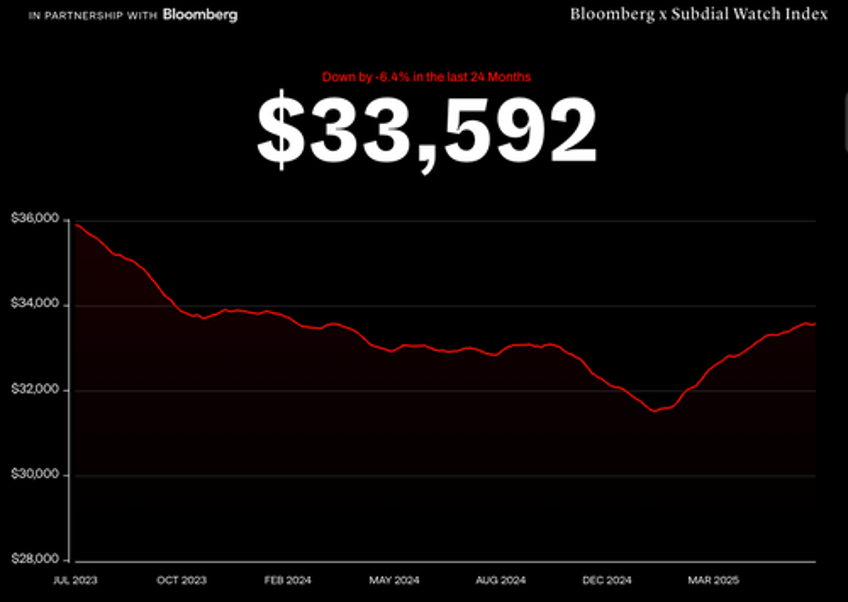

With secondary market prices for timepieces having already fallen sharply in recent years, as per Bloomberg Sundial data below, perhaps conditions may soon be ripe for contrarian investors to begin bottom-fishing Rolexes.

Used Rolex prices are unlikely to rebound meaningfully until the Federal Reserve initiates an interest rate-cutting cycle (and price rebound could occur in the form of a lag).

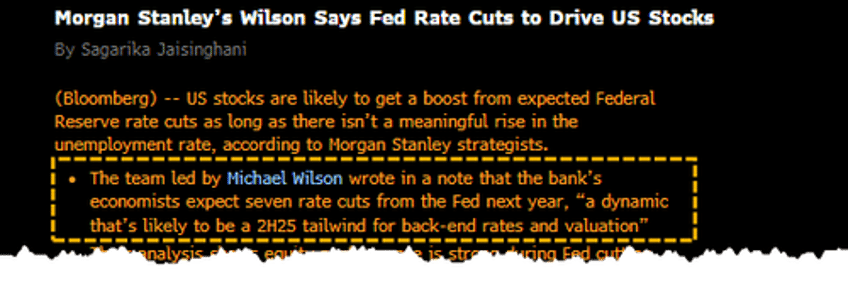

According to Morgan Stanley's Michael Wilson, that easing cycle could begin as early as next year, with the potential for at least seven rate cuts.

If realized, this shift in monetary policy could provide a supportive backdrop for risk assets—including stocks and also luxury watches—heading into the second half of 2025.

Still, UBS's Zuzanna Pusz emphasized that both the watch segment and the broader luxury market remain on shaky ground, reiterating that any "momentum to meaningfully re-accelerate" is unlikely before 2027.