The Senate version of President Trump’s Big, Beautiful Bill (BBB) will add nearly $3.3 trillion to US deficits over a decade, according to the latest estimate from the Congressional Budget Office, half a trillion more than the $2.8 trillion in deficit expansion under the House version of the same bill.

The CBO score for the so-called One Big Beautiful Bill reflects a $4.5 trillion decrease in revenues (i.e. tax cuts relative to the pre-TCJA baseline) and a $1.2 trillion decrease in spending through 2034, relative to a current law baseline.

The Senate bill, by Republican request, was also scored as saving $508 billion over a decade relative to a current policy baseline. The party’s lawmakers have sought to use the accounting maneuver to permanently extend President Donald Trump’s 2017 income-tax cuts, and score them as costing nothing.

While this approach is expected to pass, it effectively dooms the US to debt collapse as every subsequent administration will use the same tactic from now on and pretend that trillions in incremental spending every 4 years are really just an extension of the baseline. Meanwhile, the US is set to hit $40 trillion in debt in less than 2 years.

What does this mean? It means that Senate Republicans slapped a price tag on their tax package that is nearly 90% lower than the version that recently passed the House. They didn't bring the price down by changing the policies in the One Big Beautiful Bill. Instead, the Senate simply changed the way they did the math.

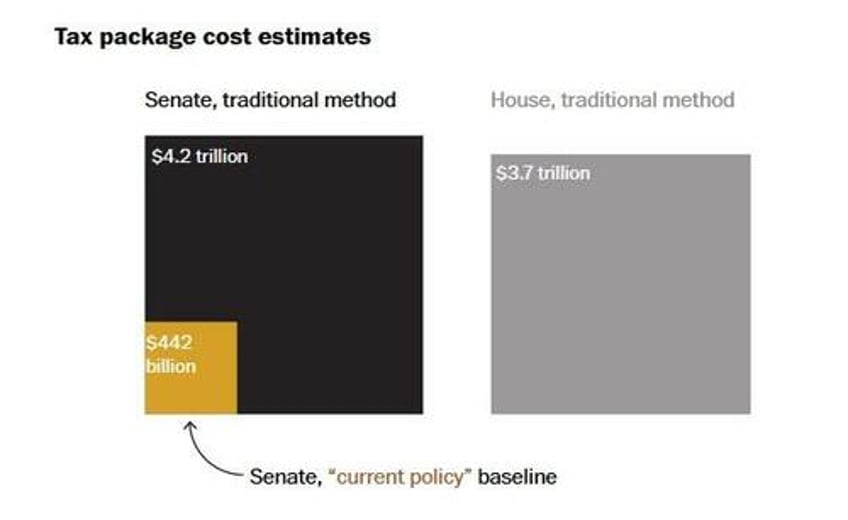

Senate Republicans are using a new method to estimate the costs of their tax package that ignores the price of continuing any tax policy in effect when the bill is passed. That method of accounting, called the "current policy" baseline, lets the Senate advertise President Donald Trump's tax package at one-tenth of its impact on the nation's finances as estimated by Congress's usual way of counting costs. If the costs were estimated in the traditional way, the Senate's proposed tax package would add $4.2 trillion to the national debt, according to preliminary estimates from the nonpartisan Committee for a Responsible Federal Budget.

"This would be the biggest and maybe most economically costly gimmick in American history," said Marc Goldwein, vice president of the Committee for a Responsible Federal Budget, in a post on X.

As a result, Senate Republicans have moved forward with a plan to mask the $3.8 trillion cost of extending expiring tax cuts. GOP senators voted Monday in favor of the plan to count the extension of Trump’s 2017 tax cuts as costing nothing, over objections from Democrats and despite concerns raised by economists about the US debt trajectory.

Republicans argue that using this accounting method, known as “current policy,” would allow them to include more tax cuts in Trump’s “One Big, Beautiful Bill.”

The cost of extending Trump’s first-term tax cuts, according to the Joint Committee on Taxation, totals $3.8 trillion. The other tax provisions in the bill cost nearly $693 billion, and only that smaller figure is considered in the official price tag for the bill.

Use of the current policy baseline is unprecedented for the reconciliation process the Republicans are using to approve the massive legislation with a simple majority. The cost of a bill is normally measured according to what effect it would have on the federal budget under current law. But the Republicans want to revise the process by assuming that current policies remain in place indefinitely.

The reason for this accounting gimmickry is that the bill’s staggering cost - which ends up adding substantially to the deficit instead of cutting it as some had expected as recently as weeks ago - has been a big problem for fiscal conservatives. It has faced several obstacles in the Senate as lawmakers have demanded conflicting changes. Then a number of spending cuts included in the package were changed as they did not comply with Senate rules for the reconciliation process.

Democrats and some economists argue that use of the current policy baseline allows GOP lawmakers to circumvent rules that would otherwise limit the bill’s fiscal effects. That, they say, imperils the nation’s fiscal trajectory although with the US already facing guaranteed debt collapse, may as well go full throttle.

“Republicans can use whatever budgetary gimmicks they want to try and make the math work on paper,” Senate Minority Leader Chuck Schumer said Sunday. “But you can’t paper over the real life consequences of adding tens of trillions to the debt.”

“Even a preschooler knows this is magic math,” said Patty Murray of Washington State, the top Democrat on the Senate Appropriations Committee. She accused Republicans of “trashing the rules” to pass the bill.

Senator Lindsey Graham of South Carolina said that Republicans aren’t doing “anything sneaky.”

“The bottom line is we are going to make the tax cuts permanent,” he said.

The vote allows Republicans to circumvent rules that would normally limit the fiscal impact of legislation passed through the fast-track reconciliation process. Economists have warned the legislation, regardless of how it’s counted, would still add trillions to deficits.

As noted above, the cost of the Senate bill is higher than the CBO’s $2.8 trillion projected cost of the version passed by the House last month, which also accounts for economic effects and higher interest rates spurred by larger debt loads.

As Bloomberg notes, the legislation encompasses much of Trump’s economic agenda: in addition to the 2017 tax break extension, effectively making it permanent, it would make make various spending cuts to safety net programs, including Medicaid and the Supplemental Nutrition Assistance Program, or food stamps.

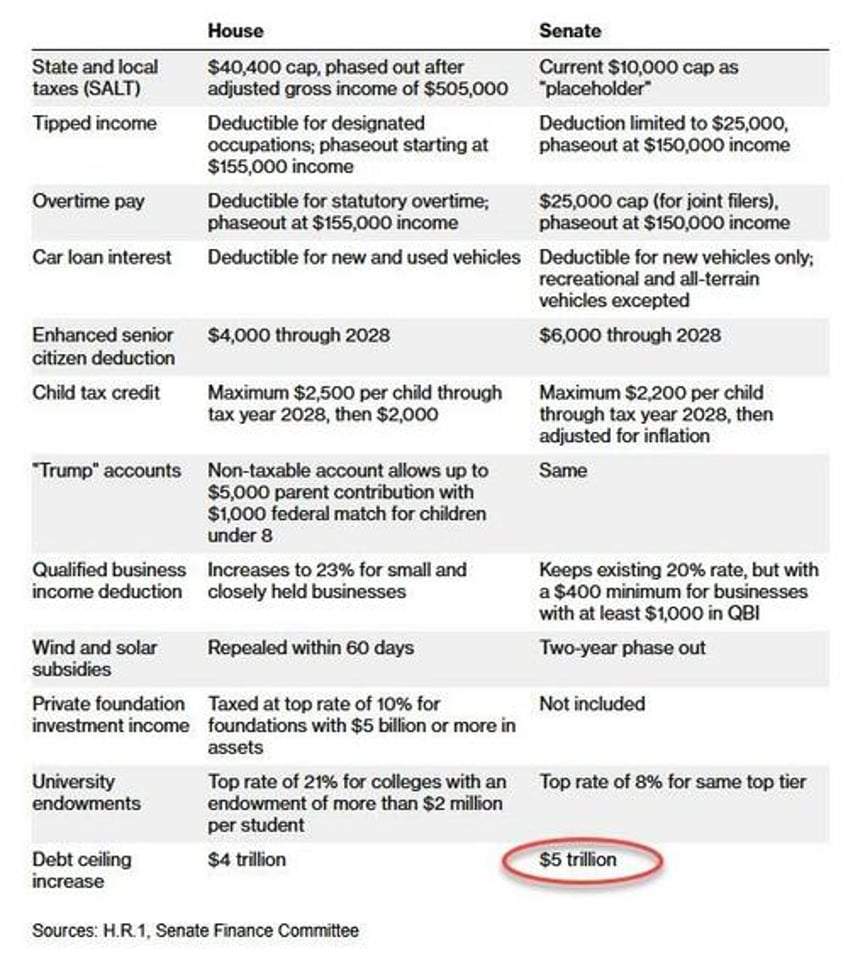

The Senate version made three business tax breaks permanent, limits deductions on new tax breaks on workers’ tips and overtime and includes changes to some of the Medicaid provisions.

House and Senate Republicans have also reached a deal to alter the cap on federal deductions for state and local taxes. That limit will remain at the $40,000 limit set in the House bill, but it will be limited to a five-year period, rather than 10 years.

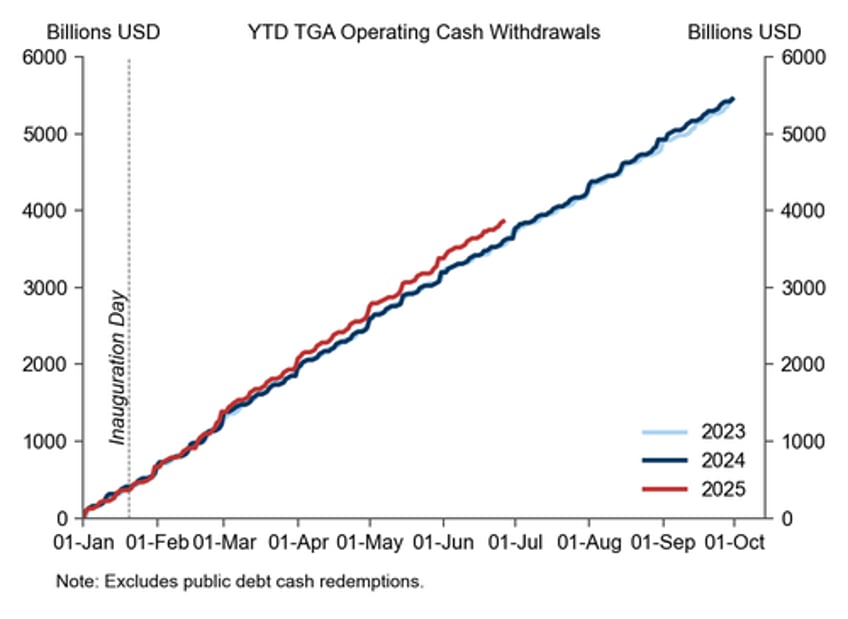

Of course there is a simple way to keep track of how much is being spent by the US government, and that's simply to add up US federal government spending, using operating cash withdrawals from the Treasury's cash balance as proxy. It hardly needs to be explained.

All accounting gimicks aside, at the end of the day just one number matters, and it's pretty clear: the House version of the BBB seeks to add $4 trillion to the debt ceiling, pushing it to $40 trillion. The Senate version: $5 trillion.

In retrospect, Andrew Yang's take that the Big Beautiful Bill should be called the BBB Act because that’s what the US Credit Rating will be in a few years, will end up being optimistic.

The Big Beautiful Bill should be called the BBB Act because that’s what the US Credit Rating will be in a few years.

— Andrew Yang🧢⬆️🇺🇸 (@AndrewYang) June 4, 2025