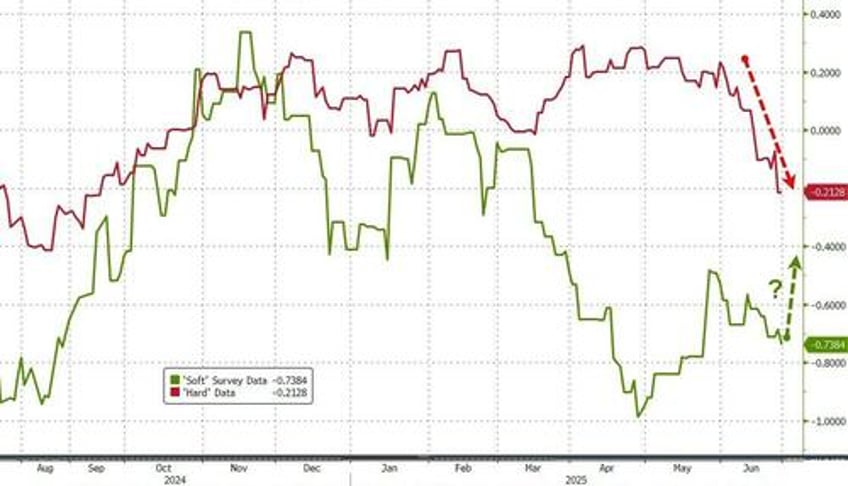

Despite 'hard' data plummeting, catching down to 'soft' data's early demise, expectations were for a modest rise in Manufacturing survey data this morning.

S&P Global Manufacturing PMI rose from 52.0 to 52.9 in June (better than 52.0 exp) - the strongest in over 3 years

ISM Manufacturing rose from 48.5 to 49.0 (better than 48.8 exp) - highest since Feb 2025

For once, both surveys agreed with each other...

Source: Bloomberg

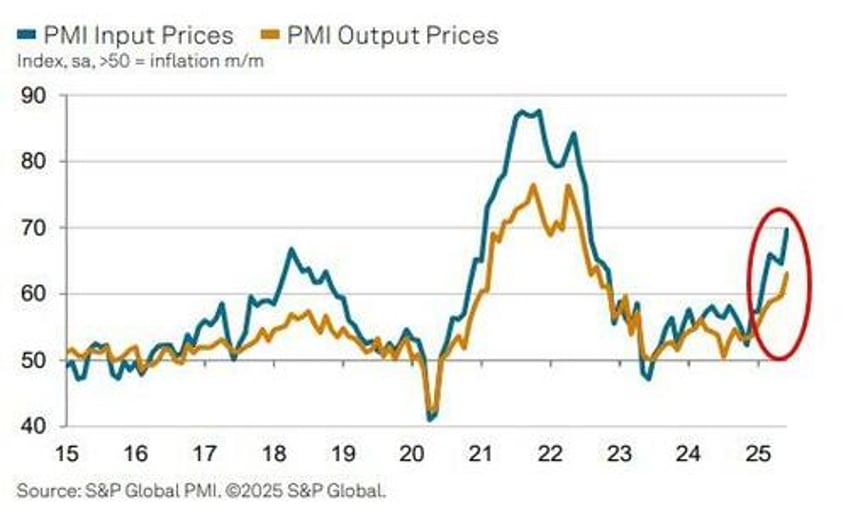

However, tariffs remained a prevalent theme, notably affecting purchasing decisions and prices.

Latest data showed manufacturers raising their input buying activity to the greatest extent since April 2022, at times reflective of efforts to build up inventories given ongoing trade and price uncertainty.

Nonetheless, input costs still rose sharply, with inflation hitting its highest level for nearly three years.

A similar trend was seen for output charges, which rose to the greatest degree since September 2022.

In the ISM survey, both employment and new orders remain below 50 (in contraction) and weakened in June.

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence: “June saw a welcome return to growth for US manufacturing production after three months of decline..."

"...with higher workloads driven by rising orders from both domestic and export customers. Reviving demand has also encouraged factories to take on additional staff at a rate not seen since September 2022.

“However, at least some of this improvement has been driven by inventory building, as factories and their customers in retail and wholesale markets have sought to safeguard against tariff-related price rises and possible supply issues. It therefore seems likely that we will get pay-back in the form of slower growth as we head into the second half of the year.

However, inflation looms:

“These price pressures are already building, with factories reporting steep cost increases again in June, linked to tariffs, which they are passing through to customers. The big question of course is whether this merely results in a short-term change in the price level rather than a more worrying return of stubborn inflation.

“More encouragingly, business confidence has continued to improve from the low-point seen in April, with US manufacturers becoming more optimistic in the face of fewer trade and tariff worries compared to the heightened uncertainty seen in April, That said, many firms remain cautious as they await news of trade deals as the deadline for paused tariffs draws closer."

Is 'soft' data about to recover?