Something remarkable is taking place under the market's silky-smooth, VIX 13 surface: hedge funds are quietly blowing up. Not blowing up in the traditional sense of Amaranth, LTCM or Archegos, but as a result some rather unique market dynamics (discussed in "Historic "Spot Up/Vol Up" Chase Amid Multiple Unprecedented Developments In Derivatives") hedge funds find themselves suddenly breaching position limits and forced to liquidate exposure (on both the long and short sides), in other words, degross and delever.

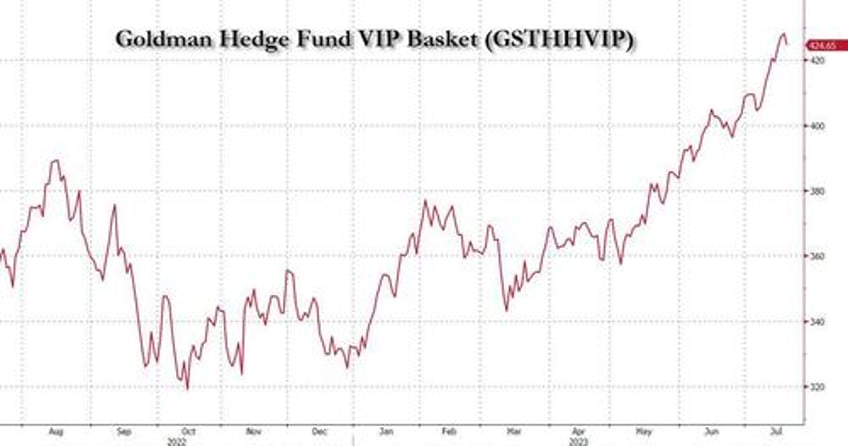

But how is that possible in a market where the hedge fund VIP stocks (the 30 most popular stocks among the hdge fund universe, BBG ticker GSTHHVIP) are soaring, since the top 10 stocks in the basket are also the infamous "Magnificent 7"?