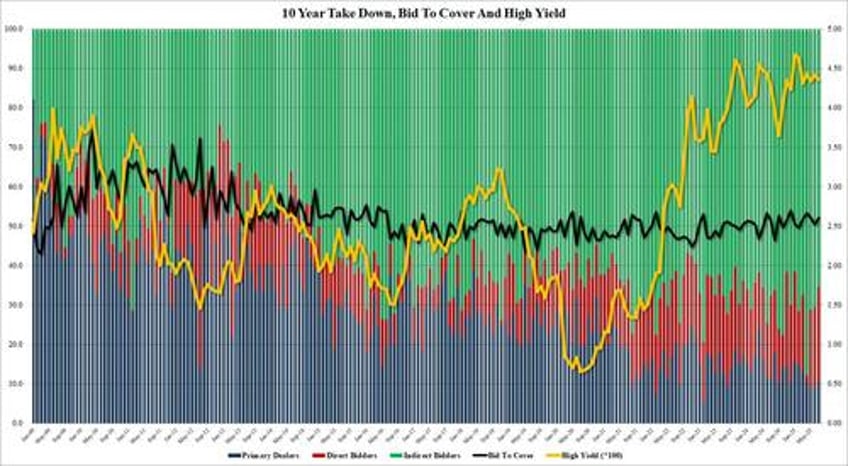

After yesterday's ugly, tailing 3Y auction, which saw record Directs as foreign buyers tumbled, moments ago the Treasury sold $39BN in 10Y notes in a closely watched auction. In the end, the auction went through without a glitch, with solid buyside demand which was foreshadowed by today's sharp bid across the curve.

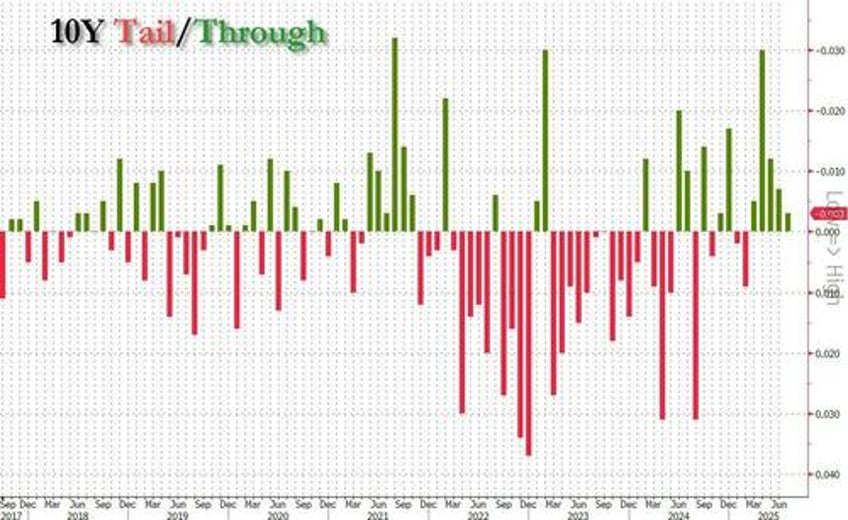

The auction priced at a high yield of 4.362%, down from 4.421% last month and in a narrow range since February's outlier 4.623%. The auction also stopped through the 4.365% When Issued by 0.3bps, this was the 5th consecutive tail in a row, although the smallest of the bunch.

The bid to cover was 2.61, up from 2.52 in June and the highest since April; it was also above the six-auction average of 2.56

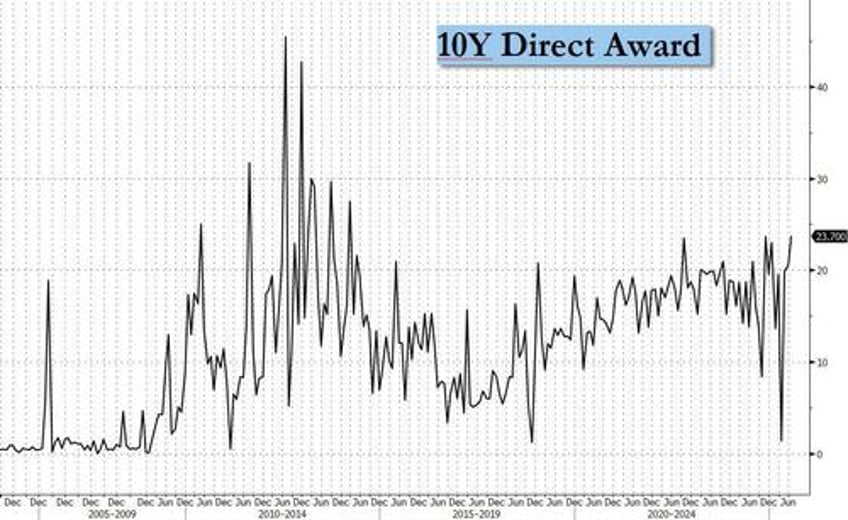

The internals were less impressive, with Indirects awarded 65.4%, down from 70.6% last month, and the lowest since January. And while they were far from a record, Directs rose to 23.7% (after plunging to just 1.4% during the April market mayhem), the highest going back all the way to March 2014.

That left Dealers with just 10.9%, up from 9.0% in June but one of the lowest on record.

Overall, this was a very solid auction, one that left yesterday's poor, tailing 3Y in the dust, and not a moment too soon: with long-end yields blowing out across the world the the 30Y about to break the 5% redline, buyers had to step in or the equity selloff would have come back with a vengeance.