The last month or two have seen one heck of a move higher in Equities, based on two catalysts that Nomura MD Charlie McElligott has discussed previously in detail:

1. The “Trump Collar”

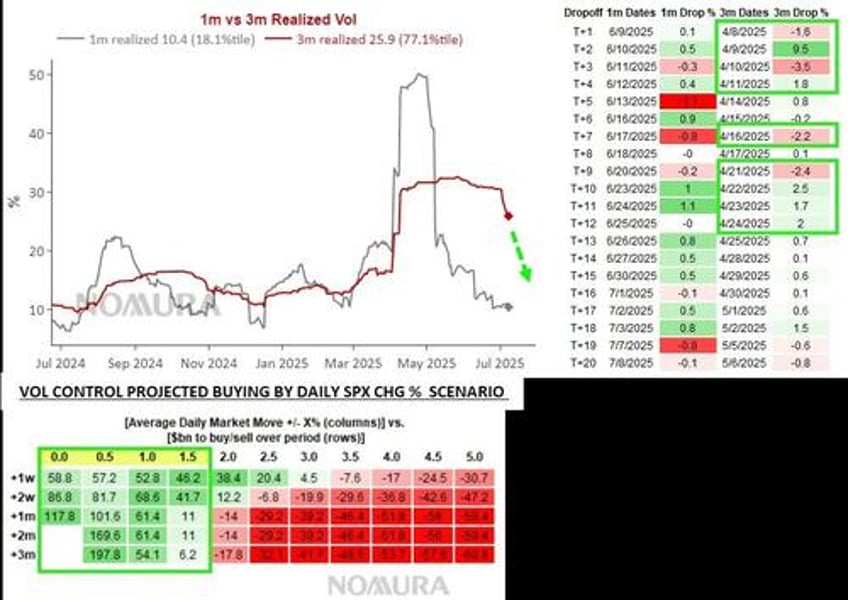

POTUS de facto “Selling the Call” at highs, leaning-in on Tariff rhetoric when the market is giving it to him, but still with his “Long Put” struck lower in the case of self-induced calamity has allowed for massive realized Vol compression in recent months...

...as the market reconditioned itself to his reaction function(s), and away from his prior “Human VVIX” / Status Quo Disruptor-In-Chief -role in the early post “Liberation Day” era

2. The realized Vol melt

A function of:

1] - The Trump Collar;

2] - The TREMENDOUS VOL SUPPLY in single-name and Index which is sitting on Vols locally, with 10d rVol at 8;

3] - The late Mar / early April “outlier daily Equities moves” drop-off dates pushing out-of-sample; And

4] - Resurgent stock Dispersion / Short Correlation, further bleeding Index Vol) is then facilitating a substantial reallocation back into Equities from the Target Vol / Vol Control -universe (“Volatility Is Your Exposure Toggle”), with the next 1w / 2w window projected as the heaviest window of demand…and judging by the vibecheck X / Fintwit, this demand has been WELL socialized i.e. FRONT-RUN by Discretionary / Retail

These dynamics have then contributed to an ever-present and passive bid under Spot recently, which has then too rallied-us into those previously noted Upside Call strikes (6100-6300) which Dealers were Short to Customers, who were hedging this very “Right Tail Breakout” / performance chase-scenario which has seen SPX Call Skew’s long-awaited steepening back to %ile ranks last seen at February’s prior ATH’s…and then meant $Delta buying the higher we ran into said Dealer “Short Calls,” which have moved ITM in “Peak Dealer Pucker” –fashion