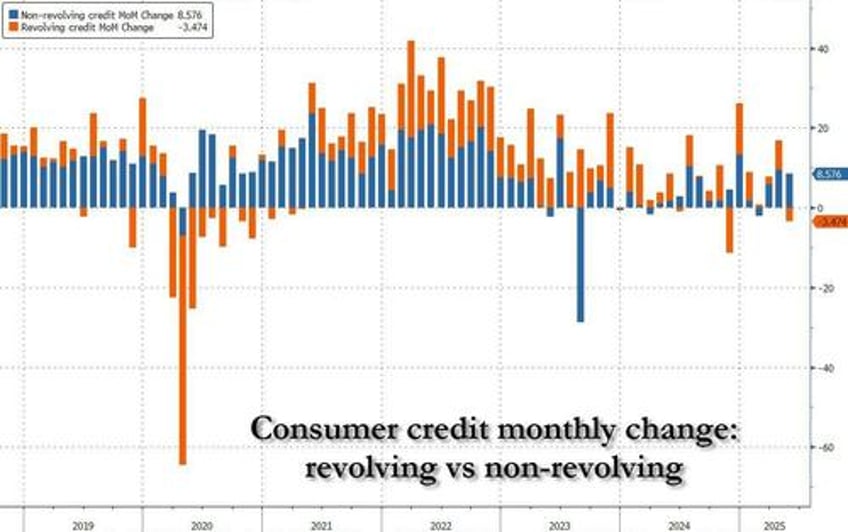

One month after consumer credit unexpectedly jumped the most in 2025, when it spiked by $17.9 billion (since revised to $16.9 billion) in the month of April, moments ago the Fed released its monthly consumer credit report which showed that the yoyo action in credit-fueled consumer spending continued, and in May while total consumer credit rose a modest $5.1 billion, half of the $10.55 billion expected, it was all on the back of non-revolving credit (i.e., student and car loans). That's because revolving (or credit card) debt slumped by $3.5 billion, the first drop in 2025, and the second biggest monthly decline since covid.

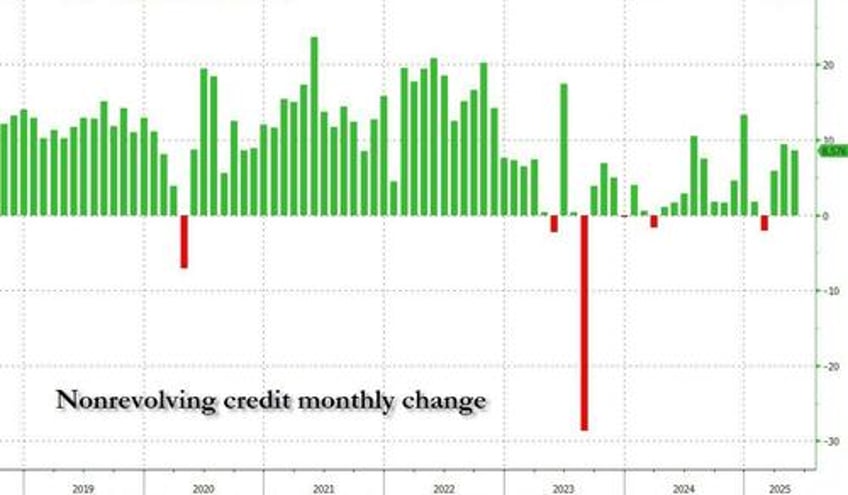

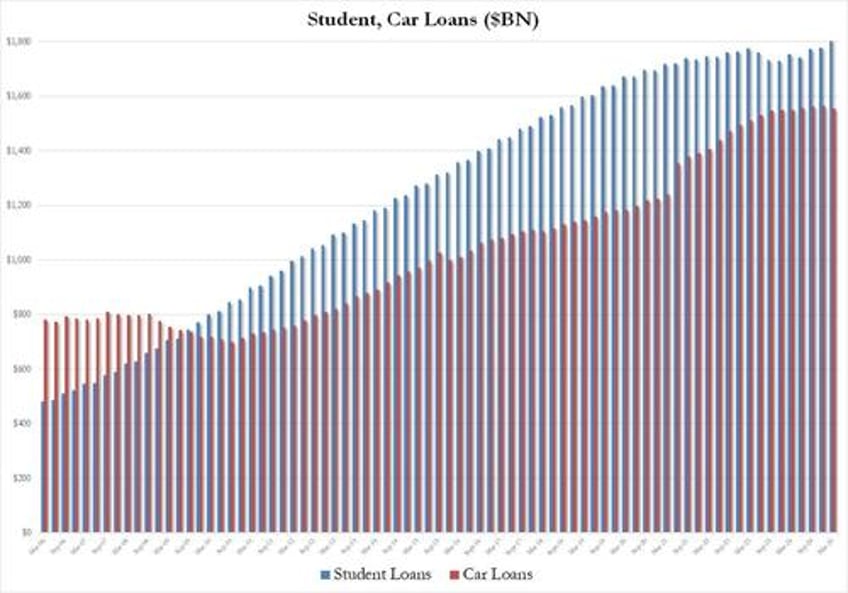

Starting with nonrevolving credit, the monthly change remained sturdy, with the total rising to a new record high of $3.749 trillion...

... although the composition is curious, with auto loans actually shrinking in Q1 by $8.5 billion to $1.555 trillion, while student loans - which for years had flatlined thanks to BIden's repayment moratorium - soared by $27 billion in Q1 to a new record high just over $1.8 trillion, their biggest quarterly increase since the $34.1 billion spent on stuff lessons during the covid pandemic.

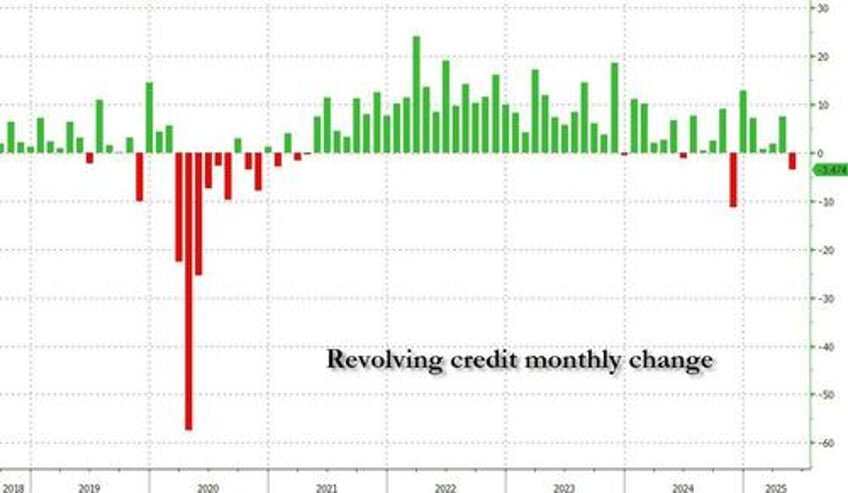

But, as noted above, it was revolving credit that was the standout in May and as shown below, credit card debt unexpectedly shrank by $3.5 billion to just under $1.299 trillion.

Such sudden drops in credit card debt are always concerning and indicative of either a sharp reversal looming in the economy, or households who are stuffed with debt and no longer want - or can get - more credit for purchases.

We expect to find out which is the right answer in the coming months.