By Peter Tchir of Academy Securities

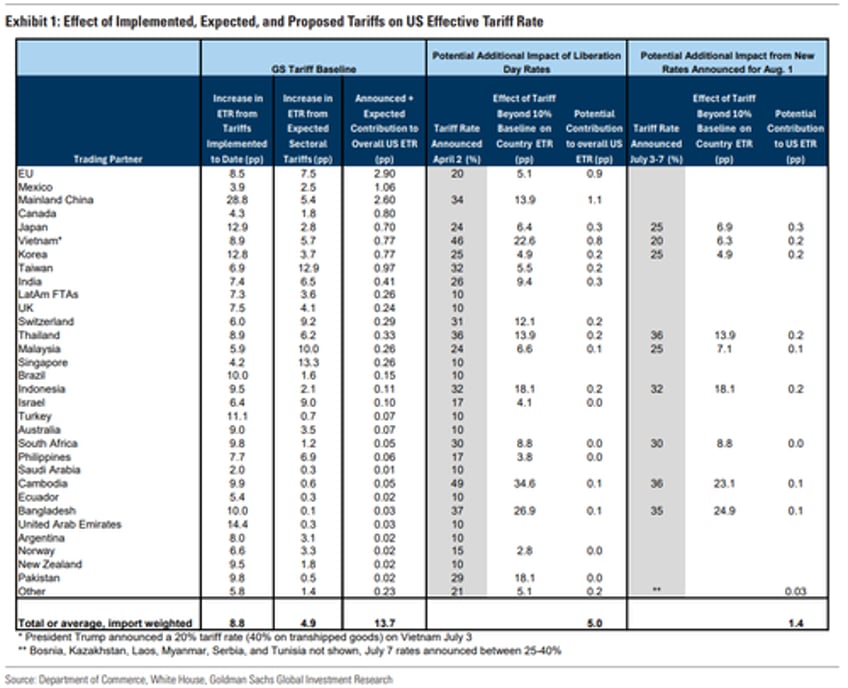

Equities and bonds sold off (a bit) yesterday, primarily on tariff headlines. Letters went out to a myriad of countries, with Japan and South Korea leading the way. Their tariffs were “reset” to roughly the Liberation Day rates.

We discussed the risk that the administration would take another serious stab at tariffs, in this weekend’s Big Beautiful Production for Security.

For now, the market’s muted response makes sense:

The messaging from both the President, but particularly from Bessent, seem to be guiding to “more negotiations” into a “newish” August “sort of” deadline.

Given prior pauses, extensions and pullbacks, it is reasonable for the market to assume that the latest round of tariffs (via letters) won’t amount to much (it was incredibly difficult not to include a joke about the post office losing the letters in the mail).

This administration has been extremely busy. The President is very “hands on” and he had to give the decision to go ahead with the strike on Iran, he had to manage the process of getting the Big Beautiful Bill passed (which, we discussed in more detail this weekend), and he went to NATO to get 5% commitments. So the admin might just need the time to get refocused on trade deals as they likely took a backseat to those pressing issues.

While the market is right not to get too concerned at the moment, there is a risk that it is being very complacent:

The tariff revenue is real and the administration may want more of it, a LOT more of it.

We don’t know what other countries are thinking. Messaging from many other countries seems to be that:

The U.S. goals seem unclear and confusing, making deals difficult.

Many countries seem to be thinking about tariffing “services” which they may decide is a good way for them to boost their tech industries where they are quite clearly behind and dependent on U.S. based firms (that would not be good).

Markets will be on edge, looking towards deals. Very little risk of new, higher tariffs is being priced into the market. That seems both plausible and dangerous from a positioning standpoint.

I’d rather fight the move in bond yields (10’s at 4.41%) than “buy the dip” as stock futures are already higher.

Maybe these tariff headlines are “fake news” but at the all-time highs, that is a might big assumption.