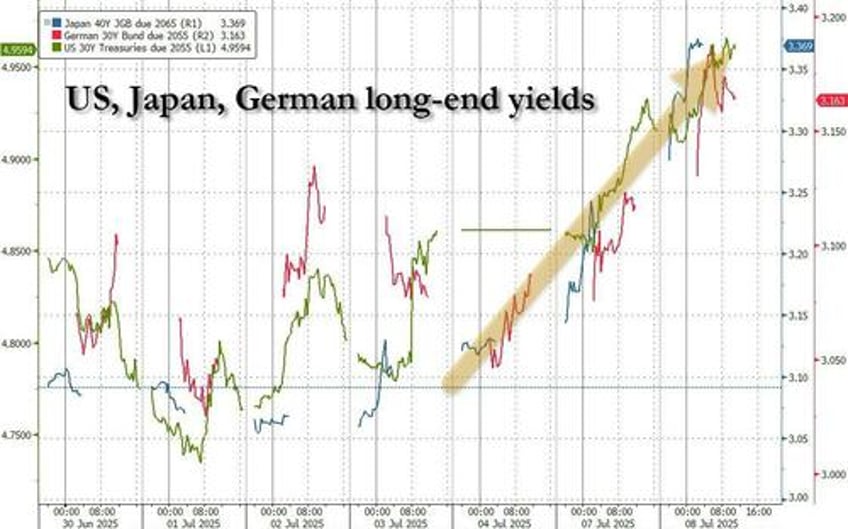

Duration destruction: that's how one can summarize the overnight surge in yields on the long-end, which started in Japan after another ugly 5Y auction, moved to Europe where markets are starting to wonder just how Germany, and the continent, will pay for all that fiscal stimulus, and concluded in the US where the realization that US debt will soon hit $50 trillion is starting to raise its ugly head.

What happened? Well, as usually is the case these days, bonds took their cue from jitters in Japan over the country’s political situation and associated fiscal risks. Japanese 30-year bond yields rose as much as 13 basis points after another poor 5Y auction (Bid/Cover tumbled to 3.54 from 4.58), as well as on growing fears the country's rice (hyper)inflation and upcoming elections could lead to a government collapse (see "Will Japan's Rice Price Shock Lead To Government Collapse And Spark A Global Bond Crisis"). Shortly after, Australian bonds also slump after the RBA unexpectedly kept interest rates unchanged.