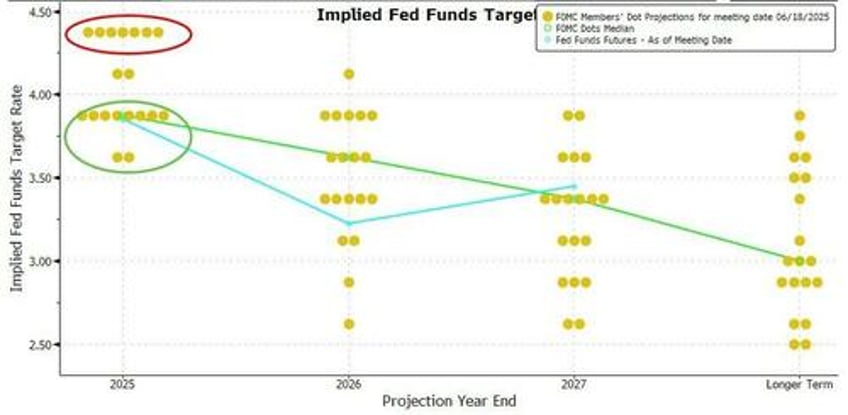

Since the last FOMC meeting (June 18th), which saw a hawkish tilt to the dots (with Fed members notably divided - nearly as many participants anticipated no rate cuts this year as expected two), we have seen stronger-than-expected jobs data, constant diatribes from the president that 'too late' Powell should be cutting rates, and some tariff developments that supported Powell's pause.

Source: Bloomberg

Stocks have melted up since the FOMC meeting (even as macro has weakened - bad news is good news)...

Source: Bloomberg

...while crude was clubbed like a baby seal (Israel-Iran 'peace') as bonds have been very modestly bid against dollar and gold weakness...

Source: Bloomberg.

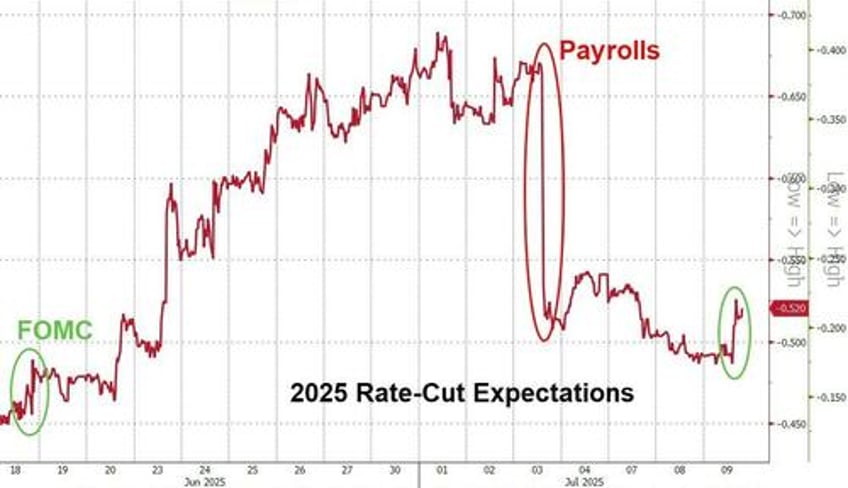

Rate-cut odds have risen modestly for 2025 since The FOMC meetings (two full cuts priced in, but July off the table) but are well down from pre-payrolls levels...

Source: Bloomberg

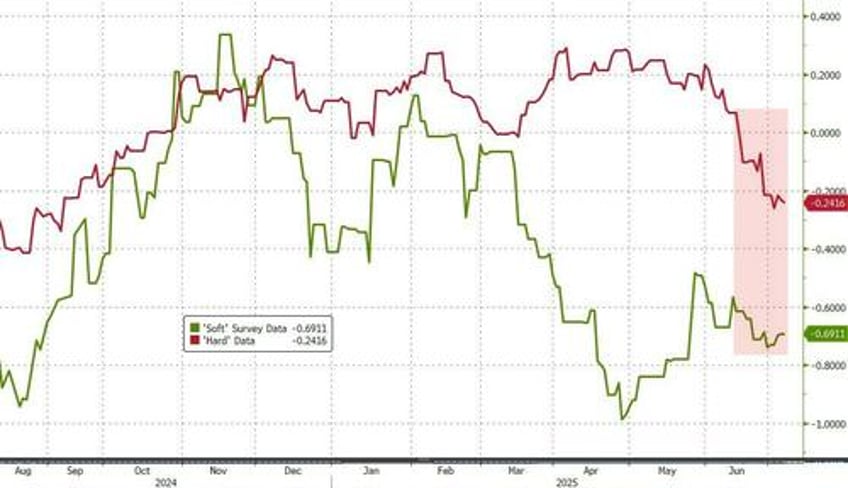

And both 'hard' and 'soft' data has weakened relative to expectations since the last FOMC...

Source: Bloomberg

So, what does The Fed want us to know they are thinking about?

Fed members are confused about tariff risks:

"In discussing their outlooks for inflation, participants noted that increased tariffs were likely to put upward pressure on prices.

There was considerable uncertainty, however, about the timing, size, and duration of these effects.

Many observed that it might take some time for the effect of higher tariffs to be reflected in the prices of final goods because firms might choose not to raise prices on affected goods and services until they had run down inventories of products imported before the increase in tariffs or because it would take some time for tariffs on intermediate goods to work through the supply chain."

But convinced growth will slow...

- *FED MINUTES: MAJORITY SAW SLOWER ECONOMIC GROWTH GOING FORWARD

While the market has priced-out cuts in July, the Minutes show:

"Most participants assessed that some reduction in the target range for the federal funds rate this year would likely be appropriate, noting that upward pressure on inflation from tariffs may be temporary or modest, that medium- and longer-term inflation expectations had remained well anchored, or that some weakening of economic activity and labor market conditions could occur.

A couple said they would be open to considering a cut as soon as July if data evolved as they expected

Some saw the most likely appropriate path would involve no rate cuts in 2025. Those participants cited recent elevated inflation readings, elevated business and consumer inflation expectations and ongoing economic resilience.

Several said current Fed funds rate may not be far above its neutral rate.

All participants viewed it as appropriate to maintain Fed funds rate at the current target range.

Despite the market pricing out 'uncertainty' about tariffs, The Fed members are cluelessly guessing...

Participants agreed risks of higher inflation and weaker labor market conditions had diminished but remain elevated.

Participants observed uncertainty about economic outlook had diminished amid the reduction in announced and expected tarifffs, but overall uncertainty continued to be elevated.

Fed balance sheet size:

"Since balance sheet runoff commenced in June 2022, SOMA securities holdings had fallen almost $2¼ trillion. As a percentage of GDP, the portfolio had declined to close to where it had been at the start of the pandemic. The corresponding drain in Federal Reserve liabilities had largely come out of balances at the Reverse Repo facility, while reserve levels had been relatively little changed over that period. Respondents to the June Desk survey, on average, expected runoff to end in February of next year, a month later compared with the previous survey, with an expected size of the SOMA portfolio of $6.2 trillion, or about 20% of GDP. At that point, the respondents, on average, expected reserves to be at $2.9 trillion and the ON RRP balance to be low."

Read the full Minutes below: