In yet more confirmation that propaganda works, two 'soft' data surveys this morning signal the end of the world is imminent... and it's worse than it's ever been before.

First, we saw The Philly Fed Non-Manufacturing Survey plunge to -42.7 (in April) from -32.5 with current conditions and six-month-forward expectations at their worst levels since the peak of the COVID lockdowns...

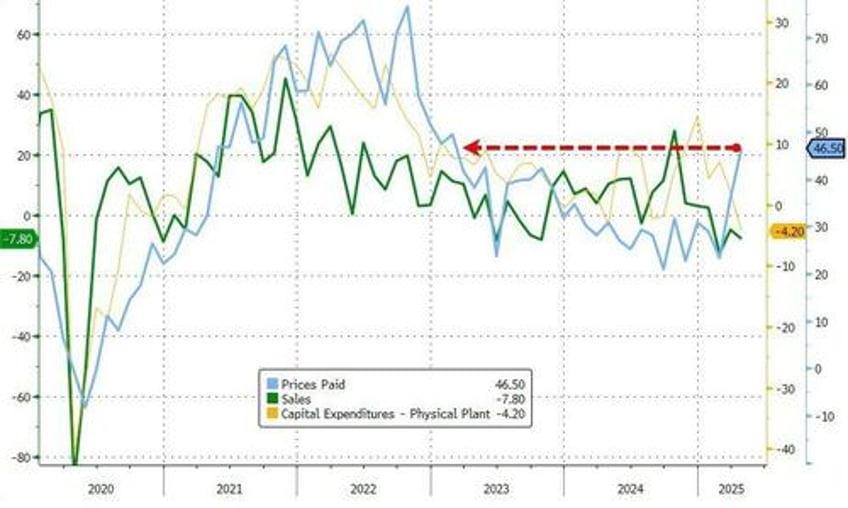

Under the hood, Sales and CapEx expectations tumbled while Prices Paid soared to two year highs...

Simply put, firms remained pessimistic and continue to expect declines in activity over the next six months at their own firms and in the region.

The same - but worse - picture was evident with The Richmond Fed's Manufacturing Activity survey which tumbled to -13 (-7 exp) with overall Business Conditions plummeting to -30 - just shy of the lowest levels since the COVID lockdowns...

But, under the hood, it was expectations for New Orders that too the proverbial biscuit, collapsing to the worst levels in history... worse than at the very peak of global supply chain closure during the COVID lockdowns!!!

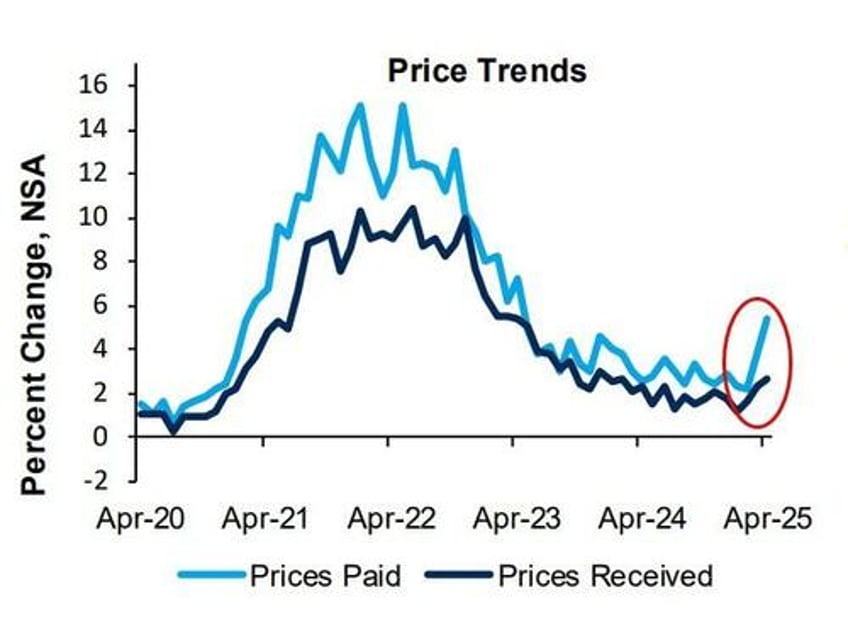

And Prices Paid are also soaring for Richmond Manufacturers...

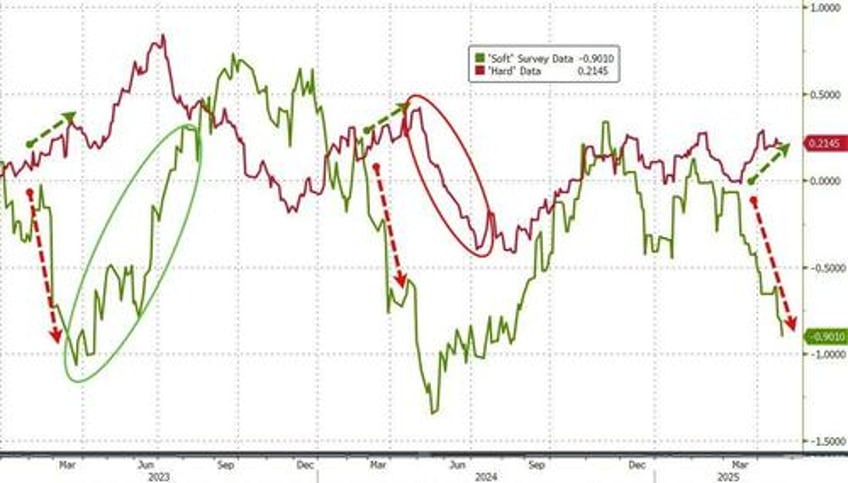

And so, the trend continues lower in 'soft' data and higher in 'hard data'...

The question is - will we see a replay of Q2 2024 (where 'hard' data caught down to 'soft') or Q2 2023 (where 'hard' data kept rising and 'soft' data finally shrugged off the sentiment cloud)?