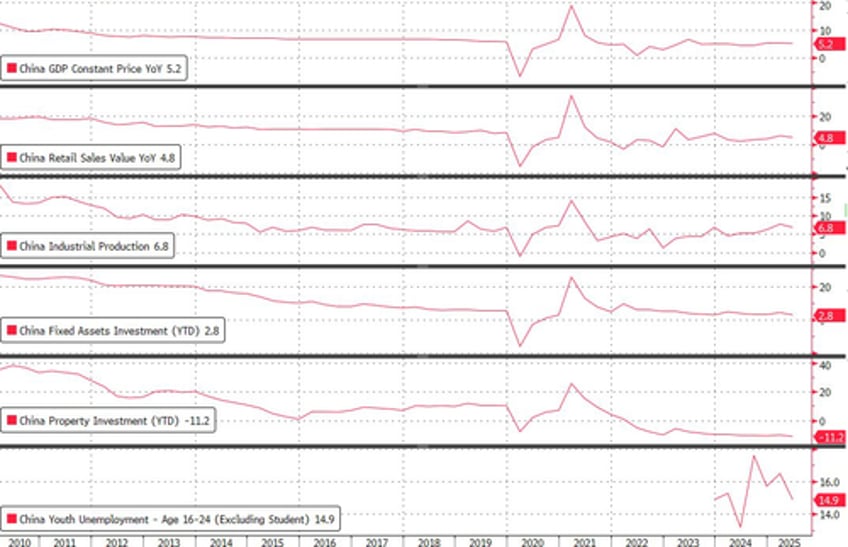

China's GDP grew 5.2% on the year in the second quarter, just fractionally above expectations (as is usually the case when Beijing reports fake numbers) the National Bureau of Statistics said Tuesday, fueled by frontloaded exports ahead of even more tariffs and a flood of subsidies that supported the manufacturing sector.

The figure beat the median forecast for 5.1% growth but was slower than the 5.4% expansion in the first quarter. Still, it keeps the country on track to meet the government's growth target of "around 5%" for the full year.

Exports rose 5.8% for the quarter, off slightly the 5.9% growth pace in the first half of 2025, as the trade war with the U.S. fueled front-loading and export diversion to other countries. The U.S. jacked up tariffs on Chinese goods in April to as high as 145%, before temporarily lowering most of them following an agreement about a month later. A decline in U.S.-bound shipments was offset by growth in other regions, such as Southeast Asia - which China uses as a transshipment hub - and Europe, where dumping of Chinese EVs is crushing the local automotive industry.

The economy "withstood pressures and rose to challenges, with overall stable and improving economic performance," the NBS said in a statement as it goalseeked the random number which has zero bearing to what is going on in the economy. In fact, the one number that does matter, China power output, rose just 0.8% YoY for the Jan-Jun period (to 4537.1b kwh), and is a much more accurate reflection of China's actual growth.

Wednesday's GDP figure reveals that "growth in the world's second-largest economy remains resilient, despite U.S. President Donald Trump's volatile tariff policy on China" according to the Nikkei. After reaching near embargo-level rates, US tariffs on Chinese imports were lowered to 55% following a temporary truce reached in May, prompting a new flood of exports seeking to frontrun the eventual increase of tariffs.

The data also underscores a perennial imbalance in China's economy that could face further headwinds in the second half of the year: sluggish domestic demand and an excess supply of goods. As noted before, the country remains stuck in its longest streak of deflation in decades, weighing on corporate profits and wage growth. Consumption continued to lag behind other growth drivers, as falling home prices and a weak job market dampen consumer spending.

"The economic outlook for the rest of the year remains challenging," said Zichun Huang, an economist at Capital Economics. "With exports set to slow and the tailwind from fiscal support on course to fade, growth is likely to slow further during the second half of this year."

Elsewhere in the data dump, Industrial output growth jumped to 6.8% in June from a year earlier, accelerating from May's 5.8%, suggesting manufacturers have been rushing to fulfill orders amid May's trade truce with Washington.

Growth in retail sales, a proxy for consumption, slowed sharply to 4.8% in June year-on-year, from 6.4% in May. The surveyed urban jobless rate stood at 5% in June, unchanged from May, though unemployment is expected to worsen as a record 12.2 million college graduates hit the labor market this summer.

Beijing has made reviving consumption a central economic objective for the year, though it has so far refrained from offering cash handouts to households. Instead, China focused on expanding the budget and widened the range of subsidized goods to include smartphones and tablets. The central government earmarked 300 billion yuan ($41.8 billion) to fund subsidy program for consumer goods this year. While some cities suspended the program in recent months after funds ran out, the government has pledged to roll out a new round of subsidies this month.

Meanwhile, a prolonged property market slowdown continues to weigh on consumer confidence, as housing accounts for around 70% of Chinese household wealth. New home prices in 70 key cities in June fell 0.3% from May, the biggest monthly drop in eight months, according to data provider Wind Information. Falling asset prices have dampened consumers' appetite for big-ticket items, intensifying price wars in industries ranging from electric vehicles to food.

Sheng Laiyun, NBS deputy director, acknowledged that existing policies are insufficient to stem falling home sales and prices. "More efforts are needed to stabilize and transform the sector," Sheng told reporters on Monday.

One major challenge facing Beijing is how to end persistent deflation. In recent weeks, authorities have urged industries, including solar panels and electric vehicles, to refrain from price wars that have pushed many companies into the red, though analysts question how effective such top-down approach will be.

The producer price index, which measures wholesale prices at factory gates, recorded its steepest drop in almost two years in June. The government has recently stepped up its criticism of excessive competition, signaling greater desire to address oversupply issues. But "local officials may balk at the economic cost of implementing them unless they are also accompanied by more substantial demand-side stimulus," Capital Economics wrote in a report last week.

Trade relations with the U.S. remain uncertain as Beijing is set to renegotiate terms with Washington as the Aug. 12 deadline on the trade war truce approaches. Tensions have also escalated with the European Union, where officials have criticized China's new export controls on rare-earth minerals. Leaders from the bloc are set to meet with their Chinese counterparts later this month.

Some advisers to Chinese policymakers are urging more proactive measures to absorb the impact of volatile U.S. tariff policy. Huang Yiping, a member of the People's Bank of China's monetary policy committee, said earlier this month that China should consider launching an additional fiscal stimulus of up to 1.5 trillion yuan to offset the tariff shock.

Still, many analysts believe the robust (if completely fake) GDP figures reported so far suggest policymakers are in no rush to unveil large-scale stimulus measures to meet the full-year growth target of around 5%. Or at least the fake numbers give Beijing the buffer zone to ignore the ongoing economic slowdown until it's too late.

"A major stimulus is unlikely if exports remain steady, because Beijing will do just enough to hit its growth target," said Larry Hu, chief China economist at Macquarie Group.

"In short, what Beijing will do largely depends on the economic policies and tariff rates set in Washington."