JPMorgan puts $50 Billion on riskier companies to get in on the action.

Jamie Dimon Wants In

At every market top there is a signal. But signals are not discernable until after the fact. Is this bit of arrogance a signal?

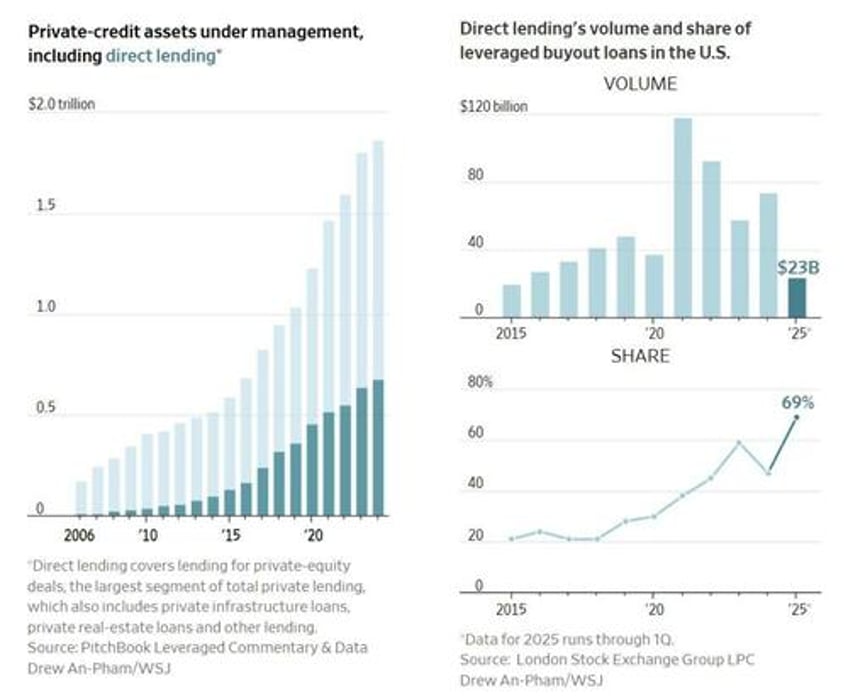

The Wall Street Journal reports Jamie Dimon Says Private Credit Is Dangerous—and He Wants JPMorgan to Get In on It

Jamie Dimon says Wall Street’s hottest trend is a recipe for a financial crisis, but he’s investing billions to get in on it anyway. His plan: swoop in strategically and profit if there’s a meltdown.

In the ballroom of the swanky Loews Hotel in Miami Beach, Dimon got on stage in front of hundreds of clients in February to talk about the boom in unregulated lending to highly indebted companies. This fast-growing market has been sidelining big banks for years, and JPMorgan Chase’s (JPM) chief executive said it reminded him of the craze in subprime mortgages that sparked the 2008 financial crisis.

“Parts of direct lending are good,” Dimon said at the event in February, according to people who attended. “But not everyone does a great job, and that’s what causes problems with financial products.” He said that in the 2008 financial crisis, Bear Stearns and Lehman Brothers got in late, made bad choices and “bought these two shitty little mortgage companies,” leading eventually to “everything” blowing up.

The comparison was jarring. Just hours earlier, JPMorgan had announced it was investing $50 billion in private credit, more than a decade after financial firms such as Blackstone and Ares Management, which aren’t banks, kicked off the boom in lending to financially risky companies. Banks have typically shied away from this business because of stiff regulations meant to protect depositors.

The rise of private credit has disrupted banks’ fee-rich business of lending to corporate America, and JPMorgan and some of its peers have lost out as their new, unregulated competitors have expanded.

Dimon is racing to claim a stake before JPMorgan, the nation’s biggest and most profitable bank, is left behind, people familiar with his thinking said. Even if there is a crisis, Dimon has said he can position JPMorgan to profit.

JPMorgan was actually an early participant in the market but let its private-credit unit go just as the boom was igniting.

JPMorgan had promised to overhaul how it managed risk after its “London Whale” debacle in 2012, when traders took aggressive bets that bank executives were effectively in the dark about and lost more than $6 billion, leading the bank to admit wrongdoing and agree to pay more than $920 million in fines. The following year regulators imposed stricter limits on how much risk banks were allowed to take in corporate lending.

“As a bank, you can only watch private credit come from nowhere and get to a trillion dollar industry for so long,” said Glenn Schorr, a senior analyst at Evercore covering Wall Street. “This is what its clients are asking for.”

FOMO Hits JP Morgan

Jamie Dimon is singing those Fear of Missing Out blues.

It is very reminiscent of Citibank’s 2007 blowup.

Quotes of the Day / Top Call

On July 10, 2007 I posted Quotes of the Day / Top Call

No End Soon to Buyout Boom: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing”.

If ever there was market arrogance, the statements by Chuck Prince says it all.

It’s tough calling a top but I am going to try. I suggest the current trend is exhausted.

Music Stops for Chuck Prince

On November 2, 2007 I noted the Music Stops for Chuck Prince

The party is over and the music has stopped for Chuck Prince. His last dance is a two-step out the door. Citi’s Prince Plans to Resign

Dear Citigroup Customer...

On March 27, 2008 I commented Dear Citigroup Customer ….

The post describes fraudulent letters sent out by Citigroup telling Adjustable Rate Mortgage (ARM) customers their mortgage rate were about to reset and offered them a higher fixed rate.

Citigroup knew full well mortgage rates were headed lower. I provided image clips of the letters.

Is This the Top?

You tell me. I thought the signal was clear in 2007.

Now?

I did not think the market would roar back to new highs after the tariff whipsaw, but it did.

S&P 500 Daily Chart

S&P 500 Daily Chart from Stockcharts, annotations by Mish

There are three open gaps below that I expect to be filled. But timing is unknown.

A gap occurs when stocks open above the high of the previous day (or below the low of the previous day) and stay there for the secession.

The December-March double-top eventually plunged over 20 percent intraday. Then Trump backed down on tariffs.

From that low, the S&P 500 made a new all-time high. But nothing fundamentally has changed.

If anything, fundamentals are worse. We have new 50 percent tariffs on copper, steel, and aluminum. Trump just announce a 30 percent tariff on Mexico and the EU, and 50 percent on Brazil.

As long as the market ignores these actions, Trump will do more.