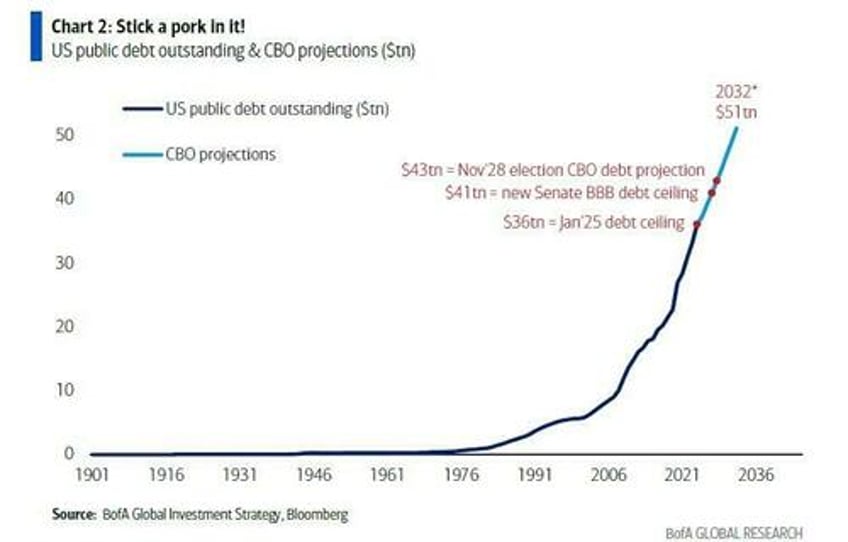

After being decidedly bullish on bonds for much of the first half, the last few notes have seen BofA chief investment strategist Michael Hartnett turn increasingly downbeat on prospects for fixed income, and especially long duration, dedicating much of his last note, one dissecting the "Big, Beautiful Bubble", on the exponential surge in US (and global) debt issuance which will push total US debt above the insane high water mark of $50 trillion by 2032, if not sooner.

With a ton of new issuance on deck, demand for said paper will continue to decline until rates rise enough to make said paper attractive enough. And one can be absolutely certain the US will now unleash an epic deficit-funding debt barrage because as Hartnett put it, since Trump “can’t cut spending, can’t cut defense, can’t cut debt, go big with tariffs, so only way they can pay for One Big Beautiful Bill is with One Big Beautiful Bubble.”