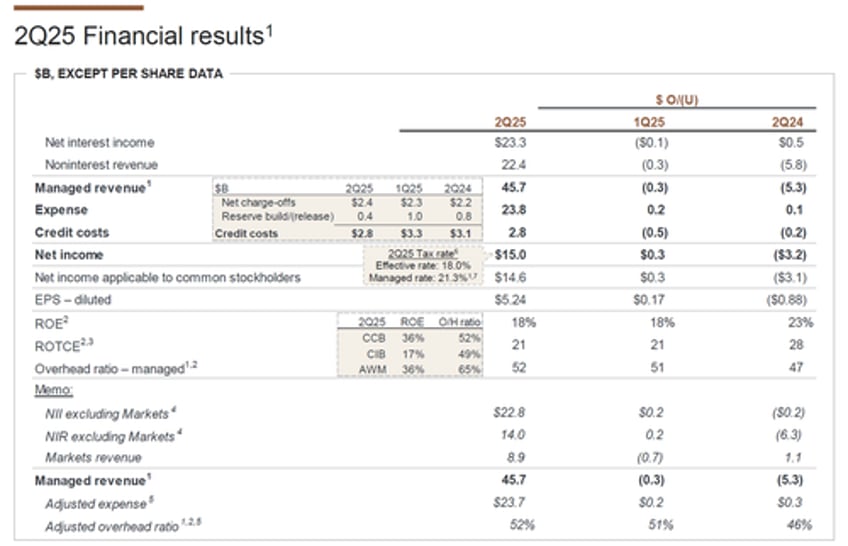

Q2 earnings season has officially begun as the big banks start reporting results, and the first one as usual is JPMorgan, with no surprises after yet another top and bottom line beat. Here is a snapshot of what the largest US banks just reported:

- Adjusted EPS $4.96, beating estimates of $4.47

- Adjusted revenue $45.68 billion, beating estimates of $44.05 billion, but down $5.3 billion from a year ago due to a slide in non-interest revenue.

- Managed net interest income $23.31 billion, missing estimate $23.59 billion

- FICC sales & trading revenue $5.69 billion, beating estimates of $5.22 billion

- Equities sales & trading revenue $3.25 billion, beating estimate of $3.2 billion

- Investment banking revenue $2.68 billion, beating estimates of $2.16 billion

- Advisory revenue $844 million, beating estimates of $672.2 million

- Equity underwriting rev. $465 million, beating estimates of $351.4 million

- Debt underwriting rev. $1.20 billion, beating estimates of $1.01 billion

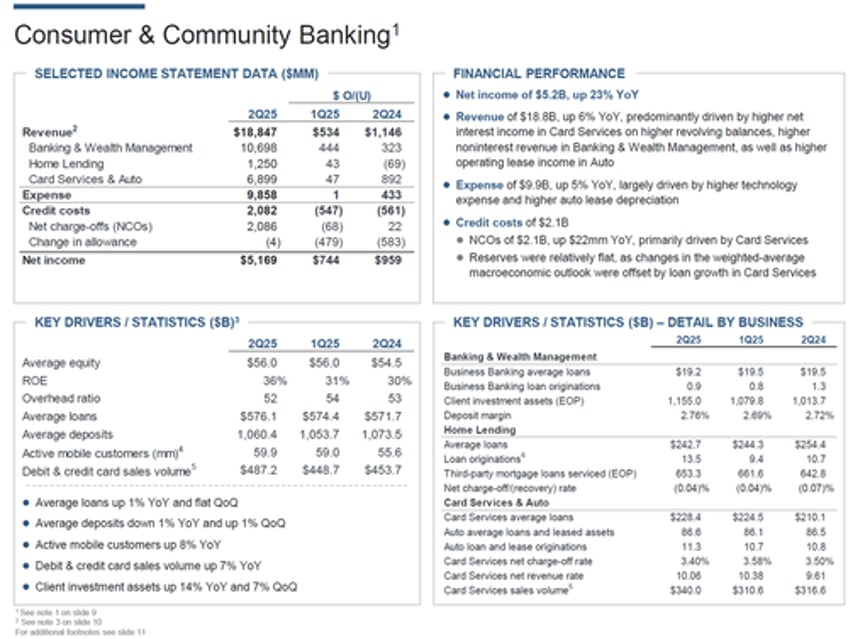

JPMorgan's provision for Q2 credit losses was $2.85BN, below the est. $3.22BN, as a result of net charge-offs of $2.41 billion (just under the $2.46 billion estimated) and a reserve build which shrank to $0.4 billion, down from $1.0 billion in Q1 and $0.8 billion a year ago. The bank said that charge-offs were"“primarily driven by Card Services." Putting this number in context, JPMorgan reported a credit card net charge-off rate of 3.4%, less than the 3.66% that analysts predicted. And some more context: American credit card balances hit $1.18 trillion outstanding in the first three months of the year, according to the Federal Reserve Bank of New York.

The effective tax rate for the company was 18.0%, below the 21.3% managed tax rate. This is notable because the bank discussed a “significant item” which appears to be an income tax benefit that represents $774 million of net income (and $0.28 of earnings per share). Some more from a footnote: “Second-quarter 2025 net income, earnings per share and ROTCE excluding the $774mm income tax benefit are non-GAAP financial measures. Excluding this item resulted in a decrease of $774mm (after tax) to reported net income from $15.0B to $14.2B; a decrease of $0.28 per share to reported EPS from $5.24 to $4.96; and a decrease of 1% to ROTCE from 21% to 20%. Management believes these measures provide useful information to investors and analysts in assessing the firm’s results.”

And visually:

Commenting on the quarter, Jamie Dimon called the results “strong” noting that “each of the lines of business performed well." Discussing CIB, he noted that “we supported clients as they navigated volatile market conditions" adding that the group “gained momentum as market sentiment improved." In CCB, Dimon touted about 500,000 net new checking accounts, and cited “positive early reactions” to the “refreshed Sapphire Reserve.” In AWM, “asset management fees rose 10%.”

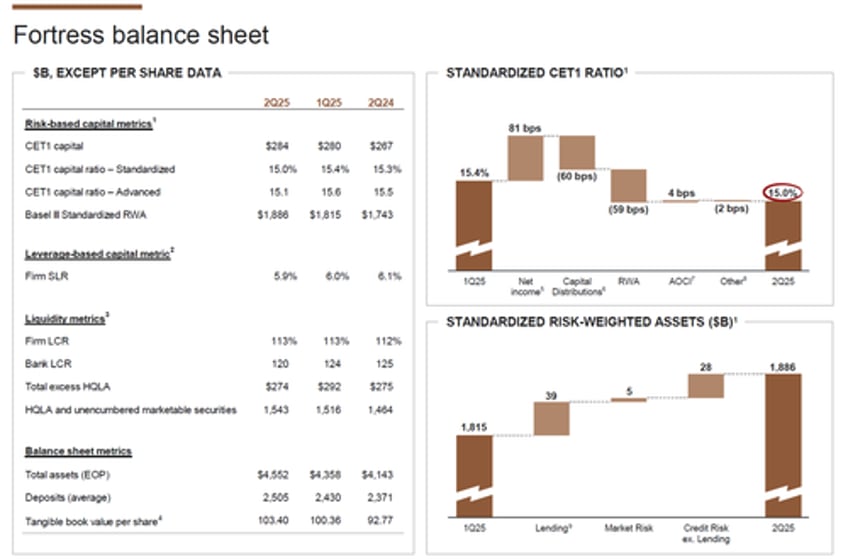

And while Dimon mentions the announced dividend boost, he says the bank has “far in excess of our required capital levels,” along with “an extraordinary amount of liquidity.” Sure enough, JPMorgan’s return on equity hit 18%, which then goes all the way up to 21% if you’re using ROTCE. Here it is visualized.

The positive sentiment from Dimon in his comments also extended to the US economy, which he says “remained resilient.” Looking ahead, he calls out “the finalization of tax reform and potential deregulation,” as you might expect. But Dimon added a word of warning that “significant risks persist,” especially “from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices.”

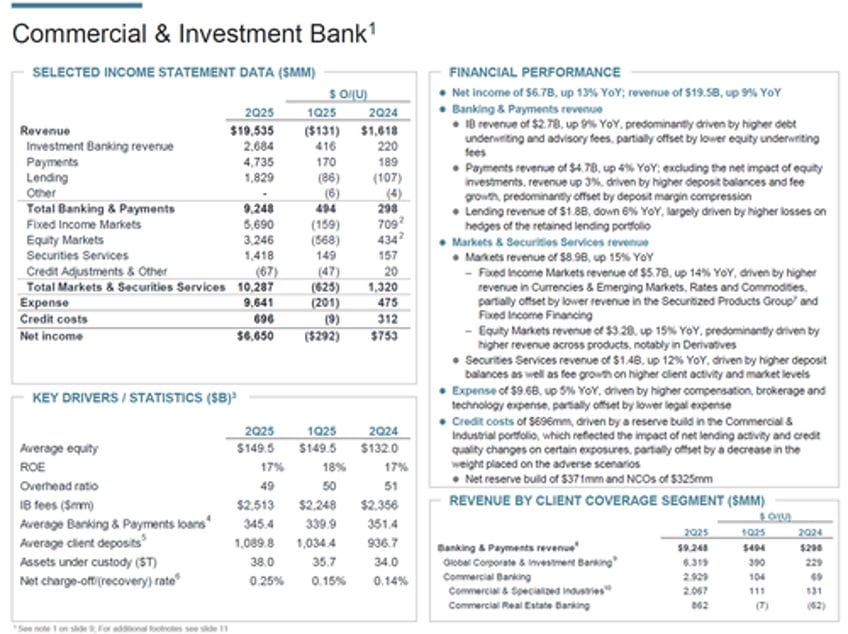

Turning to the most profitable group, Commercial and Investment Banking, JPMorgan’s traders notched a record first half with $8.9 billion in markets revenue.

The volatility around trade policy drove a lot of activity as investors repositioned their holdings.

- JPMorgan’s FICC revenue topped predictions, coming in at $5.7 billion, beating estimates of $5.22 billion, “driven by higher revenue in Currencies & Emerging Markets, Rates and Commodities, partially offset by lower revenue in the Securitized Products Group and Fixed Income Financing.”

- Equity Sales and Trading of $3.25 billion also beat estimates of $3.2 billion, "driven by higher revenue across products, notably in Derivatives."

- Investment banking revenue also beat expectations, coming in at $2.7 billion, up 9%. The number was 15% higher from the prior year, boding well for typical leaders Goldman Sachs and Morgan Stanley, which report on July 16. As BBG reminds us, one thing to note is that JPM floated an internal memo from yesterday which said that the bank is creating a unit focused specifically on bespoke financing structures as public and private markets converge.

Elsewhere, average loans were up 5% year over year and average deposits were up 6%, with both up 3% if you’re looking at quarter over quarter.

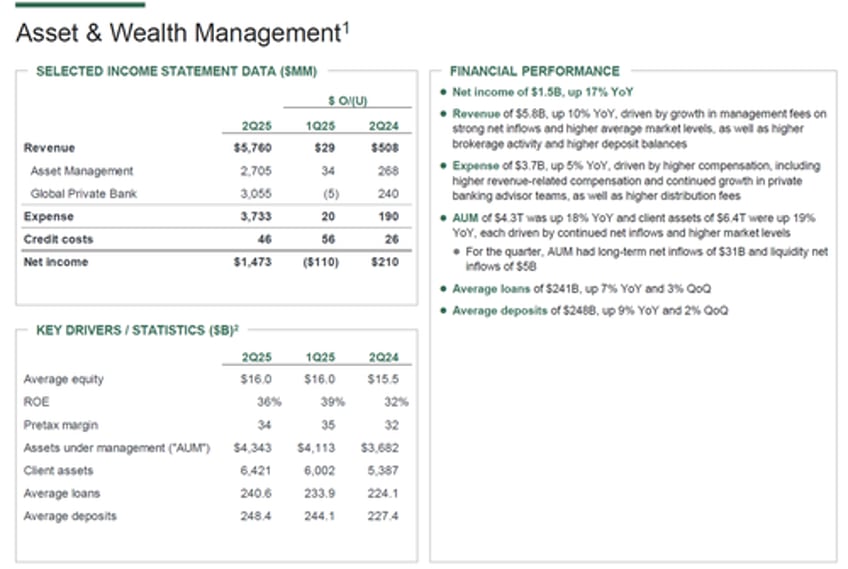

Taking a quick look at the bank’s asset and wealth management division, the group generated $1.5 billion of net income up 17% compared to a year ago as net revenue was up 10% to $5.8 billion, “driven by growth in management fees on strong net inflows and higher average market levels, as well as higher brokerage activity and higher deposit balances.” Assets under management were up 18% to $4.3 trillion and client assets were up 19% to $6.4 trillion, “driven by continued net inflows and higher market levels.” And yet $3.7 billion of noninterest expense was up 5%, “driven by higher compensation, including higher revenue-related compensation and continued growth in private banking advisor teams, as well as higher distribution fees.”

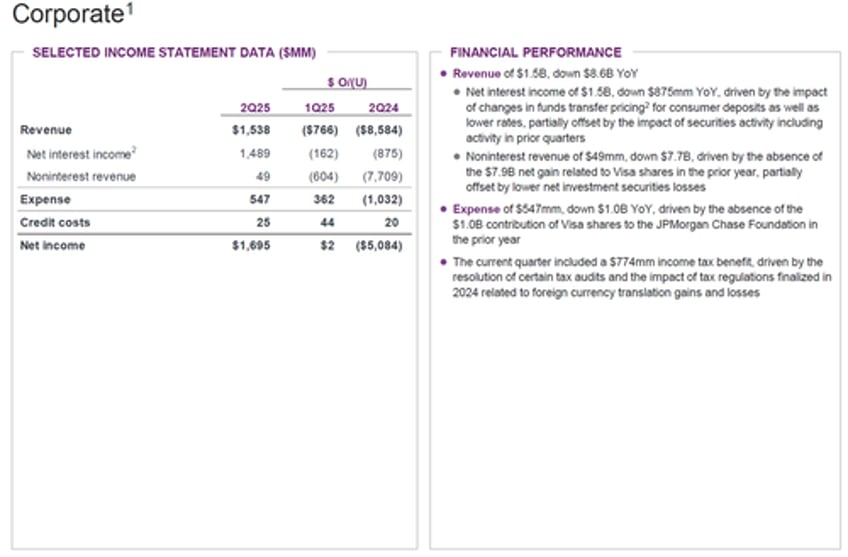

Finally, while the corporate division is usually ignored by most investors, this quarter it was somewhat more notable as it generated $1.7 billion of net income down a remarkable-sounding $5.1 billion. Here's why: $49 million of noninterest revenue was down $7.7 billion, “driven by the absence of the $7.9 billion net gain related to Visa shares in the prior year, partially offset by lower net investment securities losses.”

Another notable item: “the current quarter included a $774 million income tax benefit” - that’s the one we talked about earlier - “driven by the resolution of certain tax audits and the impact of tax regulations finalized in 2024 related to foreign currency translation gains and losses.” Expect this disclosure to spark questions during the investor call.

JPM also reported 317,160 employees down slightly from 318,477 in this year’s first quarter, but up from 313,206 a year ago. This leads directly to the bank’s $13.7 billion of compensation expense which was just higher than what analysts expected.

The bank also reported a total $4.55 trillion of assets, which represents a 10% jump from where they were only a year ago, a whopping increase. As Bloomberg puts it, "It’s like the biggest bank in the US bought two big regional rivals -- a pair of top-20 US banks -- in the span of 12 months or so." Or, rather, was gifted as in the case of the 2023 bank crisis when the FDIC promptly made Jamie Dimon an even bigger billionaire.

Finally, looking at the company's outlook, it once again raised its net interest income projection by $1 billion, from $94.5 billion to $95.5 billion.

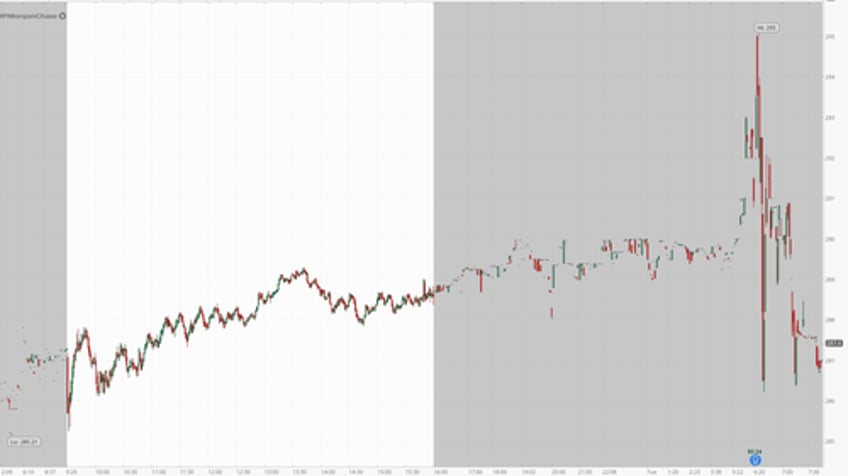

The results, which generally beat across the board, were solid but not stellar enough to blow the market away which had already priced JPM stock to perfection, and the shares are trading fractionally lower premarket just shy of record highs.

Full Q2 presentation below