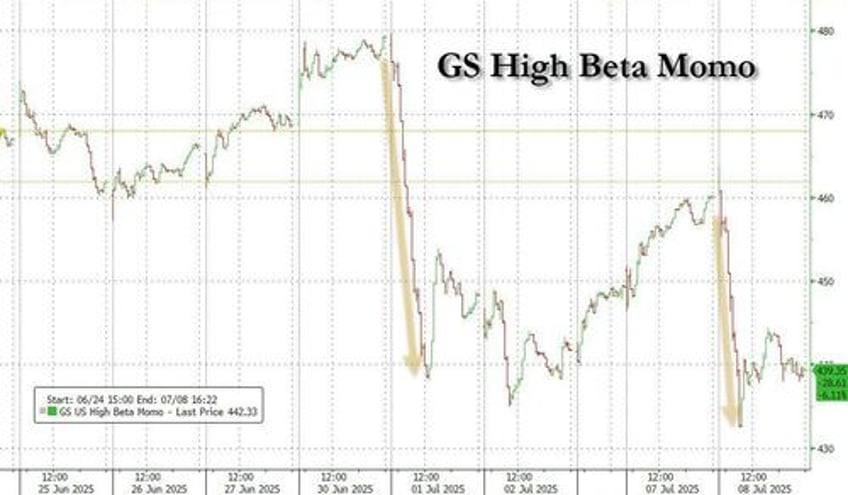

Last week's Momo selloff and hedge fund degrossing - which we detailed in "Momentum Meltdown: The Best Trade Of 2025 Just Had A Major Reversal" - is increasingly not looking like a one-off according to Morgan Stanly's QDS head Chris Metli, who notes that the Momentum unwind continued on Tuesday, and brought the drawdown in various momentum indexes since June 30th to -6.5%.

Goldman's TMT specialist Peter Bartlett agrees, and writes this morning that there has been heavy client focus on recent momentum unwind (GS High Beta Momentum Pair Basket -4.5% yesterday and now down 8.3% mtd).