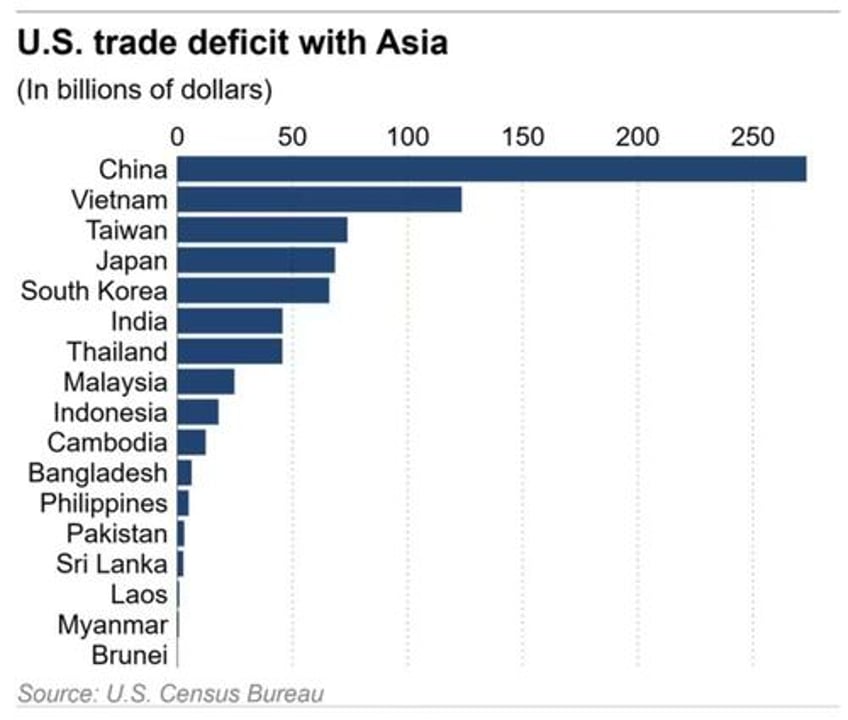

Asian nations are ramping up energy imports from the U.S. to gain leverage in tariff talks with President Trump, though concessions in areas like autos and agriculture may prove harder to secure, according to a new report from Nikkei.

"Asian trading partners have been the most forthcoming in terms of doing the deals," said Scott Bessent, Trump’s chief tariff negotiator, pointing to India, South Korea, and Japan.

Negotiations are underway with Vietnam, Japan, South Korea, Indonesia, and India ahead of the July 9 deadline, after the U.S. paused tariffs for 90 days in April. Except for China—which has retaliated—over 100 countries are engaging to avoid fallout.

Liquefied natural gas (LNG) is a key bargaining chip. Asian economies are pledging more imports of U.S. LNG, which is expected to see demand rise as countries shift from coal. “In the longer term, Asia could buy more U.S. LNG for future decades,” said Alex Froley of ICIS.

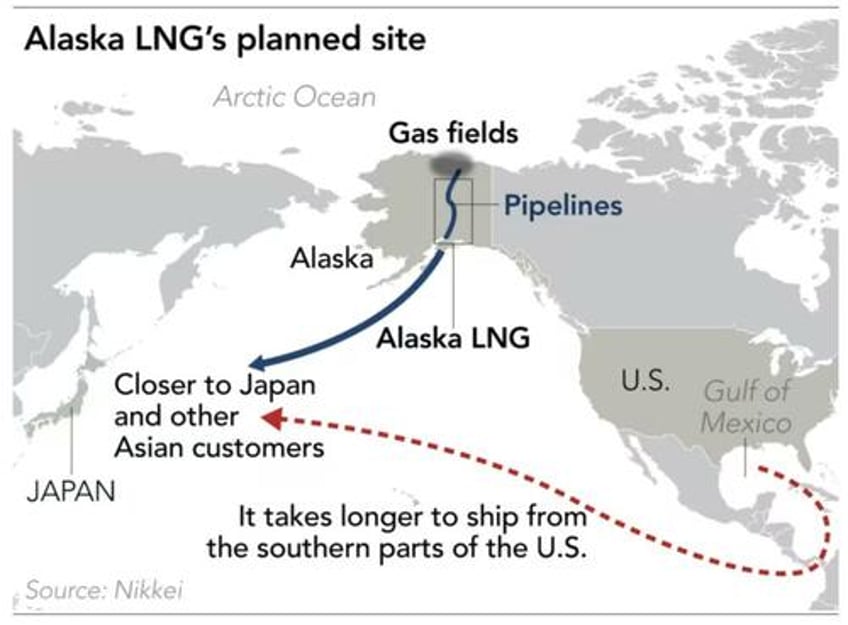

The Nikkei report says that Japan, South Korea, Taiwan, Thailand, and Vietnam are expanding LNG purchases, while Indonesia may focus on other fuels like LPG and crude oil. Some are eyeing a potential $44 billion LNG project in Alaska. Bessent hinted that a “big energy deal” there involving “the Japanese and perhaps the Koreans, perhaps the Taiwanese” could influence tariffs.

South Korea is coordinating a visit to Alaska, and Taiwan’s CPC signed a non-binding letter to participate. Japan’s JERA called it "one of the promising procurement sources," though cost remains a barrier.

Automotive trade remains tense. Trump has criticized the lack of U.S. cars in Asia. Japan had a $48 billion auto surplus with the U.S. in 2024. While Tokyo may ease crash-test rules and expand preferential treatment for imports, actual gains are doubtful. “It’s difficult to drive large and powerful American cars on narrow Japanese streets,” said Takashi Imamura of Marubeni Institute.

Japan’s automakers already produce extensively in the U.S. “Trump’s complaints may be just a ploy to have the upper hand in the overall negotiations,” Imamura added.

In agriculture, the U.S. is pushing for expanded exports of rice, soybeans, and corn. Japan is a key target, though Tokyo refuted claims of a “700%” tariff on rice. Political resistance is strong, particularly ahead of Japan’s upper-house elections.

Still, Japan and South Korea are already top buyers of U.S. rice, pork, and wheat. “Asia already relies on the U.S. for agricultural imports like soybeans, wheat and corn,” said Keisuke Sano of Nomura Research Institute. But broader shifts will be slow: “It will take more time, as that requires a change in culture,” he noted.

Thailand is exploring expanded U.S. imports but faces opposition from farmers and environmental groups.

South Korea is also leveraging shipbuilding. Its Hyundai Heavy Industries signed an MOU with Huntington Ingalls to explore U.S. shipyard investments. The U.S., once a global shipbuilding leader, now seeks Asian investment to revive the industry. “We’ve got to look at all options,” said U.S. Navy Secretary John Phelan.

Security spending may factor in too. Trump called the U.S.-Japan defense treaty “one-sided” and wants allies to pay more. Before an April 16 meeting, Trump said Japan was negotiating both tariffs and “the cost of military support.” Later, he clarified the military issue was “another subject” but repeated that allies “have gone rich” while the U.S. “has been ripped off.”

Defense imports may be included in deals. Taiwan’s President Lai pledged “additional arms procurements” to help reduce its trade gap with the U.S., according to the report.

Recall, we wrote late last month that India could be the most likely to sign a major U.S. trade deal.

We noted that India is the nation most likely to announce the first major trade deal with the Trump admin not only because of Apple's decision to shift all US-focused iPhone production from China to India, but because India and China have a bit of a regional superpower rivalry between them, with the former recently surpassing the latter as the world's most populous country (China is facing a crippling demographic crisis in several decades that would rival Japan's), and with ambitions to overtake China's GDP over the next 2 decades.

Case in point, Indian trade negotiators are planning to showcase the country’s large pipeline of Boeing plane orders and the potential for more to come as they seek a favorable deal with the US, Bloomberg reported citing people familiar with the matter. In the absence of a deal, Indian goods exports to the US face up to 26% levies after Trump’s 90-day pause on implementation of reciprocal tariffs ends in July.

The plan is to get Indian carriers’ existing orders and under-negotiation deals with the American planemaker counted in discussions for a bilateral trade pact that could potentially shield the country from higher US tariffs.

Along with Air India, Akasa Air-operator SNV Aviation and SpiceJet have placed a combined order for 590 aircraft worth $67 billion with Boeing in recent years. With deliveries and payments for 506 of those planes staggered over several years, India wants to highlight how these private purchases would serve to narrow the more than $47 billion trade surplus New Delhi runs with Washington — a key gripe of President Donald Trump.