As expected, just hours after the PBOC cut rates and injected billions into the economy to give Xi Jinping ammunition in the upcoming trade war negotiations, the FOMC did... noting: the Fed kept the target range for the federal funds rate unchanged at 4.25-4.50%. The decision was unanimous. In its formal statement the FOMC said (changes in italics) “Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace.” In other words, the negative GDP growth figure for Q1 did not concern the Committee. However, looking ahead the possible challenges are mounting: “Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.”

Recapping the statement, Goldman chief US economist David Mericle writes:

- Very close to what we were expecting. Surveys have weakened a lot, hard data has not – we continue to think that they will want to see that before they make any changes.

- Very little new info here - No policy change, highlighting that uncertainly has increased further.

- Highlighting risk on both sides of the mandate - higher unemployment and inflation.

- Very first paragraph acknowledges Q1 GDP (and other data) was weaker because of “swings in net exports”

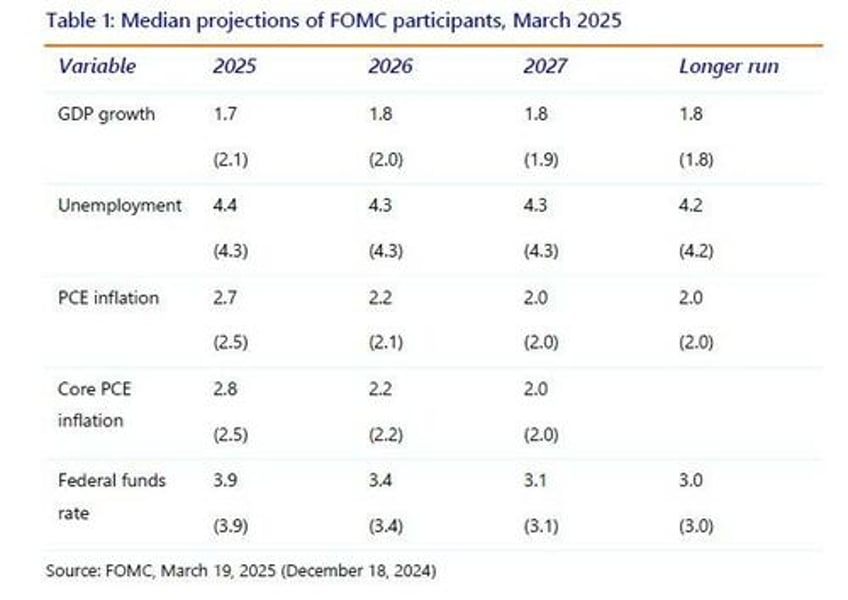

In his prepared speech, Rabobank's Philip Marey notes how Powell stressed that despite the heightened uncertainty, the economy remains solid (a point he underscored during the subsequent press conference when he confirmed that there had been no weakness in the hard data). The drop in GDP growth in Q1 was caused by swings in net exports in anticipation of the tariffs, while the labor market has remained solid and the current stance of monetary policy leaves the FOMC well-positioned. Avoiding persistent inflation will depend on the size of the tariffs, the time it takes for the tariffs to move through the economy and keeping long-term inflation expectations anchored.

Powell repeated that if the FOMC would face the challenging situation where the two sides of the mandate came in conflict, the Committee would look at the size of the deviations from target and the time it would take for these gaps to close. In fact, his prepared speech sounded very much like his previous speech on April 16. During the Q&A, when asked whether the FOMC was any closer to what side of the mandate needs to be addressed first, Powell said it was too early to know what the tariffs are going to be and how they are going to affect the economy. He repeated that the FOMC is in a good position to wait and see and that they can afford to be patient. He said the right thing to do is to wait for more clarity and then the Committee knows which way to go, a point which Fed mouhtpiece Nick Timiraos highlighted in his tweet noting that Powell said wait no less than 22 times.

Fed Chair Jay Powell used some version of the word "wait" ("waiting," "await") 22 times at the press conference.

— Nick Timiraos (@NickTimiraos) May 7, 2025

Half of those were "wait and see" re: what to do with interest rates

However, during the press conference he could not explain what they were looking for in the data that would get them to move. When specifically asked about moving at the next meeting, he said that they did not think they need to be in a hurry, but if something develops they could act. Right now they are waiting for more data and he really could not give a time frame on when they would move. He also did not want to speculate on the June update of the Summary of Economic Projections, which in March still indicated two rate cuts. So essentially Powell spent the press conference telling us nothing new and dodging questions about Trump. All we know now is that they are going to wait and see which part of the mandate needs to be addressed first in terms of deviation from target and how long that is expected to last.

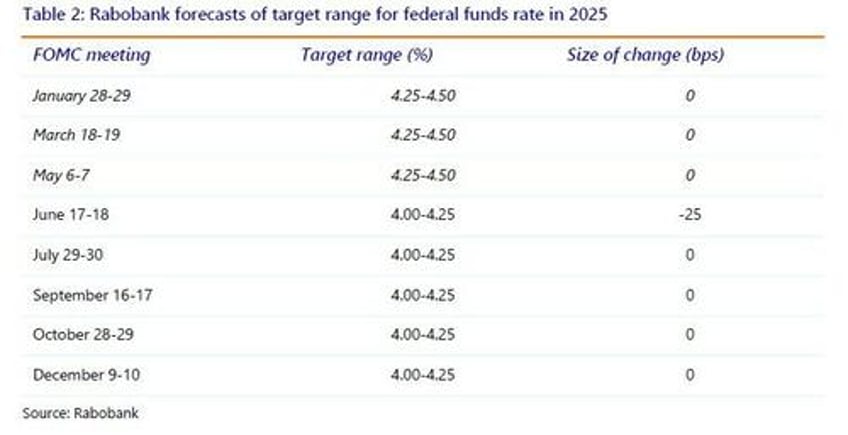

Summarizing his opinion of today's decision, Marey writes that the FOMC is clearly in no hurry to cut and is waiting for more clarity about government policy and its impact on the economy. That said, Rabobank expects that the "stagflationary dilemma" will eventually lead to a pause in the Fed’s cutting cycle. However, a deterioration in the labor market could still convince the FOMC to make one more cut in the coming months. For now, the bank has pencilled in one final cut on June 18 before the pause. However, this will depend on the incoming data, in particular the Employment Report for May, which will be published on June 6. Nonfarm payroll growth has slowed down to the 100-200K range this year, but most of the impact of the tariffs is still likely to come and this could be visible as soon as in the May report. This would be crucial in the Fed’s justification of a rate cut in June. However, if it takes longer for the tariffs to show up in the labor data a final cut could come later, in July or September.

Next, we excerpt from the first take by Goldman's head of US rates strategy, Will Marshall:

Changes in the Fed statement were largely matter-of-fact, with a straightforward acknowledgement of the reason for volatility in the Q1 growth info, most substantive was the acknowledgement of the increase in uncertainty escalating (conflicting) risks to both sides of the mandate.

Not a particularly strong signal, which isn't much of a surprise in a wait-and-see environment. Keys at the press conference will be around the characterization of inflation risks (how they're thinking about the transitory/one-off assessment and what might erode that), and what they're attuned to on the activity side amid the divergent signals between hard and survey-based data (where presumably the bar is higher for the Fed as it seems to be for the market).

Front-end pricing at current levels should be pretty comfortable insofar as markets have undone some of the more acute FCI tightening of last month, but there's not a huge amount of cut risk priced into the very near-term that might be seen as excessive.

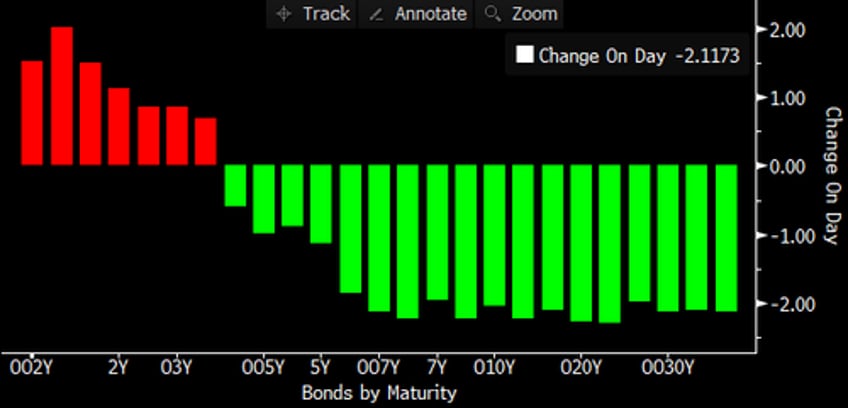

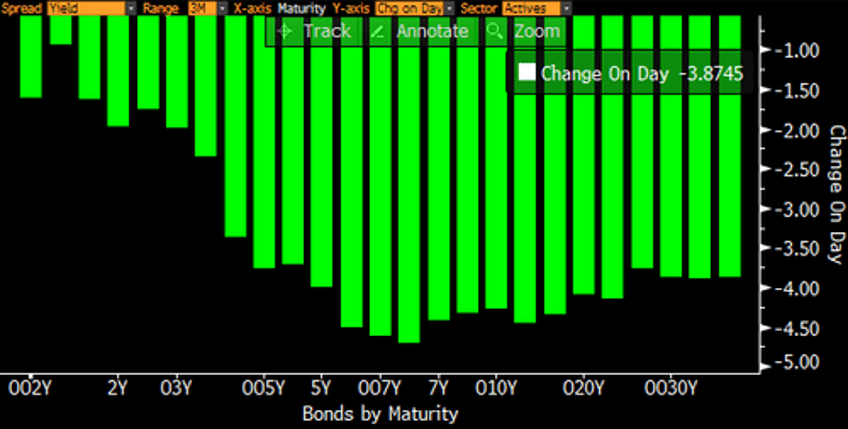

Rates Moves: Curve Pre vs. Post FOMC:

Pre (5 minutes before)

Post

More in the full Rabobank and Goldman notes available to pro subs.