After last week's central bank fireworks, the most exciting event of the otherwise quiet and holiday-shortened week will happen once markets are actually closed for the month and Q1 is done and dusted in performance terms: as DB's Jim Reid reminds us, the monthly US personal income and spending report, which contains the crucial core PCE, is released on Good Friday when bond and equity markets are closed. The flash CPIs in Italy and France also come out on Friday, with the Spanish print due on Wednesday. Staying on the inflation theme, Tokyo CPI is out on Thursday, with the summary of opinions from last week's BoJ meeting on Wednesday. This will garner some attention given the once-in-a-generation shift in policy. Australian CPI is out on Wednesday.

Staying with central banks, there are lots of Fed speakers this week that can add some color to last week's generally dovish FOMC. They are listed in the day-by-day week ahead at the end.

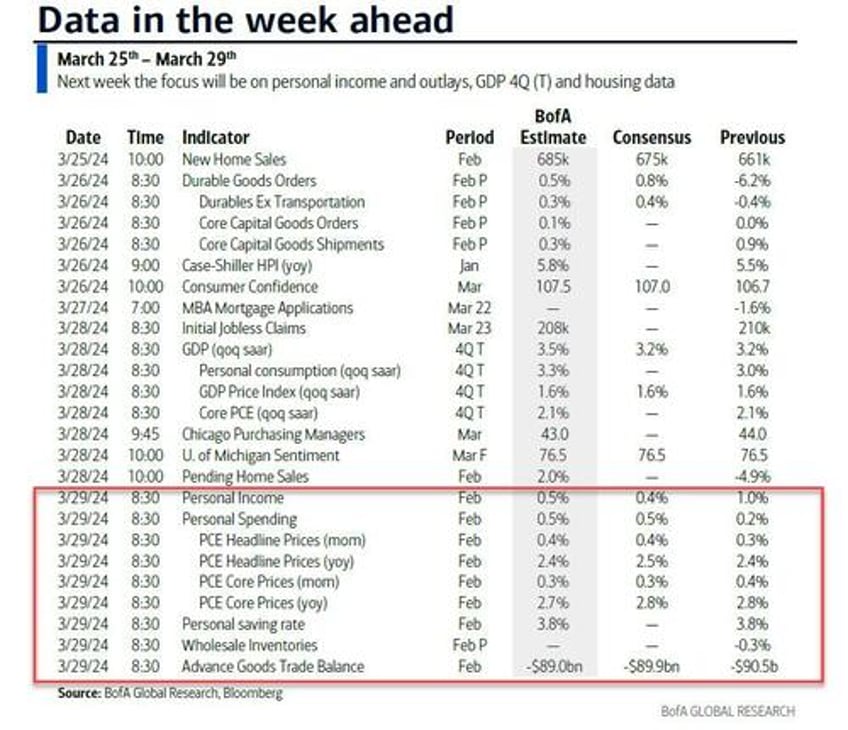

In terms of the key US data, today sees new home sales, tomorrow sees durable goods and consumer confidence, Wednesday the final consumer sentiment reading and pending home sales, while Thursday sees the final release of Q4 GDP, trade data, the Chicago PMI and, of course, initial jobless claims.

In terms of that core PCE print on Good Friday, DB economists expect +0.27% vs. 0.42% last month. In Powell's press conference, he remarked that the month-over-month print for core PCE could be "well below 30bps" at the end of the month. Taking him at his word does offer downside risk to the economists' forecast who believe upward revisions to the January healthcare services prices could square these two numbers.

In Europe, DB's European economists' inflation chartbook covers recent trends and their forecasts here. For March readings, they expect the headline Eurozone index to come in at 2.5% (vs 2.6% in February) and core at 3.1% (3.1%). On a country level, their projections include 2.4% for Germany (2.8% next week), 2.5% for France (3.2% Friday), 1.3% in Italy (0.8% Friday) and 3.5% in Spain (3.0% Wednesday).

Courtesy of DB, here is a day-by-day calendar of events

Monday March 25

- Data: US March Dallas Fed manufacturing activity, February new home sales, Chicago Fed national activity index, Japan February services PPI

- Central banks: Fed's Bostic and Cook speak, ECB's Holzmann speaks, BoE's Mann speaks

- Auctions: US 2-yr Notes ($66bn)

Tuesday March 26

- Data: US March Conference Board consumer confidence, Richmond Fed manufacturing index, Richmond Fed business conditions, Philadelphia Fed non-manufacturing activity, Dallas Fed services activity, February durable goods orders, January FHFA house price index, Germany April GfK consumer confidence

- Auctions: US 5-yr Notes ($67bn)

Wednesday March 27

- Data: UK March Lloyds business barometer, China February industrial profits, France March consumer confidence, Eurozone March services, industrial and economic confidence

- Central banks: BoJ's summary of opinions (March MPM), Tamura speaks, Fed's Waller speaks, ECB's Cipollone speaks

- Auctions: US 2-yr FRN ($28bn, reopening), 7-yr Notes ($43bn)

Thursday March 28

- Data: US March MNI Chicago PMI, Kansas City Fed manufacturing activity, February pending home sales, initial jobless claims, UK Q4 current account balance, Japan March Tokyo CPI, February retail sales, job-to-applicant ratio, jobless rate, industrial production, Italy March manufacturing and consumer confidence, economic sentiment, February PPI, Germany March unemployment claims rate, Eurozone February M3, Canada January GDP

- Central banks: ECB's Villeroy speaks

Friday March 29

- Data: US March Kansas City Fed services activity, February personal spending and income, PCE deflator, retail inventories, advance goods trade balance, Japan February housing starts, Italy March CPI, France March CPI, February PPI, consumer spending

- Central banks: Fed's Powell speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Tuesday and the core PCE inflation report on Friday. There are several speaking engagements from Fed officials this week, including an event with Governor Waller at the Economic Club of New York on Wednesday and a discussion with Chair Powell hosted by the San Francisco Fed on Friday.

Monday, March 25

- 08:25 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a discussion on equity and economic development at the University of Cincinnati Real Estate Center’s March Roundtable. Q&A is expected. On March 22nd, President Bostic noted that he only expected the FOMC to cut the fed funds rate once in 2024. President Bostic said he was “less confident than … in December” that inflation would continue to decline toward the Fed’s 2% target, and that the recent data on inflation showed “some troubling things.” Still, President Bostic noted that his baseline forecast was “a close call,” and that the FOMC would “have to see how the data come in over the next several weeks.”

- 09:05 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will give an interview to Yahoo Finance. On February 29th, President Goolsbee noted that the fed funds rate was “pretty restrictive” and urged the FOMC to “think about how long we want to remain in this restrictive territory.” President Goolsbee said he expected there was still “supply benefit coming through the system both on the supply chain and the impact of labor supply.”

- 10:00 AM New home sales, February (GS +6.5%, consensus +2.1%, last +1.5%)

- 10:30 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver a speech at Harvard University on the Fed’s dual mandate and the balance of risks. Text and Q&A are expected. On February 22nd, Governor Cook said that she would like to have “greater confidence that inflation is converging to 2% before beginning to cut the policy rate.” Governor Cook also noted that she saw “an eventual rate cut as adjusting policy to reflect a shifting balance of risks” and that she believed “the risks to achieving our employment and inflation goals” were “moving into better balance after being weighted toward excessive inflation.”

Tuesday, March 26

- 08:30 AM Durable goods orders, February preliminary (GS +0.4%, consensus +1.2%, last -6.2%); Durable goods orders ex-transportation, February preliminary (GS +0.9%, consensus +0.4%, last -0.4%); Core capital goods orders, February preliminary (GS +0.7%, consensus +0.1%, last flat); Core capital goods shipments, February preliminary (GS +0.4%, consensus flat, last +0.9%): We estimate that durable goods orders rose 0.4% in the preliminary February report (mom sa), reflecting further weakness in commercial aircraft orders but strong core measures. Specifically, we forecast a 0.7% increase in core capital goods orders following above-normal order cancellations in January, and we forecast a 0.4% increase in core capital goods shipments reflecting strong industrial production data and the rebound in foreign manufacturing activity.

- 09:00 AM FHFA house price index, January (consensus +0.3%, last +0.1%)

- 09:00 AM S&P Case-Shiller 20-city home price index, January (GS +0.2%, consensus +0.2%, last +0.21%)

- 10:00 AM Conference Board consumer confidence, March (GS 107.1, consensus 106.9, last 106.7)

Wednesday, March 27

- There are no major economic data releases scheduled.

- 06:00 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak at an event hosted by the Economic Club of New York. Text and Q&A are expected. On February 22nd, Governor Waller noted that recent data had “reinforced my view that we need to verify that the progress on inflation we saw in the last half of 2023 will continue, and this means there is no rush to begin cutting interest rates to normalize monetary policy.” Governor Waller noted that he still expected it would “be appropriate sometime this year to begin easing monetary policy, but the start of policy easing and number of rate cuts will depend on the incoming data.”

Thursday, March 28

- 08:30 AM GDP, Q4 third release (GS +3.2%, consensus +3.2%, last +3.2%); Personal consumption, Q4 third release (GS +3.0%, consensus +3.0%, last +3.0%); We estimate no revision to Q4 GDP growth, at +3.2% (qoq ar).; 08:30 AM Initial jobless claims, week ended March 23 (GS 205k, consensus 213k, last 210k); Continuing jobless claims, week ended March 16 (consensus 1,816k, last 1,807k): We expect initial jobless claims to decline by 5k to 205k. The BLS included an annual update of the seasonal factors in the jobless claims report from two weeks ago that substantially reduced the seasonal distortions that had been introduced by pandemic volatility.

- 09:45 AM Chicago PMI, March (GS 47.5, consensus 46.0, last 44.0): We estimate that the Chicago PMI rose by 3.5pt to 47.5 in March, reflecting the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 10:00 AM Pending home sales, February (GS +2.1%, consensus +1.3%, last -4.9%)

- 10:00 AM University of Michigan consumer sentiment, March final (GS 76.8, consensus 76.5, last 76.5); University of Michigan 5-10-year inflation expectations, March final (GS 2.9%, consensus 2.9%, last 2.9%): We estimate the University of Michigan consumer sentiment index increased to 76.8 in the final March reading and estimate the report's measure of long-term inflation expectations was unrevised at 2.9%.

Friday, March 29

- 08:30 AM Personal income, February (GS +0.4%, consensus +0.4%, last +1.0%); Personal spending, February (GS +0.5%, consensus +0.5%, last + 0.2%); PCE price index, February (GS +0.36%, consensus +0.4, last +0.34%); PCE price index (yoy), February (GS +2.47%, consensus +2.5%, last +2.4%); Core PCE price index, February (GS +0.29%, consensus +0.3%, last +0.42%); Core PCE price index (yoy), February (GS +2.81%, consensus +2.8%, last +2.8%): We estimate personal income increased 0.4% and personal spending increased 0.5% in February. We estimate that the core PCE price index rose +0.29%, corresponding to a year-over-year rate of 2.81%. Additionally, we expect that the headline PCE price index increased by 0.36% from the prior month, corresponding to a year-over-year rate of 2.47%. Our forecast is consistent with a 0.33% increase in our trimmed core PCE measure (vs. 0.41% in January and 0.35% in December).

- 08:30 AM Advance goods trade balance, February (GS -$92.0bn, consensus -$89.7bn, last -$90.2bn)

- 08:30 AM Wholesale inventories, February preliminary (consensus +0.2%, last -0.3%)

- 11:15 AM Fed Chair Powell and San Francisco Fed President Daly (FOMC voter) speak: San Francisco Fed President Mary Daly will deliver opening remarks and Fed Chair Jerome Powell will participate in a moderated discussion at the San Francisco Fed’s Macroeconomics and Monetary Policy Conference. As noted in our FOMC recap, Chair Powell did not seem concerned by the firmer January and February inflation data. He noted that there was reason to think that seasonal effects could have boosted the January number and that the Fed staff expected core PCE inflation to be “well below” 30bp in February, “which is not terribly high.” Chair Powell also noted that stronger growth had been made possible by faster growth of labor supply and was therefore not an argument against rate cuts, and that FOMC participants thought it would be appropriate to slow the pace of balance sheet runoff “fairly soon.” On February 16th, President Daly noted that “the median [of three cuts in the December SEP seemed] like a reasonable baseline to me.”

Soruce: DB, Goldman, BofA