US equity futures are sliding as bond yields spike to 4.36%, the highest level since November, and the price of Brent crude rises to a new five-month high above $89 driven mostly by supply/demand dynamics but a geopolitical fear premium over the brewing Israel-Iran conflict begins to build, and as fears that the Fed may not cut rates in June start to percolate. The rest of the commodities complex is also pushing higher with strength in metals notable as Ags come from sale and gold jumps right back to all time highs despite the recent strength in the dollar. As of 7:50am, S&P and Nasdaq futures drop 0.4%, as health insurance stocks tumbled after regulators didn’t boost payments for private Medicare plans like the industry had come to expect; Mag7 names are mixed with Semis up small despite NVDA sliding. In Europe, most markets are mostly higher after reopening after the Easter holiday with only Spain in the red: energy, AI, and semis the best performing segments with additional support from banks, as regional curves bear steepen. The risk-on tone in APAC where HK showed significant outperformance. The yield curve is steeper, and the Bloomberg dollar index dropped. Bitcoin slumped after several sharp sell orders hit futures during Asian trading. Today’s macro data focus is on JOLTS and 3x Fedspeakers.

In premarket trading, crypto-related stocks fell with Coinbase Global down 2.5%, as pressure continued to build on Bitcoin, which shed 5% to trade below $67,000, having fallen about 10% from its mid-March peaks. US health insurance stocks were the other big premarket losers, after regulators didn’t boost payments for private Medicare plans like the industry had come to expect. Humana heavily exposed to Medicare, fell 9.2%, while UnitedHealth Group Inc. dropped 4.3%. Here are some other notable premarket movers:

- Clorox shares dip 1% after the cleaning and consumer products company was downgraded to neutral from buy at Citigroup, which said their call for a quick recovery following the cyberattack last year has “largely played out.”

- PVH shares slump 23% after the Calvin Klein owner forecast current fiscal year sales to decline more than consensus had expected. Analysts noted that the clothing company’s fourth-quarter results beat expectations, but expressed disappointment over the first-quarter and full-year outlook.

- Trump Media fell 3.8%, putting the stock on course to extend declines for a third consecutive session, after the firm disclosed a more than $58 million loss in 2023. The shares tumbled 21% on Monday.

All eyes were on interest rates as 10-year treasury yields rose about three basis points, adding to a 10 basis-point jump on Monday, when data showed an unexpected expansion in US manufacturing for the first time since September 2022. The impact was felt worldwide, with British 10-year yields climbing as much as 12 basis points, and German borrowing costs up almost 10 basis points.

As a result of rising oil price inflation, traders now reckon that the Fed will deliver fewer than three rate cuts this year, a view that could be bolstered if data at the end of this week show the US economy continued to add jobs at a healthy clip in March. They also see a good chance the central bank will push back the timing of its first rate cut, with odds of a June cut briefly falling below 50% on Monday.

Fed Chair Powell, who is due to speak again on Wednesday, said Friday that officials are awaiting more evidence prices are contained, adding that it wouldn’t be appropriate to lower rates until officials are sure inflation is in check. “The Fed is a difficult spot right now because if it eases too soon it could reignite the economy and inflation comes back, but if it doesn’t ease quickly enough, you get a bigger-than-expected economic slowdown,” said Andrew Pease, global head of investment strategy at Russell Investments Ltd. “At the margin, the data noise could convince the Fed to wait beyond June.”

Expectations of higher-for-longer Fed rates kept the dollar close to six-week highs against a basket of Group-of-Ten peers. The yen also stayed in focus, as the Japanese currency slipped further toward the 152-per-dollar level that many traders believe could force authorities’ hand toward intervention.

Markets are also keeping a close eye on geopolitical developments, as an Israeli airstrike on Iran’s embassy in Syria sent gold prices surging to a record high. Oil rallied above $85 as the attack added a risk premium to an already tight market.

European stocks rose but erased much of their earlier gains, with energy and mining stocks keading gains among sectors as US crude futures hit $85 a barrel for the first time since October, while real estate and media stocks laggedThe Stoxx 600 adds 0.1%, but well of earlier highs, while the FTSE 100 earlier topped 8,000 for the first time since February 2023. Here are the most notable European movers:

- Europe’s energy sub-index rises as much as 2.2% as oil advanced to a five-month high, buoyed by heightened geopolitical risks in the Middle East and tighter supply from Mexico.

- The basic resources sector gains as much as 2.3% as the price of aluminium, copper, nickel and iron ore all rise.

- Henkel shares gain as much as 2.4% to the highest in almost a year as Barclays (equal weight) raises its price target on the German industrial product manufacturer.

- Rheinmetall gains as much as 2.6% after getting an order to supply components for 22 self-propelled howitzers PzH2000 from KNDS Germany worth around €135 million.

- Delivery Hero shares rise as much as 7% in Frankfurt following local reports that its South Korean arm Woowa Brothers recorded a 65% increase in operating profit in 2023.

- Aker Carbon Capture shares surge as much as 49% after the company was awarded a contract from Norway’s Statkraft to capture 220,000 tonnes of carbon dioxide each year at the Heimdal waste-to-energy plant.

- Krones shares rise as much as 6% to a record high after Berenberg upgrades, saying the bottling machine manufacturer’s shares now represent an attractive buying opportunity.

- Ionos shares jump as much as 11% to the highest since its 2023 IPO following a DPA report that the cloud provider won a contract with Germany’s Federal Administration worth up to €410 million.

- Jungheinrich shares climb as much as 4.9% after Barclays gave the German machinery manufacturer a price target boost, citing constructive 2024 guidance and an attractive valuation.

- SSAB shares slide as much as 4.9% after the Sweden steelmaker unveiled plans to invest up to €4.5 billion on a new plant in Lulea that will help clean up one of the world’s dirtiest industries.

- Munters shares drop as much as 7.1% after Berenberg downgrades the Swedish industrial climate firm to hold from buy, saying the stock looks “somewhat inflated” following a strong run.

- S4 Capital shares fall as much as 8.2% after Citi said the advertising and marketing specialist’s near-term outlook is cloudy following disappointing guidance for 2024.

Earlier in the session, Asian stocks gained rebounding after Monday’s slump, with technology stocks climbing and Hong Kong posting strong gains as the market reopened following holidays.The MSCI Asia Pacific Index climbed as much as 0.6%, with chipmakers TSMC and Samsung among the biggest contributors. Hong Kong benchmarks gained more than 2%, leading the region higher, while mainland China stocks drifted lower after a three-day gain on improving economic data. Japanese stocks were mixed. Key gauges advanced in Taiwan, Singapore, South Korea and the Philippines.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark outperformed as it played catch up on return from the Easter holiday closures, while the mainland was indecisive after a tepid PBoC liquidity operation

- Nikkei 225 was choppy and failed to sustain a brief foray back above the 40,000 status.

- Australia's ASX 200 initially printed a fresh record high but then pared its gains as strength in the commodity-related industries was offset by losses in the consumer-related sectors, while RBA Minutes did little to spur price action.

“China is one of the most under-owned equity markets globally, so there is definitely some catch-up,” Stephanie Leung, chief investment officer at StashAway, told Bloomberg TV. “Leading indicators are telling us that China has already seen its worst in terms of cyclical downturn,” she said.

In FX, the Bloomberg Dollar Spot Index erased earlier gains, while Treasury yields extended yesterday’s sharp selloff and European bonds fell, catching up with Monday’s drop in USTs

- EUR/USD drops 0.2% to 1.0725, its lowest since Feb. 15; Bavaria March CPI slowed to 2.3% annually from 2.6% prior

- USD/CHF rallies 0.5% to 0.9086, a five-month high; Switzerland’s manufacturing PMI to 45.2 (estimate 45.0) in March from 44 in February

- Demand for USD/JPY during and after the Tokyo fix saw it climb to 151.80; investors are considering whether the macro backdrop is now strong enough for spot to breach 152 and possibly force the hand of Japanese authorities, according to Asia-based FX traders

- GBP/USD reverses losses, rises 0.1% to 1.2561; UK house prices fell for the first time in three months, suggesting the market may be stagnating due to high mortgage rates and strained affordability

In emerging markets, the Turkish lira surged against the dollar after President Recep Tayyip Erdogan indicated his economic team will be allowed to stay the course with orthodox monetary policies, despite a rout for the ruling party in local elections over the weekend.

In rates, treasuries extended Monday’s aggressive selloff, sending 10-year yields to four-month highs over 4.36%. Yields are near cheapest levels of the day in early US session amid latest rise in oil futures, up nearly 2% at highest level since October. Yields are cheaper by 2bp-6bp across the curve with front-end outperformance steepening 2s10s spread by 4bp; 10-year yields around 4.36% are more than 5bp higher on the day, while core European government bonds drop, echoing the sharp decline in Treasuries on Monday. Bunds did pare losses after German state CPI numbers suggested a slightly lower-than-forecast national reading. German 10-year yields rise 7bps to 2.37%. WTI crude oil futures over $85/bbl are a source of upward pressure on Treasury yields, along with technical factors as 10-year tests 4.35%. Fed-dated OIS rates are little changed, pricing in around 14bp of rate cuts for June meeting; further out, around 63bp of cuts remain priced in for December FOMC.

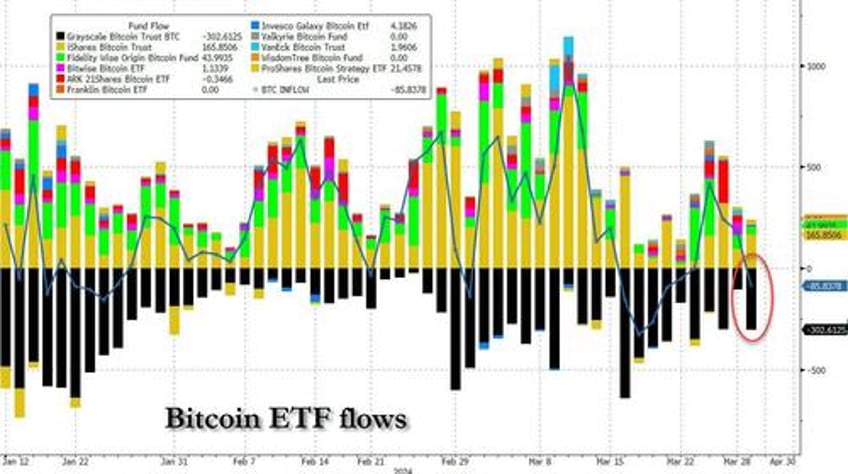

Pressure continues to build on Bitcoin, which shed 5% to trade below $67,000, having fallen about 10% from its mid-March peaks. Crypto-related stocks fell in US premarket trading, with Coinbase Global down 2.5%.

In commodities, crude futures pierced $85 for the first time since October, the latest milestone in a market that has rallied against a backdrop of OPEC+ cuts, strong demand and heightened geopolitical risk. WTI added as much as 1.8% in New York, while the global Brent benchmark neared $89 a barrel, after Iran vowed revenge on Israel after blaming it for a deadly air strike on its embassy in Syria — a rare direct confrontation in the adversaries’ escalating proxy conflict over the war in Gaza. Israel “will be punished. We will make them regret their crime,” Iran’s Supreme Leader, Ayatollah Ali Khamenei, said on Tuesday, according to the state-run Islamic Republic News Agency. Spot gold rises 0.5% to a new record high.

Looking at today's calendar, the US economic data slate includes February JOLTS job openings and factory orders (10am) along with four scheduled Fed speakers: Bowman (10:10am), Williams (12pm), Mester (12:05pm) and Daly (1:30pm)

Market Snapshot

- S&P 500 futures little changed at 5,294.25

- STOXX Europe 600 up 0.4% to 514.50

- MXAP up 0.5% to 176.49

- MXAPJ up 0.7% to 541.07

- Nikkei little changed at 39,838.91

- Topix down 0.2% to 2,714.45

- Hang Seng Index up 2.4% to 16,931.52

- Shanghai Composite little changed at 3,074.96

- Sensex down 0.3% to 73,782.30

- Australia S&P/ASX 200 down 0.1% to 7,887.87

- Kospi up 0.2% to 2,753.16

- German 10Y yield little changed at 2.34%

- Euro down 0.1% to $1.0731

- Brent Futures up 1.3% to $88.55/bbl

- Brent Futures up 1.3% to $88.55/bbl

- Gold spot up 0.5% to $2,261.71

- US Dollar Index little changed at 105.01

Top Overnight News

- WTI hit $85 for the first time since October as Iran vowed revenge for what it says was an Israeli airstrike on its embassy in Syria, and amid tighter supply from Mexico. Adding to momentum, OPEC+ may decide tomorrow to continue with output curbs, while both Brent and WTI’s prompt spread jumped. BBG

- Australia’s central bank signaled a further shift toward a neutral stance as minutes of its March meeting showed the board didn’t consider the case to raise interest rates for the first time since May 2022. BBG

- Several Chinese developers’ shares have been suspended from trading in Hong Kong starting Tuesday due to their failure to meet the deadline for publishing last year’s annual results, another sign of the turmoil in the country’s real-estate sector. WSJ

- A resurfaced speech from Xi Jinping suggests Chinese policymakers may start trading government bonds to regulate liquidity — a pivot for a central bank that hasn’t made a significant bond purchase since 2007. The remarks were made in October but publicized only recently. BBG

- Japan may intervene in the FX market at any time should the yen weaken beyond its current range, the country’s former currency chief said. Dollar-yen options traders are betting authorities may let the yen slide to 153 or beyond before stepping in. An intervention would probably target a five-yen rally against the greenback, strategists said. BBG

- Eurozone inflation expectations over the next 12 months fell to +3.1% from +3.3%, dropping to the lowest level since the start of Russia’s unjustified war on Ukraine in Feb 2022. ECB

- Speaker Mike Johnson has begun publicly laying out potential conditions for extending a fresh round of American military assistance to Ukraine, the strongest indication yet that he plans to push through the House a package that many Republicans view as toxic and have tried to block. NYT

- Banks will have to cut their exposure to commercial real estate because of a $2tn “wall” of property debt coming due in the next three years, according to a leading US brokerage. “Banks will be under pressure,” said Barry Gosin, chief executive of Newmark, which handled $50bn of loan sales for failed Signature Bank. FT

- Health insurance stocks fell sharply after US regulators didn’t boost payments for private Medicare plans like the industry had come to expect. The decision by the administration of President Joe Biden to hold firm on proposed Medicare Advantage rates for 2025 shows a break with recent practice, taking Wall Street by surprise. Only once in the past 10 years have final rates not improved from regulators’ initial proposals. BBG

- China’s protracted property sales drought has weighed on many of the nation’s biggest builders and eroded the balance sheets of the largest state-owned banks as their bad loans swell. Beijing has tasked banks with helping pump up the domestic economy as well as supporting debt-laden developers. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with price action mostly rangebound after the weak performance on Wall St where hot ISM Manufacturing PMI data saw markets trim Fed rate cut bets. ASX 200 initially printed a fresh record high but then pared its gains as strength in the commodity-related industries was offset by losses in the consumer-related sectors, while RBA Minutes did little to spur price action. Nikkei 225 was choppy and failed to sustain a brief foray back above the 40,000 status. Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark outperformed as it played catch up on return from the Easter holiday closures, while the mainland was indecisive after a tepid PBoC liquidity operation.

Top Asian news

- Japanese Finance Minister Suzuki reiterated it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he won't rule out any steps to respond to disorderly FX moves and is closely watching FX moves with a high sense of urgency but made no comment on FX intervention.

- RBA Minutes from the March 18th-19th meeting stated members agreed it is appropriate to leave rates unchanged and there was no mention in the minutes that the board considered the option to raise rates, while the Board agreed it is difficult to either rule in or out future changes in cash rate. RBA Minutes stated the economic outlook is uncertain but risks seemed broadly balanced and it would take "some time" before the board could be confident inflation is returning to the target, as well as noted that upside risks to inflation had not yet materialised and consumption was very weak.

- RBA Assistant Governor Kent said the RBA intends to change the way it provides liquidity to the banking system in which it is to adopt an ample reserves system for monetary policy and will use open market repo operations at a price near the Cash Rate target, while it will commence a public consultation and liaison with participants shortly. RBA's Kent also stated that the outlook for inflation and policy is uncertain.

European bourses, Stoxx600 (+0.1%) began the session on a firm footing and rose further at the open before the upside eventually petered out. A modest dovish reaction was seen following the German State CPIs, though this faded as indices succumbed to broader but equally as modest pressure. European sectors hold a slight negative tilt; Basic Resources and Energy are the clear outperformers, propped up by broader strength in underlying commodity prices. Real Estate lags, hampered by the higher yield environment. US Equity Futures (ES -0.1%, NQ -0.1%, RTY U/C) are slightly lower continuing the losses seen in the prior session (sparked by the hot US ISM Manufacturing data). Crypto-exposed stocks are lower in the pre-market after an over 5% drop in Bitcoin.

Top European news

- ECB Consumer Inflation Expectations survey (Feb) - 12-months ahead 3.1% (prev. 3.3%); 3-year ahead 2.5% (prev. 2.5%); Economic growth expectations for the next 12 months remained unchanged at -1.1%.

FX

- DXY is holding around 105 following yesterday's hot ISM manufacturing print. DXY has been as high as 105.10 with not much in the way of resistance until the 14th November high at 105.73.

- EUR is softer vs. the USD after taking a beating yesterday. Today, weakness has been assisted by soft ECB inflation survey and regional German CPI. EUR/USD has been as low as 1.0725 with the 15th Feb low at 1.0723.

- JPY is steady vs. the USD after advancing to a 151.80 peak overnight but fell short of testing the YTD high at 151.97. It remains the case that a more dovish Fed story is required to reverse the fortunes of the pair.

- Antipodeans are both firmer vs. the USD but AUD more so alongside the rally in metals prices. AUD/USD back on a 0.65 handle but still below yesterday's peak at 0.6538.

- PBoC set USD/CNY mid-point at 7.0957 vs exp. 7.2433 (prev. 7.0938).

Fixed Income

- USTs are near yesterday's US ISM Manufacturing induced lows at 110-00; a slight uptick was seen after the EZ PMIs/German state CPIs, though focus will remain on a busy data docket and a number of Fed speakers.

- Bunds are bearish, as the region reacted to Monday's US ISM data, taking Bunds to a low of 132.47; following the EZ SCE/German regional CPIs, Bunds edged higher, towards a peak of 132.95, though has since pared much of the upside.

- Gilt price action is in-fitting with Bunds, though with much of the initial upside on the EZ-data unwound following the upward revision to UK Manufacturing PMI which brought the measure back into expansionary territory. Gilts have been as low as 98.85, and should the downside continue, 98.68 (6th March) could be in play.

- Germany sells EUR 3.71bln vs exp. EUR 4.5bln 2.50% 2026 Schatz: b/c 2.3x (prev. 2.64x), average yield 2.84% (prev. 2.80%), retention 17.56% (prev. 18.96%)

Commodities

- A positive session for the crude complex as tailwinds from the revision higher in Chinese and EZ Manufacturing PMIs, strong US ISM Manufacturing PMI, and escalating geopolitics counter the headwinds from the pushback in US rate cut pricing; Brent currently around USD 88.80/bbl.

- Precious metals are firmer across the board despite the stronger Dollar but amidst a slew of geopolitical update; XAU hit a fresh record high at USD 2.265.49/oz yesterday with the yellow metal in a USD 2,247-2,262.69/oz range thus far.

- Base metals are also higher across the board despite the price action in the Dollar this morning, with the complex likely moving to the slew of constructive Manufacturing PMIs from China, the US, and across the EZ.

- Venezuela oil exports reportedly hit a 4-year peak as US sanctions deadline looms, according to Reuters citing shipping data and documents.

- Barclays says "we are now entering a period for the LNG market where we see it as demand-constrained"; says a demand-constrained LNG market is also set to constrain prices.

Geopolitics: Middle East

- US told Iran it had no involvement or advanced knowledge of the Israeli strike on a diplomatic compound in Syria, according to Axios citing a US official.

- Israeli shelling on a car of the World Central Kitchen organization in Gaza caused the death of 4 foreigners, according to Al Jazeera.

- White House said US and Israeli teams had a constructive engagement on Rafah on Monday and agreed that they share the objective to see Hamas defeated in Rafah. US expressed its concerns with various courses of action in Rafah, while the Israeli side agreed to take the concerns into account and to have follow-up discussions between experts on Rafah with follow-up discussions to include an in-person strategic consultative group meeting as early as next week, according to Reuters.

- US President Biden’s administration is reportedly considering the approval of a USD 18bln sale of aircraft and other munitions to Israel including F-15 jets.

- "Israeli media quoting official: The atmosphere of the truce talks in Cairo is positive and will continue", according to Al Arabiya

Geopolitics: Other

- North Korea fired a suspected ballistic missile which was reported to have fallen shortly after and appeared to have landed outside of Japan's exclusive economic zone.

- Japanese PM Kishida said Japan launched a protest against North Korea's missile launch and that North Korean missile launch affects not only peace and stability in the region but also the international community, while it was separately reported that the US military condemned North Korea's missile launch.

- South Korean President Yoon said North Korea will try to sow confusion in South Korea ahead of the election, while it was also reported that South Korea imposed sanctions on two Russian organisations and two Russian individuals linked to North Korea's missile program.

- Attempted drone attack on an oil refinery within Russia's Nizhnekamsk, via Tass; attack was thwarted, no damage occurred.

- Ukrainian intelligence source says attacks on Russian refineries will continue in order to reduce Russia's oil revenue, according to Reuters

US Event Calendar

- March Wards Total Vehicle Sales, est. 15.8m, prior 15.8m

- 10:00: Feb. Durable Goods Orders, est. 1.4%, prior 1.4%

- Feb. Durables-Less Transportation, prior 0.5%

- Feb. Cap Goods Ship Nondef Ex Air, prior -0.4%

- Feb. Cap Goods Orders Nondef Ex Air, prior 0.7%

- 10:00: Feb. Factory Orders, est. 1.0%, prior -3.6%

- Feb. Factory Orders Ex Trans, prior -0.8%

- 10:00: Feb. JOLTs Job Openings, est. 8.73m, prior 8.86m

Central Bank Speakers

- 10:10: Fed’s Bowman Speaks on Bank Mergers, Acquisitions

- 12:00: Fed’s Williams Moderates Discussion at Economic Club of NY

- 12:05: Fed’s Mester Gives Remarks on Economic Outlook

- 13:30: Fed’s Daly Participates in Fireside Chat

DB's Jim Reid concludes the overnight wrap

Welcome back to all those in Europe that enjoyed the long Easter weekend. With Jim off skiing in the Alps, and trying to avoid adding to his injuries in the process, Henry and I are filling in on the EMR duties for a couple of weeks. Markets will be hoping to avoid any accidents of their own after a strong Q1 for risk assets. While most European markets were closed yesterday, the first session of Q2 was a challenging one for US markets.Treasuries saw their weakest session in several weeks, with 10yr yields up by +11.0bps, as stronger manufacturing ISM data reignited doubts over the extent of Fed rate cuts this year.

Before reviewing these latest moves and previewing the rest of the week ahead, let us recap the notable milestones we saw for risk assets in Q1. With the start of a new month, Henry just published our usual performance review of how different assets fared over March and Q1 (see here). Several equity indices posted record highs, with the S&P 500 up more than +10% in Q1, marking the first time in over a decade that it’s seen back-to-back quarterly gains in double digits. Meanwhile in Japan, the Nikkei saw its strongest performance since Q2 2009, and surpassed its previous record high from 1989. But even as risk assets did well, bonds saw a weaker performance, as more persistent inflation and the strength of the economy led investors to price in fewer rate cuts.

Since the start of the year we’ve regularly highlighted the challenge faced by central banks, especially the Fed, in calibrating their expected easing cycles. My report last week noted how credit conditions suggested higher risks of a delay to the start of rates easing in the US than in Europe (see here for more), while Henry has previously noted how market expectations of a dovish shift have already been delayed several times in this cycle. Prospects for delayed Fed cuts were again a key theme yesterday after an upside surprise in the March manufacturing ISM. The headline reading rose to 50.3 (vs. 48.3 expected), its first above-50 print since September 2022, while the employment recovered to 47.4 (vs. 47.5 expected) from a seven-month low of 45.9. Most concerning from the inflation perspective, ISM prices paid jumped to 55.8 (vs. 53.0 expected), their highest level since July 2022.

This came in some contrast to the core PCE inflation print out while markets were closed on Friday. The February core PCE deflator (+0.26% vs. +0.3% expected) remained somewhat elevated but eased considerably after the +0.45% January print, with the annual print slowing by a tenth to 2.8%. Following the PCE print, Fed Chair Powell commented on Friday that the data were “pretty much in line with our expectations", while also noting that “we don't need to be in a hurry to cut”. Our US economists note that 20bps prints for March and April would lower annual core PCE inflation to 2.5%, which they would see as just enough progress for the Fed to begin rate cuts at the June meeting.

Fed funds pricing of a June cut neared fifty-fifty intra-day yesterday after the ISM print before closing at 62%. That’s down from just over 70% this time yesterday and 77% last Wednesday, prior to hawkish comments from Fed Governor Waller.The amount of Fed cuts priced by year-end fell to 67bps, its lowest since the end of October, pricing out half of a 25 bps cut since last Wednesday.

Treasuries sold off across the curve yesterday, with 10yr yields rising +11.0bps to 4.31%, their sharpest rise since mid-February. 2yr yields were +8.5bps higher at 4.71%. While the stronger ISM reading was the key trigger, the sell-off was probably exacerbated by technical factors, given thinner liquidity amid the holiday in Europe and a jump in corporate bond issues on Monday. 10yr Treasury yields are trading -0.5bps lower overnight as I type.

The rise in yields weighed on US equities. The S&P 500 was down a modest -0.20% but this was a broad decline with 73% of constituents down on the day and the equal weighed version of the index falling by -0.61%. The Dow Jones (-0.60%) and the small-cap Russell 2000 (-1.02%) underperformed. By contrast, tech stocks were resilient, as the NASDAQ (+0.11%) and the Magnificent 7 (+0.63%) posted gains, the latter boosted by a +3.02% rise for Alphabet. US equity futures are trading marginally lower overnight.

On the other hand, t he US dollar benefitted, with the broad dollar index (+0.51%) rising to its highest level since November. In commodities, Gold posted a new all-time high at $2,238/oz (+0.37% yesterday following on a +2.98% gain last week), while WTI crude oil closed at its highest level since October (+0.65% to $83.71/bbl), in part amid renewed concerns over the conflict in the Middle East after an Israeli strike against an Iranian consulate in Syria. WTI crude futures are trading half a percent higher at above $84/bbl overnight.

Over in Asia, equity markets are mostly trading higher this morning despite a weak handover from Wall Street overnight. The Hang Seng (+2.19%) is leading gains after resuming trading from a long weekend and powered by a rally in Xiaomi (+10.71%) as the company began taking orders for its newly launched electric vehicle. Elsewhere, the Chinese stocks are mixed, at -0.25% for the CSI and +0.03% for the Shanghai Composite. China stocks had notched their biggest daily gain in a month yesterday after the latest manufacturing PMI data reinforced economic recovery hopes in the world’s second biggest economy. Meanwhile, the Nikkei is near flat (-0.03%) with a slight reversal after reclaiming the 40,000 points mark earlier in the session, while the KOSPI (+0.12%) is seeing minor gains.

Today was on the lighter on the data side in Asia, with one release of note being Australia’s manufacturing PMI, which fell from 47.8 to 47.3 in March, its lowest since May 2020. It was a busier data docket in Asia on Monday. In China, the Caixin/S&P Global manufacturing PMI rose from 50.9 to 51.1 in March, with manufacturing activity expanding at its fastest pace in 13 months and corroborating the 11-month high in the official manufacturing PMI over the weekend. China’s Caixin services PMI scheduled to release tomorrow will grab market attention. Elsewhere, the BoJ’s Tankan Survey for Q1 showed sentiment among Japan’s largest service-sector firms advance to its highest level in more than three decades at +34 (vs. +32 expected). Business confidence among major manufacturers' did weaken for the first time in four quarters following a sharp drop in the auto sector caused by production cuts, but the reading was still a touch above expectations at +11.0 (vs +10.0 expected).

In FX, t he Japanese yen is trading at 151.78 versus the dollar, within touching distance from its 34-year low of 151.975 seen last week amid possibility of intervention from the Japanese authorities. Meanwhile, remarks from Japanese Finance Minister Suzuki this morning did little to support the yen as he reiterated that officials are keeping their powder dry as they watch how currency moves play out.

In central bank news, the minutes of the Reserve Bank of Australia’s (RBA) March meeting confirmed that for the first time in the current cycle the RBA did not discuss additional interest rate increases. The minutes indicated that the board members acknowledged the need for more time to assess the inflation trajectory before considering future rate change, and emphasized that overall financial conditions remained restrictive, particularly for households.

Looking forward to the rest of the week, today and tomorrow will first see focus on European inflation data, with the flash March inflation print for Germany this morning followed by the euro area release tomorrow. Friday saw both France’s (+2.4% yoy vs +2.8% expected) and Italy’s (+1.3% vs. +1.5% expected) inflation releases come in below expectations on the EU-harmonised measure. Our European economists see the euro area inflation print tracking at +2.5% headline and +3.0% core (vs +2.6% and +3.1% previous). While only a marginal slowing in the annual rate, this would offer a degree of relief after upside core inflation surprises in the January and February prints. This morning we also get the latest colour on inflation expectations from the ECB’s February consumer expectations survey.

Over in the US, the highlight of the week will be the March jobs report on Friday. Our US economists see headline payrolls coming in at +200k (vs. +275k previously), with unemployment falling a tenth to 3.8%. Coupled with an uptick in hours worked and a +0.2% rise in average hourly earnings, their expectations would equate to the payrolls-based compensation growth proxy running at a strong pace of just above 5% annualized in Q1. So very much consistent with a solid labour market persisting at the start of 2024.

Ahead of payrolls, today’s JOLTS report for February will give other important labour market colour. Powell has often referenced the job openings to unemployed ratio when assessing labour market normalisation, while our rates strategists have highlighted the quits rate, which has now declined to near its historical average, as arguably the most reliable indicator for real wage growth. We’ll also pay extra attention to the services ISM tomorrow, including its employment and prices paid components.

Last but by no means least, central bank speakers will be in focus, most of all with Fed Chair Powell speaking tomorrow. With a speech dedicated to the economic outlook, we might expect a carefully worded message. We will also hear from a host of other Fed speakers, including trios of regional Fed presidents speaking on both Tuesday (New York Fed President Williams, Cleveland's Mester and San Francisco's Daly) and Thursday (Chicago's Goolsbee, Philadelphia's Harker and Richmond's Barkin). Over in Europe, we have the ECB’s de Cos speaking on Wednesday and the accounts of the March ECB meeting being published on Thursday.