After a soft 3Y and a stellar 10Y auction, moments ago the Treasury concluded its weekly issuance of coupon paper with a 30Y auction that came in smack in the middle.

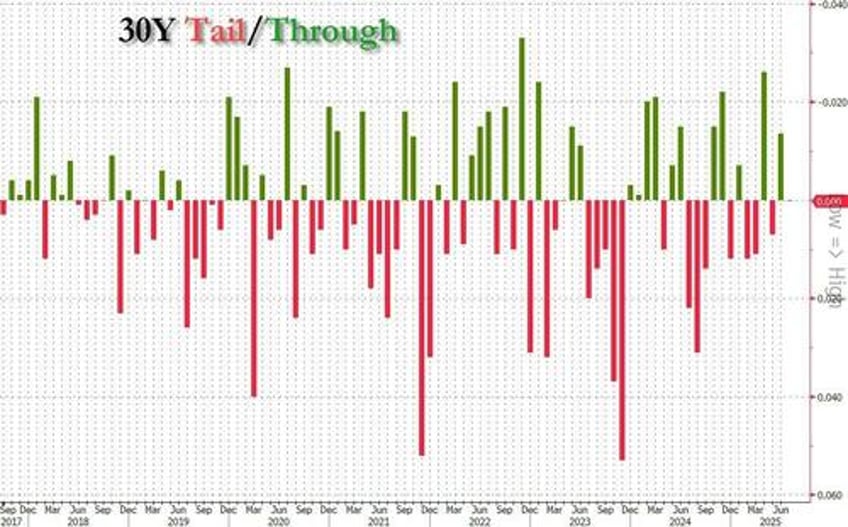

The auction, a reopening of 29Year-10Month cusip UK2, priced at a high yield of 4.889%, up modestly from 8.44% in June and the highest long-end auction since January's 4.913%, which was a record for the tenor (for now). It also stopped through the When Issued 4.890% by 0.1basis point, the second consecutive stop though.

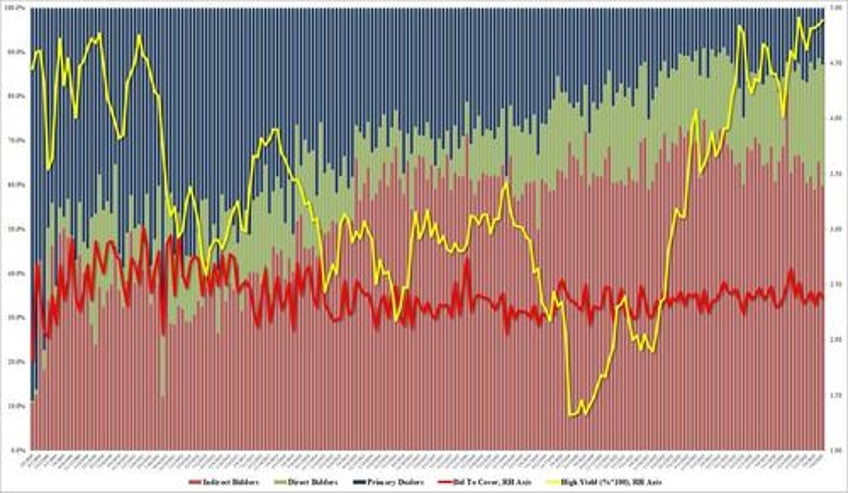

The bid to cover was 2.383, down from 2.430 in June but in the recent range; indeed it priced just below the six-auction average of 2.399.

The internals were also average, with Indirects awarded 59.8%, down from 65.2% in June, and below the recent average of 63.0%. And with Dealers taking just 12.8%, the recent trend of near record Directs continued, as they took down 27.4% today, the highest since October 2011, and the third highest on record.

Overall, this was a mediocre, forgettable auction, with yields on the verge of hitting record highs...

... yet one which certainly took advantage of today's bid across the curve despite yet another markewide meltup.