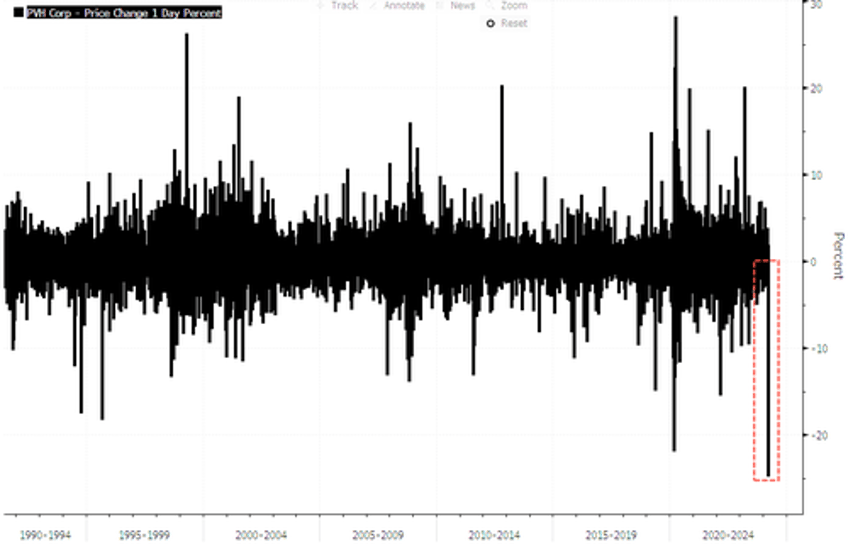

PVH Corp., the owner of Tommy Hilfiger and Calvin Klein brands, is poised for one the largest intraday drops ever if premarket losses hold following the release of full-year sales guidance that missed Wall Street's expectations on Monday evening.

PVH's revenue was flat in the fourth quarter due to its souring performance in North America, and it warned about a decline in first-quarter sales. The company noted the "challenging macroeconomic environment in Europe, particularly impacting the wholesale business" as one reason for the sales slowdown.

PVH expects first-quarter revenue to plunge 11% to $1.92 billion, missing Wall Street estimates. FactSet estimates had analysts around $2.09 billion. The company forecasted revenue declines of 6% to 7% to as much as $8.57 billion, while analysts anticipated $9.04 billion.

Here's a snapshot of the fourth quarter results (courtesy of Bloomberg):

Adjusted EPS $3.72 vs. $2.38 y/y, estimate $3.52 (Bloomberg Consensus)

Revenue $2.49 billion vs. $2.49 billion y/y, estimate $2.42 billion

Calvin Klein total revenue $1.06 billion, +4.3% y/y, estimate $1.04 billion

Calvin Klein North America revenue $360.0 million, -7.8% y/y, estimate $387.3 million

Calvin Klein international revenue $704.4 million, +12% y/y, estimate $640.9 million

Tommy Hilfiger total revenue $1.35 billion, +0.8% y/y, estimate $1.34 billion

Tommy Hilfiger North America revenue $400.6 million, +4.5% y/y, estimate $398.7 million

Tommy Hilfiger international revenue $950.6 million, -0.7% y/y, estimate $925 million

Gross margin 60.3% vs. 56.8% y/y, estimate 59.8%

Inventory -21.2%, estimate -20%

First quarter forecast:

- Sees revenue -11%

And 2025 year forecast:

- Sees revenue -6% to -7%

In a press release, Stefan Larsson, CEO, commented that "macro has become more challenged" and that "our focus is on quality of sales to further strengthen our market-leading position."

Zac Coughlin, CFO, also blamed a "tougher macroeconomic backdrop" on the sales slowdown.

PVH shares crashed as much as 24% in premarket trading in New York on the dismal earnings news and sour forecasts. If losses hold into the cash session, this would represent the largest intra-day losses ever for the company.

Here's what Wall Street analysts are saying about the earnings (courtesy of Bloomberg):

TD Cowen, John Kernan (buy)

Sales guidance for the year is "well below" Kernan's current model and the more muted buy-side expectations for a decline in the low single digits

Notes growth in North America and Asia-Pacific regions will be offset by a sizable decline in Europe

"Assuming Europe Wholesale is $2.6B of a $4.4B Europe base, the guidance could imply Europe wholesale down high-teens to 20% in FY24"

JPMorgan, Matthew Boss (overweight)

While PVH beat expectations in 4Q, the full-year guidance was "set below consensus"

Flags commentary on declining growth in Europe, which Boss notes is primarily wholesale driven; also notes full-year outlook contemplates softer direct-to-consumer growth in the region

PT cut to $146 from $165

BMO Capital Markets, Simeon Siegel (market perform)

The top- and bottom-line beat in 4Q was "impressive," though 1Q and full-year guidance were below consensus expectations

Revenue came ahead, with the international business leading the beat, driven by Asia-Pacific; however, macro continued to weigh on Europe

Evercore ISI, Michael Binetti (outperform)

Margin outlook for 2024 is significantly disappointing, though Binetti believes PVH is planning for positive growth in North America direct-to-consumer and wholesale

"PVH significantly backtracked on several of the inputs it gave just 90 days ago for 2024—largely due to worsening trends in Europe"

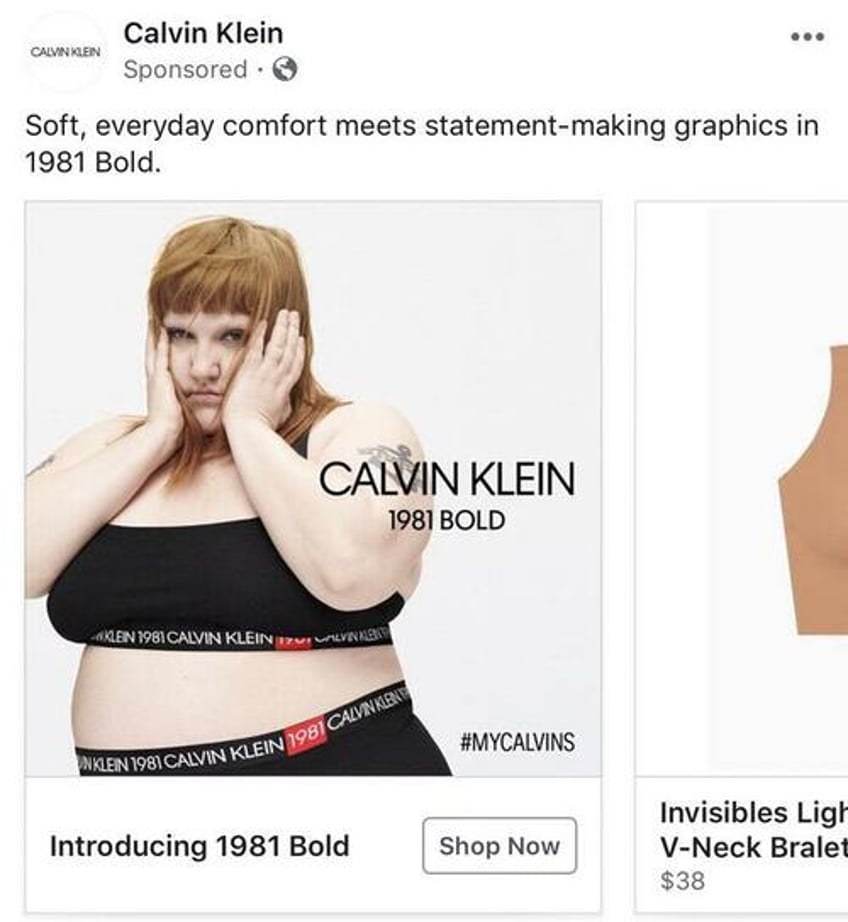

Go woke, go broke?

Maybe...

Blame it on the 'macro,' of course.

Calvin Klein wants you to know that this is the new normal: Obese, complacent and androgynous. pic.twitter.com/FyFG6xZzAW

— 𝐆𝐫𝐞𝐠 🏳️🌈 (@HarmfulOpinion) September 27, 2022

Sigh...