By Martin Lynge Rasmussen of Money: Inside and Out

China has been preparing for further tension in the US-China relationship since Trump's first term, including by increasing the resilience of the Chinese financial system to external shocks. One key part of such plans is likely to reduce the importance of the US dollar for Chinese economic activity and increase the international usage of the RMB. We consider here (some) data relevant to tracking China’s FX diversification. Two trends emerge.

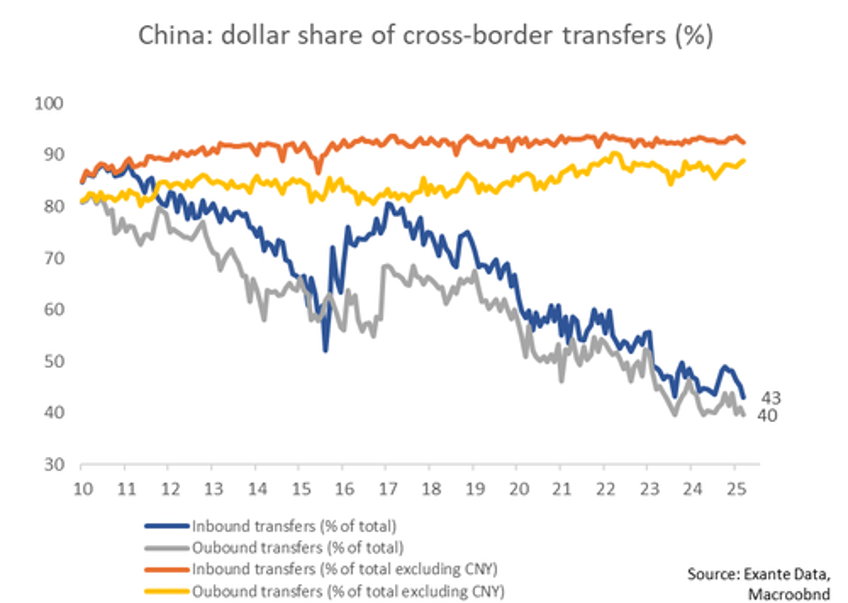

Firstly, China has managed to reduce its reliance on the dollar by increasing the role of the renminbi. The dollar’s share of Chinese cross-border transfers has declined structurally in the last 15 years, from 80-85% in 2010 to 40-45% now, and the vast majority of the decline has been driven by higher renminbi flows. Relatedly, the CNH's share of global trade financing has increased from around 2% in 2021 to over 7% now (and picked up further since November), and has come at the expense of the dollar's market share. One explanation for the increasing linkage between renminbi cross-border transfers and its global market share is that the RMB is increasingly being used for 'real' economic transactions with foreigners rather than simply for cross-border transfers between Chinese entities.

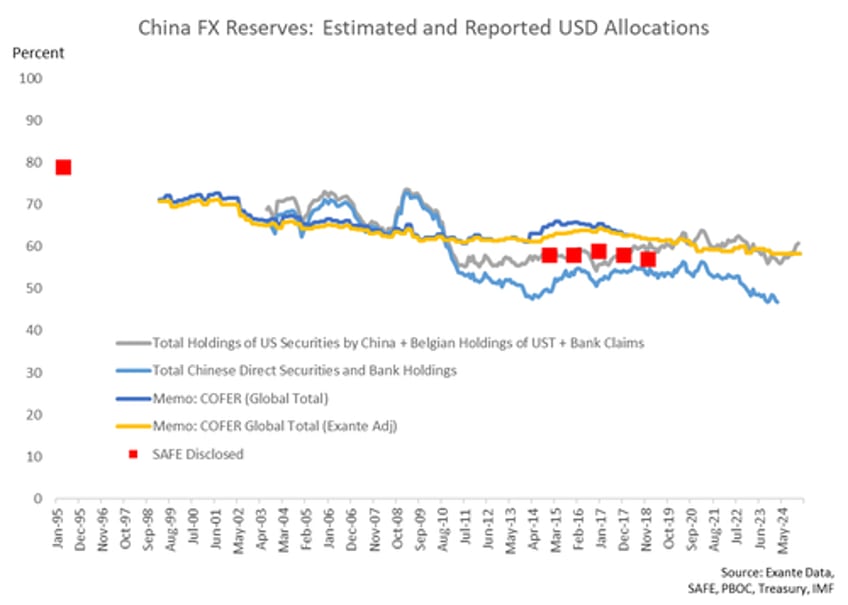

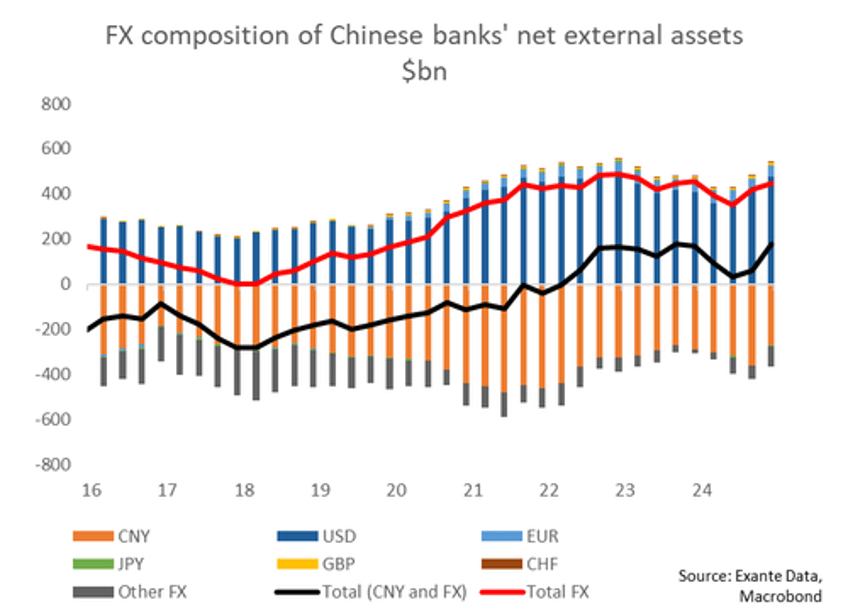

Secondly, against this, FX diversification has not made much progress. The dollar share of China's FX reserves, for example, seems to have remained constant in recent years. Relatedly, banks' external dollar net assets have been broadly stable in recent years and stood at $476bn in Q4-2024 (though gross assets and gross liabilities have fallen). But as China’s GDP has increased, dollar exposure-to-GDP ratios have declined. Non-USD FX net assets (e.g. those denominated in EUR) have remained minor and haven't increased meaningfully. And onshore FX trading remains extremely dominated by USDCNY, with very little trading in other pairs.

FX denomination of Chinese flows: structural decline but little sign of sharp drop recently (outside of trade finance)

The share of Chinese cross-border transfers that are denominated in dollars has declined from around 80-85% in the early 2010s to around 40-45% now. But the entirety of the decline in the dollar share is due to the rising role of cross-border renminbi flows. If we exclude CNY and only look at cross-border FX flows, the dollar's share of Chinese cross-border transfers has remained extremely high. As such, beyond the renminbi, other currencies have not become more dominant in Chinese cross-border flows.

This data is published by SAFE each month and measures cross-border bank transfers in both renminbi and FX.

From China's point of view, FX diversification matters as being cut off from the global dollar system, even if a tail risk, would reduce China's ability to carry out transactions related to international trade and investment. A question therefore is the extent to which the rise of renminbi in cross-border flows has led to an increase in China's ability to carry out trade with non-Chinese entities denominated in renminbi, or whether the flows simply reflect e.g. flows between mainland Chinese companies and their offshore subsidiaries (and other activities that wouldn't help China carry out international trade absent access to dollars).

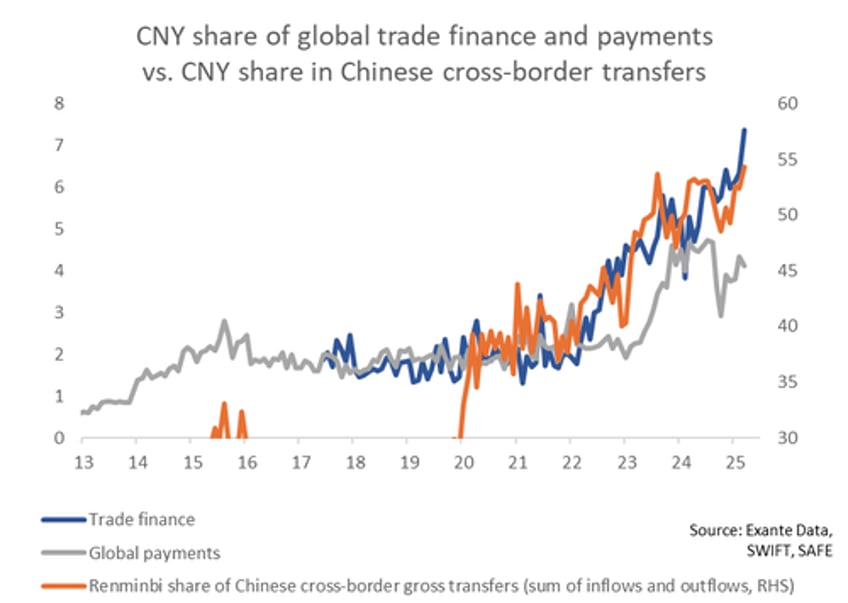

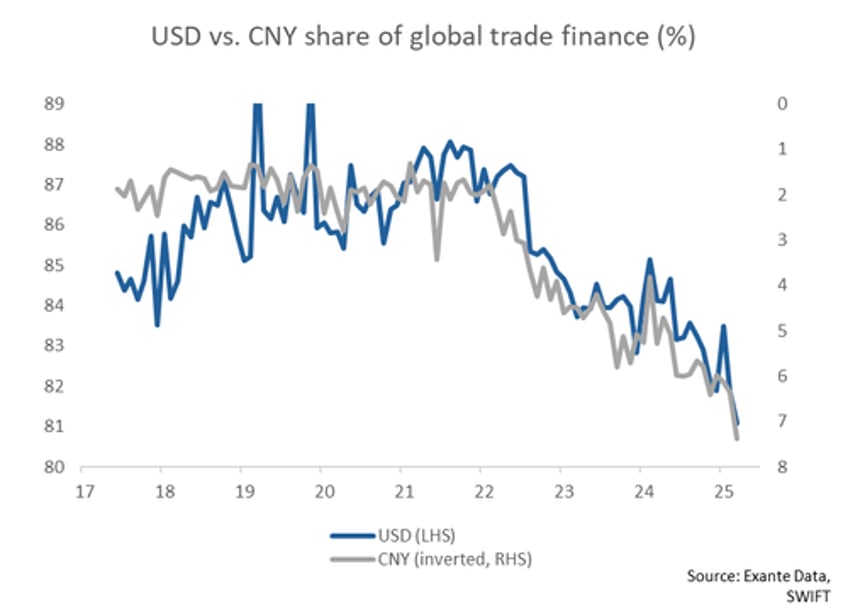

Data from SWIFT suggests that usage of the renminbi has surged in recent years, though it remains very low relative to dollar usage. The CNY's share of global trade finance transactions has increased from 1.9% during 2018-2021 to 6.4% in November last year and 7.4% in March. We would think the freezing of Russian reserves has led to a sharp increase in the usage of renminbi in Russia-China trade, though other EMs might also have begun to dip their toes in CNY-denominated trade, too. Renminbi usage in payments has also doubled since 2022. At the same time, the dollar's share in international trade financing has declined from around 86% during 2018-2021 to around 81% now, a decline similar to the increase seen by the renminbi.

Since 2020, the rising share of renminbi in global trade finance and payments has trended together with the share of renminbi in Chinese cross-border transfers. This could suggest that cross-border renminbi transfers were, to some extent, driven by cross-border transfers between Chinese entities rather than with non-Chinese entities before 2020. If true, this would mean that the rise in cross-border renminbi transfers since 2020 has been due to "real" activities rather than 'financial engineering'.

The share of global trade finance denominated in dollars vs. renminbi has been closely inversely related since at least 2022. This also supports the idea that the renminbi's global usage has risen, and that it has come at the cost of the dollar.

When it comes to onshore FX trading, the dollar is as dominant as ever across different FX instruments as well as on the whole. This mirrors the total ex-CNY cross-border transfers, where the dollar also remains dominant.

Hedging behavior: gradual increase in hedges continues

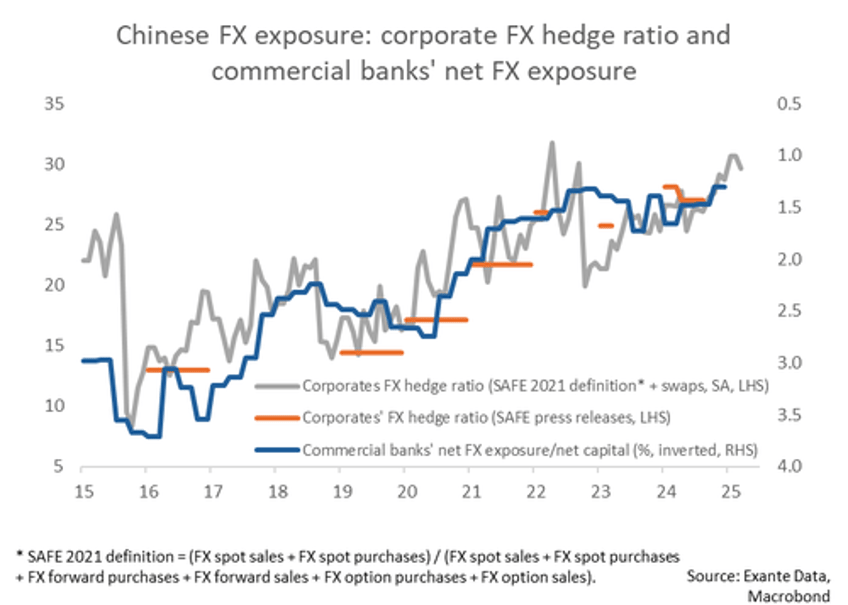

Another way FX exposure changes is through changes to FX hedging ratios, which measure the extent to which FX assets are protected against moves in foreign exchange rates.

SAFE defines Chinese corporate FX hedging in terms of FX transactions, rather than via the share of FX net assets that are hedged. This ratio has increased from a bottom of <10% in 2015 to nearly 30% in 2025.

Banks' net FX exposure (as a percent of net assets) has declined from a high of around 3.5% in 2015 to below 1.5% by Q4 last year.

The two series are different from regular "FX hedge ratios" yet might still tell us something about "true" hedge ratios, given how closely they correlate over time.

FX exposure of Chinese entities: stable net dollar assets amid a decline in both assets and liabilities

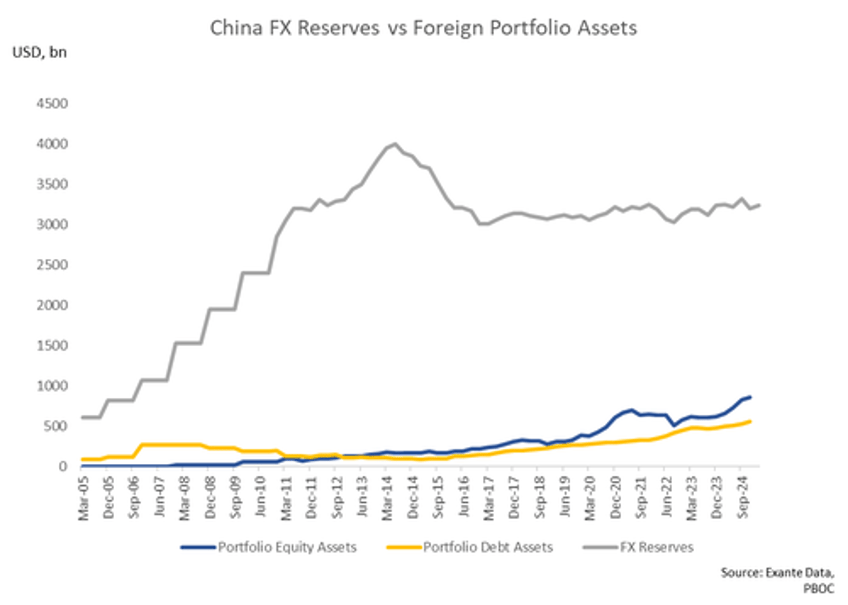

Most Chinese foreign assets (including non-dollar assets) are held by the PBOC, though holdings by other entities have increased in the past decade.

The share of Chinese FX assets that are held in dollars has not materially declined in recent years, however.

As we have little insight into the composition of official FX holdings, we dig into banks' external assets and liabilities, for which we have better data. This data is compiled by SAFE on a BoP basis, and therefore measures Chinese banks' assets and liabilities against non-residents across both CNY and FX. We can see that, like for flows related to trade, it is a question of dollars vs. renminbi and that holdings of non-USD FX remain small.

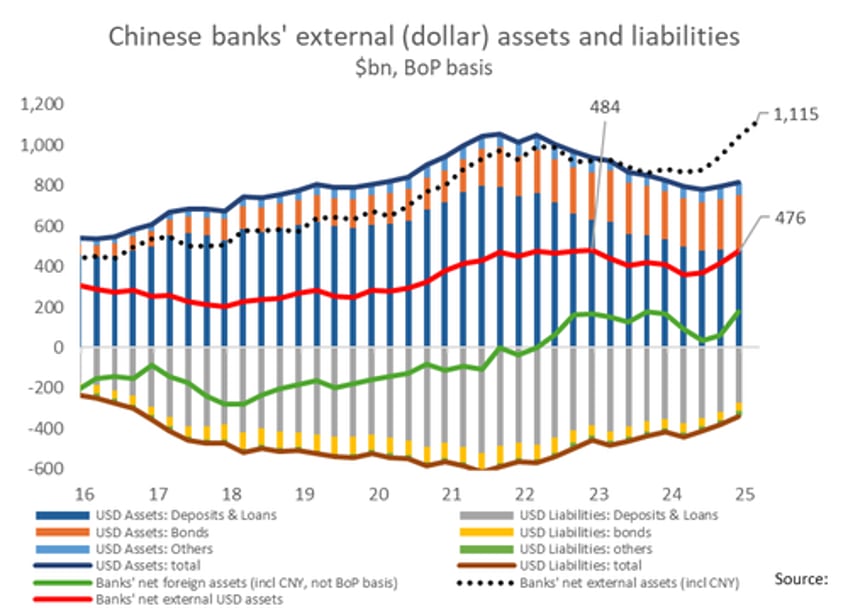

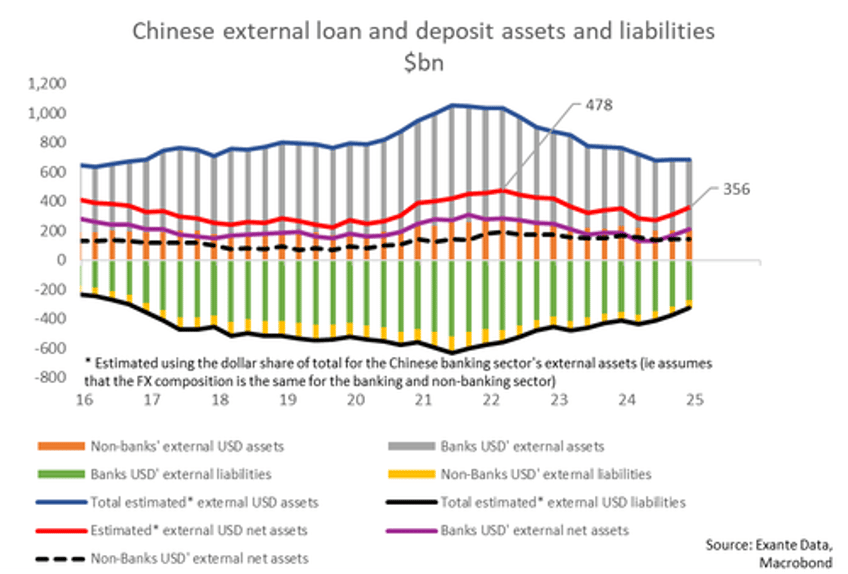

Chinese banks' net dollar assets now stand at $476bn according to the BoP-basis data published by SAFE. This is much below the $1,115bn implied by the PBOC's data on net foreign assets of "other depositary institutions" (i.e., banks). Though there are likely differences in the statistical caliber of this data, we are surprised that this divergence hasn't gotten attention; we are not sure what is behind the large difference and will investigate the topic further. One explanation could be that the $1,11bn includes net FX assets held onshore, whereas the $476bn only includes assets and liabilities vs. non-residents. While it is technically true that Chinese banks' external net dollar assets have been broadly stable, it has occurred amid a $200bn decline in banks' external dollar assets and $224bn decline in their external dollar liabilities since Q4-2021 (i.e. before Russia invaded Ukraine).

There are many actors beyond banks in China, of course. To get a better sense of dollar holdings beyond banks, we do a rough estimate of bank vs. non-bank holdings of dollar-denominated loans and deposits, as well as bonds. More specifically, we apply banks' dollar share of external assets and apply this to the given IIP category (and our estimate therefore assumes that banks and non-banks' dollar allocations are similar across loans, deposits, and bonds).

Loans and deposits: Chinese external dollar net loans and deposit assets stood at $356bn in Q4-2024, down from $478bn in Q1-2022. Our assumptions furthermore imply that banks' and non-banks' external USD loans and deposit assets are of rather similar size. One explanation for the large size of non-bank dollar net assets could be that they have a substantial amount of dollar deposits with banks outside of China.

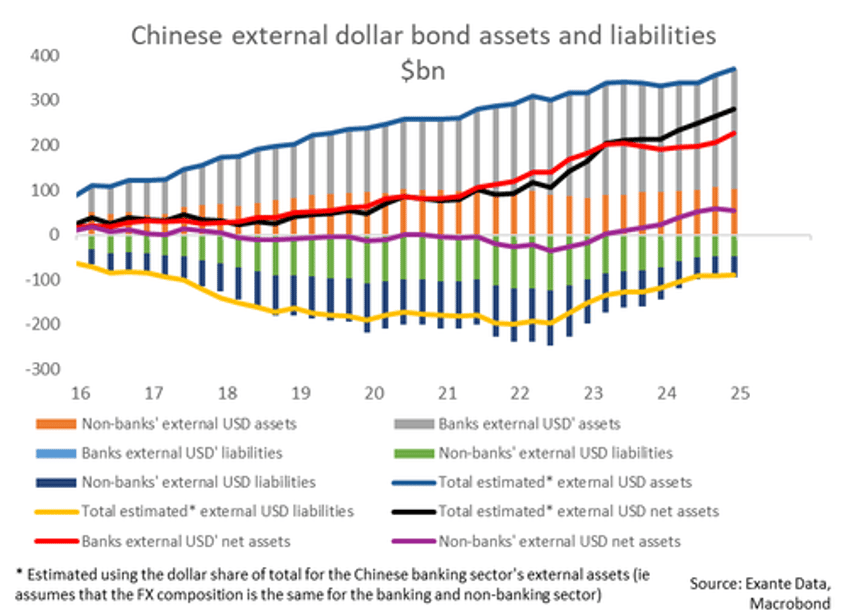

Bonds: the vast majority of external dollar net assets are held by banks, however, and non-banks' net assets only turned positive during 2023.