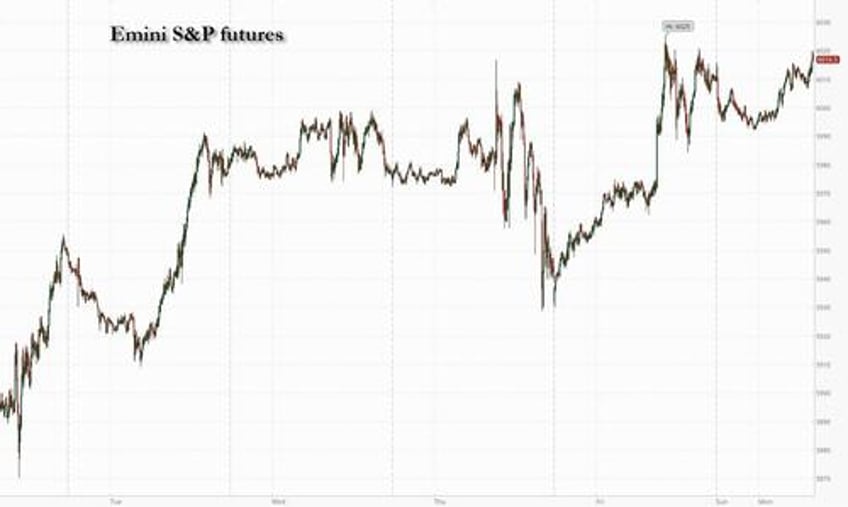

US equity futures reverse earlier losses and trade near session highs, with small cap/Russell outperformance pointing to a further potential squeeze in high-beta names as investors monitor talks between the US and China in London to defuse tensions over rare-earth minerals and advanced technology. As of 8:00AM, S&P futures rose 0.2% after the main gauge broke through the 6,000 level for the first time since February at the end of last week. Nasdaq 100 futs gained 0.1%, with Mag7 names mixed premarket, Semis are higher, and cyclicals poised to outperform Defensives. Chinese shares trading in Hong Kong entered a bull market. European stocks barely budged, while a gauge for emerging-market equities was set for its highest close in more than three years. Bond yields are lower, and USD is weaker as commodities are led by Energy and precious metals; silver continues to close the gap to gold, although today it is platinum and palladium's turn to shine. Today’s focus is the US/China trade mtg in London: overnight, HK and HSTECH performed well into the summit. Macro data prints include NY Fed’s 1-year inflation expectations (3.63% prior print) which could affect the yield curve as the Fed is in its blackout window.

In premarket trading, Mag 7 were mostly higher with the exception of Tesla which isdown 2.3% after Baird downgraded the stock to neutral, noting that the recent share price rally followed a fundamentally poor quarter for the EV maker. Other names traded flat to up: Nvidia +0.4%, Apple +0.6%, Alphabet +0.6%, Amazon +0.4%, Meta Platforms +0.04%, Microsoft -0.1%. Warner Bros Discovery (WBD) rose 4% after saying it will separate the company into two publicly traded businesses, splitting its streaming and studios business and its TV networks operations by the middle of next year. Here are some other notable premarket movers:

- Air mobility stocks are set to extend gains after President Donald Trump signed an executive action establishing an electric “Vertical Takeoff and Landing” integration pilot program, according to a White House fact sheet.

- Archer Aviation (ACHR) +9%, Joby Aviation (JOBY) +9%, Vertical Aerospace (EVTL) +7%

- EchoStar (SATS) falls 9% after the Wall Street Journal reported the company is weighing a potential chapter 11 bankruptcy filing amid a Federal Communications Commission review of certain of its wireless and satellite spectrum rights, citing people familiar with the matter.

- Etoro Group (ETOR) rises 3.3% after Mizuho, Jefferies and Citizens initiate the investment platform with a buy-equivalent rating, citing a growing retail-investor client base and potential for further growth in Europe and the US.

- Grab Holdings Ltd. (GRAB) inches 1% lower after the company said it isn’t in talks to acquire Southeast Asia internet peer GoTo Group “at this time,” signaling it’s halting or at least pausing a planned $7 billion acquisition of its Southeast Asia internet peer.

- Opendoor Technologies (OPEN) drops 13% after the company announced plans to seek holder permission for a reverse stock split between 1-for-10 and 1-for-50 at its special meeting on July 28.

- Robinhood (HOOD) falls 4% and AppLovin (APP) is down 4% after S&P Dow Jones Indices left the S&P 500 unchanged in its latest round of quarterly rebalancing on Friday.

- Sunnova Energy International Inc. (NOVA), one of the largest US rooftop solar companies, falls 33% after filing for bankruptcy in Texas following struggles with mounting debt and diminishing sales prospects.

As if the past two months never happened, the S&P is nearing all-time highs after shaking off the volatility that followed President Donald Trump’s sweeping tariff announcements in early April. Still, traders are searching for catalysts for sustained advances, as the full economic impact of the trade war has yet to fully manifest and key trade-related questions remain unresolved.

“We will break to new highs eventually,” Keith Lerner, co-chief investment officer at Truist Advisory Services, told Bloomberg TV. “The market is dealing with uncertainty around tariffs, it matters but it’s not the only thing that matters. Technology is back at the forefront.”

At a time when global investors are pushing back against long-term government debt, a $22 billion auction of 30-year bonds on Thursday is bound to be one of Wall Street’s most anticipated events this week. Traders will also focus on Wednesday’s US inflation report for May. Consumers probably saw a slightly faster pace of price increases as companies gradually pass along higher import duties, according to a Bloomberg survey of economists.

“In May, when the 30-year went above 5%, we have seen buyers buying the dip,” Vasiliki Pachatouridi, head of BlackRock’s iShares fixed-income product strategy for EMEA, told Bloomberg TV. “We are underweight the long end of the curve, but there are people out there that still see value in US Treasuries at the right price.”

In Europe, the Stoxx 600 is little changed as stocks tread water with gains in real estate, leisure and travel being offset by losses in technology and banks. The DAX falls 0.5% as SAP shares provide a notable drag on the index. Among individual movers, Alphawave advances after Qualcomm agreed to buy the semiconductor company for about $2.4 billion in cash. Markets in Denmark, Switzerland, Turkey, Hungary and Norway are closed for a holiday. Here are the most notable European movers:

- Alphawave shares gain as much as 23.3% to reach 183.9 pence, after the semiconductor firm said US chipmaker Qualcomm agreed to take over the company for a price equating to 183p per share.

- The Blockchain Group rises as much as 25% after the company launched a €300m capital increase in a deal with asset management firm TOBAM.

- M&G shares rises as much as 2.8% as UBS raises its recommendation to buy from neutral, saying it expects the company to continue to deliver growth within asset management.

- Ageas shares gain as much as 3.2% to the highest since October 2008 after BofA raised its rating on the life insurance firm to buy.

- Carel shares rise as much as 5.5% to the highest since February 2024 after UBS initiated coverage on the HVAC and humidification manufacturercndes with a buy rating.

- European defense stocks are losing ground on Monday, dropping for a second consecutive session, as they fall further from recent record highs.

- Trustpilot Group’s shares fall as much as 8.9%, their biggest drop in two months, after Panmure Liberum resumed coverage with a sell recommendation, noting the consumer-review site faces high execution risk amid a complex multi-year business transition.

- Gaztransport et Technigaz shares drop as much as 9.5% after being given a new underweight rating from Morgan Stanley, while SBM Offshore gains as much as 2.3% after being initiated at overweight.

- Dunelm drops as much as 6.3%, the most in almost three months, as RBC downgrades to sector perform and says the homeware retailer’s qualities now seem reflected in the stock.

In FX, the dollar dropped 0.3%, pushing the currency to fresh two-year lows. New Zealand, Australian dollars led G10 gains; NZD/USD rose 0.8% to 0.6063, AUD/USD rose 0.6% to 0.6532; Australian financial market was closed on holiday. GBP/USD rose 0.3% to 1.3572, EUR/USD rose 0.3% to 1.1426. USD/JPY fell 0.5% to 144.07 before recouping losses to rise back to 144.50.

In rates, treasury yields are slightly lower across the curve, unwinding a small portion of Friday’s steep losses caused by May jobs report, ahead of the sale of 3-, 10- and 30-year Treasuries later this week. US front-end yields are richer by about 2bp, outperforming longer maturities and steepening 5s30s curve by about 1bp; 10-year around 4.49% is about 1bp lower on the day, German counterpart about 2bp lower. Italian government bonds are leading gains in European debt, with Italian 10-year borrowing costs falling 6 bps and further narrowing the spread with Germany to around 92 bps. Treasury auctions include $58 billion 3-year new issue Tuesday and $39 billion 10-year and $22 billion 30-year reopenings Wednesday and Thursday. This week’s focal points include May CPI data on Wednesday and Treasury auction cycle starting Tuesday. Fed officials are in an external communications blackout ahead of the June 18 policy announcement.

In commodities, spot gold rises $8 to around $3,318/oz, while platinum breaks out to multi-year highs. Oil prices are steady with WTI near $64.60 a barrel.

Looking at today's calendar, we have April wholesale inventories (10am) and May NY Fed 1-year inflation expectations (11am). Also ahead this week are May CPI. PPI and the grotesquely laughable University of Michigan sentiment (of democrats).

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.8%

- Stoxx Europe 600 little changed

- DAX -0.5%, CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.48%

- VIX +0.8 points at 17.61

- Bloomberg Dollar Index -0.3% at 1207.96

- euro +0.4% at $1.1437

- WTI crude little changed at $64.64/barrel

Top Overnight News

- The US and China will resume trade talks today in London, with tariffs, rare-earth minerals and advanced technology at the top of the agenda. Each country has accused the other of reneging on a deal made in Geneva in May. BBG

- US President Trump thinks support has solidified for the tax bill over the last 24 hours and will take a look at Elon Musk’s government contracts, while he has no plans to speak to Musk and noted that DOGE helped a lot. Trump stated he is thinking about the next Fed Chair and it is coming out very soon, as well as suggested a good Fed Chair would lower rates.

- Trump warned Elon Musk of serious consequences if he backs Democrats who oppose the Republican tax bill. The president told NBC he’s “very confident” the bill will pass by July 4. BBG

- US Defense Secretary Hegseth said active-duty troops will be mobilised if violence continues in Los Angeles, while President Trump deployed the National Guard to LA immigration ‘riots’ after claiming state officials cannot do their jobs, according to Sky News. Furthermore, reports noted that as many as 500 Marines are “in a prepared-to-deploy status” should they be needed to protect federal property and personnel and US President Trump posted on Truth Social "Looking really bad in L.A. BRING IN THE TROOPS!!!"

- China’s trade numbers for May fall a bit short, including exports +4.8% (vs. the Street +6%) and imports -3.4% (vs. the Street -0.8%), w/exports to the US slumping by the most since the start of COVID. FT

- China's producer deflation deepened to its worst level in almost two years in May while consumer prices extended declines, as the economy grappled with trade tensions and a prolonged housing downturn. PPI (-3.3% vs. the Street -3.2% and vs. -2.7% in Apr) and CPI (-0.1% vs. the Street -0.2% and vs. -0.1% in Apr). RTRS

- Japan is considering buying back some super-long government bonds issued in the past at low interest rates, two sources with direct knowledge of the plan said on Monday, underscoring its focus on reining in any abrupt rise in bond yields. The move would come on top of an expected government plan to trim issuance of super-long bonds -- such as those with 20-, 30- or 40-year maturities -- in the wake of sharp rises in their yields. RTRS

- A US trade team currently in India for trade discussions has extended its stay, a sign talks are progressing ahead of a July deadline. BBG

- Iran will send a counteroffer “in the coming days” via Oman in response to a US proposal on Tehran’s nuclear program, a Foreign Ministry spokesman said. BBG

- Canadian PM Carney is to announce Canada's national defence spending will meet the 2% of GDP NATO goal: Globe & Mail.

- US state and local governments are selling municipal bonds at a record pace on fears that Congress could partially pay for President Trump’s “big beautiful bill” by cutting a tax break for airports, hospitals, and affordable housing projects. FT

- Apple’s WWDC gets underway today, with a focus on new software interfaces for the iPhone, iPad, Mac, Apple TV and Watch. But only minor AI changes are expected, offering little to investors worried it’s lagging behind in that space. BBG

- Citi expects the Fed to deliver 75bps of rate cuts this year, 25bps in September, October and December, comes after Friday's NFP data; expects Fed to deliver 50bps in 2026, via 25bps in Jan and March.

- Fed’s Musalem (voter) said he sees a 50-50 chance that Trump tariffs could either boost inflation for a quarter or two, or cause sustained inflation, according to an FT interview. Musalem said this means the Fed will likely face uncertainty right through the summer and political interference could make it harder for the Fed to lower interest rates.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher following last Friday's gains on Wall St, but with trade somewhat quietened amid the holiday closure in Australia and as participants digested mixed Chinese data. Nikkei 225 reclaimed the 38,000 level after last week's currency weakness and with upward revisions to Japanese GDP data. Hang Seng and Shanghai Comp gained amid some trade-related optimism with officials from the US and China set to meet in London today, although the gains in the mainland are capped as participants also digested key data releases which showed a continued deflation and mostly softer trade data.

Top Asian News

- BoJ Deputy Governor Uchida said central banks are shrinking their balance sheet but many of them are unlikely to return to conventional monetary adjustment methods, while he added that many central banks are likely to use interest payment on reserves to guide short-term interest rates while maintaining the balance sheet size that meets market demand.

- China sold 1.96mln passenger cars in May, +13.9% Y/Y, according to China's auto industry body CPCA.

- China to raise minimum wage standard and expand coverage of social insurance, via Xinhua.

European bourses (STOXX600 -0.1%) are broadly modestly lower across the board and with price action fairly muted, given parts of Europe are off today on account of Whit Monday. European sectors mixed and with the breadth of the market exceptionally narrow, given the holiday-thinned conditions for some parts of Europe. Real Estate leads given the relatively lower yield environment in Europe; Travel & Leisure follows closely behind.

Top European News

- NATO Secretary General Rutte will reportedly call for a 400% increase in air and missile defence in his London speech.

- UK Chancellor Reeves is to announce a transformative GBP 86bln in the Spending Review to turbo-charge the fastest growing sectors, from tech and life sciences to advanced manufacturing and defence, as part of the government’s plan to invest in Britain’s renewal through the Modern Industrial Strategy.

- BoE’s Greene said the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term, while she noted their view is they can look through it but added there is a pretty big risk.

- ECB's Kazimir says he thinks the bank is nearly done with, if not already at the end of the easing cycle; sees clear downside risks to growth but would be a mistake to ignore upside inflation risks. Need to keep all options open. Data over the summer will indicate whether additional fine-tuning is required.

- ECB President Lagarde reiterated that the central bank is in a good position on rates and to deal with uncertainties ahead.

- ECB’s Escriva said the path of monetary policy easing in the eurozone could require further adjustments if the current macroeconomic and inflation outlooks are confirmed, while he added the central scenario of GDP growth around 1% and inflation of 2% could require some fine-tuning, according to Reuters.

- ECB’s Nagel said the ECB can take its time on interest rates with monetary policy now set at a neutral level that is no longer restrictive and that the central bank has maximum flexibility on rates.

- ECB’s Schnabel said do not expect a sustained decoupling between the ECB and the Fed, while she expects the trade conflict to play out as a global shock that’s working through both lower demand and supply.

- ECB’s Vujcic said a small deviation on either side of the 2% inflation target is not a problem and the central bank should not overreact to inflation edging below the target, while he added the bar for QE will be higher in light of past experience.

- EU was urged to exempt more companies from supply chain law although rules on curbing environmental and rights abuses should not be scrapped, according to Swedish conservative MEP Warborn cited by FT.

- Fitch cut Austria’s sovereign rating from AA+ to AA; Outlook Stable, while it affirmed Hungary at BBB: Outlook Stable, while S&P raised Slovenia’s rating from AA- to AA; Outlook Stable.

FX

- DXY has kicked the week off on the backfoot after being boosted on Friday post-NFP. Focus at the start of the week has been on the trade front ahead of an anticipated meeting between US-China officials in London to discuss the trade situation; note, Chinese Foreign Ministry spokesman avoided a question on the matter at a briefing today. Elsewhere, whilst the Fed is in its blackout period, US President Trump has teased over a potential imminent decision on who will replace Fed Chair Powell when his term expires next year. DXY has delved as low as 98.81 but is holding above Friday's trough at 98.65.

- EUR/USD has moved back onto a 1.14 handle following last Friday's NFP-induced selling. Fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. EUR/USD has ventured as high as 1.1429 but is yet to approach Friday's 1.1457 peak.

- JPY is firmer vs. the USD and towards the top of the G10 leaderboard after suffering in the wake of last Friday's US jobs report. Newsflow out of Japan has been on the light side aside from an upwards revision to Q1 GDP and Japanese Economy Minister Akazawa continuing to urge the US again to reconsider tariff measures, whilst suggesting that further progress has been made in trade talks with the US. USD/JPY has crossed back below its 50DMA at 144.43 and is currently holding above the 144 mark.

- As is the case across G10 FX, GBP is firmer vs. the USD in a reversal of the price action seen post-NFP on Friday. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. Cable remains on a 1.35 handle but sub-Friday's 1.3585 peak.

- Antipodeans are both firmer vs. the USD and towards the top of the G10 leaderboard. Newsflow for Australia and New Zealand has been light over the weekend, with the former away from market. Of note for both however, was the latest round of Chinese trade which saw both imports and exports fall short of expectations on account of the trade war.

Fixed Income

- US paper is attempting to atone for Friday's losses which were brought about by the firmer-than-expected US jobs report, which avoided the soft outcome that some in the market had been positioning for. Quiet schedule today, but focus will be on the US-China meeting in London today; time still not disclosed. Sep'25 UST contract has been as high as 110.05+ but is some way off Friday's peak at 110.29+.

- Bunds have very much started the week off on the front foot and are leading global fixed income markets higher. From a fundamental perspective, fresh macro drivers for the Eurozone are lacking following the hawkish reaction to last week's ECB policy announcement. We have seen further commentary from Bank officials over the weekend with Nagel noting that the central bank has maximum flexibility on rates, whilst Schnabel stated we should not expect a sustained decoupling between the ECB and the Fed. Sep'25 Bunds have eclipsed Friday's best at 130.77 with focus on a test of 131.00.

- Gilts are higher, being dragged up by the moves in German paper with fresh UK drivers lacking. Over the weekend, BoE's Greene remarked that the disinflation process is ongoing and expects inflation to continue to come down to the target over the medium-term. UK docket today is light, more focus on Wednesday's UK spending review. Sep'25 Gilts have moved back onto a 92 handle but thus far are respecting Friday's peak at 92.36.

- Japanese government is considering buying back some super-long JGBs issued in the past, according to Reuters sources.

Commodities

- Crude benchmarks are flat, with price action fairly muted in catalyst thin trade thus far. Some modest upticks on commentary out of Iran, which noted that Tehran will be proposing a counter offer to the US nuclear proposal by tomorrow (Tuesday). WTI and Brent reside within tight USD 64.20-64.86 and 66.07-66.69/bbl ranges respectively, and currently rest within the middle of these bounds.

- Spot gold is firmer, and benefitting from the softer dollar (DXY -0.3%), and subdued risk environment. The yellow-metal saw fleeting support on the aforementioned news from Iran, which pushed the metal towards session highs of USD 3,328/oz, before it faced resistance at this level.

- Copper is on the front foot, shrugging off mixed Chinese data, which showed Y/Y CPI remaining in deflationary territory. Elsewhere, LME data showed copper stocks fell 10k. The industrial metal was choppy on this update, though ultimately rose after ten minutes. 3M LME copper trades within a range of USD 9,670.75-9,738.1/t.

- Venezuela is planning to increase gasoline prices by 50% as it braces for a decline in oil revenue following the suspension of operations by Chevron (CVX) and other foreign energy firms, according to Bloomberg citing people familiar with the decision.

Geopolitics: Middle East

- Iran will reportedly propose a counter offer to the US nuclear proposal soon, according to state TV; will be sent by tomorrow.

- Israel’s military said it struck a Hamas member in southern Syria.

- US-based Gaza Humanitarian Foundation said it did not distribute aid on Saturday because Hamas made direct threats against its operations, while a Hamas official said he had no knowledge of alleged threats to the US-backed aid group in Gaza. Furthermore, Al Jazeera reported that Israeli attacks killed more than 40 in Gaza as aid seekers were shot dead.

- Israeli Defence Minister Katz threatened to “take all necessary measures” to prevent a humanitarian ship carrying climate campaigner Greta Thunberg from reaching Gaza, according to The Guardian. It was later reported that the Freedom Flotilla Coalition said it ship was 'under assault' and the Israeli Army had boarded the Gaza-bound ship.

Geopolitics: Ukraine

- Russian forces captured Zoria in Ukraine’s Donetsk region and reached the Dnipropetrovsk region in Ukraine, according to TASS and Interfax. However, it was later reported that Ukrainian General Staff spokesman Kovalev denied claims by the Russian Defence Ministry that its forces advanced into Ukraine’s eastern Dnipropetrovsk region for the first time since it launched its full-scale invasion.

- Head of the Russian delegation at talks with Ukraine in Istanbul said Russia handed over to Ukraine the first list of 640 POWs for exchange, according to TASS. Furthermore, the Russian Defence Ministry said Russia launched a large-scale humanitarian operation to repatriate more than 6,000 bodies of deceased Ukrainian military personnel and exchange prisoners of war, while Ukrainian officials rejected Russian claims that Ukraine was delaying the exchange of soldiers’ bodies.

- Ukrainian drone attack sparked a short-lived fire at the Azot chemical plant in Russia’s Tula region, although there was no threat to air quality near the plant, according to the regional governor.

- US believes Russian retaliation for Ukraine’s drone attack is not over yet and it expects a multi-pronged strike.

- Poland scrambled aircraft to ensure airspace security after Russia launches strikes on Ukraine.

Geopolitics: Other

- US expressed concern to the UK government about allowing China to build a large embassy in London that security officials believe would pose a risk to sensitive communications infrastructure serving the City, according to FT. It was also reported that the UK government promised to assess any security concerns related to the construction of a Chinese embassy near the City of London, which is an issue that could potentially complicate trade talks with the US, according to Bloomberg.

- Thai army said provocations by Cambodia and buildup of military forces show a clear intent to use force, and the Thai army is to control the opening and closing of all border checkpoints along the Thailand-Cambodia border, while it added that Cambodia enforced its military presence, equipment and constructed fortifications.

US Event Calendar

- 10:00 am: Apr F Wholesale Inventories MoM, est. 0%, prior 0%

DB's Jim Reid concludes the overnight wrap

This morning we've just published our latest annual default study, a document I first published in 1999. Over the years, it has evolved into a framework for presenting our structural, multi-year view on the default outlook. For over a decade until 2022, that structural view held that—aside from cyclical spikes—we were living in an ultra-low default environment. This was driven by factors such as low nominal and real yields, aggressive monetary intervention (e.g., QE), and a persistent global savings glut.

However, our 2022 edition marked a turning point. We argued that the ultra-low default world was ending, as inflation and term premia were pushing nominal and real yields structurally higher. While we haven’t yet seen a cyclical spike in defaults—largely due to the avoidance of a US recession—there are clear signs that higher-for-longer funding costs, especially in the U.S., are taking a toll. Leveraged loan issuer-weighted default rates are not far off COVID-era levels, and issuer-weighted defaults in the B and CCC rating buckets are now running above their post-2004 averages, even after two years of solid economic growth. In short, regardless of the cyclical backdrop, we believe the ultra-low default era that characterised much of this study’s first 25 years is now behind us.

After leading this report since its inception, I’ve handed the reins to Steve Caprio and his team, who have compiled this year’s edition. While the authorship has changed, the structural conclusions remain consistent. Marrying these with a cyclical view, Steve’s team projects that US spec-grade default rates should decline modestly from 4.7% today to 4.4% by year-end 2025, before rising again to an above consensus 4.8% by Q2 2026—with potential upside risk toward 5–5.5%. While Europe’s outlook is more benign, the region will not be immune to the structural shift underway. See the full report here including all the usual charts and tables showing how credit spreads compare to that required to compensate for default risk.

The highlight this week will be US CPI on Wednesday and a resumption of trade talks between the US and China today in London. Bessent, Lutnick and Greer are set to meet Chinese representatives at the meeting today. So it's all the big guns from the US administration. The monthly 30-yr UST auction on Thursday will also be a heavy focus with all the attention on the long-end in recent weeks. There's a 10yr auction the day before as well. So a good test of demand as the fiscal bill meanders its way through Congress. Before we preview the CPI release the other main highlights this week are the NY Fed 1-yr inflation expectations today; US NFIB small business optimism, UK employment data and Danish and Norwegian CPI tomorrow; that CPI, the 10yr UST auction and the UK Spending Review on Wednesday; US PPI, US jobless claims, UK monthly GDP, the 30yr UST auction and my birthday on Thursday; and the UoM consumer sentiment (including inflation expectations) on Friday. A fuller day-by-day diary of events is at the end as usual.

With regards to US CPI, our US economists expect weak seasonally adjusted gas prices to again keep the headline rate (+0.20% forecast vs. +0.22% previous) gain below that of core (+0.31% vs. +0.24%). This should help the YoY rate for both headline and core to rise two-tenths to 2.5% and 3.0%, respectively. Shorter-term trends for core would be mixed with the three-month annualised rate rising by three-tenths to 2.4% while the six-month rate would remain steady at 3.0%. Our economists do expect tariffs to begin to impact core goods prices, especially in categories like household furnishings and supplies where we saw potential preliminary tariff impacts in the April data. On the services side, our economists will be most attuned to the volatile categories like lodging away and airline fares that have been a meaningful drag of late. For PPI the following day, our economists expect a +0.27% increase in May which would reduce the YoY rate by a couple of tenths. As ever, how the subcomponents that feed into core PCE come out will be the most interesting part of the release. Note that the Fed are now on media blackout ahead of next Wednesday's (18th) FOMC.

It's not clear that the Fed will have learnt too much more than they already knew from Friday's payrolls data. May headline (+139k vs. 147k) and private (140k vs. 146k) payrolls were slightly above the 126k consensus but -95k of net revisions to the two previous months softened the beat. Our economists point out that we now have very stable private sector hiring trends over the past three (133k), six (146k) and twelve (122k) months. However they also point out the narrow breadth in job growth as health care / social assistance (+78k) and leisure / hospitality (+48k) continued to drive the majority of private sector job gains in May and have accounted for 75% of private job growth over the past twelve months. See our economists US employment chart book here that came out after the report on Friday for much more. Staying on employment there will be increased attention on claims this week given the recent tick up. It's not clear whether its seasonals or evidence that there is some real time slipping in employment trends.

Asian equity markets are building on Friday’s gains on Wall Street driven by optimism surrounding high-level trade discussions between China and the United States scheduled for later today. The lack of major weakness in payrolls is also helping. Across the region, the KOSPI (+1.51%) is outpacing its regional peers, extending last week’s rally after the Liberal Party won the presidential election. The Nikkei (+1.05%) is also strong after a positive revision in Q1 GDP data. Elsewhere, the Hang Seng (+1.02%) is also trading noticeably higher, driven by gains in technology shares, particularly following Meta's weekend announcement of plans to invest $10 billion in startup Scale AI, which focuses on data labeling to support the expansion of AI models as part of its broader AI development strategy. Elsewhere, Chinese stocks are more subdued after soft inflation data (more below), with the CSI (+0.22%) and the Shanghai Composite (+0.23%) both underperforming. S&P 500 (-0.22%) and NASDAQ 100 (-0.25%) futures are reversing some of Friday's gains though.

Coming back to China, consumer prices have decreased for the fourth consecutive month in May, registering a decline of -0.1% y/y (compared to an expected -0.2% and -0.1% in April). This trend might suggest that Beijing's stimulus measures have not yet been sufficient to enhance domestic consumption amid ongoing trade tensions. Furthermore, deflationary pressures are intensifying on some measures as the PPI fell by -3.3% year-on-year in May, surpassing the expected -3.2% and marking the most significant drop in nearly two years, exceeding April’s decline of -2.7%.

Interestingly Chinese exports to the US fell -34.4% in May whilst rising 11% to the RoW, showing that exports didn't recover that well to the US after the trade truce and also that China are finding other avenues to export goods.

In FX, the Japanese yen (+0.25%) is strengthening, trading at 144.49 against the dollar, recovering after two days of losses in response to an upward revision of Japan's Q1 GDP figures. 30yr JGBs are +4bps higher.

Recapping last week now and the risk-on move continued as the news of further US-China talks and a decent US jobs report boosted investor optimism. So that helped to outweigh the weak data from earlier in the week, and meant the S&P 500 rose +1.50% (+1.03% Friday), whilst Europe’s STOXX 600 was up +0.91% (+0.32% Friday). In fact, the Friday move took the S&P into technical bull market territory, having now gained +20.42% since its closing low on April 8. The jobs report contrasted with the ADP report on Wednesday, which hit a two-year low, as well as the contractionary ISM services print. And even though nonfarm payrolls saw downward revisions of -95k to the previous two months, those were mostly in March, before Liberation Day occurred.

The jobs report meant investors priced out the likelihood of Fed rate cuts this year, with just 44bps now priced in by December, down -10.6bps on the week (-9.4bps Friday). That’s the fewest cuts priced since February (we'd priced 60bps immediately after the weak claims data the day before), and it triggered a significant flattening in the US Treasury curve. For instance, the 2yr Treasury yield was up +13.9bps (+11.6bps Friday) to 4.04%, whilst the 30yr yield was only up +3.7bps (+9.0bps Friday) to 4.97%. The 10-year Treasury yield also rose +10.5bps (+11.5bps Friday) to 4.51%. Similar movements were echoed in Europe, as the 10-year Bund yield ended the week up +7.4bps (-0.6bps) at 2.57%. That also came as ECB President Lagarde indicated on Thursday that they were approaching the end of their easing cycle.

Elsewhere, oil prices performed strongly last week, as OPEC+ announced a production increase of 411,000 barrels per day, which was less than some had expected. This led to a rally in crude oil, with WTI posting its biggest weekly gain of 2025, up +6.23% (+1.91% Friday) to $64.58/bbl, whilst Brent crude was up +4.02% (+1.73% Friday) to $66.47/bbl.

Meanwhile, US credit spreads ended the week tighter, with IG tightening -3bps (-3bps Friday) to 85bps, its tightest in 3 months. And HY spreads tightened -15bps (-9bps Friday) to 300bps. European sovereign bond spreads also tightened, with the 10yr Italian-German spread down -5.4bps (-1.8bps Friday) to just 93bps, the tightest since February 2021.