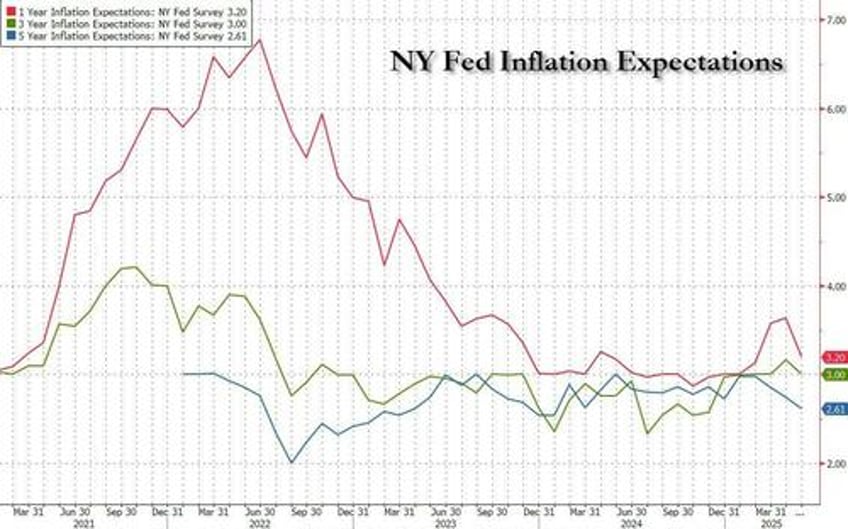

For the first time since 2024, inflation expectations tracked by the NY Fed survey of Consumer Expectations dropped across all three horizons in May.

One-year-ahead inflation expectations declined by 0.4% to 3.2%, three-year-ahead inflation expectations declined by 0.2% to 3.0%, and five-year-ahead inflation expectations declined by 0.1% to 2.6%.

The declines in median one- and three-year-ahead inflation expectations were broad-based across age, education, and income groups, so there is nothing the Marxists at UMich can say to mitigate what is clearly a renormalization of the previous ridiculous expectations for imminent hyperinflation due to tariffs which, as we have said all along, destroy demand and lead to lower prices in the long run (something which even Goldman now agrees with). Median inflation uncertainty (the uncertainty expressed regarding future inflation outcomes) also declined at the one-year horizon and was unchanged at the three- and five-year horizons.

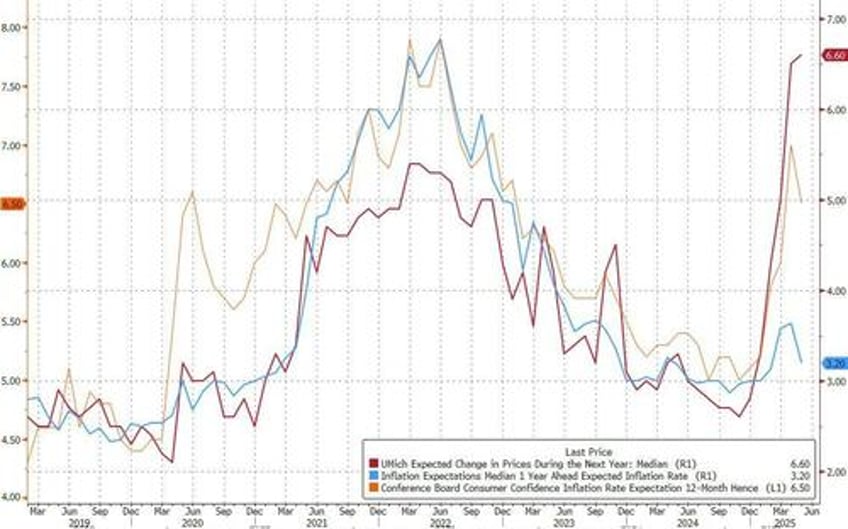

The latest NY Fed inflation expectations are falling in line with other household-based surveys pointing to a rebound in sentiment in the wake of the announcement, even if the laughable UMichigan survey of a few confused Democrats by a few confused Marxists, still shows 1 Year inflation expectations at a record high 6.6%!

Since the beginning of the year consumers have been bracing for higher prices, even though there has so far been zero evidence prices are in fact rising; instead many business continue to internalize the price increases while Chinese suppliers have also been asked to share the pain.

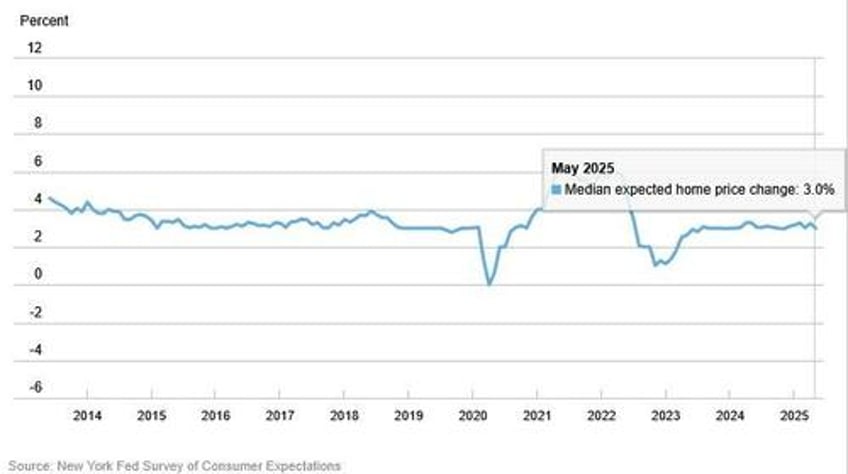

There was more good news on the inflation front: first, the survey found that median home price growth expectations decreased by 0.3% point to 3.0%. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023. The decline was driven by respondents in the West and South census regions.

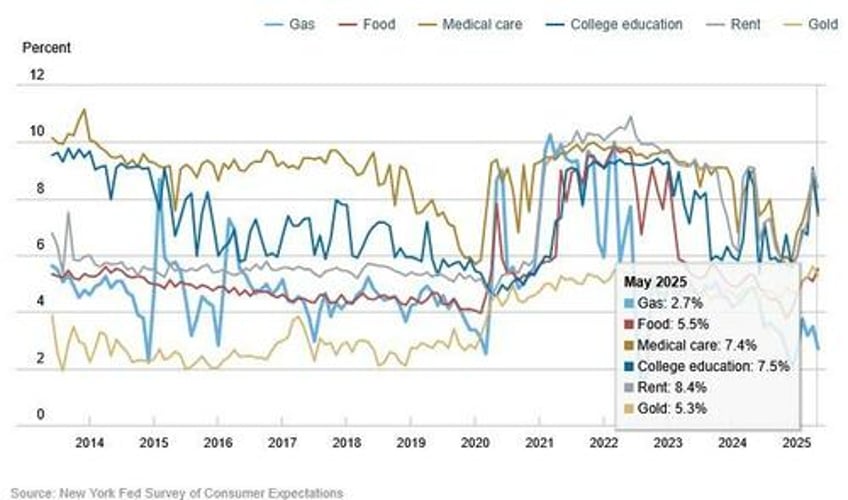

Also, the median year-ahead commodity price change expectations decreased by 0.8 percentage point for gas to 2.7%, 1.3 percentage points for the cost of medical care to 7.4%, 1.6 percentage points for the cost of college education to 7.5%, and 0.6 percentage point for rent to 8.4%. The only place where price expectations increased was in year-ahead food prices which increased by 0.4 percentage point to 5.5%, the highest level since October 2023.

Fed officials are closely following consumer estimates of price pressures to assess whether tariffs could lead to a persistent inflation spike. The broad-based improvements in inflation expectations suggest that the Fed is that much closer to cutting rates, confirming that once again Trump will have been correct in urging "too late Powell" to cut.

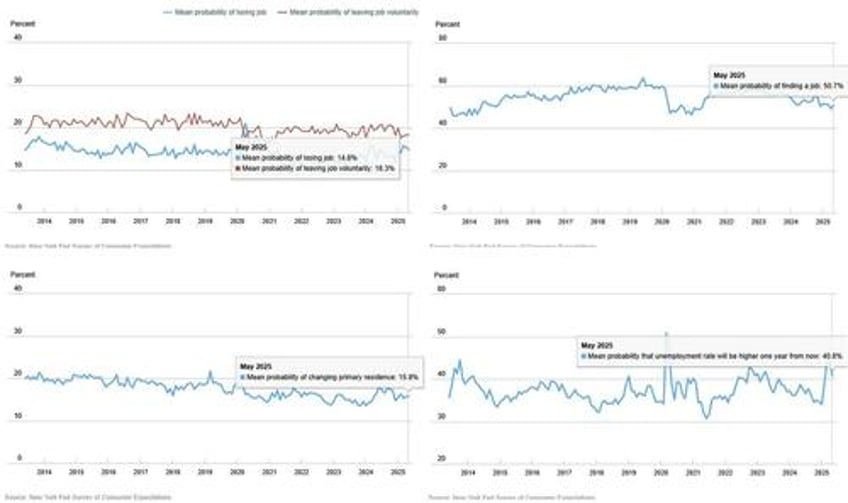

It wasn't just inflation expectations that improved: Americans’ views about their job prospects also improved slightly in May. The perceived probability of losing one’s job in the next year dropped 0.5%, while respondents’ likelihood of quitting voluntarily ticked up. The mean expectation that the unemployment rate will be higher one year from now decreased 3.3% to 40.8%.

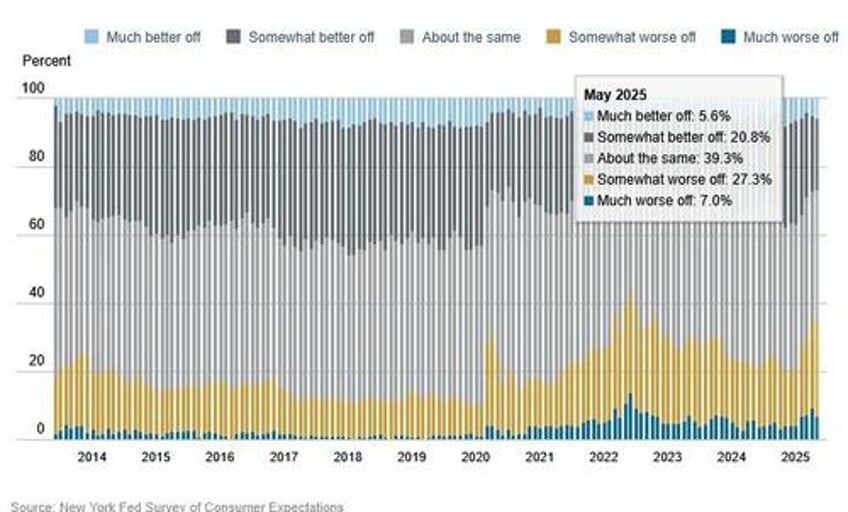

But wait, there was even more good news (ahead of the idiotic UMich report later this week): Households’ perceptions of their own finances also improved, with the share of respondents saying they will be worse off in a year declining slightly.

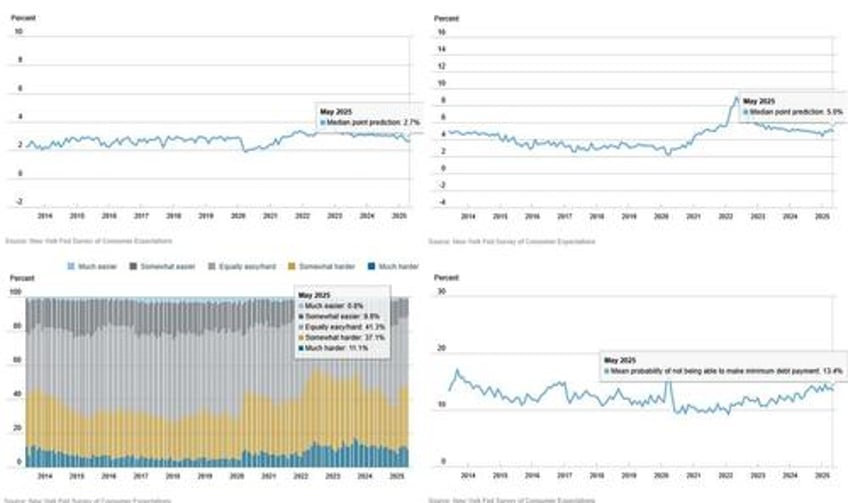

A smaller share of participants reported that it was harder to access credit although the average perceived probability of missing a minimum payment in the next three months dropped to the lowest since January. Also, a smaller percentage of consumers, 13.45% vs 13.94% in prior month, expect to not be able to make minimum debt payments over the next three months, the lowest level since January 2025. The decrease was driven by those with more than a high school diploma and those with household incomes over $50,000.

Some more details from the report:

- The median expected growth in household income increased by 0.1% point to 2.7% in May, while remaining well below the trailing 12-month average of 3.0%.

- Median nominal household spending growth expectations declined by 0.2% point to 5.0%, remaining just above the trailing 12-month average of 4.9%.

- Perceptions of credit access compared to a year ago improved, with a smaller share of households reporting it is harder to get credit, and a larger share reporting it is easier. Conversely, expectations for future credit availability deteriorated, with the share of respondents expecting it will be easier to obtain credit a year from now decreasing to 10.6% from 12.1%.

- The median expectation regarding a year-ahead change in taxes at current income level was unchanged at 3.3%.

- Median year-ahead expected growth in government debt increased by 0.6 percentage point to 5.4%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 1.1 percentage points to 25.4%.

Finally, the mean perceived probability that the US stock market will be higher 12 months from now increased.

Average perceived probability of missing a minimum debt payment over the next three months decreased by 0.5 percentage point to 13.4%, the lowest level since January 2025.