Oil prices are lower overnight following API's report of a large crude inventory build.

API

Crude +9.34mm (-1.2mm exp) - biggest build in six weeks

Cushing +2.39mm

Gasoline -4.437mm (-1.7mm exp) - 8th straight weekly draw

Distillates +531k (+100k exp)

DOE

Crude +3.17mm (-1.2mm exp)

Cushing +2.1mm - biggest build since Jan 2023

Gasoline +1.3mm (-1.7mm exp)

Distillates -1.185mm (+100k exp)

Unlike API's report, the official data showed gasoline stocks building last week (first build in 8 weeks) and stocks at the crucial Cushing hub surged by the most since Jan 2023...

Source: Bloomberg

The Biden administration added to the SPR once again (+744k barrels)...

Source: Bloomberg

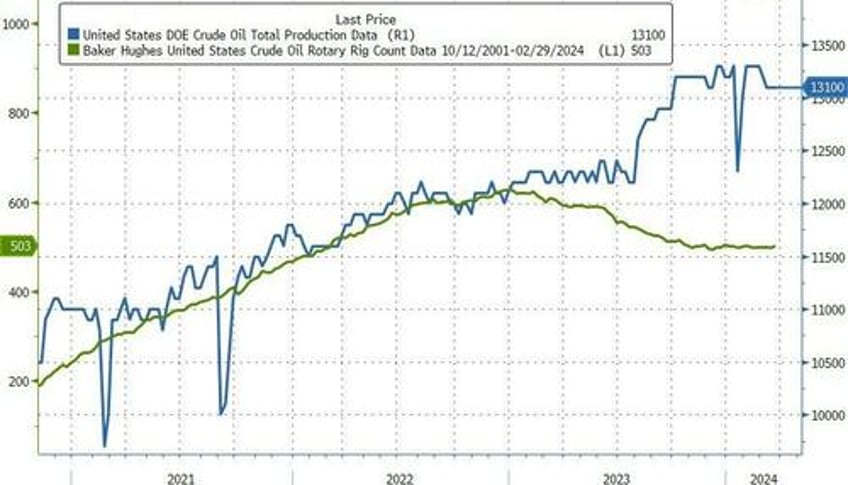

US Crude production was unchanged near record highs last week...

Source: Bloomberg

WTI was trading just above $81 ahead of the official data, and rallied back up to pre-API levels...

Geopolitical uncertainty amid Ukrainian drone attacks on Russian oil infrastructure and extended supply cutbacks by OPEC+ have buoyed prices, although a challenging economic outlook in China and robust non-OPEC supply growth remain headwinds.

“Given an approaching end of month, end of quarter and the long Easter weekend, it is understandable that a little froth comes off the markets,” said John Evans, an analyst at brokerage PVM.

“Yesterday’s likely trimming of length and the resultant negative day is exacerbated by a surprising build in crude stock data produced by the API.”

And finally, as gasoline stocks decline, wholesale gasoline prices imply pump prices are going much higher...

Source: Bloomberg

Not a good sign for Powell or Biden...