Oil prices dipped lower today, consolidating just off five-month highs.

"WTI crude oil and Brent crude oil front month futures trade steady after both climbing 1.6% on Monday as Ukrainian drones hit another Russian oil refinery, adding to the list of casualties of Russian refining infrastructure, which according to (Goldman Sachs) has knocked out an estimated 900,000 barrels per day of refining capacity," Saxo Bank noted.

Expectations were for a third weekly crude draw in a row and an eighth weekly decline in gasoline stocks...

API

Crude +9.34mm (-1.2mm exp) - biggest build in six weeks

Cushing +2.39mm

Gasoline -4.437mm (-1.7mm exp) - 8th straight weekly draw

Distillates +531k (+100k exp)

Against expectations of a small draw, API reported a surprise significantly large crude build and stocks at the Cushing Hub rose notably. Gasoline stocks fell for the 8th week in a row..

Source: Bloomberg

WTI was hovering around $81.50 ahead of the API print and legged lower on the surprise crude build...

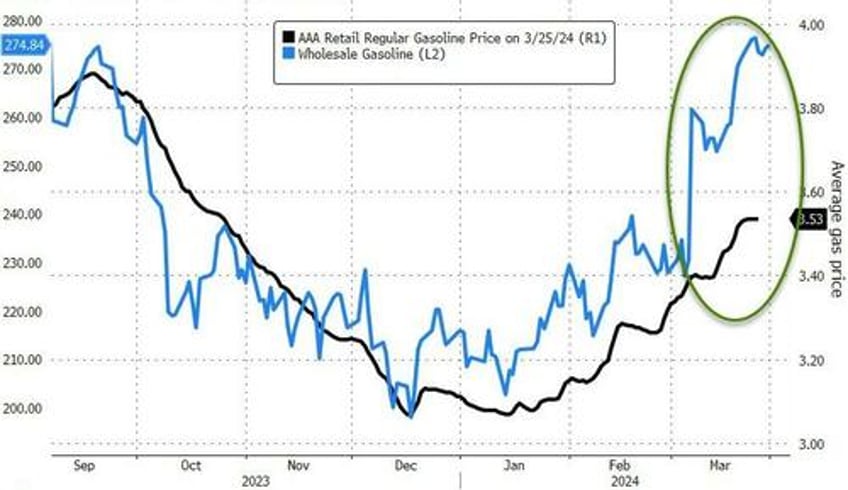

And finally, as gasoline stocks decline, wholesale gasoline prices imply pump prices are going much higher...

Source: Bloomberg

Not a good sign for Powell or Biden...