"There has been no data suggesting the Fed would ease. There have been no banking crisis events, No Govt shutdown fears,

no surprise war escalations. And yet Gold moves… But it is not alone."

Happy Easter

Sections:(shown):

- Tactical Acceleration.

- Breaking it down

- Bazooka or No?

- Frontrunning Xi: Stocks, Gold, Silver, Bitcoin

- Someone is Spending Their Money Fast

- Charts: Market Behavior

- Bottom line:

- But why?

- But who? Why China?**

- **Goldman: Maybe Bazooka now?**

- What About BRICS Mandates?

- What Happened Last QE? (partial)**

- IF WE ARE RIGHT:

- THE RISKS:

Why are Gold and Stocks Both Rallying?

Xi doesn't just fire the bazooka. He is the bazooka...

Tactical Acceleration.

GoldFix ZH Edit

Our suspicion is, someone is about to announce policy change. Either Japan, China, or Europe. NOT THE US at least initially; With Japan and China being the most likely.

But Japan just changed policy and while that still can (and will) affect the market, it is a known-unknown. So that leaves China.

Breaking it down:

The best candidate for acceleration we all know can no doubt be the coming BRICS summit if this is China buying. Or even more so, some western announcement regarding Gold and currency re-valuation. But this is different.

Please keep in mind the following statement we’ve made on social-media semi-humorously several times before reading on:

"There are no more shorts in Gold, only longs waiting to buy."

We think when a situation such as above exists, and you have made up your mind strategically to buy something, the only things remaining between you and action are reasons to wait (like data or news) or similarly, catalysts to buy. in short: Timing of action is next.

So… we can spot one catalyst for the acceleration coming out of China not discussed much (ZH excepted) yet. The back-burnered China stimulus “Bazooka”.

Bazooka or No?

For the past months China has been watched closely by western banks for a bazooka of stimulus to get things going there. Banks have set the table for that talking about Copper as being in short supply as well. But they stopped talking “Bazooka” a few months ago.

And no bazooka has come. Until maybe now. Goldman Sachs published a very dry policy brief report entitled: China: PBOC reportedly ordered to inject liquidity to the economy

Here’s that report’s bottom line (emphasis ours):

Offshore media reported today (March 28th) that President Xi ordered the PBOC to inject liquidity into the economy via buying central government bonds (CGB),... “the People’s Bank of China should gradually increase the trading of treasury bonds in its open market operations”.

Though the exact quote didn’t seem to point to a direct order for PBOC to buy CGB in the secondary market, some investors 2interpreted this news as a green light for rapid PBOC balance sheet expansion. This would guide long-term CGB yields down further, as investors would price out the impact of supply shocks.

ZeroHedge also noted this and did a write up of the GS analysis titled Did China Just Quietly Start Q?:

Questions have been swirling about what is behind the recent surge in gold (and general spike across all commodity prices). This may be the answer.Today the SCMP reported that it is "just a matter of time before China’s central bank pulls out a controversial monetary policy tool that it has not used in more than two decades" adding that President Xi ordered the PBOC to inject liquidity into the economy via buying central government bonds (CGB),

The previously cited report went on to describe that this indirect QE served a double duty of soaking up the increased issuance by the Government as well as encouraging stability in the CGB markets which would lend support to stocks presumably. Long story short, they will buy their own bonds if this report is accurate simultaneously weakening the Yuan and lowering their Bond yields. That money has to go somewhere right?

Stocks, Gold, and Bitcoin are Frontrunning Xi

If the US Fed is not easing in June, an increasing probability, then why are stocks, Gold, and even the dollar rallying? We believe someone is again sniffing out a type of Bazooka in China.

It could be China buying gold in anticipation of a monetary easing. It could be Western banks buying in anticipation of this happening. Not sure yet.

But someone has decided they cannot wait for a dip in gold right now; even with a strong dollar.

The signs of this are apparent: There has been no data suggesting the Fed would ease. There have been no unmanaged banking crisis events, No Govt shutdown fears, no surprise war escalations. And yet Gold moves… But it is not alone.

But it’s not just gold rallying. It's stocks as well

During this time Stocks and Gold have made repeated new All Time Highs with the dollar remaining strong and getting stronger.1

Bitcoin has also recovered nicely from a spate of futures-related selling to challenge once again its own ATH.

Market Behavior Since Feb 12th

We noted Gold’s behavior started re-exhibiting that of a big buyer again roundabout on Feb 12th, but weren’t sure. Here are all the key markets watched from that day forward.

Gold buying. gets away from whoever was buying it, or they went to market…

Silver, alternately participating, then getting hammered as Gold keeps rising…

The Dollar: Having no appreciable negative effect on commodities while holding its own…

Copper: Got the message early with Gold, but backing off recently…

Stocks, Just chugging along, not a worry in the world…

Bitcoin, no real correlation and doing its own thing, but not contradicting things either…

Oil: Someone is buying it, and while US Driving season is a factor, and the Russian factor looms large, The world does not use as much RBOB as it used to…

Bottom line:

Someone is no longer willing to wait to buy Gold, Stocks, or even Dollars.

What Happened Last China QE?

This next sentence by Goldman describes the *effects* of a QE event.

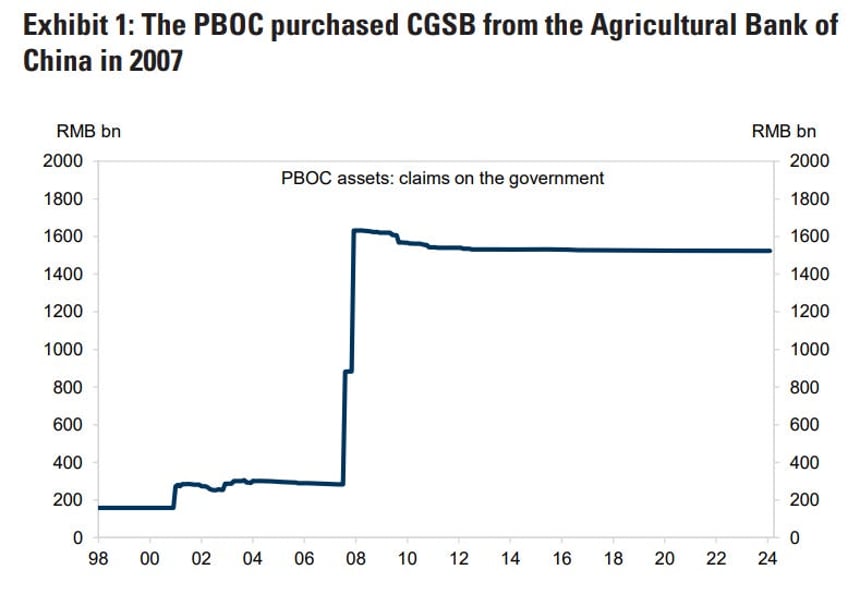

"This would guide long-term CGB yields down further…similar to the experience of 2007."

This is The PBOC buying its own Government’s long term Bonds in 2007…

Here’s What Happened Last Time China did indirect QE…

This time, China’s potential effect economically is a lot bigger, as is their appetite for Gold and commodities.

We know one thing for sure. When bond yields drop, as they did in 2009 by our own QE, investors look for alternatives to Bonds. And it always means the intended target is stocks. To the extent China’s government does not dissuade commodity investment, it also means Gold, Oil, and Silver. They do need to grow their capital/financial markets now.

More from that report here

Free Posts To Your Mailbox