Published by GMG Research

Follow us @gmgresearch.

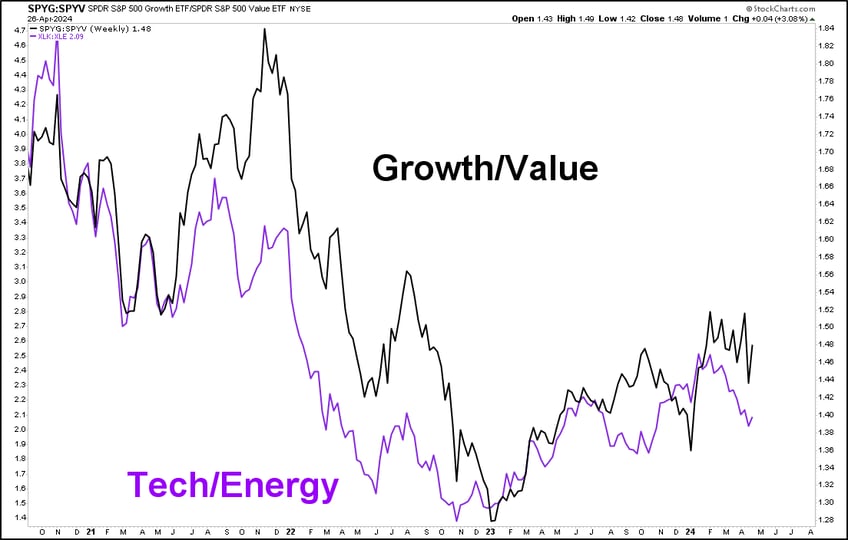

Earlier subscribers know this has been our controlling narrative since Covid.

IMPORTANT: Yield Curve wants to steepen….. BUT, since the 2yr yield looks to continue its march higher, that means an even higher 10YR.

AMD reports this Tuesday and is already extremely oversold.

Meta: A gift, look to add sooner rather than later.

On February 20th we wrote how the sentiment around Google was an opportunity. Look now.

2 Year rates want to be at NEW highs.

Tencent: A distinct China breakout. Pay attention to this.

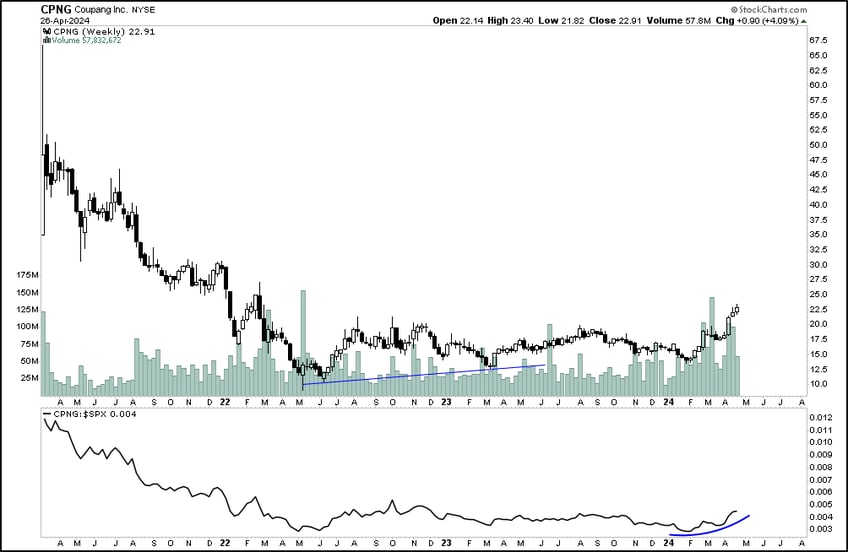

Coupang on a tear with increasingly high volume.

ASML (The AI Gatekeeper): $775 would be a STEAL.

All Hasboro needed to do was get rid of their trash Wizards of the Coast president. MTG will be in a better place now.

Intel: 4 years ago we wrote about Intel and how worthless it is relative to NVDA and AMD. Look at that underperformance since then.

AUD/JPY showing more inflation to come. Our main commodity indicator noone wants you to know about.

Huge earnings for AMD, Amazon, McDonalds (need to lower their prices) and Apple.

THE IMPORTANCE OF MACRO: It is extremely important to learn and understand global macro. Majority of a stock’s movement can be explained by the “big-picture” story, while company-specific movements only account for a fraction of their move. Most dumb sheep investors on Wall Street are trained with a bottom-up mindset which can lead to a lot of confusion when macro forces take over markets.

CORRELATIONS between asset classes are asymmetrical; they behave differently in good times versus bad. Essentially, diversification tends to work well when you don’t want it to (during rallies), but it fails to protect us during downturns. This challenges the traditional investment strategy of diversification, highlighting the need for a more nuanced approach to managing portfolio risk, especially in volatile markets.

Factory New Master Piece: $1100 going parabolic.

Lastly, the SEC is coming after the Ethereum “ecosystem” (metamask); no chance of an ETF approval anytime soon.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.