With homebuilder confidence languishing near COVID lockdown lows...

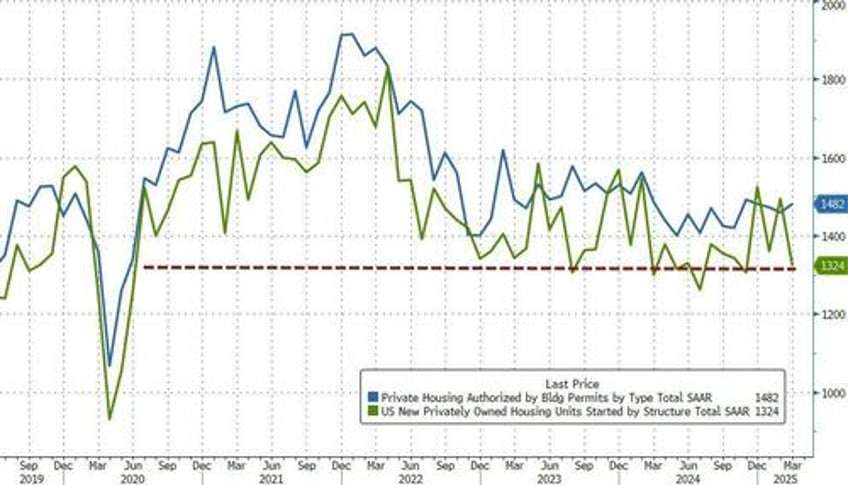

...and mortgage rates rebounding higher - it should be no surprise that Housing Starts were expected to decline in March. However, the scale of the drop is dramatic, tumbling 11.4% MoM (vs -5.4% exp).

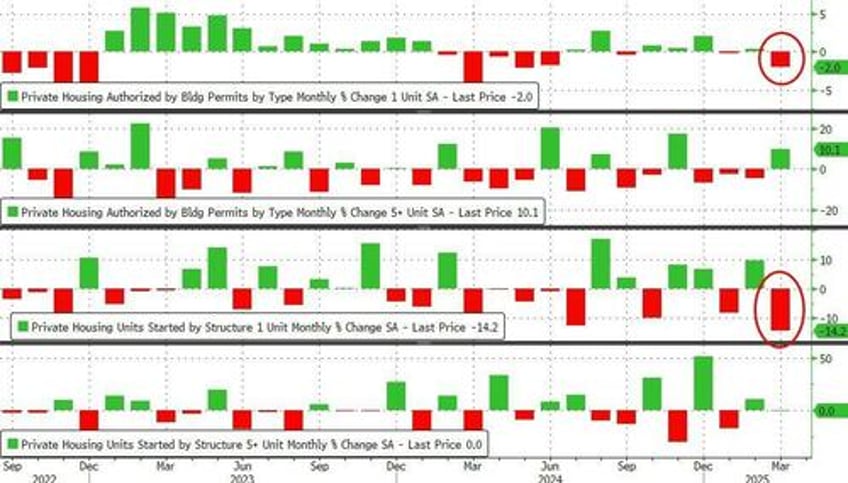

The monthly swings in Housing Starts recently have been wild to say the least. Building Permits rose 1.6% MoM (better than expected)...

Source: Bloomberg

On a SAAR basis,. Housing Starts are back near COVID lockdown lows...

Source: Bloomberg

The plunge in Housing Starts was dominated by a 14.2% MoM collapse in single-family home starts - the biggest drop since April 2020....

Source: Bloomberg

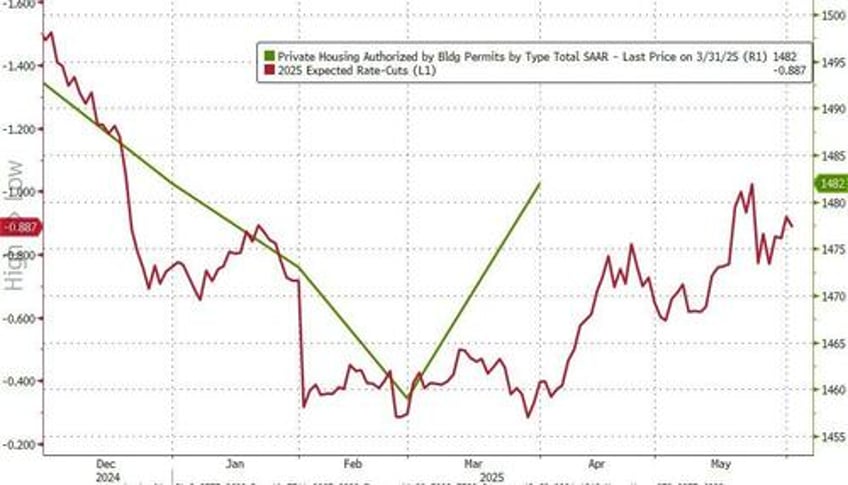

The more forward looking Building Permits continue to (roughly) track Fed rate cut expectations...

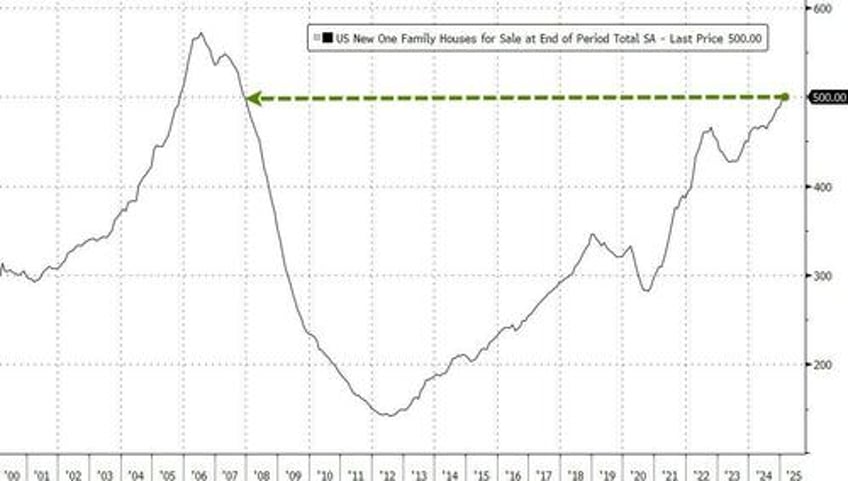

Prices have come off their peak somewhat as builders deploy incentives to try to clear excess inventory, which still stands at the highest since 2007.

That’s also prompting builders to slow down on projects, with the number of single-family homes under construction falling to the lowest level in four years, continuing a steady decline back to mid-2022.

Will Fed rate cuts even help at this point?