After the hotter-than-expected CPI (which has been shrugged off entirely by the stock market), Producer Prices were expected to rebound very modestly MoM but continue to slow on a YoY basis in January. Instead, like CPI, it re-accelerated with headline rising 0.3% MoM (+0.1% MoM exp), which left PPI up 0.9% YoY (down from December but hotter than the +0.6% exp)...

Source: Bloomberg

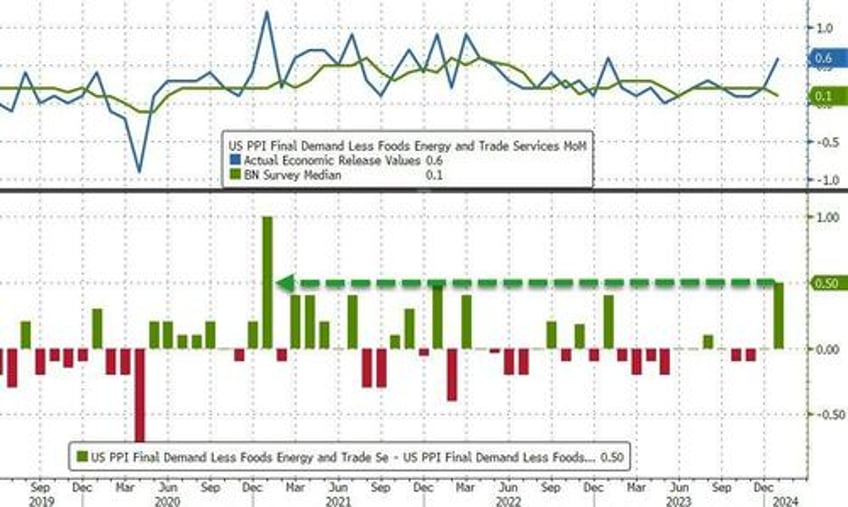

The picture was even worse under the hood with PPI ex food and energy up 0.5% MoM (vs +0.2% prior and +0.1% exp) and ex-food, energy, and trade up 0.6% MoM (vs +0.1% exp).

This was the biggest 'beat' for Core PPI since Jan 2021...

In fact, core PPI reached a new record high (reminder, disinflation does not mean lower prices), now up 17.4% since Biden was elected...

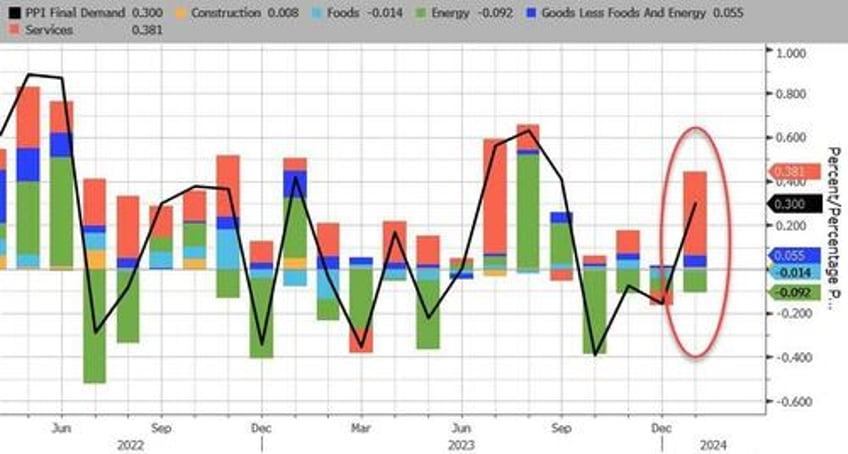

Services PPI soared MoM, and energy continues to be a driver of deflation (but is losing its power)...

Source: Bloomberg

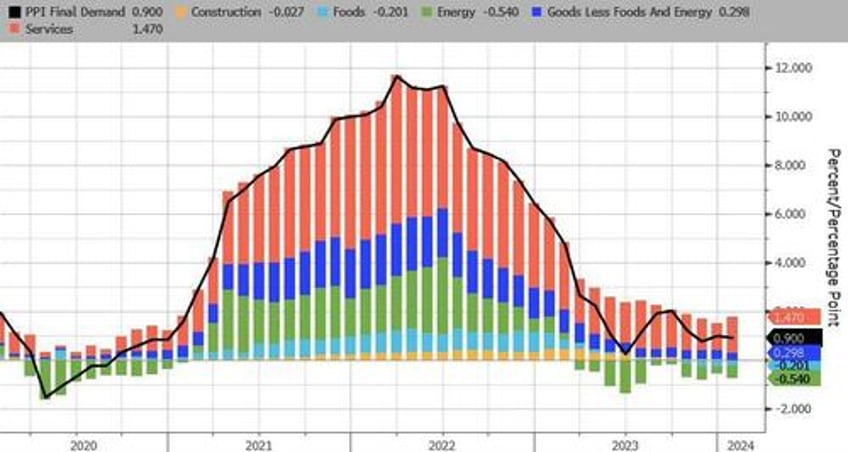

And on a YoY basis, Services PPI is also re-accelerating (+1.47% from +1.14%). Energy continues to be the deflationary driver...

Source: Bloomberg

This is not good news for the disinflationistas. And it will stop President Biden's narrative that 'prices are coming down'...