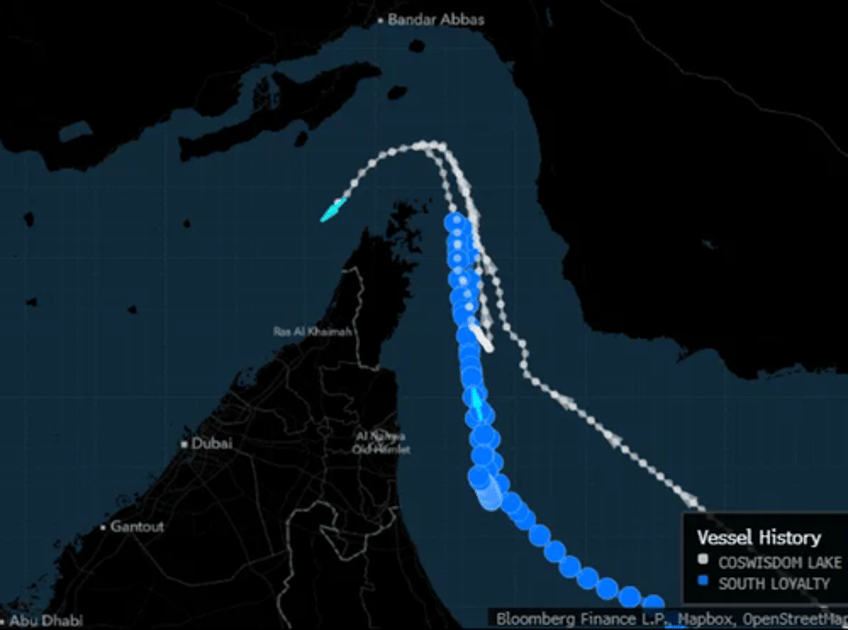

Two supertankers—Coswisdom Lake and South Loyalty—each capable of carrying 2 million barrels of crude, abruptly altered course in the Strait of Hormuz over the weekend after U.S. stealth bomber strikes on Iran's nuclear facilities.

The Coswisdom Lake and South Loyalty both entered the waterway and abruptly changed course on Sunday, according to vessel tracking data compiled by Bloomberg. The first of the two carriers then did a second U-turn and is now going back through Hormuz. The other one remains outside of the Persian Gulf, according to its signals on Monday. -Bloomberg

On Sunday, Iranian state-owned outlet Press TV quoted Major General Kowsari, a senior member of the Iranian Parliament's National Security Commission, as stating:

"Parliament has reached the conclusion that the Strait of Hormuz should be closed, but the final decision in this regard lies with the Supreme National Security Council."

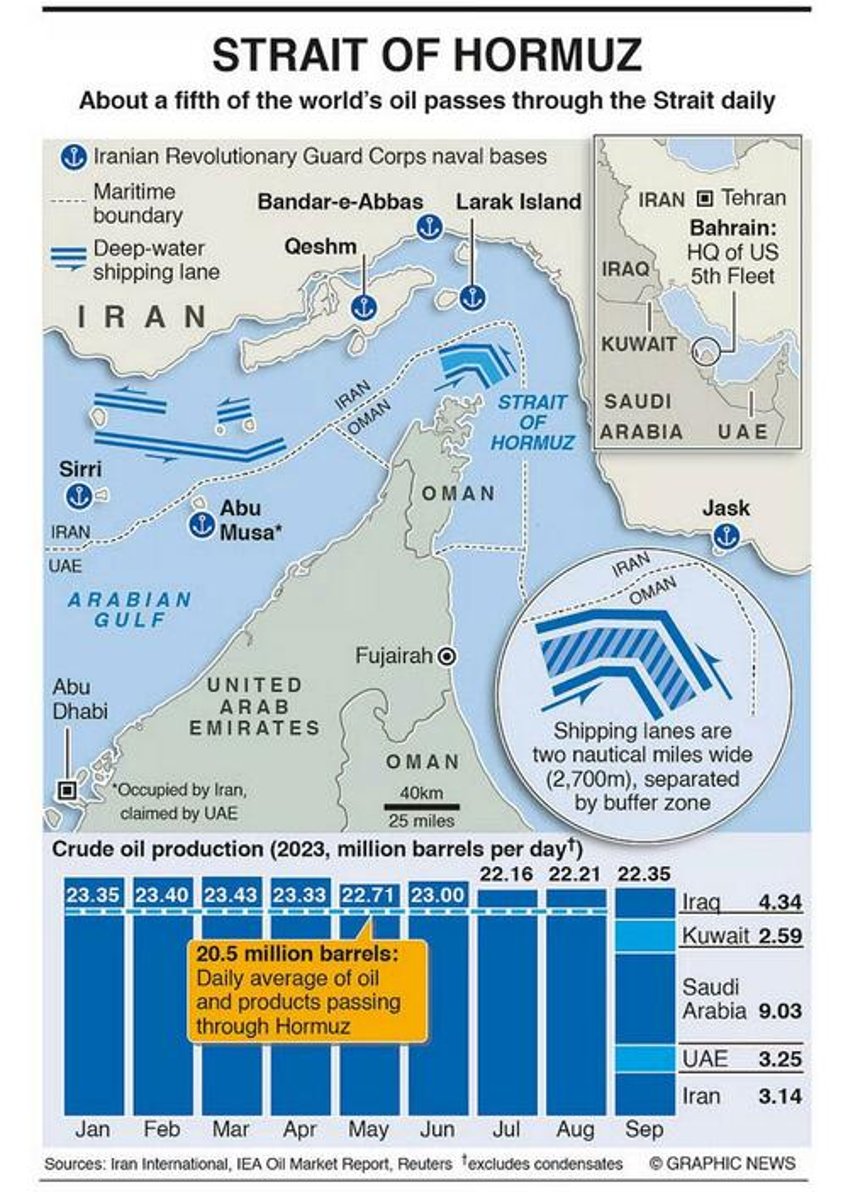

RBC Capital Markets analysts, led by Helima Croft, believe Iran doesn't need to close the critical maritime chokepoint to disrupt global oil transport. Instead, Tehran could use targeted strikes on individual tankers or key infrastructure—such as the port of Fujairah—to destabilize the vital waterway.

Croft and her team note:

Iran could have already inflicted major damage but hasn't, suggesting strategic restraint—so far.

Even limited actions could prompt shippers to avoid the region, especially in the current high-risk environment.

If Iran's leadership feels its survival is threatened, it may mobilize allied groups in Iraq and Yemen, further escalating threats to regional energy assets.

RBC warns it may take days or weeks to gauge Tehran's true response and cautions against assuming the danger has passed.

In the overnight, Brent crude futures reversed sharply—now trading around Friday's close and down 6% or so from intraday highs. UBS Research warned that the real left-tail risk remains a Strait of Hormuz closure, which would trigger a disruption larger than the 2022 Russian supply shock and could send prices soaring above $120.

Other critical research on Hormuz scenarios:

What's Next For Oil: Banks See Oil Spiking As High As $120; Worst-Case Odds Rise To 17%

$150 Oil? Goldman Lays Out How Markets Will React To U.S. Escalation In Iran

"Iran's asymmetric response is possible...limited yet impactful (partial disruption in Hormuz/Red Sea plausible, though full closure unlikely)," Goldman analyst Giulio Esposito noted on Monday.

Keep in mind that any closure—partial or full—of the Strait of Hormuz would impact Asian importers, such as China, India, Japan, South Korea, and Singapore, as well as parts of Europe, the most. The U.S. is comparatively less exposed, thanks to shale production and Strategic Petroleum Reserve. The real question is—will Asia stand by and allow Tehran to shutter the waterway?