Oil prices extended recent gains today - back near the OPEC-Cut spike levels from April - helped by tighter supplies and optimism that China’s government will boost the country’s economy. As Bloomberg reports, China, the world’s largest crude importer, indicated more support for the real estate sector alongside pledges to boost consumption on Monday.

WTI also closed back above its 200-day moving-average, which for now is acting as fresh support.

"Near-term, the market is going to look at U.S. inventory numbers to see whether they indicate an elevated level of exports, which would indicate how tight Asian markets especially are," said Michael Lynch, president of Strategic Energy & Economic Research.

"That would be a signal about both Chinese demand and Russian oil exports."

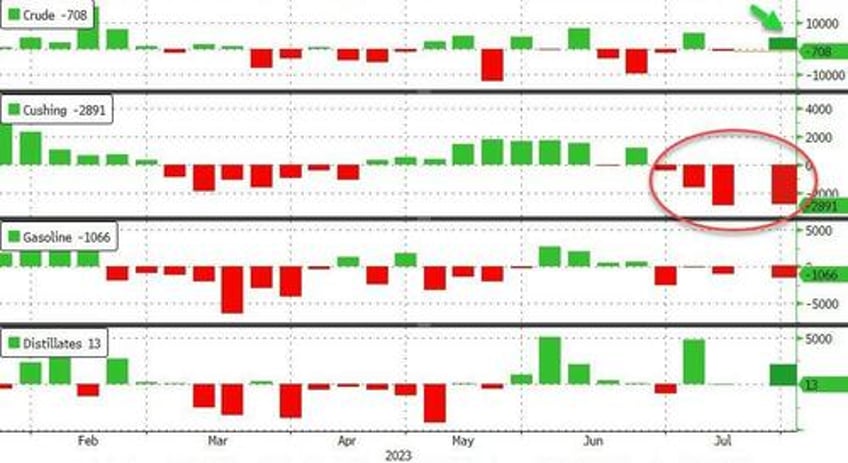

API

Crude +1.319mm (-2.2mm exp)

Cushing -2.34mm

Gasoline -1.043mm (-1.7mm exp)

Distillates +1.614mm (-600k exp)

After a small draw last week, expectations were for a larger drop in crude inventories this week, but API reported a surprise 1.3mm barrel build. Cushing saw another sizable draw but Distillates' surprised with a 3rd weekly build in a row...

Source: Bloomberg

WTI was hovering around $79.60 ahead of the API print and kneejerked lower...

Finally, we note that WTI’s prompt spread is at 43 cents a barrel in backwardation - the highest since November, signaling that physical markets are still parched for crude.