After another solid day for tech which saw the Nasdaq rise 0.7% and the Dow closed green for 12th consecutive day, its longest stretch since Feb 2017, yet where volumes were rather muted ahead of today's mega cap earnings barrage and tomorrow's Fed announcement, moments ago we got results from two tech giants, Microsoft and Alphabet (Google), both of which reported much stronger than expected results, yet where the stock reactions were polar opposite with GOOGL spiking after results while MSFT slumping (at least until the company provides its guidance during the earnings call in a few minutes).

We summarize Google's results in a separate post, and focus on MSFT here. And so, without further ado, this is what the company that spawned clippy and chatGPT just reported:

- Revenue $56.19 billion, beating the consensus estimate $55.49 billion

- Productivity and Business Processes revenue $18.29 billion, beating consensus estimate $18.1 billion

- Intelligent Cloud revenue $23.99 billion, beating consensus estimate $23.8 billion

- More Personal Computing revenue $13.91 billion, estimate $13.58 billion

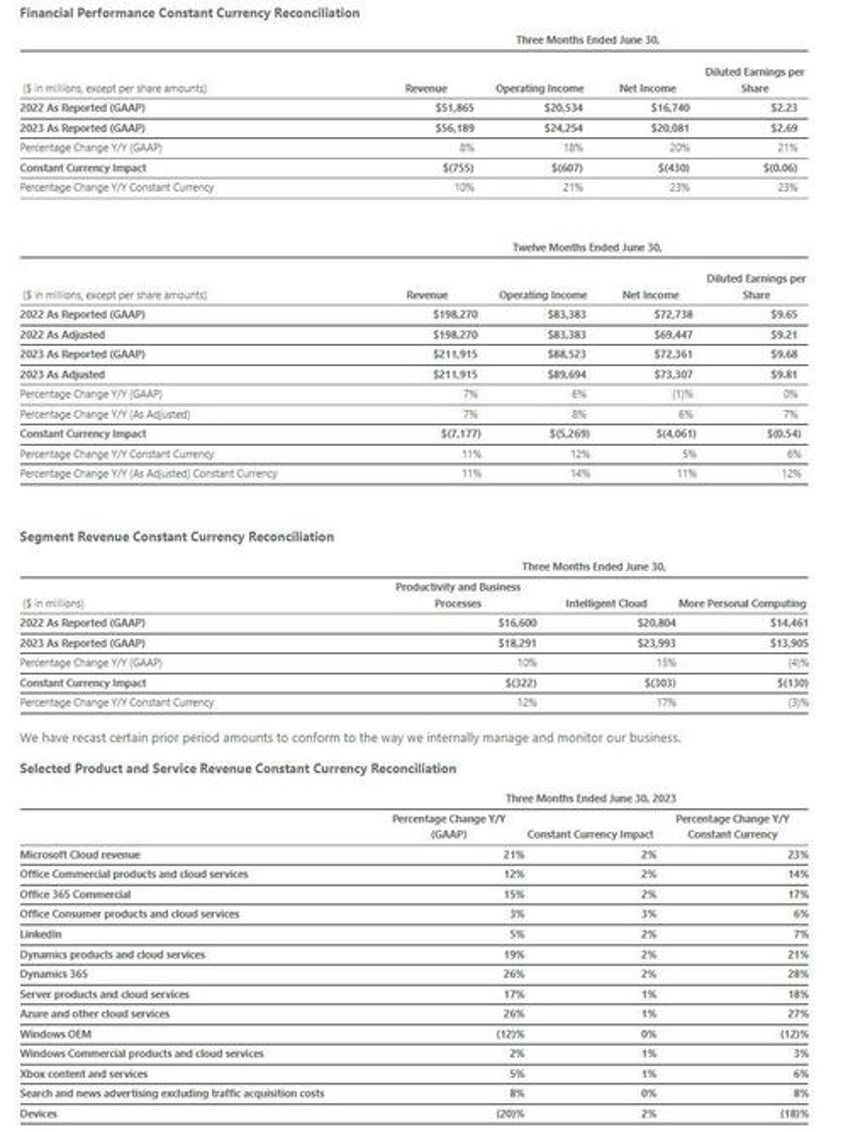

- Revenue at constant currency +10%, estimate +8.52%

- EPS $2.69, beating exp. $2.55

- Operating income $24.25 billion, beating estimates of $23.28 billion

- Capital expenditure $8.94 billion, beating estimates of $7.85 billion

Of note: annual sales growth moderated to 7% in 2023 after five straight years of increases above 10%. Microsoft fired 10,000 workers in the March quarter, including in key businesses like Azure and security software. The company also made a smaller number of additional layoffs in July, in areas like sales and support.

Here is the full financial summary:

Despite beating estimates, the prevailing view was that Microsoft reported "tepid" fourth-quarter sales growth, held back by decelerating demand for cloud-computing services - according to Bloomberg - while the software maker waits for a revenue boost from new artificial intelligence-powered products.

Indeed, while overall results topped analysts’ projections, and Azure cloud services revenue was also higher than expected, cloud growth slowed to 27% (excluding currency fluctuations), from 31% in the previous quarter.

In recent months, CEO Satya Nadella has unveiled an array of new AI programs — based on models from partner OpenAI — for most of Microsoft’s major product lines, and demand is surging for internet-based services that let customers use the OpenAI technologies.

Still, the company’s Office productivity suite including AI isn’t yet broadly available, and overall spending on Azure services and Office applications is easing after several years of rising corporate investments. At the same time, personal computer shipments dropped for the sixth quarter in a row, eroding sales of Windows software and Surface devices.

In fact, one may almost ask if AI is more hope and hype than actual revenue.

“Clients who had been gung ho on cloud came back and said, ‘We’d better optimize what we bought,’” said Mark Moerdler, an analyst at Sanford C. Bernstein & Co. “You won’t see huge tailwinds from AI — it will be incremental.”

The shares fell about 1.5% following the report, after climbing to $350.98 at the close in New York, before recouping some losses.

The stock rose 18% in the three months ending in June, outpacing the 8.3% increase in the S&P 500 Index in that period. Last week, shares of Microsoft reached a record high, fueled by optimism for new AI strategies and products.

That said, the entire weakness after hours may be reversed momentarily when MSFT "will provide forward-looking guidance in connection with this quarterly earnings announcement", something it does not do in its press release... and of course expect several dozen mentions of "AI."