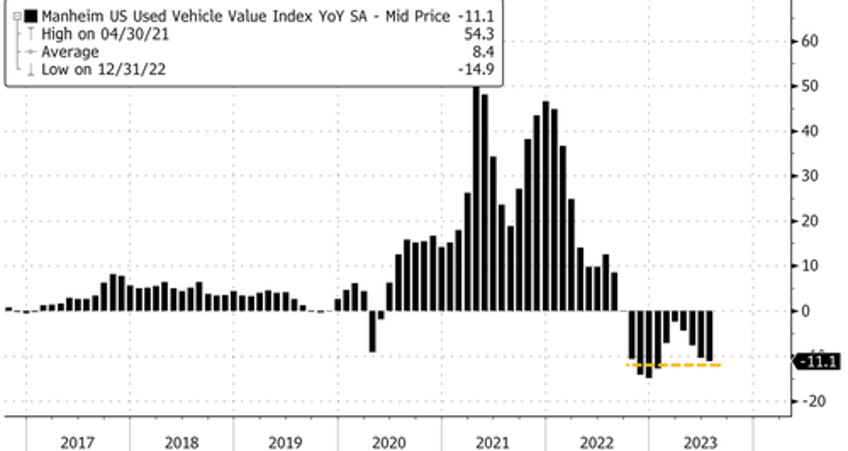

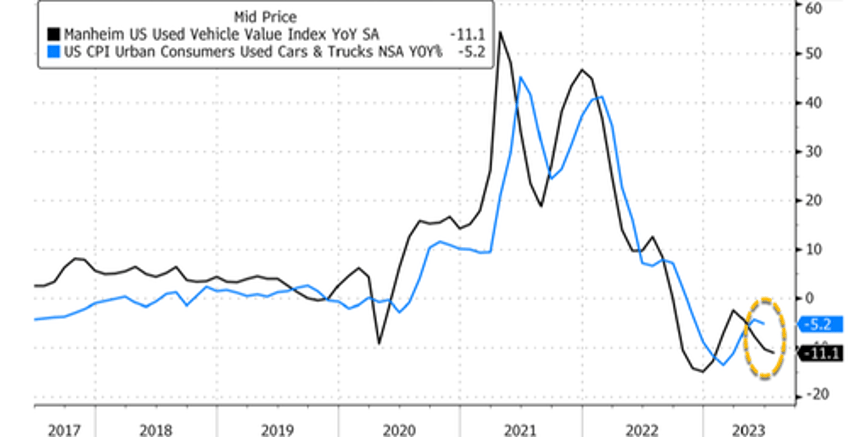

Auto research firm Cox Automotive - the owner of the closely followed Manheim price index - published new high-frequency data for the first 15 days of July that shows wholesale used-vehicle prices continue to slide. This data suggests a continued easing of inflation.

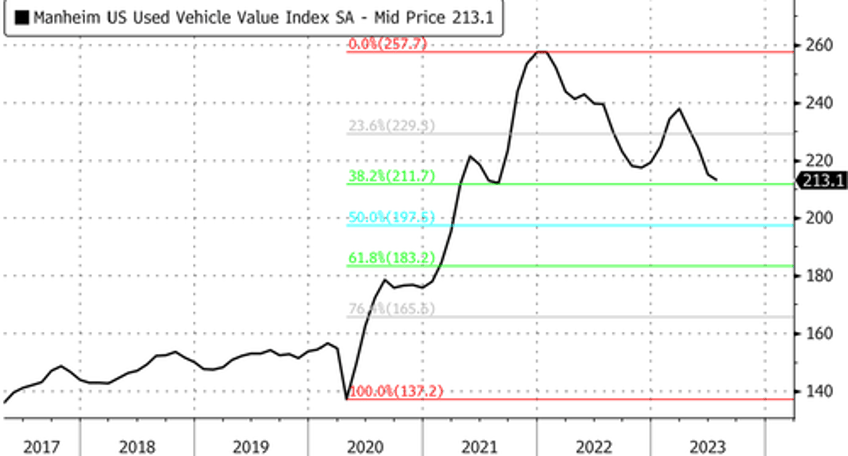

Manheim's July preliminary used-car price index plunged to 213.1, down 11.1% from the full month of July 2022.

The index is now at its lowest level since August 2021.

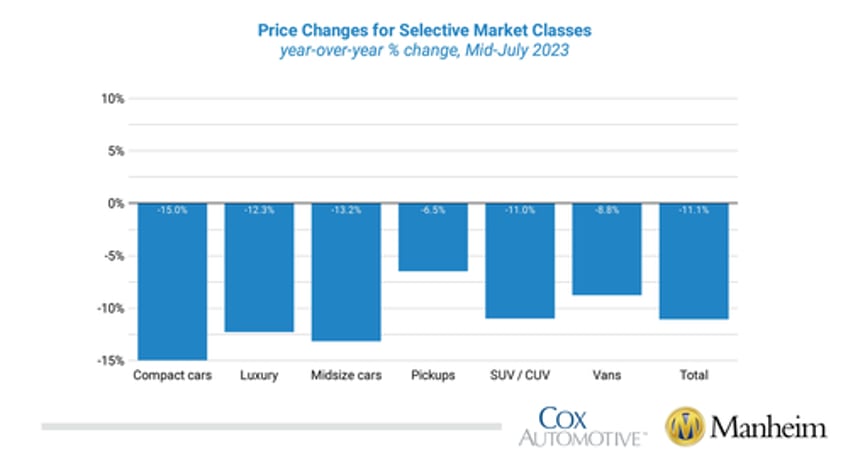

All major market segments saw lower declines year over year in the first half of July. Compact cars lost the most, down 15%, followed by a 13.2% decline in midsize cars, a 12.3% reduction in luxury, and an 11% drop in SUVs. Pick-up trucks lost the least, down 6.5%.

Following last week's consumer inflation print for June, used and new car markets appear to be returning to a state of normalcy.

For June, consumer prices for new autos were flat compared to May and up 4.1% year over year. The used car market cooled, with prices down 0.5% for June, and falling 5.2% year over year.

"With supply slowly improving and demand holding steady, all indicators point to a return to more normal patterns of depreciation for the second half of 2023 and fewer significant declines," Manheim's June report said.

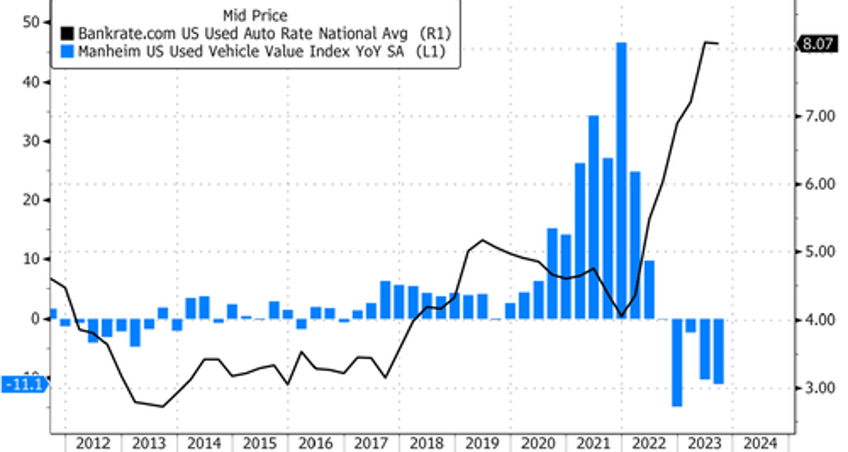

The Federal Reserve's aggressive 16-month tightening of monetary conditions sent used auto loans to decade highs, curbing demand due to an affordability crisis of high borrowing costs and elevated vehicle prices.

This is yet another indication that continued disinflation will continue in July as the Fed wages war on inflation.

This great news for consumers in the market for used vehicles, even though prices remain notably higher than pre-Covid levels. Conversely, this is bad news for those who purchased vehicles during the Covid boom because many are finding themselves underwater on loans.