Ten-year gilt yields just spiked by more than 10 bps on rumors that UK Chancellor Rachel Reeves was about to resign or be ousted.

The pressure on Reeves comes after Starmer — in a dramatic climbdown on Tuesday — abandoned controversial plans to restrict benefit payments to some disabled people, a reform pushed by the chancellor which would have saved some £5 billion ($6.9 billion), and was key to meeting her self-imposed budgetary rules at her spring statement in March.

Bloomberg reports that the welfare reform package was widely opposed by Labour MPs, with more than 120 originally threatening to vote against the policy in parliament.

Even after the last-ditch decision to drop the most contentious changes, 49 Labour MPs still voted against the bill on Tuesday, a sign of the scale of discontent.

The rebellion and U-turn are a serious blow to Starmer’s political authority as he approaches the first anniversary of Labour’s election win last July.

The decision to ditch the welfare reforms also leaves Reeves facing a widening fiscal hole of more than £6 billion to fill, including the need to fund a separate about-turn on a plan to cut winter fuel payments to pensioners.

As Bloomberg further reports, Starmer’s press secretary, Sophie Nazemi, quickly clarified his position to reporters after PMQs, saying that Reeves was going nowhere.

“She has the prime minister’s full backing,” Nazemi said.

“He’s said it repeatedly.”

The combination of Starmer’s failure to back his chancellor, and Reeves’ tears, prompted speculation about her position until the Treasury clarified that the reason for her demeanor was a personal issue.

“It’s a personal matter, which - as you would expect - we are not going to get into,” the Treasury said in a statement.

“The chancellor will be working out of Downing Street this afternoon.”

A tear just rolled down the Chancellor’s cheek at #PMQs as the PM refuses to answer whether or not she’ll stay in her job.

— Paul Brand (@PaulBrandITV) July 2, 2025

Hayfever, or something else? pic.twitter.com/HPXXQlDNo9

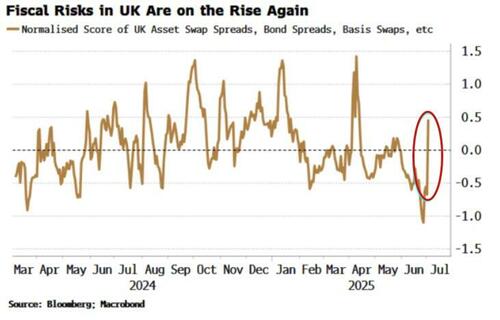

But, as Bloomberg's Simon White notes, the rapidity of the move shows the precariousness of the UK’s debt situation.

The government had planned a series of cuts to welfare and sickness benefits, but had to drastically scale them back in the face of huge opposition from backbench MPs.

The watered down changes are estimated to deliver no savings overall.

A new chancellor might drop Reeves’ commitment to not borrow more for day-to-day activities, or increase spending, justifying a deepening concern for the gilt market.

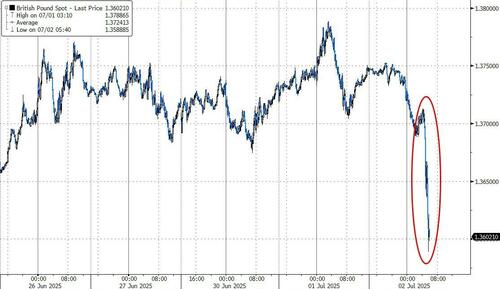

Cable tumbled...

Yields are still near their day’s highs, while a risk measure for the UK, based on asset swaps, country bond spreads and basis swaps, has widened notably.

Keep watching.