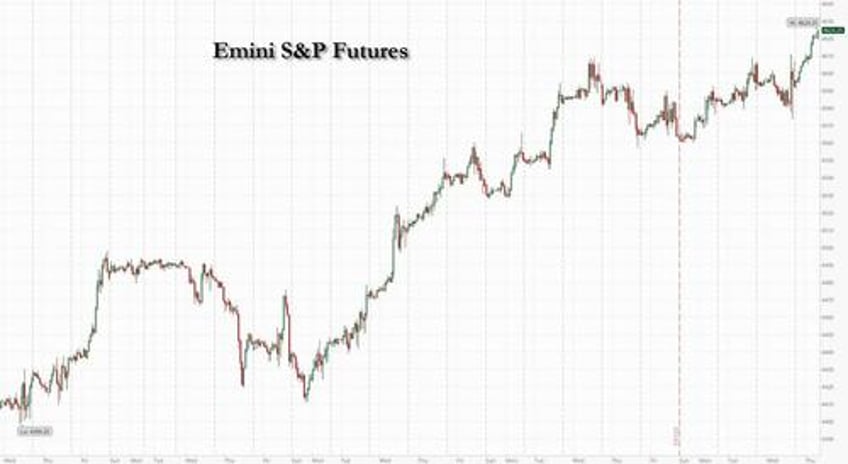

US futures and global stocks soared, and the dollar slumped as investors wagered that the Fed has reached the end of its 16-month long policy-tightening cycle. A barrage of earnings beats (sorry Mike Wilson) from high-profile companies added to the bullish momentum, propelling the Stoxx Europe 600 index 1% higher to a two-month high, while US futures pointed to a strong Wall Street session after Fed Chair Powell failed to dent market optimism during his press conference. At 7:30am Nasdaq 100 futures were up 1.3%, led by an 9% premarket surge in Facebook parent Meta Platforms which reported blowout guidance for Q3; S&P futures rose 0.6% to a fresh 2023 high at 4,623. Treasury yields dropped on the short end, while the dollar pushed lower. Oil and gold prices are up. Iron ore, meanwhile, is trading lower. Today, we will receive a slew of growth and inflation data. As Fed staff now dropped US recession forecast, today’s growth data will be important to assess the soft-landing scenario. Keep an eye on banks stocks as Fed will hold meeting at 1pm ET today to implement Basel 3 endgame agreement.

In premarket trading, megacap techs are higher led by META which has soared 9% post earnings after the Facebook parent gave a revenue forecast ahead of consensus, driven by a recovery in advertising sales. Analysts note that AI-powered tools are boosting engagement and advertiser return, with several upping their price targets. Chipmakers also advanced, led by Micron Technology which highlighted its development of high-bandwidth memory products. Here are some other notable premarket movers:

- US airline stocks drop in US premarket trading after results from peer Southwest Air showed that rising costs weighed even as demand for travel over the summer was strong, sending its shares as much as 7.4% lower in premarket trading.

- American Airlines -2%, United Airlines -1.3%, Delta Air Lines -1.2%, JetBlue Airways -3.2%

- Comcast gained more than 4% after beating profit estimates.

- EBay shares drop 5.9% after the online marketplace’s third-quarter earnings outlook missed estimates. Analysts said the beat in the company’s second-quarter results was overshadowed by the guidance, with Jefferies expressing concern that growth initiatives could result in reduced margins without an uplift in gross merchandise volume and profit.

- Estee Lauder shares fall 0.8%, after Jefferies downgraded the beauty products maker to hold from buy, along with peer Coty, on worries over a recovery in China.

The move higher came after the Fed raised the federal funds rate to a 22-year high and while it signaled further hikes would be data dependent, many investors concluded that it’s done hiking interest rates (just tell them not to look at the soaring price of gasoline and food). They have trimmed bets on more increases this year, as Fed Chair Jerome Powell pointed to signs that higher borrowing costs are working to curb price pressures. Meanwhile, a predicted 25-basis-point rate rise later Thursday from the European Central Bank could be one of its last moves this cycle.

“There is belief that the Fed is probably done,” said Timothy Graf, head of EMEA macro strategy at State Street Bank & Trust Co. “Markets are also seeing a US economy that’s held up far better than the consensus outlook. They are pricing that we have achieved a landing that everyone thought would be impossible to achieve.”

What’s more, gloomy forecasts for an earnings recession have failed to materialise, according to Graf, with equity moves showing “people were under-invested in a lot of the big themes that generated returns this year.” Indeed, surprisingly strong earnings have shattered views that the US is in an earnings recession. More than half of all companies have beat analyst estimates so far, and today stands to be the busiest of the second-quarter calendar.

European stocks followed US equity futures and Asian counterparts higher ahead of the ECB decision today. The Stoxx 600 is up 1% after snapping a six-session win streak on Wednesday, with the media, technology and construction sectors leading gains. Among individual European movers, BNP Paribas SA, Nestle SA and Carrefour SA all rallied after topping estimates. On the downside, Shell Plc retreated despite pledging more buybacks as its profits fell from last year’s highs. Barclays Plc slumped on back of a 41% decline in quarterly trading revenue. Here are the most notable European movers:

- Nestle shares rise as much 2%, the most in six weeks, after the food giant lifted the lower end of its forecast range for full- year sales growth

- Universal Music Group gains as much as 12%, biggest increase on record, as its second-quarter revenue beat estimates driven by growth from its recorded music and merchandising segments

- BNP Paribas shares advance as much as 4.3%, second-best performer in the Stoxx 600 Banks Index, after it reported what Morgan Stanley says are a strong set of results, while RBC also notes “reassuring” cost control

- RELX shares jump as much as 4.3%, the biggest intraday gain since Feb. 16, after the information and analytics company reported adjusted operating profit that beat estimates

- Inchcape shares rise as much as 14%, the most since 2009, after the UK car dealer reported strong revenue growth for the first half, boosted by its recent acquisition of US distributor Derco

- Air Liquide rises as much as 1.6% after the gas company reported first-half Ebit and margins that exceeded estimates. Performance in the Americas was supported by higher prices in Industrial Merchant and strength in Healthcare, says Morgan Stanley

- Shell drops as much as 2.3% after the oil company’s second-quarter profit missed estimates as commodity prices trended down

- Neste shares plunge as much as 13%, most since March 2020, after the Finnish refiner reported adjusted Ebitda for the second quarter that missed the average analyst estimate. RBC says the company’s outlook and sales were underwhelming

- Airbus shares slump 2.5% as analysts voice caution over the company’s decision to remove its target for raising aircraft production past pre-Covid levels and shift the focus to a longer-term goal

- Barclays shares dropped as much as 6.7% as the announcement of a buyback failed to lift the mood after the UK bank’s corporate and investment bank revenues fell short of expectations for the second quarter

- Teleperformance shares slump as much as 12%, the most in three months, after the provider of customer-relationship management services cut its revenue growth forecast for the year, saying it expects economic challenges to continue in the second half

- St James’s Place shares slide as much as 12%, the biggest intraday decline since March 2020, after the investment management company reported first- half net inflows that missed estimates. Citi said the company’s flows were pressured by the macroeconomic backdrop

Earlier in the session, Asian stocks climbed, with a rally in Chinese technology stocks and speculation that the Federal Reserve is nearing the end of its rate-hike cycle helping drive the regional benchmark toward its 2023 high. The MSCI Asia Pacific Index jumped as much as 1%, set for a fourth day of gains and approaching this year’s peak seen in late January. Chinese tech companies provided the biggest boost as electric-vehicle shares surged on plans by Volkswagen AG to invest in XPeng. The EV maker’s stock soared 33%, leading the rally in Hong Kong’s Hang Seng Tech Index and putting it on track for a technical bull market. Equities in most of Asia’s emerging markets rose as the dollar slid following the Fed’s meeting. A weaker greenback is seen as beneficial for growth in the region’s developing economies, many of which rely on imports priced in dollars.

Japanese stocks also edged higher ahead of a monetary policy decision on Friday. KOSPI gained with the spotlight on earnings including Samsung Electronics which topped estimates.

The MSCI Asia Pacific gauge is up 2.6% so far this week, boosted by a rebound in Chinese shares after authorities signaled further property easing and a consumption boost to revive a struggling economy. The regional benchmark is up 9.3% this year, versus a gain of almost 19% in the S&P 500 Index. “The near-term outlook for Asian equities is improving, with some of the macro headwinds facing the market in the past 18 months likely to turn into tailwinds,” said Soo Hai Lim, head of Asia ex-China equities at Barings. “If the second half of the year sees central-bank tightening efforts wind down and earnings to guide higher, investor sentiment toward Asian equities should also improve.”

Australia's stock market was led by strength in real estate and tech. The S&P/ASX 200 index rose 0.7% to 7,455.90, its highest close since Feb. 9, in a rally led by property and tech shares. The advance comes amid optimism the Fed is close to the end of its tightening cycle after the central bank said any further tightening would be data dependent. Read: Fed Raises Rates as Powell Keeps Options Open for Future Hikes In New Zealand, the S&P/NZX 50 index was little changed at 11,954.11

Stocks in India declined Thursday as fast-moving consumer goods firms dropped on worries over volume growth, and Mahindra led a retreat in automakers after its surprise stake disclosure in a small-sized lender. The S&P BSE Sensex fell 0.7% to 66,266.82 in Mumbai, posting a fourth drop in five sessions, while the NSE Nifty 50 Index slid 0.6%. They gauges rose 0.5% each on Wednesday. HDFC Bank contributed the most to the index decline, while Mahindra was the top decliner. The automaker closed 6.3% lower after analysts were surprised by its stake purchase in RBL Bank. The company’s market value dropped by $1.5 billion to $21.9 billion, wiping off its gains since start of the month. Out of 31 shares in the Sensex index, 9 rose and 20 fell, while 2 were unchanged.

In FX, The Bloomberg dollar index fell for the third day, extending Wednesday’s 0.3% drop, when Federal Reserve Chief Jerome Powell’s comments bolstered bets that the US tightening cycle is near an end. The Swedish krona and Norwegian krone are the best performers. EUR/USD climbed as much as 0.5% to 1.1144 ahead of the European Central Bank’s policy decision later on Thursday, where it’s set to announce a 25 basis-point rate increase. GBP/USD rose for a third day, but weakened slightly against the euro. Traders trimmed wagers on further rate hikes after a report that advisers to the Treasury are increasingly concerned over the extent of UK rate hikes. Market pricing now favors a quarter-point increase in August, which on a closing basis would the first time that’s happened since last month’s half-point hike. They also continued to pare bets on how high interest rates would rise this cycle, with pricing for the terminal rate edging back below 6%. That’s down from more than 6.5% expected earlier this month. AUD/USD rose as much as 0.9% to 0.6821 as yuan gains fueled leveraged demand for the currency and put large buy stops above 0.6850 into play.

In rates, treasuries mixed with short-end yields lower by 2bp-3bp as US trading day begins, extending the bull-steepening move that followed Wednesday’s Fed rate increase and Chair Powell’s evenhanded comments regarding additional hikes. Real-money buying in front end during Asian hours was a factor, Citi strategists said in a note; yields and key curve spreads remain inside ranges established over past week however. Yields beyond the 5-year are little changed ahead of 7-year note auction at 1pm New York time; $35b sale is the final coupon sale of the May-July financing quarter; Treasury Department is slated to announce auction sizes for August-October next week, and increases are broadly expected. WI 7-year yield at ~3.98% is higher than auction results since February and ~15bp higher than last month’s; yields across the Treasury curve were driven to YTD highs during the first week of July by strong employment data, but have since moderated from those levels.

In commodities, crude futures advance with WTI rising 1.1% to trade near $79.60. Spot gold adds 0.3%

Bitcoin is little changed in another narrow range with specifics somewhat light as broader market action remains at the whim of Central Banks and earnings, with the ECB next after the FOMC avoided shaking the boat.

To the day ahead now, and the main highlight will be the ECB’s latest policy decision and President Lagarde’s press conference. Otherwise, data releases from the US include US 2Q GDP, June preliminary durable goods orders, weekly initial jobless claims, June advance goods trade balance and June wholesale and retail inventories (all at 8:30am), June pending home sales (10am) and July Kansas City Fed manufacturing activity (11am). Finally, earnings releases include Mastercard, McDonald’s, Intel and Ford.

Market Snapshot

- S&P 500 futures up 0.6% to 4,622.00

- STOXX Europe 600 up 1.0% to 470.31

- German 10Y yield little changed at 2.48%

- Euro up 0.4% to $1.1135

- MXAP up 0.8% to 170.14

- MXAPJ up 0.8% to 537.73

- Nikkei up 0.7% to 32,891.16

- Topix up 0.5% to 2,295.14

- Hang Seng Index up 1.4% to 19,639.11

- Shanghai Composite down 0.2% to 3,216.67

- Sensex down 0.5% to 66,341.22

- Australia S&P/ASX 200 up 0.7% to 7,455.92

- Kospi up 0.4% to 2,603.81

- Brent Futures up 0.7% to $83.48/bbl

- Gold spot up 0.3% to $1,977.54

- U.S. Dollar Index down 0.27% to 100.62

Top Overnight News

- A bill that will widen the pool of men liable to be called up to serve in the Russian army has passed through a key security committee, bringing it closer to being signed into law by president Vladimir Putin. Men aged 18 to 27 are currently eligible to be conscripted in Russia for its regular army. On Thursday, the security committee of the upper house of Russia’s parliament pushed through a bill to raise the upper age limit to 30. FT

- Turkey's central bank sharply revised up its year-end inflation forecast to 58% from 22.3%. New Governor Hafize Gaye Erkan is trying to restore credibility among investors after years of wildly optimistic projections. The food inflation estimate also more than doubled to 61.5%. BBG

- Another ECB rate hike seems almost certain today, taking the deposit rate to 3.75%, but — much like the Fed yesterday — the real focus is on what's next. Clear signals for September are unlikely given the flood of data due before then. Instead, Christine Lagarde will want to maintain maximum flexibility when she speaks after the announcement. BBG

- Barclays shares slump in London trading after the company reported earnings and warned of growing pressure in its UK retail bank while the investment bank missed Street expectations (the buyback was increased but this wasn’t enough to offset the lackluster results). RTRS

- While the world’s attention has been focused on Russia’s invasion of Ukraine, new Russian attacks against U.S. drones have made Syria a fraught arena for military competition between Moscow and Washington. WSJ

- US consumers insulated from Fed tightening as most rates on personal/household debt are fixed at levels far below where they currently stand. WSJ

- New capital rules may erase almost all of the $118 billion in excess capital Wall Street's biggest banks squirreled away over the past decade, in a potential blow to shareholder buybacks. The Fed and FDIC will vote to propose the measures at separate meetings today. BBG

- Federal regulators want to impose new guardrails on the way retail investment firms such as Robinhood Markets use advanced analytics to encourage customers to trade, the latest in a series of policy efforts prompted by the 2021 meme-stock craze. WSJ

- US economic growth probably held up in the second quarter, showing sustained resilience in the face of Fed tightening. The economy is expected to have expanded by 1.8%, bolstered by a turn higher in business investment even as consumer spending cooled. Bloomberg Economics warned that expectations of weaker demand will weigh on factory production. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher in the aftermath of the FOMC meeting and press conference where the Fed delivered a widely expected 25bp rate hike and Powell kept the door open for a further increase although didn’t commit to any decision and stressed a data-dependent approach. ASX 200 was led by strength in real estate and tech, while participants also digested production updates. Nikkei 225 was initially hesitant amid a firmer currency and as the BoJ kick-started its 2-day policy meeting but eventually conformed to the rally. KOSPI gained with the spotlight on earnings including Samsung Electronics which topped estimates. Hang Seng and Shanghai Comp were positive with outperformance in Hong Kong despite the HKMA’s lockstep rate, as sentiment benefitted from recent support efforts and with the tech and auto industries lifted after China issued guidelines on the standardisation of intelligent connected vehicles and with regulators holding talks with major ride-hailing firms. Furthermore, XPeng shares surged over 30% in early trade after Volkswagen took about a 5% stake in the Co. and plans to jointly develop two electric models for the mid-size segment.

Top Asian News

- Hong Kong Monetary Authority raised its base rate by 25bps to 5.75%, as expected.

- BoK said it will strengthen the role of the standing lending facility as a liquidity backstop for financial institutions, while it will lower lending rates, accept more collateral and extend the maturity for loans taken out from its standing lending facility.

- China's National Financial Regulatory Admin. says people's consumption ability is not sufficient and the willingness of consumption not strong.

European bourses are in the green, Euro Stoxx 50 +1.4%; with action a continuation of the APAC upside post-FOMC and heavily influenced by the numerous earnings reports. Sectors primarily firmer with Media leading after Relx & UMG, Tech names are a close second given bullish Samsung AI remarks. Conversely, Energy lags following TotalEnergies & Shell's reports. Auto sector is mixed with Mercedes-Benz bid but Renault and Volkswagen pressured.

Stateside, futures are firmer with the ES +0.6% though the NQ +1.3% outperforms following Meta's after-hours report.

Top European News

- UK Treasury advisors are reportedly worried the BoE risks overdoing in the inflation fight, according to Bloomberg; believe that rate hikes should slow

- CBRT Report: Inflation forecasts revised upwards, exchange rate the main factor behind this. Click here for more detail.

FX

- Buck bears pounce on dovish elements of FOMC statement and Powell presser after latest 25bp Fed rate hike, DXY sinks from 101.000 to 100.540.

- Euro and Yen take advantage of Dollar demise ahead of ECB and BoJ, EUR/USD eyes expiries at 1.1150 and USD/JPY reverses through 140.00 where expiry interest also resides.

- Aussie and Kiwi seize on Greenback weakness and benefit from bullish risk sentiment, AUD/USD tops 0.6800 and NZD/USD approaches 0.6275.

- Franc, Pound and Loonie also up against US rival and latter underpinned by hawkish-sounding BoC minutes independently; USD/CHF closer to 0.8550 than 0.8600, Cable 1.3000 than 1.2900 and USD/CAD 1.3150 than 1.3200.

- PBoC set USD/CNY mid-point at 7.1265 vs exp. 7.1468 (prev. 7.1295)

Fixed Income

- Bonds make more headway post-Fed before pullback as spotlight shifts to ECB and top tier US data.

- Bunds towards base of 132.84-133.55 range, Gilts closer to 96.06 low than 96.81 high and T-note back below par between 112-07/111-26+ bounds.

- BTPs digesting pretty well received Italian supply after peaking early at 116.42.

Commodities

- WTI and Brent futures are firmer intraday, with the complex propped up by the broader risk appetite and softer Dollar in the aftermath of a dovish FOMC hike, whilst Chinese stimulus hopes keeps prices underpinned.

- Spot gold benefits from the softer post-FOMC Dollar, with the index posting mild gains intraday thus far but ultimately above its 100 DMA (USD 1,965.89/oz) after meandering around the moving average earlier this week.

- Base metals also benefit from the weaker Buck, but also see tailwinds from the broader risk appetite and ongoing hopes of Chinese stimulus.

- Nigeria raised August Bonny Crude official selling price to a premium of USD 0.38/bbl vs dated Brent and raised Qua Iboe OSP to a premium of USD 0.75/bbl vs dated Brent, according to Reuters.

- Russia expects to produce 515mln tons of oil this year, according to TASS.

- Russia's Government to consider lawmakers' proposal of raising oil export duty, according to RIA. Elsewhere, Russian Energy Minister Shulginov says Russia is to supply 18-20mln tonnes of oil products to Africa this year, according to Tass.

- Russian President Putin says we will be ready in the next 3-4 months to supply grain to Africa.

Geopolitics

- North Korea said a Chinese official delivered a letter from President Xi to North Korean Leader Kim and Kim said the dispatch of the Chinese delegation shows Xi's commitment to bilateral ties, while the official noted China is willing to contribute to regional peace and stability, as well as North Korea's prosperity and development, according to KCNA.

- North Korean leader Kim met with Russian Defence Minister Shoigu and they visited a missile and arms expo with senior government officials. Furthermore, North Korean and Russian defence chiefs held talks and their countries are to step up cooperation against gangster-like US hegemony, while the visit is to boost unity in the face of a common enemy and North Korea said it fully supports Russia's battle to protect sovereignty and safety, according to KCNA.

- French President Macron denounced "new imperialism" in the Pacific during a landmark visit to the region and warned of a threat to the sovereignty of smaller states, according to AFP News Agency.

- Russia's FSB says traces of explosives were detected at a vessel which was in transit from Turkey to Russia for grain shipment, via Ifx.

US Event Calendar

- 08:30: 2Q GDP Annualized QoQ, est. 1.8%, prior 2.0%

- 2Q GDP Price Index, est. 3.0%, prior 4.1%

- 2Q Personal Consumption, est. 1.2%, prior 4.2%

- 2Q Core PCE Price Index QoQ, est. 4.0%, prior 4.9%

- 08:30: July Initial Jobless Claims, est. 235,000, prior 228,000

- July Continuing Claims, est. 1.75m, prior 1.75m

- 08:30: June Durable Goods Orders, est. 1.3%, prior 1.8%

- June Durables Goods-Less Transportation, est. 0.1%, prior 0.7%

- June Cap Goods Ship Nondef Ex Air, est. 0.2%, prior 0.3%

- June Cap Goods Orders Nondef Ex Air, est. -0.1%, prior 0.7%

- 08:30: June Wholesale Inventories MoM, est. -0.1%, prior 0%

- June Retail Inventories MoM, est. 0.4%, prior 0.8%

- 08:30: June Advance Goods Trade Balance, est. -$92b, prior - $91.1b, revised -$91.9b

- 10:00: June Pending Home Sales YoY, est. -16.3%, prior -20.8%

- June Pending Home Sales (MoM), est. -0.5%, prior -2.7%

- 11:00: July Kansas City Fed Manf. Activity, est. -10, prior -12

DB's Jim Reid concludes the overnight wrap

It's fair to say that this was always going to be a holding hike for the Fed, and for markets, with limited new information likely to have been forthcoming or available. It's hard to review the meeting and stray from that view. We have two payrolls and two CPI prints before the next FOMC and they, amongst other things, will determine whether there's another hike in September and/or beyond.

After they hiked by 25bps as expected, the FOMC statement from July was almost verbatim compared to the June statement with the emphasis being put on upcoming data. Fed Chair Powell noted in his press conference that “looking ahead, we will continue to take a data-dependent approach in determining the extent of additional policy firming that may be appropriate.” That should increase the risk premia around data releases as we go forward into late-summer/early-autumn, with the next FOMC meeting not until September 19-20. One change to the statement was the characterisation of current US growth, with the committee upgrading it from “modest” to “moderate”, and Powell said that the staff forecast no longer included a recession.

During Chair Powell’s press conference, he noted that while Fed officials “welcomed” the June CPI data, they want to see a string of softer prints and more signs that inflation is cooling across a variety of leading indicators. He also noted that a strong economy could lead to further inflation down the line, seeming to reiterate the need for growth to slow further. He also noted that lending conditions are tighter, so all eyes will be on the next senior loan officer survey that’s out early next week. The overall tone was one of cautious optimism, and there was an expectation that the labour market would continue to soften. On the topic of pausing hikes in September, Powell was noncommittal and noted the data could change substantially by then.

So data dependence over forward guidance at the moment. Looking forward, market pricing for a hike in September is now at 20% this morning, with a further 21% chance of a hike in November. So the market is pricing just under half a hike more this cycle, before a pivot towards rate cuts in H1 of next year. For more on the FOMC see our US Econ team’s recap here. They continue to see this as the last hike of the cycle in the face of faster disinflation and a weakening growth outlook.

In terms of the market reaction, the 3m T-bill closed at a post-2001 high of 5.42%, the last time policy rates were at this level. The US 2yr yield was up just over +3.0bps before the statement was released before reversing course and moving lower through the US afternoon to finish down -2.4bps at 4.85%. 10yr yields were just above unchanged at 2pm EST when the decision was announced before moving sharply lower on the statement (-5.7bps drop) and then moderating to finish -1.8bps lower on the day at 3.87%. Overnight they’ve fallen another -1.6bps to 3.85%. The dollar index was weaker on the day already, before finishing down -0.46% - its first weakening after six consecutive gains.

Equities were largely unchanged with a bias toward cyclicals. The S&P 500 (-0.02%) traded in a 0.75% range during Chair Powell’s press conference. The Dow Jones rose for a 13th session in a row (+0.23%), which is the longest run of consecutive gains since 1987, and the Russell 2000 rose +0.72%. Tech was an underperformer with the software and semiconductors S&P 500 industry groups down -2.5% and -1.4% respectively. However, media did rally +2.9%, driven primarily by Alphabet which rose +5.8% after stronger results reported the previous evening. After the bell, Meta (+1.4% yesterday and +6.8% in after-market trading) reported strong Q2 sales and increased guidance on greater engagement and cost controls. Against that background, stock futures tied to the S&P 500 (+0.33%) and NASDAQ 100 (+0.71%) are pointing higher this morning.

With the Fed now out of the way, the ECB are next up today at 13:15 London time. They’re also widely expected to deliver a 25bp hike, which would take the deposit rate up to 3.75%. But once again, the big question will be what they signal about any further hikes after this one, since Governing Council members have sounded far less committed to any more hikes beyond July. In their preview for this meeting (link here), our European economists think that a further hike to 4% in September can’t be ruled out, but it’s a close call that will depend on data and events ahead of the next meeting in mid-September. As it happens, we’ll start to get some of that data from tomorrow, since the flash CPI prints for July from various countries are being released, ahead of the Euro Area-wide print on Monday. So that will be an important input to the decision.

European markets had already seen a decline ahead of the Fed’s decision, with the STOXX 600 (-0.53%) ending its run of 6 successive gains. That was echoed across the continent, with France’s CAC 40 (-1.35%) one of the biggest underperformers, although Spain’s IBEX 35 (+0.85%) was the exception as it posted a solid gain. Yields on 10yr bunds (+6.0bps), OATs (+6.1bps) and BTPs (+4.3bps) all rose on the day, having closed before the subsequent rally in US treasuries.

Speaking of Europe, our research colleagues on the German economics team have published a substantial update this week on how the German economy is doing at mid-year, both from a cyclical and structural perspective. It introduces their new Nowcast model for German GDP, and takes a look at the political situation as the traffic-light coalition nears its midterm point. Here’s the link to the report.

In Asia, equity markets are trading higher this morning after the Fed. The Hang Seng (+1.36%) is leading the gains, but the KOSPI (+0.72%), the Nikkei (+0.69%), the CSI 300 (+0.54%) and the Shanghai Composite (+0.44%) have all moved higher as well. Overnight, we’ve also seen the US dollar index continue to weaken, with another -0.07% move lower, whilst the Japanese Yen (+0.28%) has strengthened for a 4th consecutive day against the dollar ahead of tomorrow’s BoJ decision, and is now trading beneath 140 per dollar.

Finally on the data side, US new home sales fell in June for the first time in 4 months, coming in at an annualised rate of 697k (vs. 725k expected). Separately, money supply growth continued to slow in the Euro Area, with growth in M3 down to just +0.6% year-on-year (vs. +0.9% expected), marking its slowest rate since July 2010. Our European economists see the latest data as consistent with forceful but orderly pass through of ECB tightening. See their note yesterday here for more.

To the day ahead now, and the main highlight will be the ECB’s latest policy decision and President Lagarde’s press conference. Otherwise, data releases from the US include the first estimate of Q2 GDP, preliminary durable goods orders for June, and the weekly initial jobless claims. Finally, earnings releases include Mastercard, McDonald’s, Intel and Ford.