Greater inflation expectations and receding recession risk leave the interest rate cuts priced in for the Federal Reserve more vulnerable than in the UK or Europe.

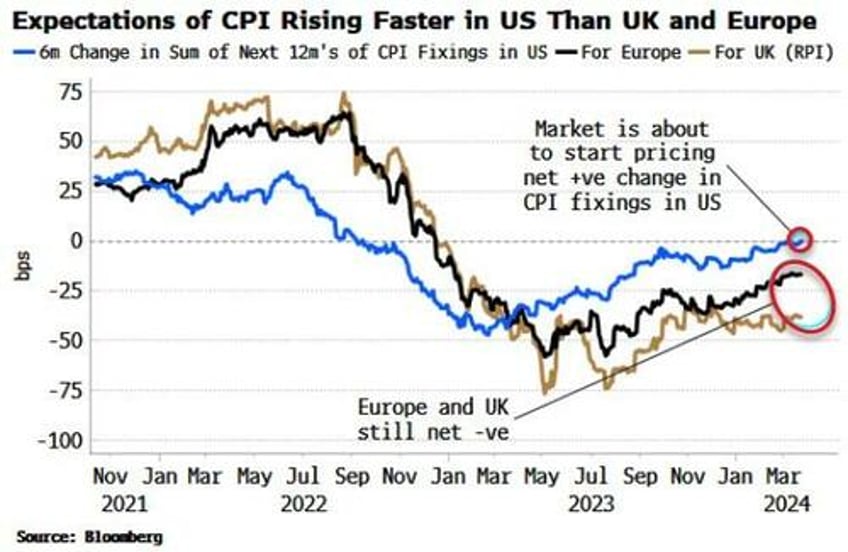

The market currently sees a similar amount of rate cuts in 2024 for the US, UK and euro area, with ~80 bps seen for the Fed and BOE and just over 90 bps expected for the ECB. The US is more exposed to rising inflation, which is beginning to be reflected in the market’s expectations. The CPI-fixing market has started marking up its estimates of where inflation is anticipated to be over the next 12 months after a protracted period of marking them down.

We can take the six-month change in the sum of the next 12 months of fixings and compare this across regions to get an idea of how different inflation expectations are evolving.

As the chart below shows, inflation expectations are being marked up by more in the US than in the UK and Europe.

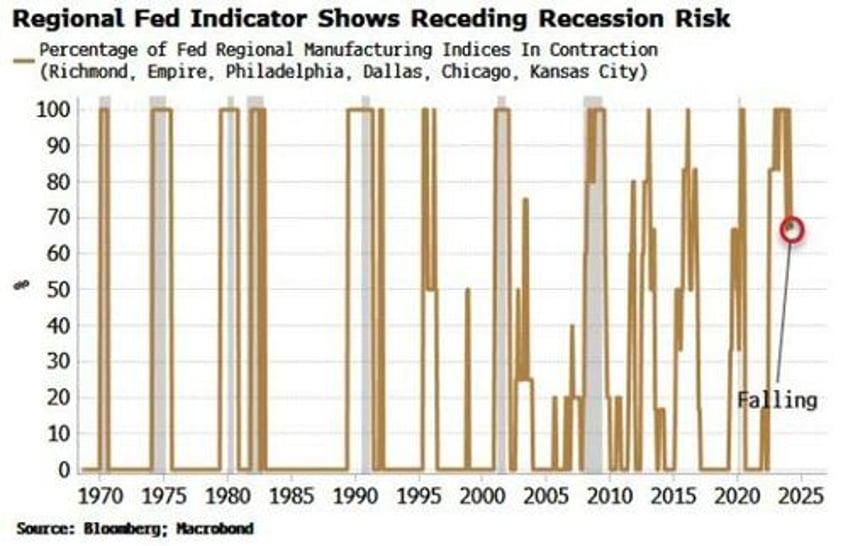

This comes when recession risks continue to recede in the US.

The Dallas Fed Manufacturing Index for March was just released, coming in weaker than expected. But the Fed regional indexes are quite useless individually as they are too volatile. However, we can improve the signal by looking at a diffusion of them.

When all of them are contracting it is not a bad recession indicator.

They had all been in contraction territory on a three-month smoothed basis for most of the last year, but now fewer than 70% of them are in the negative zone (gray bars are recessions in the chart below).

The Fed has made its life difficult when it de facto pivoted in December.

As long as the data keeps coming in solidly, and inflation inches higher, the amount of cuts expected in the US – especially relative to the UK and Europe – is at risk.

Powell stated at last week’s Fed meeting a surprise weakening in unemployment would prompt them to cut rates, but net conditions are already very loose.

The market may end reversing its position of last year - where further hikes that were telegraphed prompted more cuts to be priced, given the expected damage to the economy – and instead see cuts telegraphed as a policy mistake, and price in subsequent rate hikes.