In his latest Flow Show note (available here to pro subs), BofA's Chief Investment Strategist turns away from the US for a bit, and toward Europe where Michael Hartnett seeks client feedback on a wide variety of topics ranging from Iran, to geopolitics, US exceptionalism, MEGA, bonds, and of course, stocks.

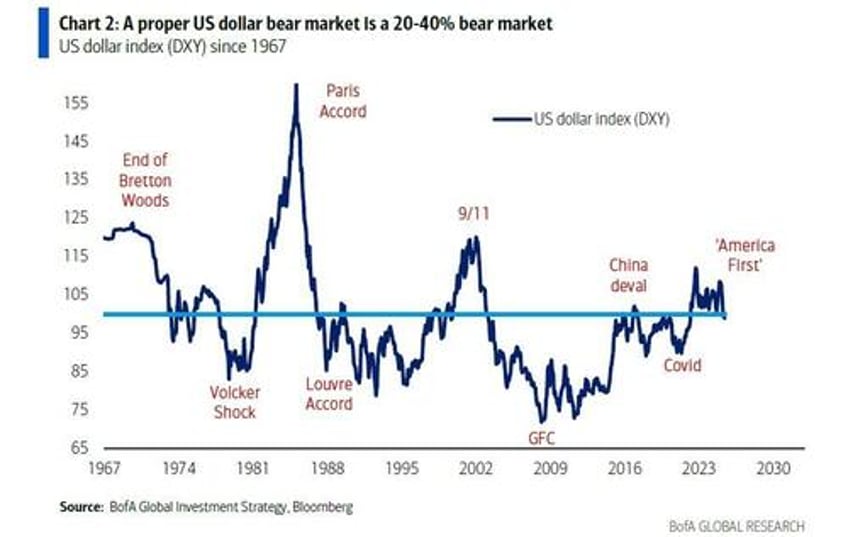

And before getting into the highlights, Hartnett picks up on the key theme he noted in the latest Fund Manager Survey, namely that with everyone short the dollar, the "biggest pain trade this summer is to be long the US dollar", and writes that "great US dollar bear markets are -20% to -40% bear markets" and adds that "great structural equity bulls always corroborated by a currency bull market," and the "best signal Europe & Asia is in a structural bull would be corporate sectors that can handle FX appreciation." We have yet to see just how resilient the rest of the world's exporters are when their currencies are surging against the only one that matters for global consumption.