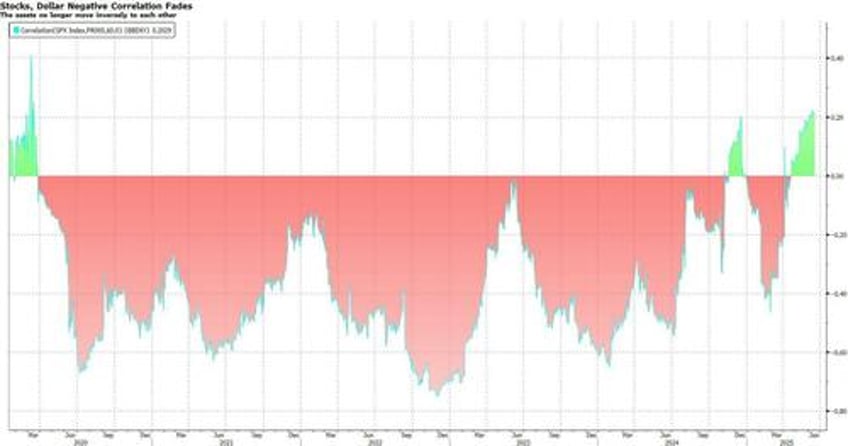

After spending nearly five years in negative territory, the correlation between the US Dollar and stocks flipped green around the time of the 2024 presidential election, before briefly reversing again, only to reverse again sharply around the time of Liberation Day, pushing the correlation to a level not seen since the covid crash.

What happened? Well, some claim that the persistent dollar weakness is an overhang from the "death of the American exceptionalism" trade which became very popular several months ago, but which then promptly disappeared from the narrative as US stocks soared promptly right back to all time highs confirming that American exceptionalism remains very much alive (and in fact, funds were flowing out of Europe and Asia into the US). Additionally, while the dollar and 10Y yields correlated closely in the past, that relationship also broke dramatically in recent months, as shown in the chart below.